This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7220

for the current year.

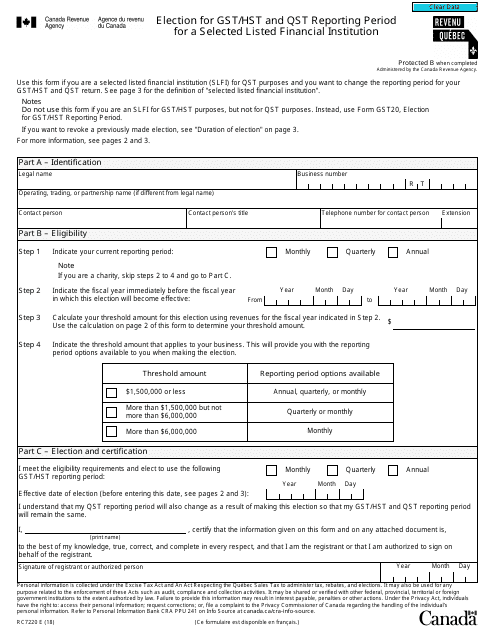

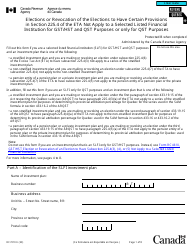

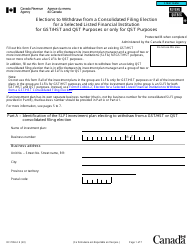

Form RC7220 Election for Gst / Hst and Qst Reporting Period for a Selected Listed Financial Institution - Canada

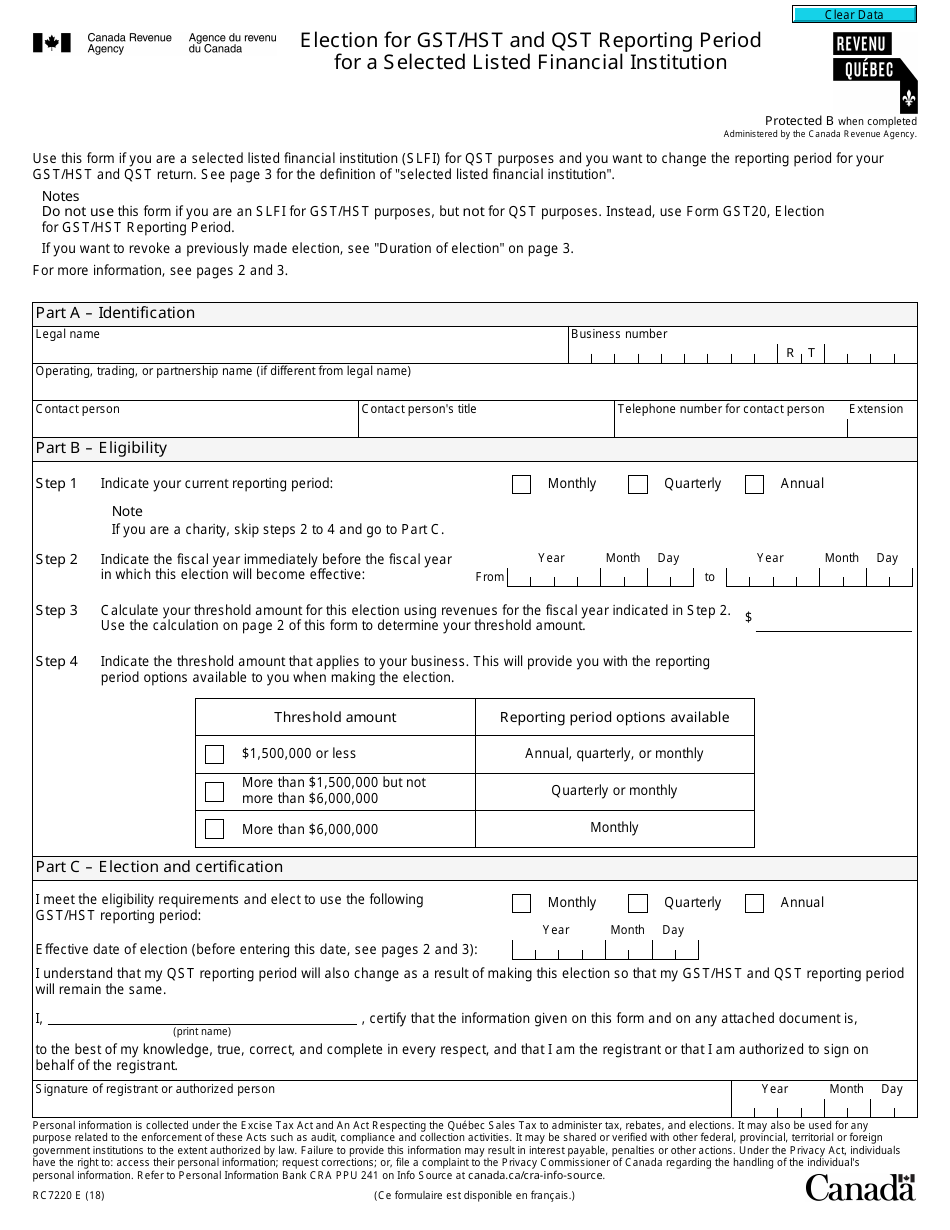

Form RC7220 is used by selected listed financial institutions in Canada to elect a reporting period for GST/HST (Goods and Services Tax/Harmonized Sales Tax) and QST (Quebec Sales Tax) purposes. This form allows these institutions to choose a reporting period that aligns with their financial year-end.

The financial institution themselves file the Form RC7220 Election for GST/HST and QST reporting period in Canada.

FAQ

Q: What is the RC7220 form?

A: The RC7220 form is the Election for GST/HST and QST Reporting Period for a Selected Listed Financial Institution in Canada.

Q: What is the purpose of the RC7220 form?

A: The purpose of the RC7220 form is to allow a selected listed financial institution in Canada to elect to have a reporting period for GST/HST and QST purposes that differs from the regular quarterly or annual periods.

Q: Who should use the RC7220 form?

A: The RC7220 form should be used by selected listed financial institutions in Canada.

Q: What is a selected listed financial institution?

A: A selected listed financial institution refers to specific financial institutions that meet certain criteria as defined by the Canada Revenue Agency.

Q: What is GST/HST?

A: GST/HST stands for Goods and Services Tax (GST) and Harmonized Sales Tax (HST), which are consumption taxes in Canada.

Q: What is QST?

A: QST stands for Quebec Sales Tax, which is a provincial sales tax in Quebec, Canada.

Q: Can a selected listed financial institution choose a reporting period other than quarterly or annually?

A: Yes, a selected listed financial institution can choose a reporting period other than quarterly or annually by completing and submitting the RC7220 form.

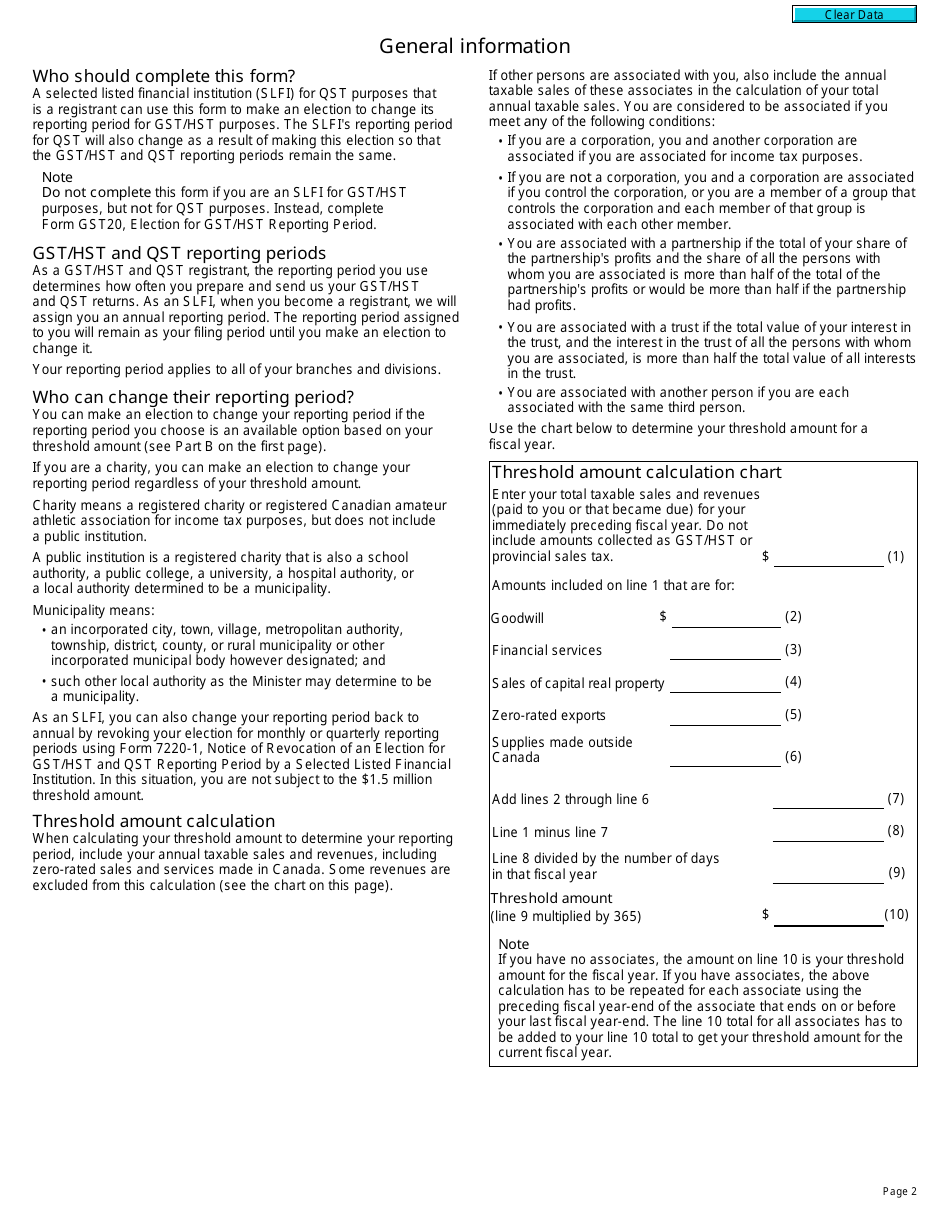

Q: Are there any deadlines for submitting the RC7220 form?

A: Yes, selected listed financial institutions must submit the RC7220 form by the deadline specified by the Canada Revenue Agency.

Q: What are the benefits of electing a different reporting period?

A: The benefits of electing a different reporting period include aligning reporting periods with the selected listed financial institution's regular business operations, simplifying accounting and reporting processes, and potentially reducing administrative burden.