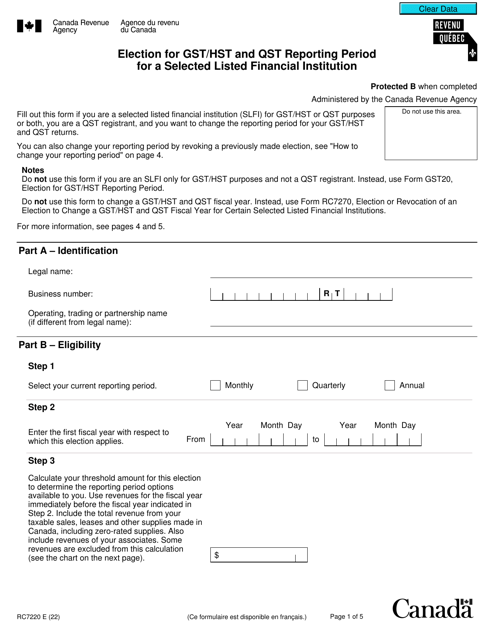

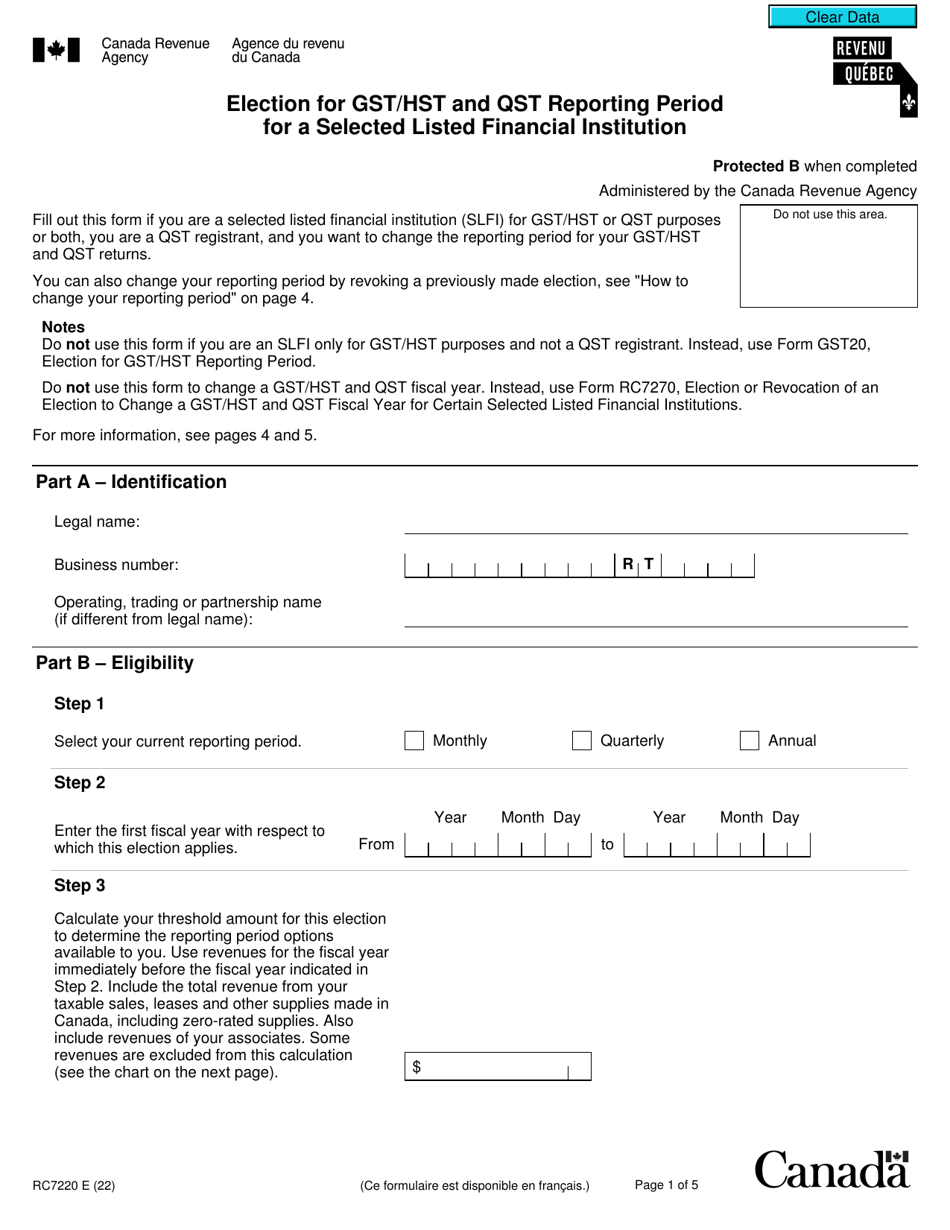

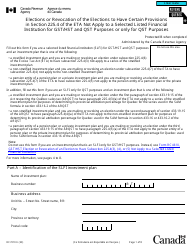

Form RC7220 Election for Gst / Hst and Qst Reporting Period for a Selected Listed Financial Institution - Canada

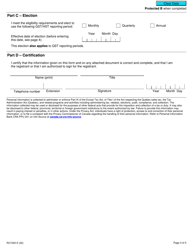

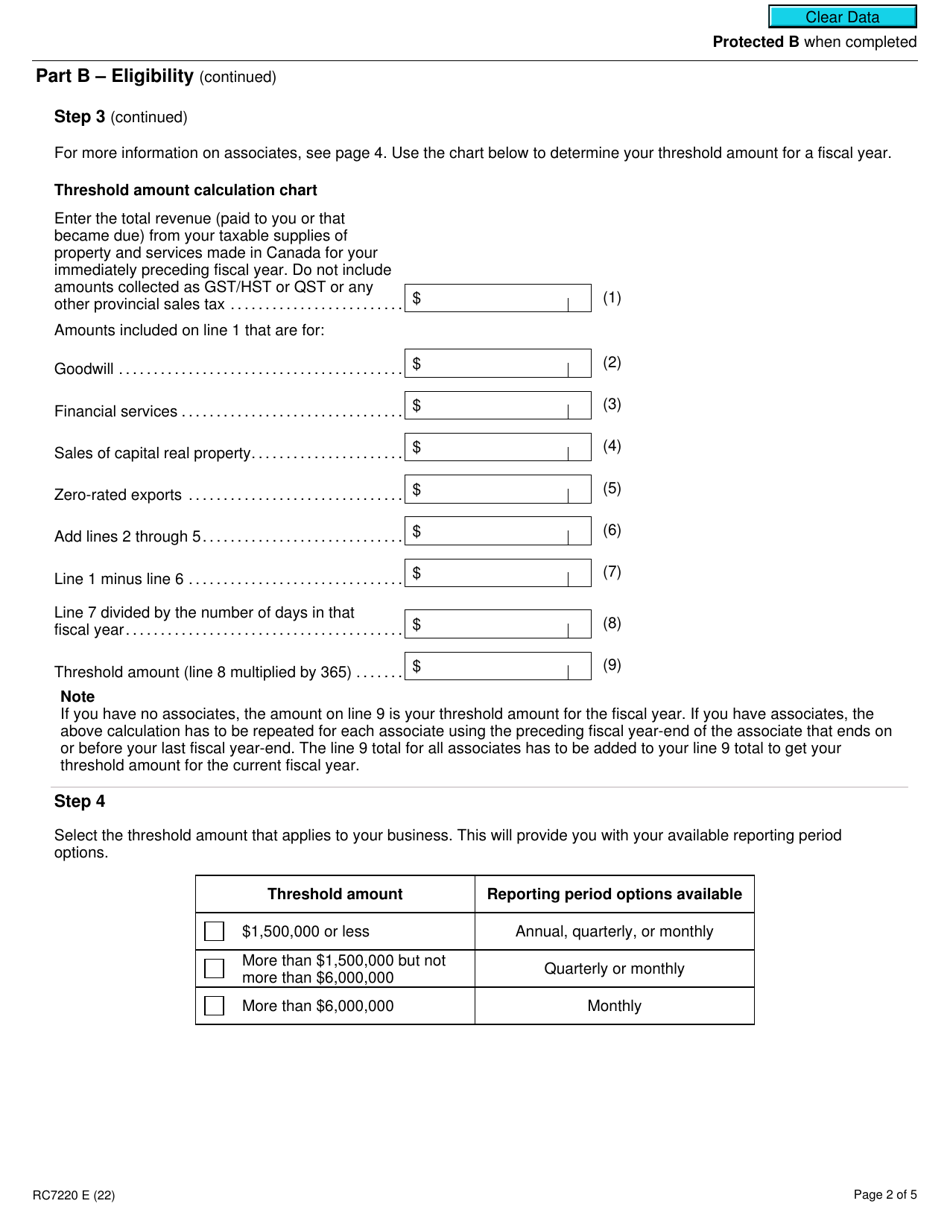

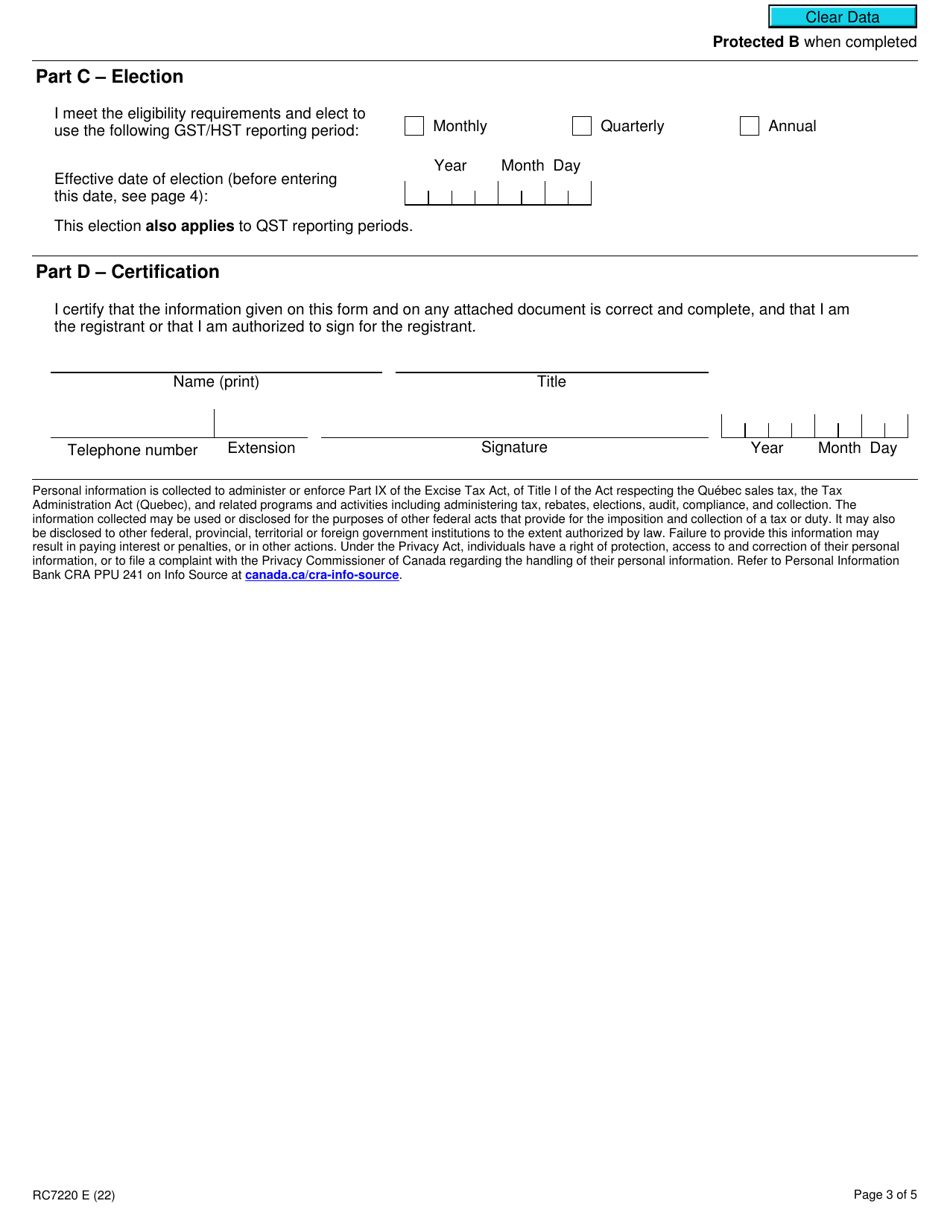

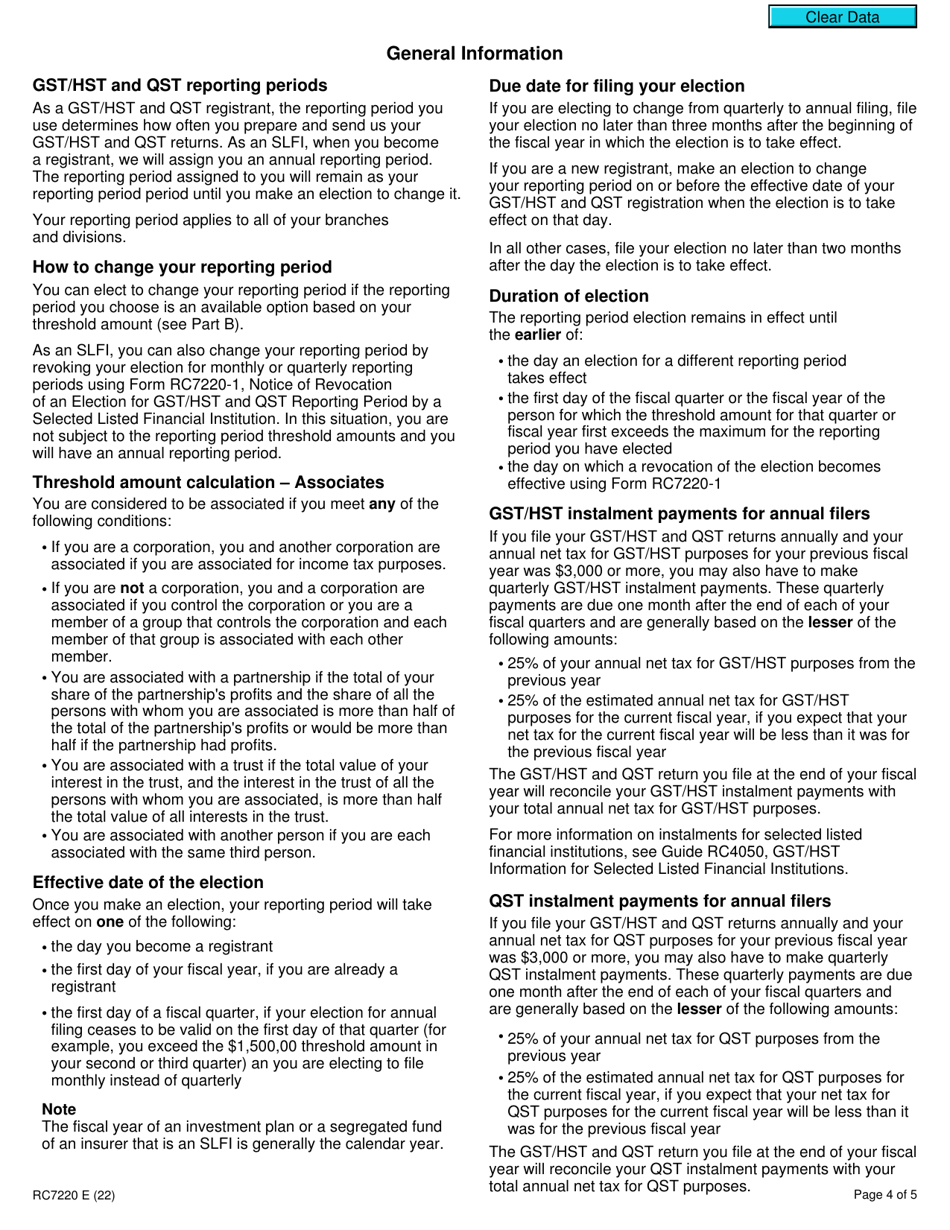

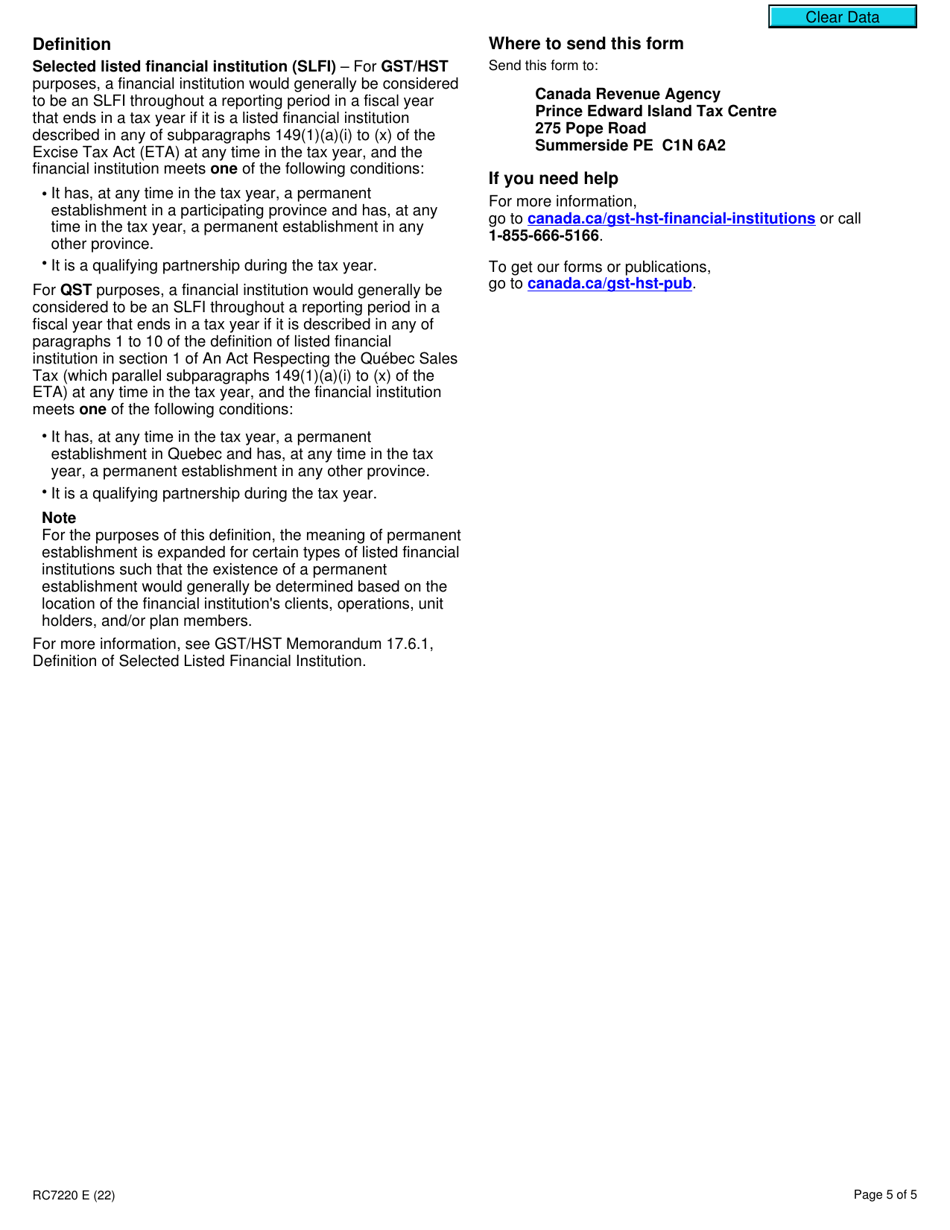

Form RC7220, Election for GST/HST and QST Reporting Period for a Selected Listed Financial Institution, is used in Canada by listed financial institutions to elect their reporting periods for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) and the Quebec Sales Tax (QST). This form allows these institutions to choose an annual or quarterly reporting period for remitting these taxes.

In Canada, the Form RC7220 Election for GST/HST and QST Reporting Period for a Selected Listed Financial Institution is filed by the selected listed financial institution itself.

Form RC7220 Election for Gst/Hst and Qst Reporting Period for a Selected Listed Financial Institution - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC7220?

A: Form RC7220 is a form used to elect the GST/HST and QST reporting period for a selected listed financial institution in Canada.

Q: Who needs to fill out Form RC7220?

A: Financial institutions in Canada that are listed in Schedule VI of the Excise Tax Act and that are required to file GST/HST and QST returns need to fill out Form RC7220.

Q: What is the purpose of filing Form RC7220?

A: The purpose of filing Form RC7220 is to elect the GST/HST and QST reporting period for a selected listed financial institution.

Q: How do I complete Form RC7220?

A: You need to provide your business number, financial institution name, address, and the requested GST/HST and QST reporting period.

Q: Are there any deadlines for submitting Form RC7220?

A: Form RC7220 should be filed at least 30 days before the first day of the proposed reporting period.

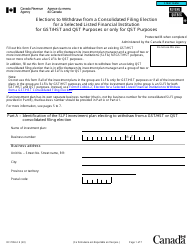

Q: Can I change my elected reporting period after filing Form RC7220?

A: Yes, you can change your elected reporting period by completing another Form RC7220 and sending it to the tax services office or tax center.

Q: Are there any penalties for not filing Form RC7220?

A: Failure to file Form RC7220 or to comply with the elected reporting period may result in penalties and interest.

Q: Can I file Form RC7220 electronically?

A: No, Form RC7220 cannot be filed electronically. It must be printed, completed, and sent by mail or delivered in person to the tax services office or tax center.