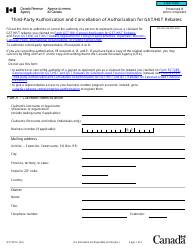

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC7257

for the current year.

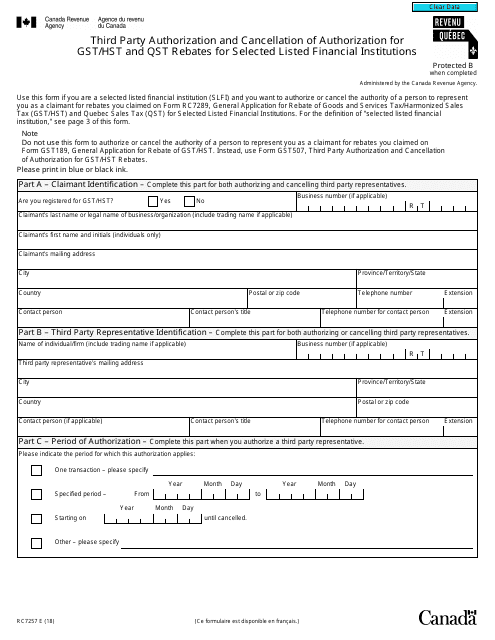

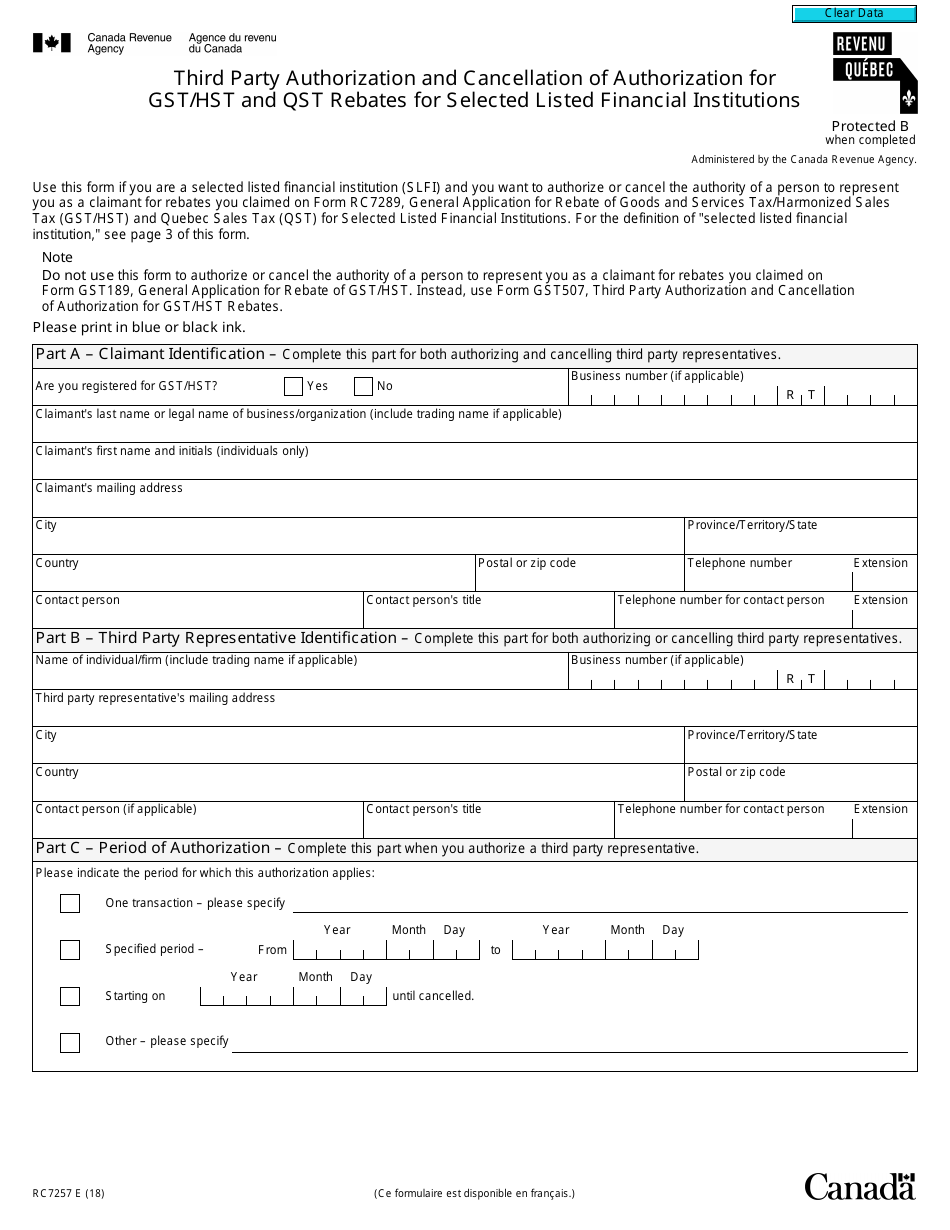

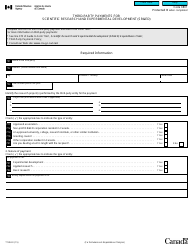

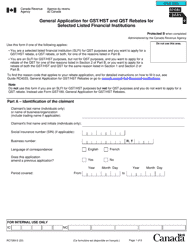

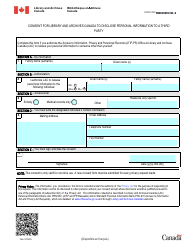

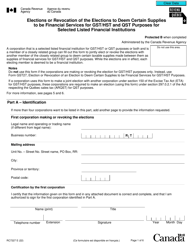

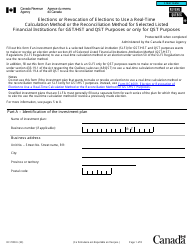

Form RC7257 Third Party Authorization and Cancellation of Authorization for Gst / Hst and Qst Rebates for Selected Listed Financial Institutions - Canada

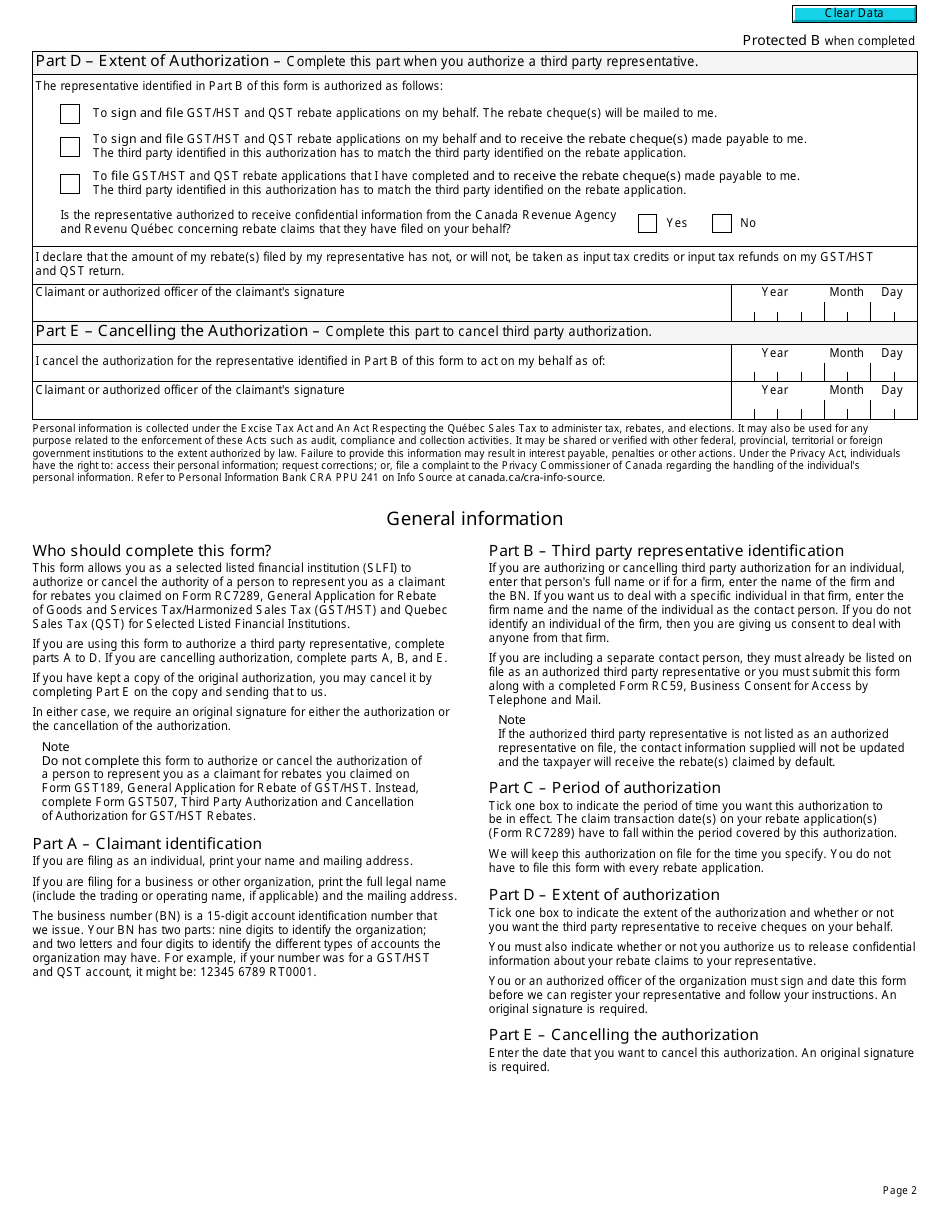

Form RC7257 Third Party Authorization and Cancellation of Authorization for GST/HST and QST Rebates for Selected Listed Financial Institutions is used in Canada to authorize or cancel the authorization for third parties to claim GST/HST and QST rebates on behalf of selected listed financial institutions.

The selected listed financial institutions in Canada file the Form RC7257 for Third Party Authorization and Cancellation of Authorization for GST/HST and QST rebates.

FAQ

Q: What is Form RC7257?

A: Form RC7257 is a document used in Canada for Third Party Authorization and Cancellation of Authorization for GST/HST and QST Rebates for Selected Listed Financial Institutions.

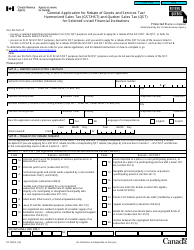

Q: What is GST and HST?

A: GST stands for Goods and Services Tax, and HST stands for Harmonized Sales Tax. They are consumption taxes applied in Canada.

Q: What is QST?

A: QST stands for Quebec Sales Tax. It is a provincial tax applied in the province of Quebec.

Q: What is a financial institution?

A: A financial institution refers to banks, trust companies, credit unions, and other similar organizations that provide financial services.

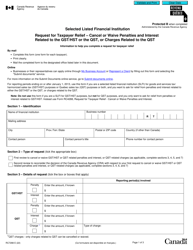

Q: What is third-party authorization?

A: Third-party authorization allows someone else to act on behalf of an individual or entity for specific purposes.

Q: Why would someone need to authorize a third-party for GST/HST and QST rebates?

A: Someone may need to authorize a third-party for GST/HST and QST rebates if they want someone else to handle the process of claiming these rebates on their behalf.

Q: What is the purpose of Form RC7257?

A: The purpose of Form RC7257 is to provide authorization or cancellation of authorization for a third-party to claim GST/HST and QST rebates for selected listed financial institutions in Canada.

Q: Is Form RC7257 mandatory?

A: Yes, if you want to authorize a third-party to claim GST/HST and QST rebates on your behalf, Form RC7257 is necessary.

Q: What information do I need to provide on Form RC7257?

A: On Form RC7257, you need to provide information such as your name, address, social insurance number, the name of your authorized representative, and their contact information.

Q: Can I cancel the authorization given on Form RC7257?

A: Yes, you can cancel the authorization given on Form RC7257 by submitting a written request to the Canada Revenue Agency.

Q: Are there any fees associated with submitting Form RC7257?

A: No, there are no fees associated with submitting Form RC7257.

Q: Can I authorize multiple third-parties using Form RC7257?

A: Yes, you can authorize multiple third-parties by attaching a separate Schedule A for each additional authorized representative.