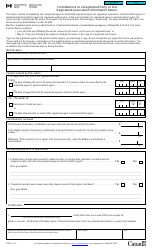

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T106

for the current year.

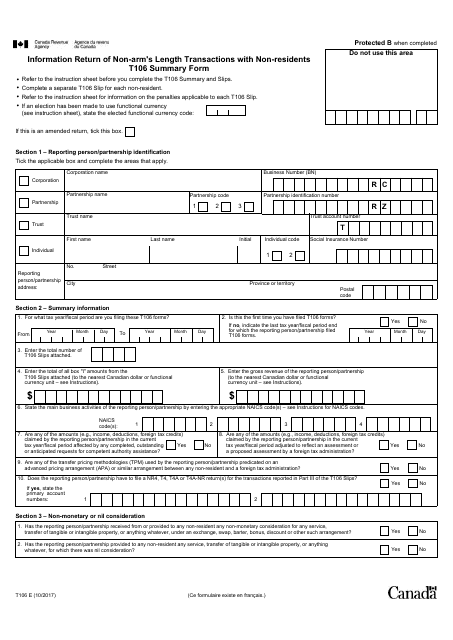

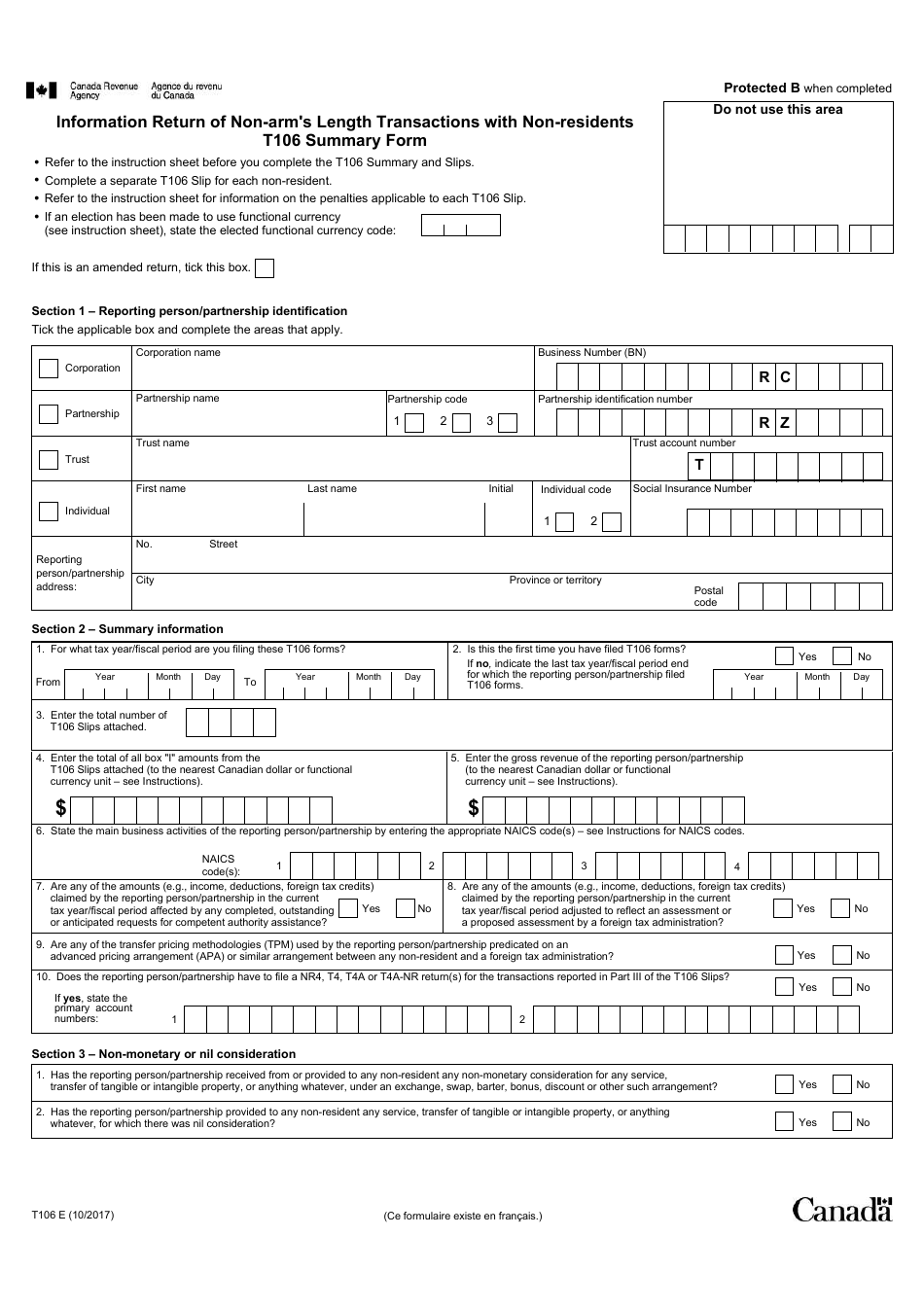

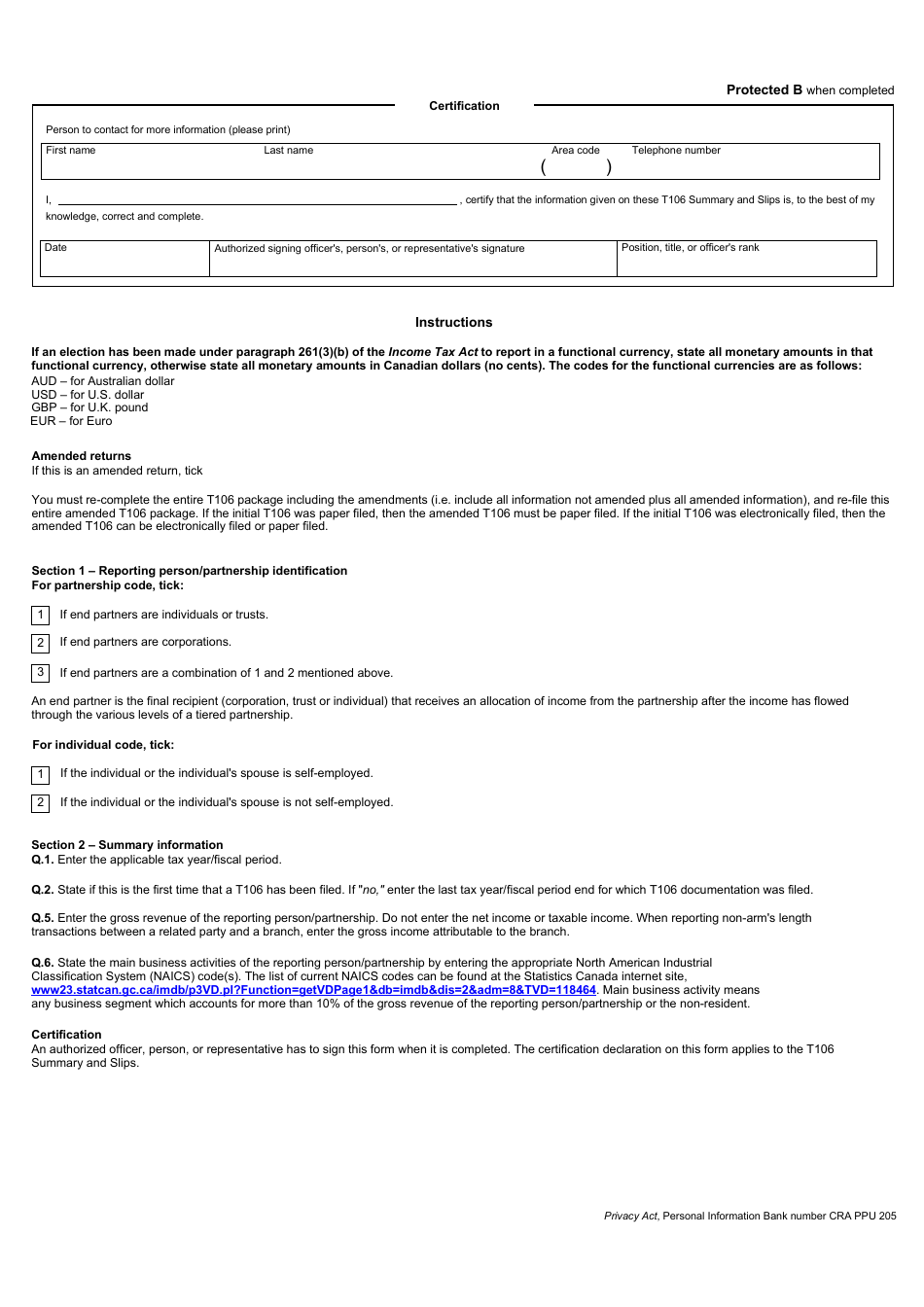

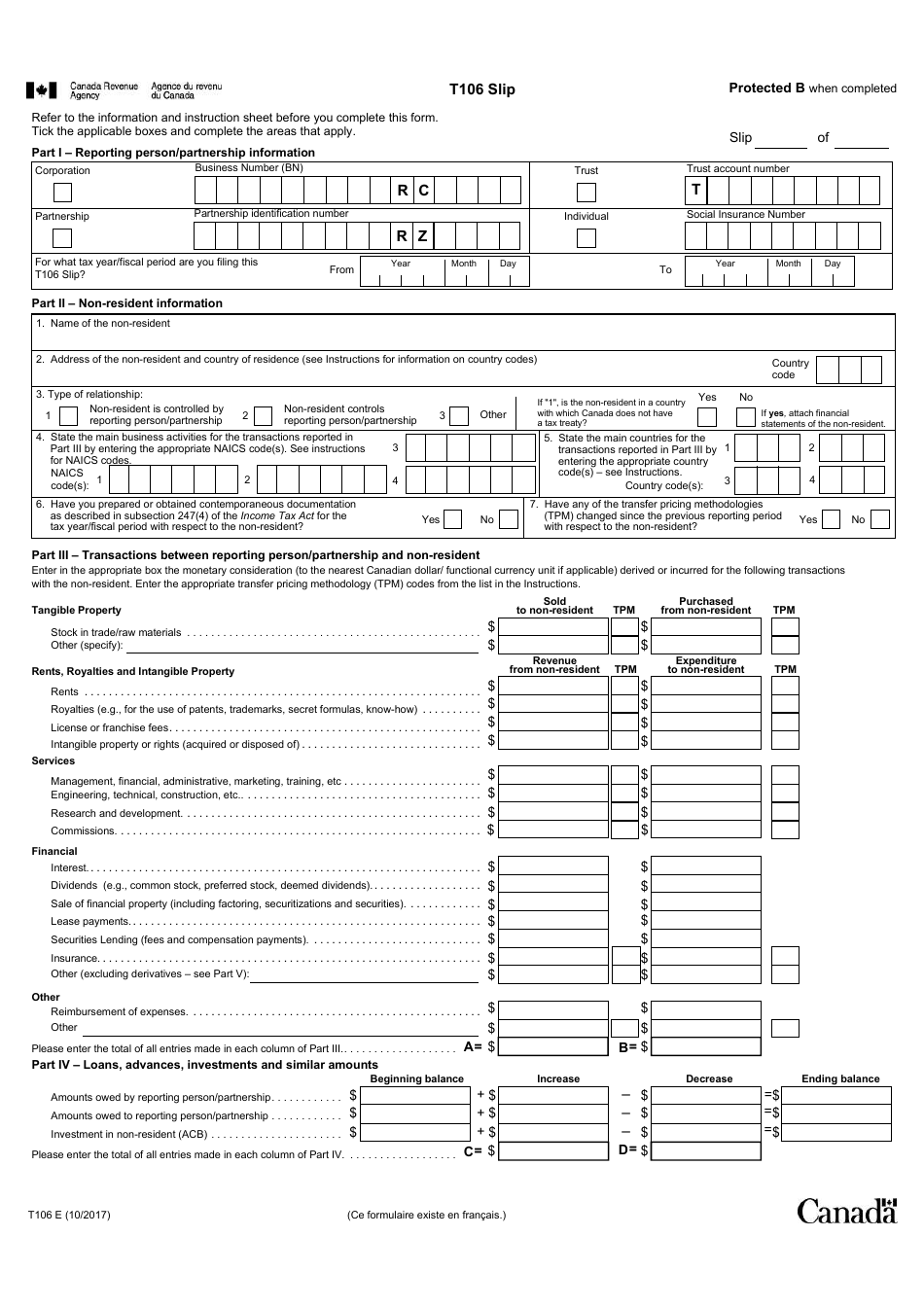

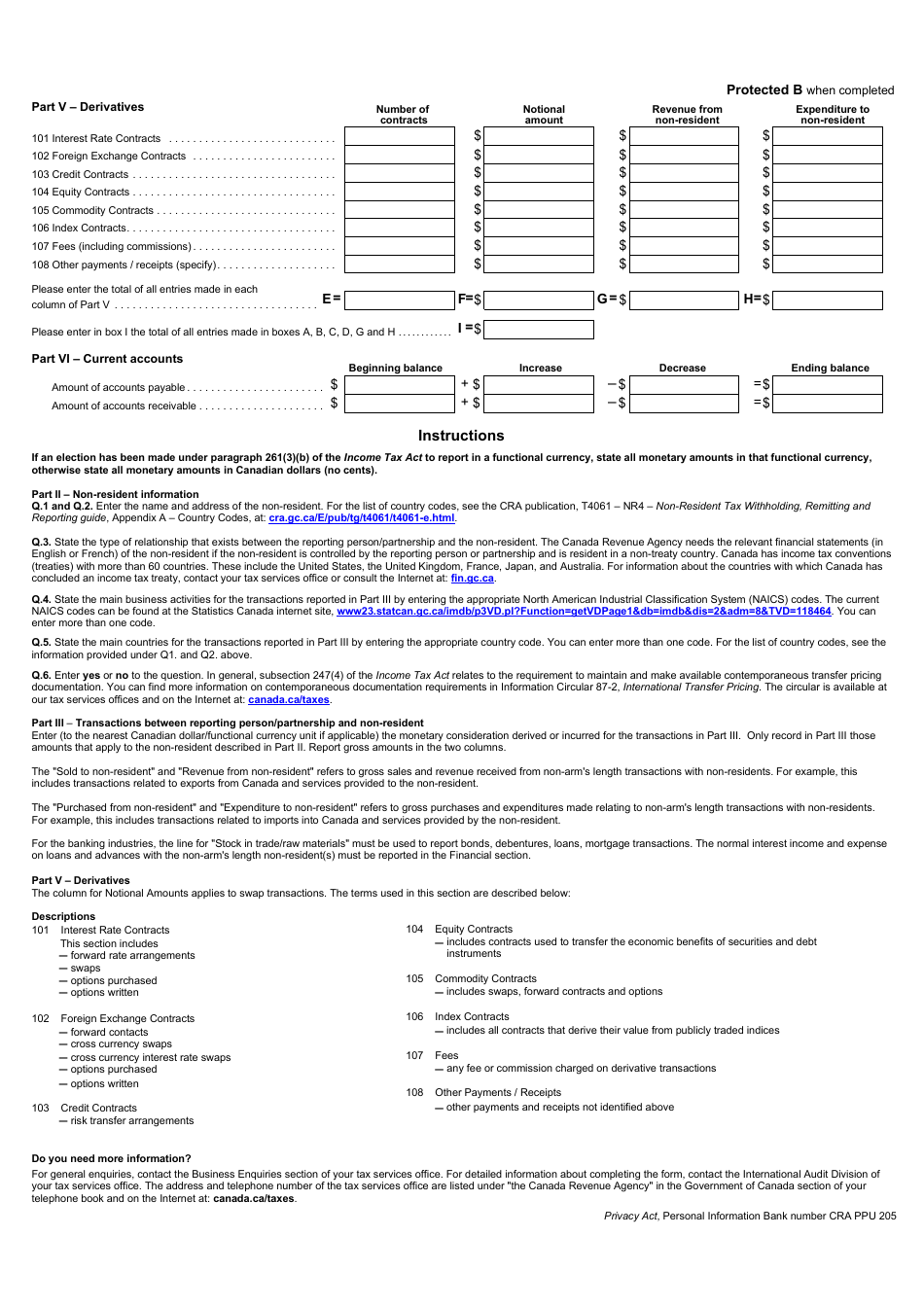

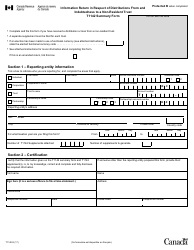

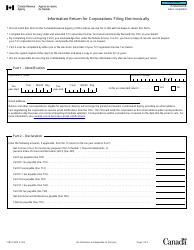

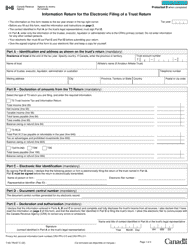

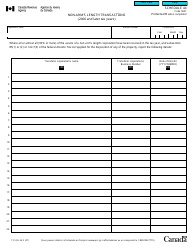

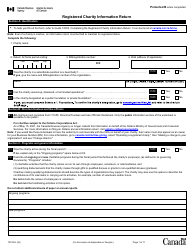

Form T106 Information Return of Non-arm's Length Transactions With Non-residents - Canada

Form T106 Information Return of Non-arm's Length Transactions With Non-residents is used in Canada to report certain transactions between Canadian taxpayers and non-residents with whom they have a non-arm's length relationship. It helps the Canadian government track and monitor these transactions for tax purposes.

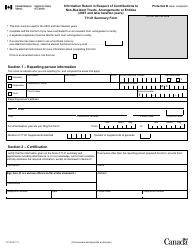

The person or entity who is involved in non-arm's length transactions with non-residents files the Form T106 Information Return in Canada.

FAQ

Q: What is Form T106?

A: Form T106 is an information return that must be filed by taxpayers in Canada to report non-arm's length transactions with non-residents.

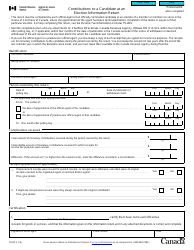

Q: Who is required to file Form T106?

A: Taxpayers in Canada who engage in non-arm's length transactions with non-residents are required to file Form T106.

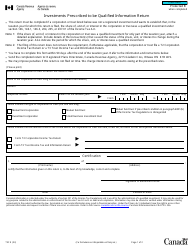

Q: What are non-arm's length transactions?

A: Non-arm's length transactions are transactions between parties who are related or have a close relationship, such as family members, business associates, or entities under common control.

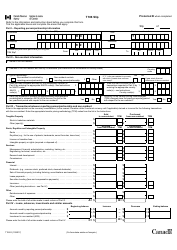

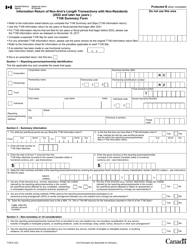

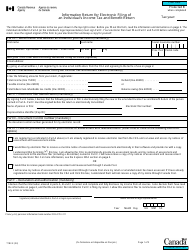

Q: What information is reported on Form T106?

A: Form T106 requires taxpayers to report details of non-arm's length transactions, including the nature of the transaction, the names and addresses of the parties involved, and the amount of the transaction.

Q: When is Form T106 due?

A: Form T106 must be filed within six months from the end of the taxpayer's taxation year.

Q: Is there a penalty for not filing Form T106?

A: Yes, there are penalties for not filing Form T106 or for filing it late. The penalty can be up to $2,500 for each failure to file.