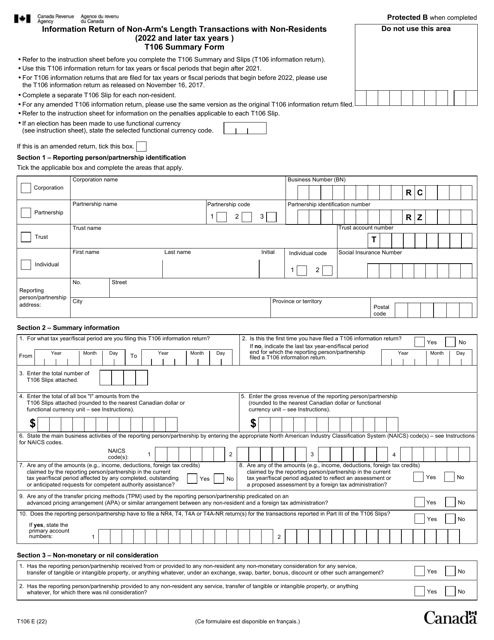

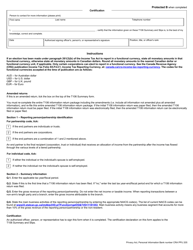

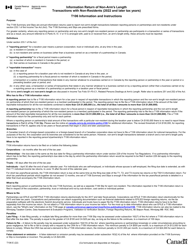

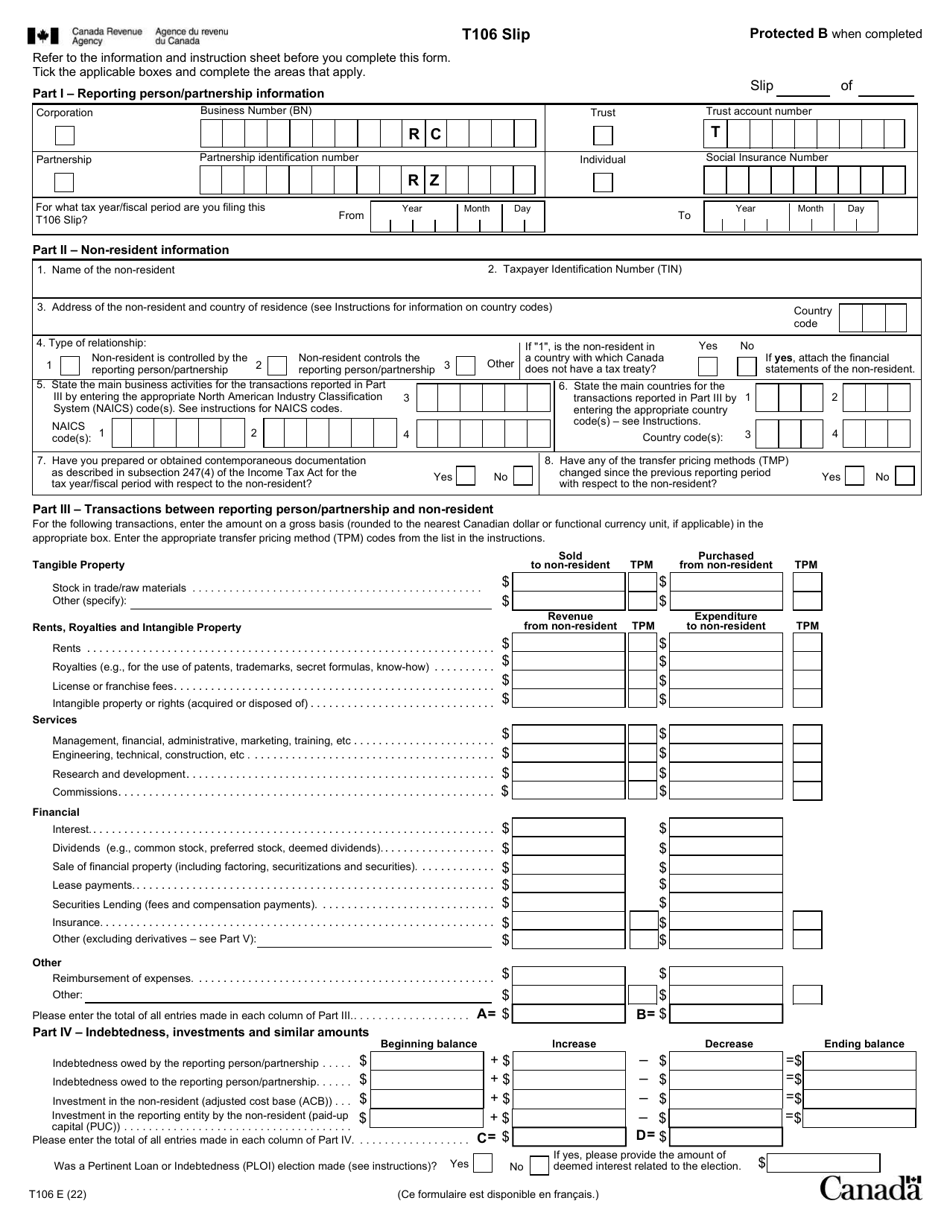

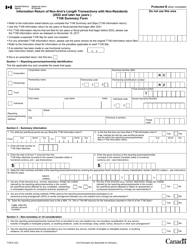

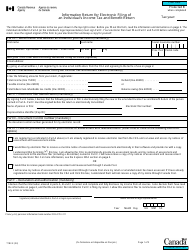

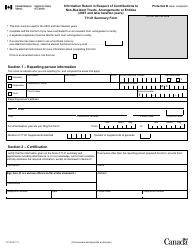

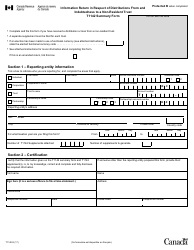

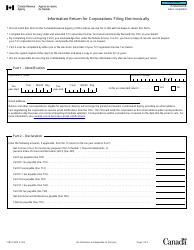

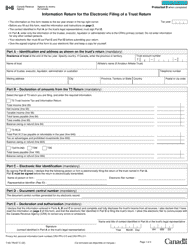

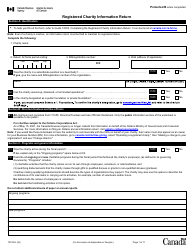

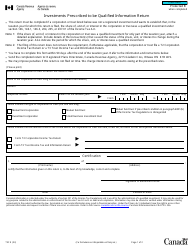

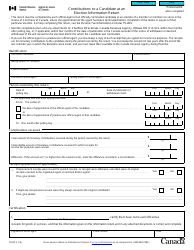

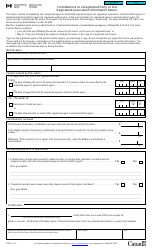

Form T106 Information Return of Non-arm's Length Transactions With Non-residents (2022 and Later Tax Years) - Canada

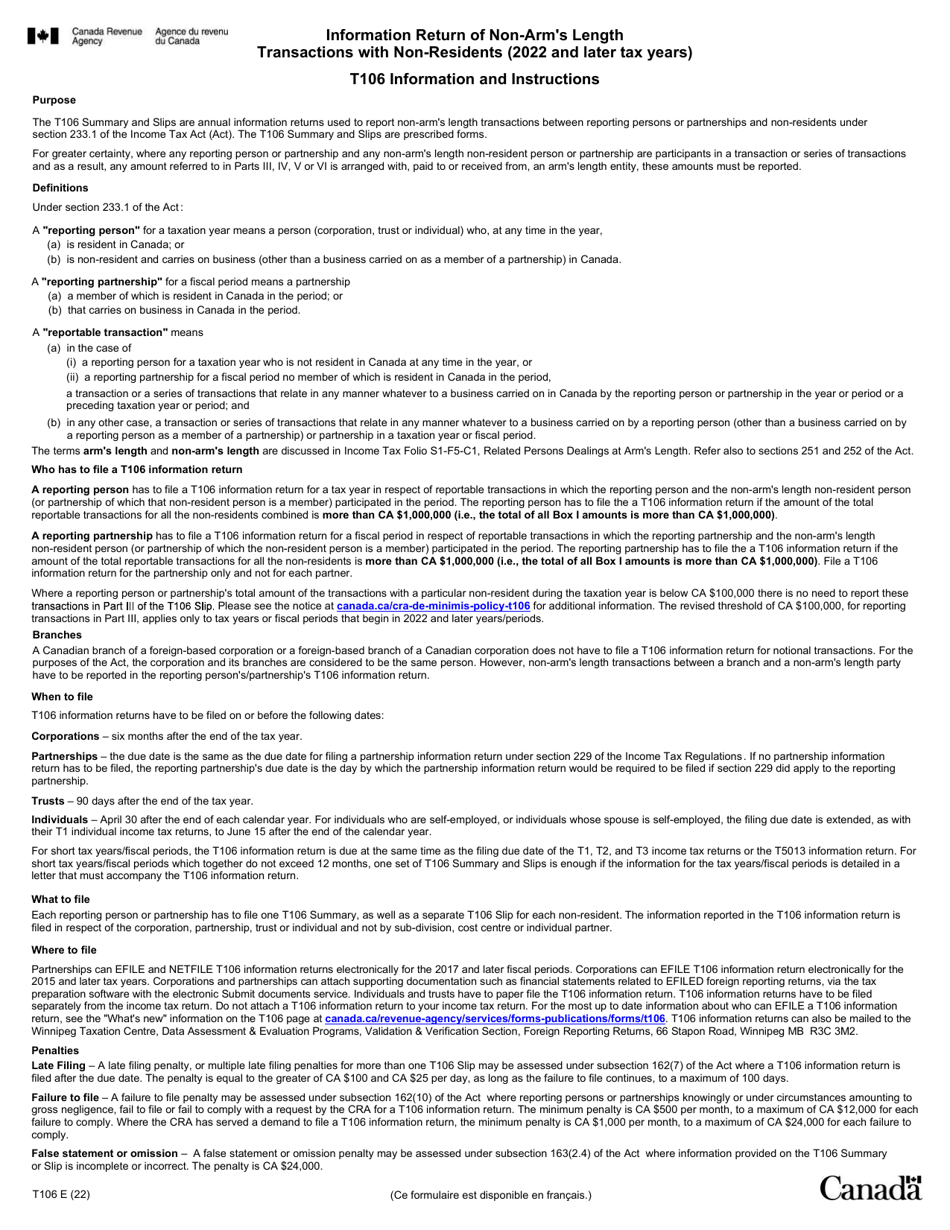

Form T106 Information Return of Non-arm's Length Transactions With Non-residents (2022 and Later Tax Years) in Canada is used to report certain transactions that Canadian residents have with non-residents with whom they have a non-arm's length relationship. It is used to provide information to the Canada Revenue Agency (CRA) about these transactions for tax purposes.

The Form T106 Information Return of Non-arm's Length Transactions With Non-residents (2022 and Later Tax Years) in Canada is filed by taxpayers who have engaged in non-arm's length transactions with non-residents.

FAQ

Q: What is Form T106?A: Form T106 is an information return used to report non-arm's length transactions with non-residents for tax years 2022 and onwards in Canada.

Q: Who needs to file Form T106?A: Any taxpayer in Canada who has engaged in non-arm's length transactions with non-residents needs to file Form T106.

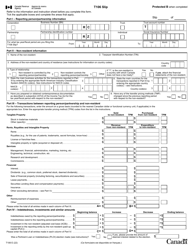

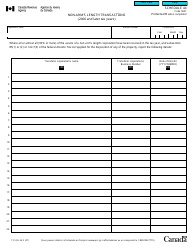

Q: What are non-arm's length transactions?A: Non-arm's length transactions are transactions between related parties, such as family members or businesses with common ownership.

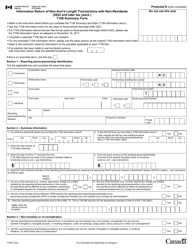

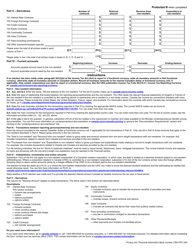

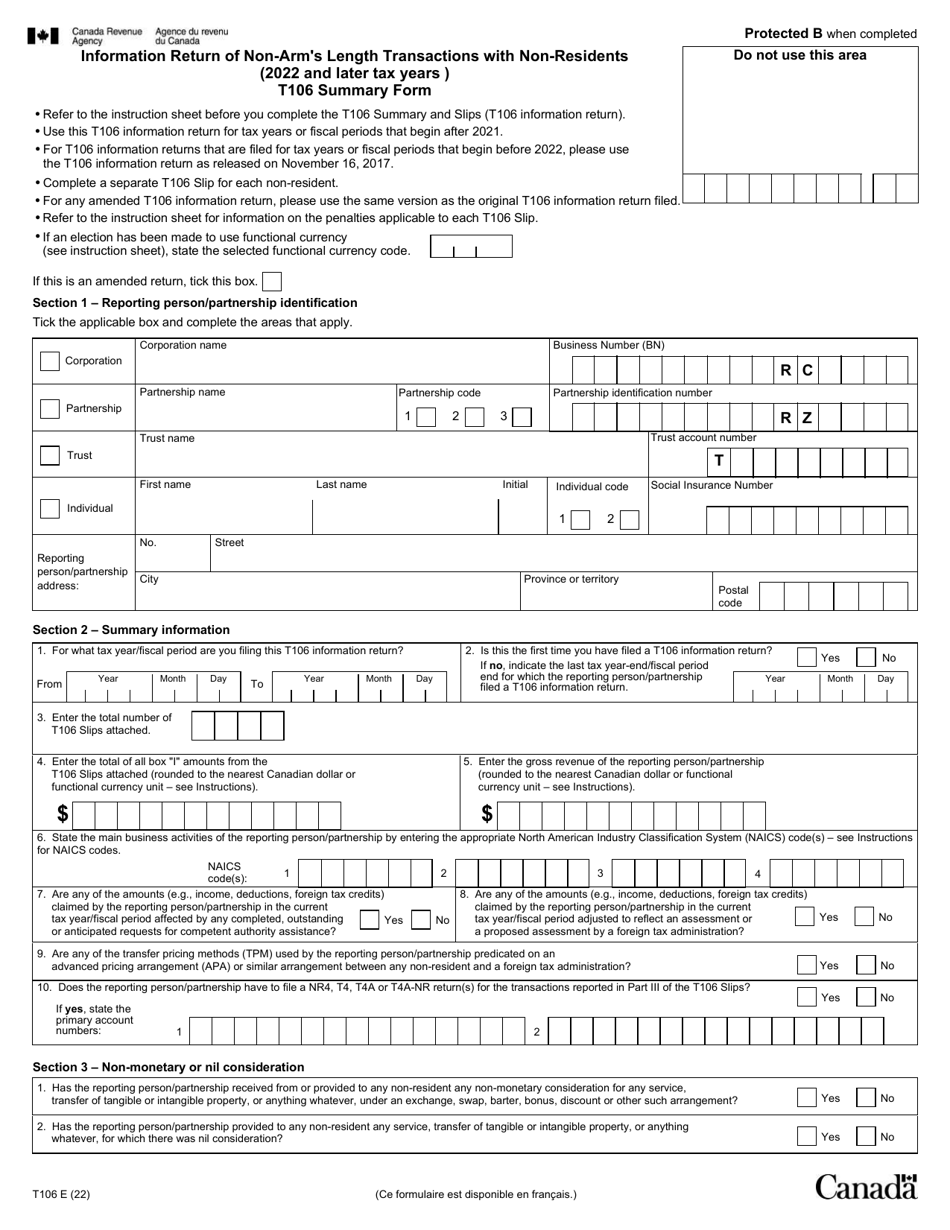

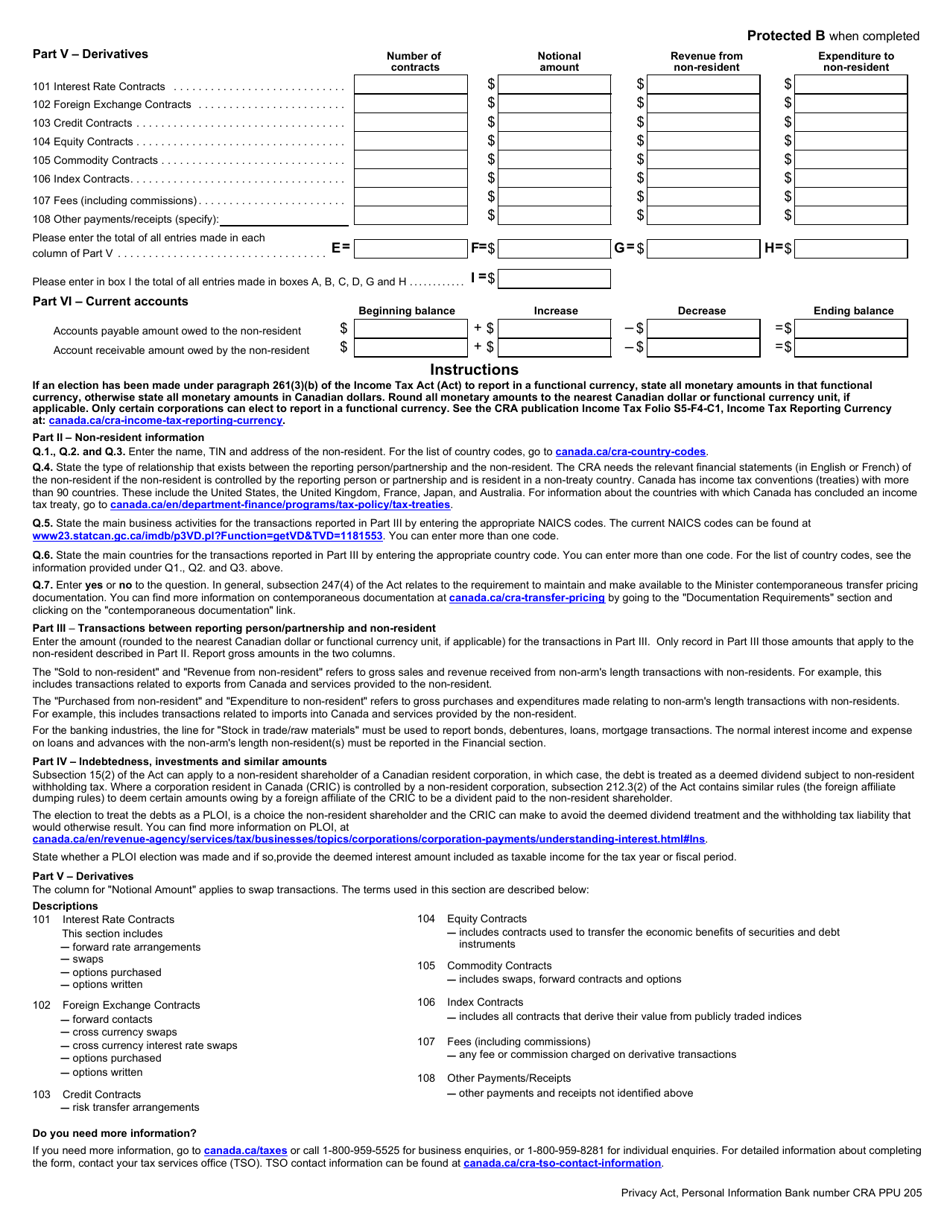

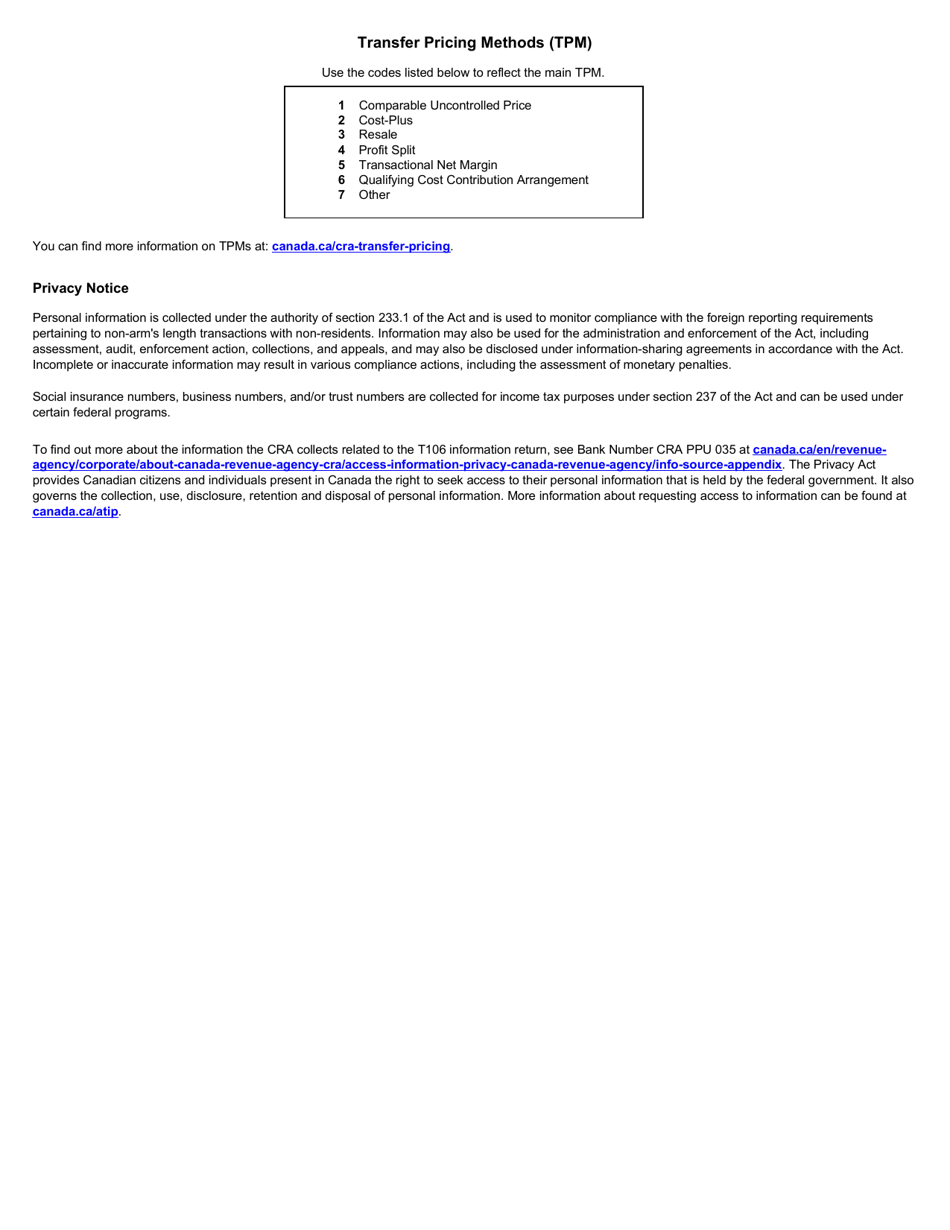

Q: What information is required on Form T106?A: Form T106 requires detailed information about the non-arm's length transactions, including the nature of the transactions, amounts involved, and the identities of the parties.

Q: When is Form T106 due?A: Form T106 is due on the same date as the taxpayer's income tax return, which is generally April 30th of the year following the tax year.

Q: Does Form T106 apply only to residents of Canada?A: No, Form T106 applies to any taxpayer in Canada, including both residents and non-residents, who have engaged in non-arm's length transactions with non-residents.

Q: Are there any penalties for not filing Form T106?A: Yes, there can be penalties for not filing Form T106 or for filing it incorrectly. It is important to comply with the filing requirements to avoid these penalties.