This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1146

for the current year.

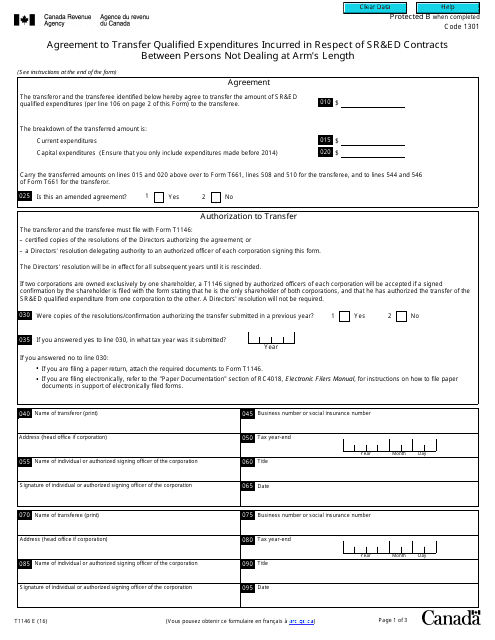

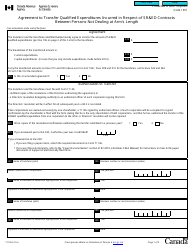

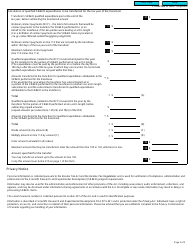

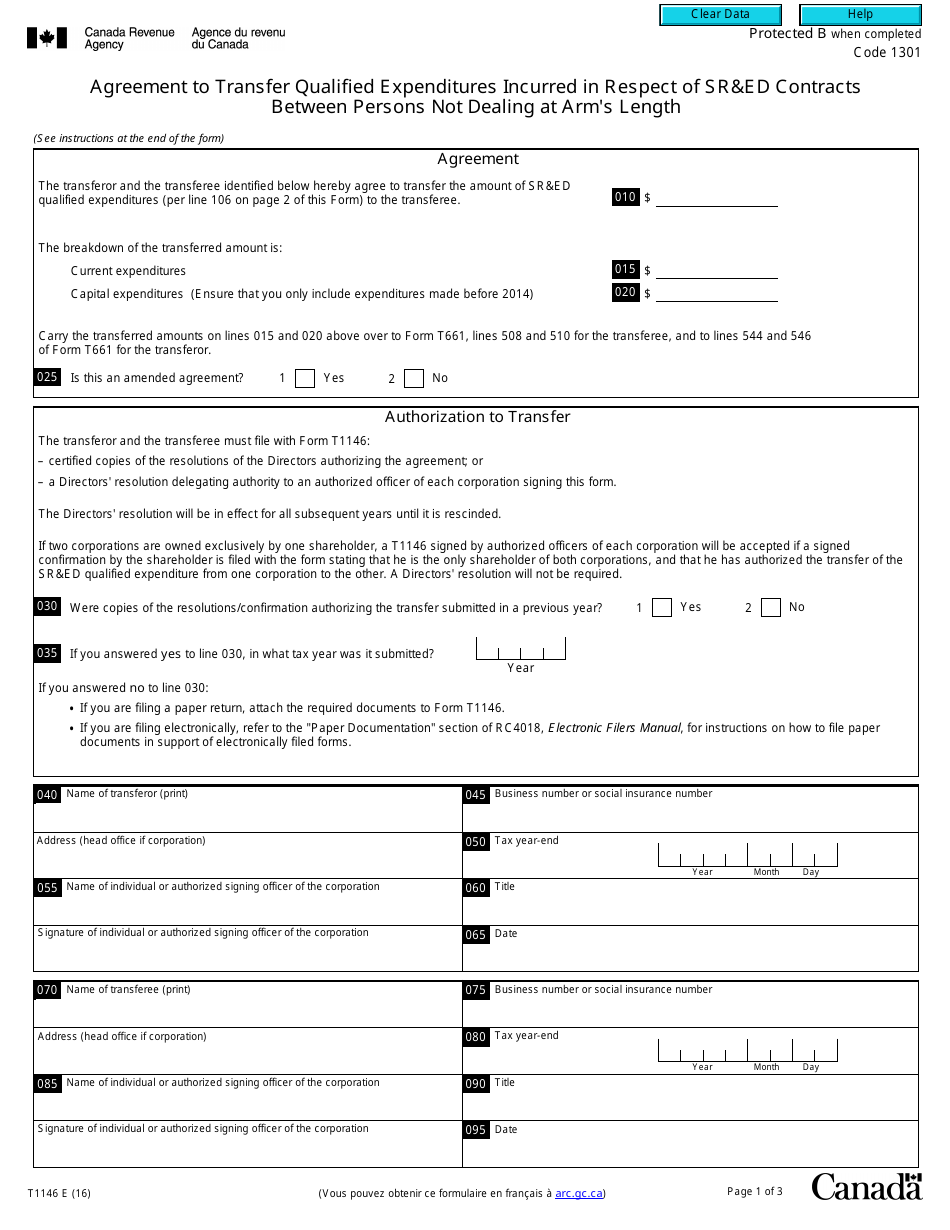

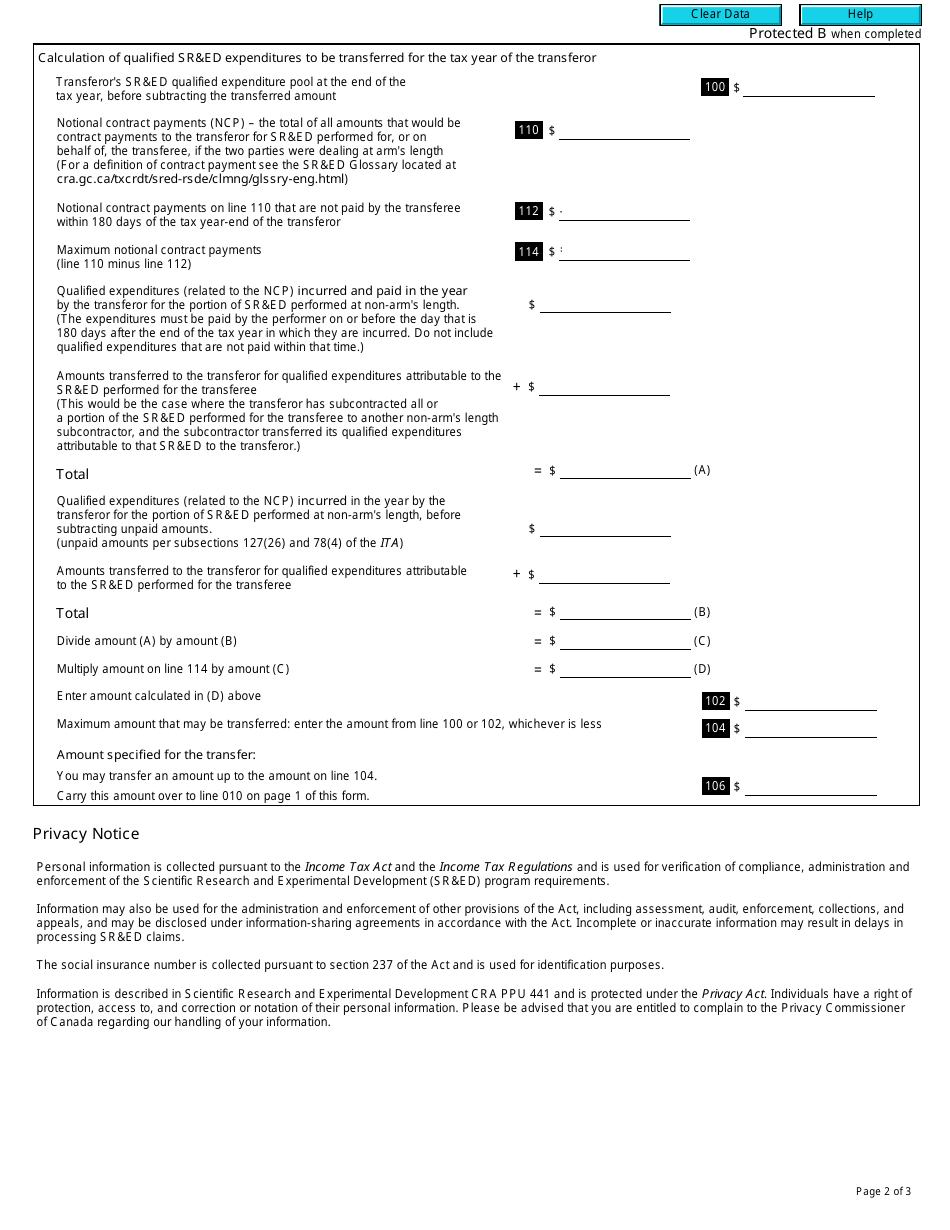

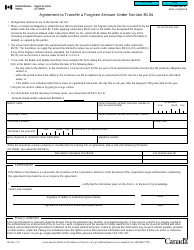

Form T1146 Agreement to Transfer Qualified Expenditures Incurred in Respect of Sr&ed Contracts Between Persons Not Dealing at Arm's Length - Canada

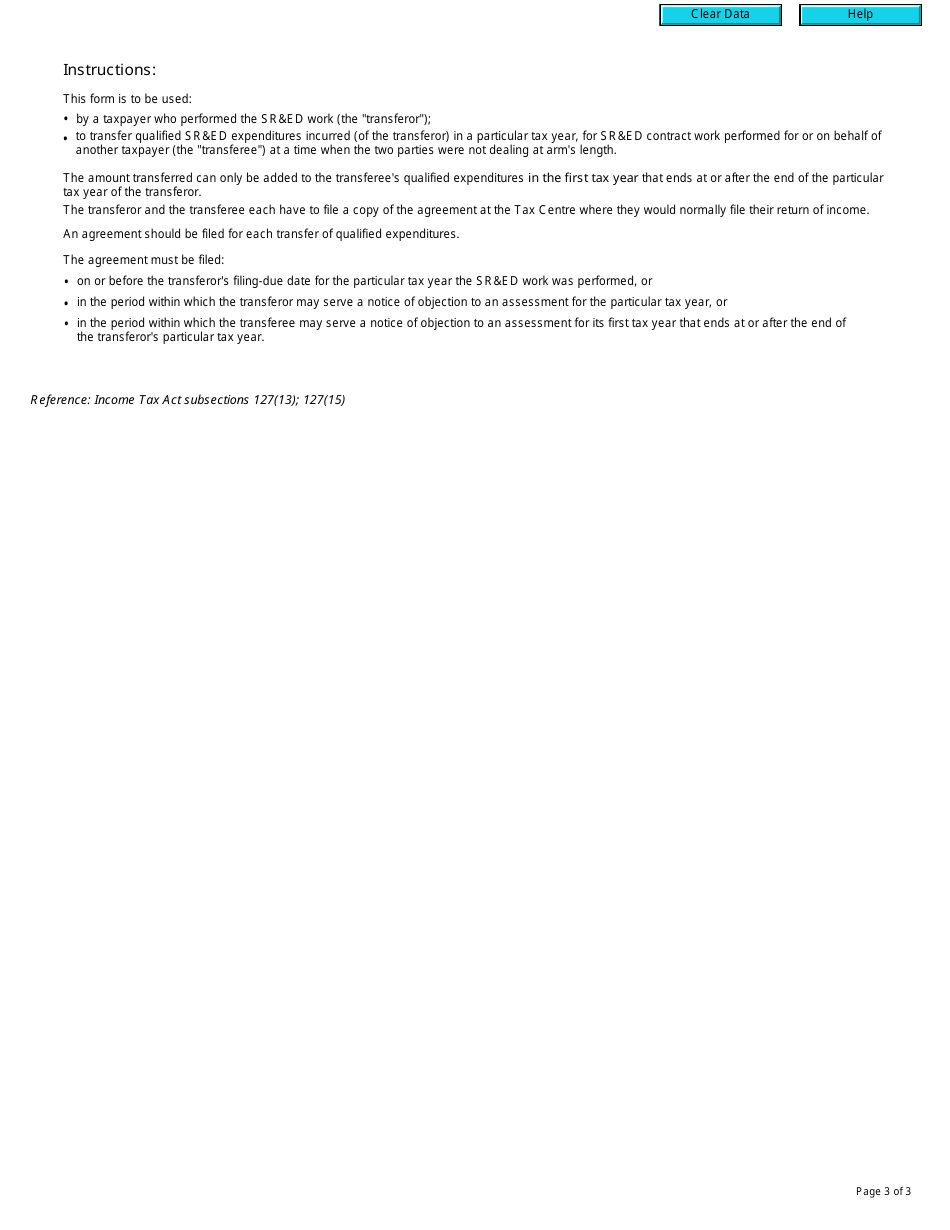

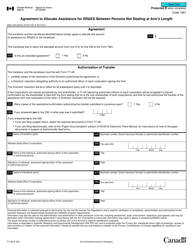

Form T1146 "Agreement to Transfer Qualified Expenditures Incurred in Respect of SR&ED Contracts Between Persons Not Dealing at Arm's Length" in Canada is used to transfer Scientific Research and Experimental Development (SR&ED) expenses between individuals or entities that are not dealing at arm's length. This form is necessary to claim tax credits for SR&ED expenses.

The taxpayer who wants to transfer qualified expenditures incurred in respect of SR&ED contracts between persons not dealing at arm's length files the Form T1146 Agreement - Canada.

FAQ

Q: What is Form T1146 Agreement to Transfer Qualified Expenditures Incurred in Respect of Sr&ed Contracts Between Persons Not Dealing at Arm's Length?

A: Form T1146 is a document used in Canada to transfer qualified expenditures for scientific research and experimental development (SR&ED) contracts between parties who are not dealing at arm's length.

Q: What is the purpose of Form T1146?

A: The purpose of Form T1146 is to allow for the transfer of qualified expenditures incurred in relation to SR&ED contracts between parties who have a non-arm's length relationship.

Q: Who should use Form T1146?

A: Parties who are not dealing at arm's length and have incurred qualified expenditures in relation to SR&ED contracts should use Form T1146.

Q: What are qualified expenditures in relation to SR&ED contracts?

A: Qualified expenditures in relation to SR&ED contracts refer to the eligible costs incurred for scientific research and experimental development activities.

Q: What does 'not dealing at arm's length' mean?

A: 'Not dealing at arm's length' refers to a relationship between parties where one party has the ability to control or influence the other party in matters of financial or operational decision-making.