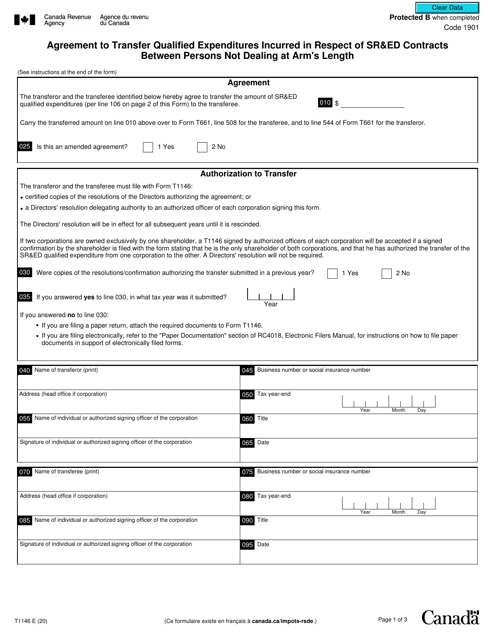

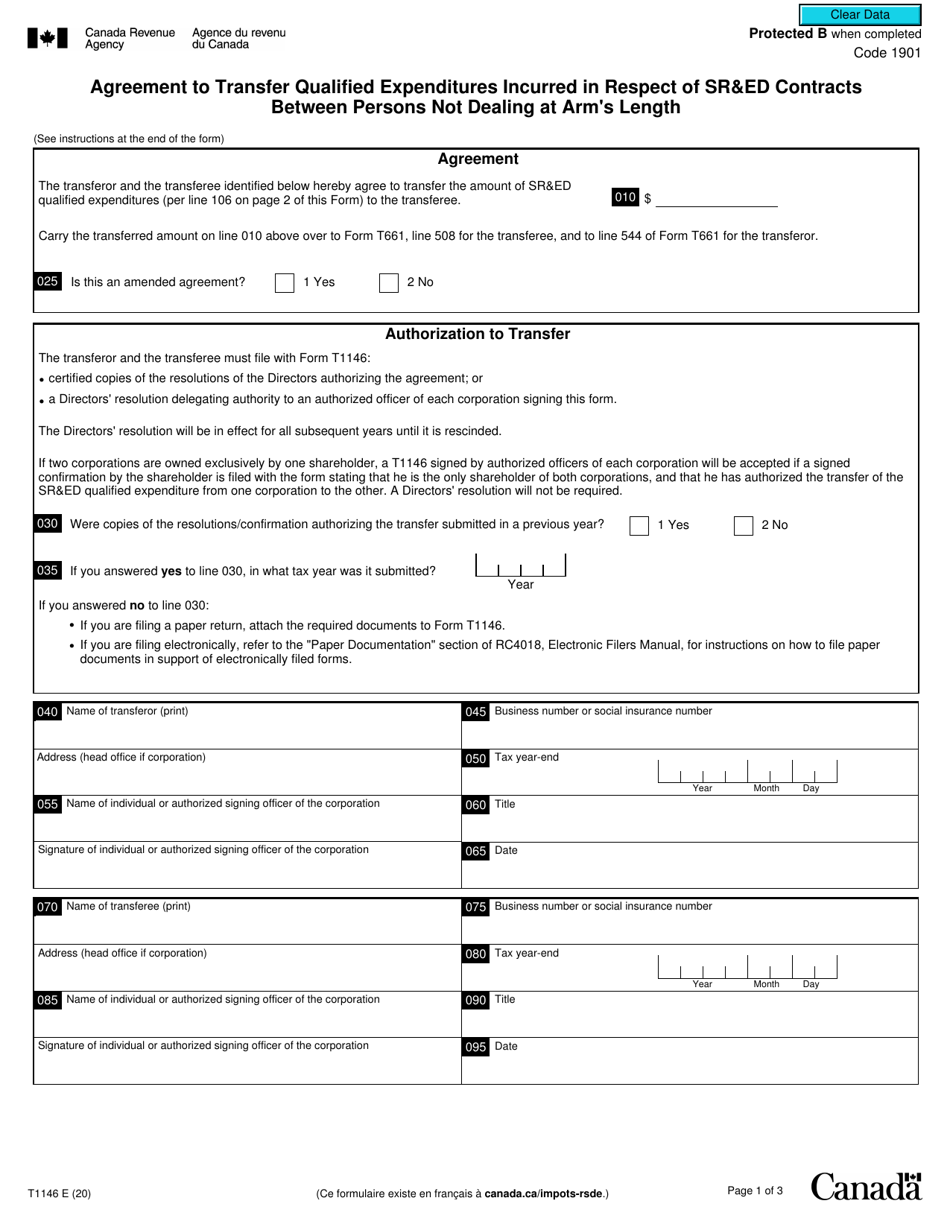

Form T1146 Agreement to Transfer Qualified Expenditures Incurred in Respect of Sr&ed Contracts Between Persons Not Dealing at Arm's Length - Canada

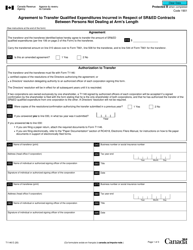

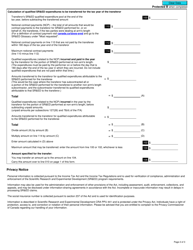

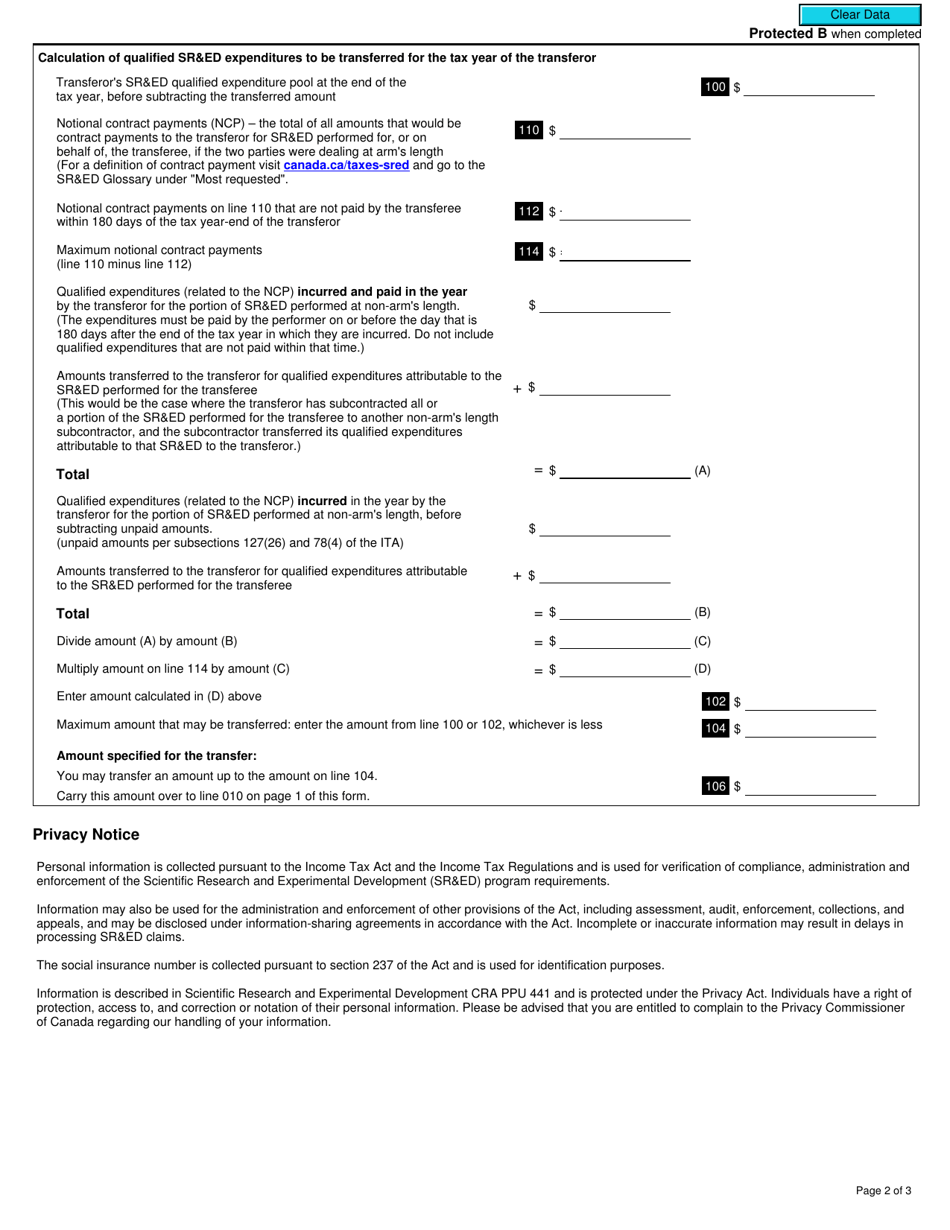

Form T1146 is used in Canada for the Agreement to Transfer Qualified Expenditures Incurred in Respect of SR&ED Contracts between persons not dealing at arm's length. This form is used when two parties who are not dealing at arm's length agree to transfer their eligible SR&ED expenditures for tax purposes. It allows for the transfer of scientific research and experimental development (SR&ED) expenditures between related parties.

Form T1146 Agreement to Transfer Qualified Expenditures Incurred in Respect of Sr&ed Contracts Between Persons Not Dealing at Arm's Length - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1146?

A: Form T1146 is an agreement to transfer qualified expenditures incurred in respect of SR&ED contracts between persons not dealing at arm's length in Canada.

Q: What is SR&ED?

A: SR&ED stands for Scientific Research and Experimental Development, which refers to the work done in the fields of science or technology that qualifies for tax incentives in Canada.

Q: Who should use Form T1146?

A: Form T1146 should be used by persons in Canada who have incurred qualified expenditures in respect of SR&ED contracts with someone they are not dealing at arm's length.

Q: What is meant by not dealing at arm's length?

A: Not dealing at arm's length means that the parties involved have a special or close relationship, such as family members or related businesses.

Q: What is the purpose of Form T1146?

A: The purpose of Form T1146 is to establish an agreement to transfer the qualified expenditures related to SR&ED contracts between persons not dealing at arm's length in Canada.

Q: Is Form T1146 mandatory?

A: No, Form T1146 is not mandatory. However, it is recommended to use this form to ensure the transfer of qualified expenditures is properly documented for tax purposes.