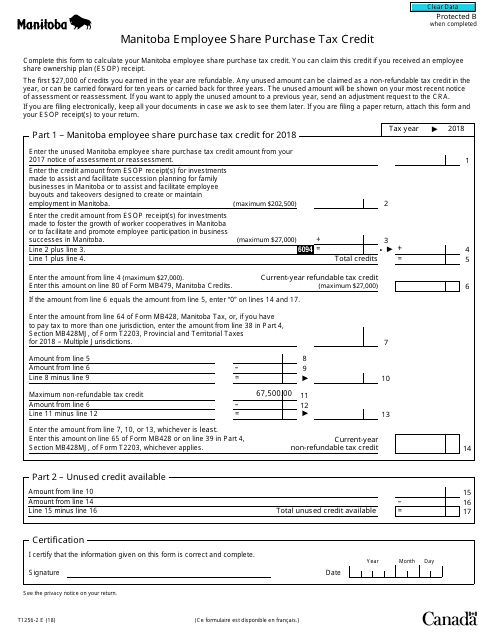

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1256-2

for the current year.

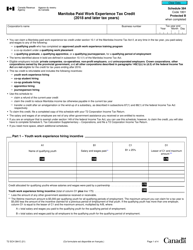

Form T1256-2 Manitoba Employee Share Purchase Tax Credit - Canada

Form T1256-2, Manitoba Employee Share Purchase Tax Credit, is used by individuals who are residents of Manitoba, Canada, and have purchased shares of a qualifying corporation through an employee share purchase plan. This form allows eligible individuals to claim a tax credit for a portion of the cost of the shares purchased.

The Form T1256-2 Manitoba Employee Share Purchase Tax Credit in Canada is filed by employees who have purchased shares from their employer and are claiming a tax credit in Manitoba.

FAQ

Q: What is Form T1256-2?

A: Form T1256-2 is a tax form used by residents of Manitoba, Canada to claim the Employee Share Purchase Tax Credit.

Q: What is the Employee Share Purchase Tax Credit?

A: The Employee Share Purchase Tax Credit is a tax credit available to individuals who participate in an employee share purchase plan in Manitoba.

Q: Who can claim the Employee Share Purchase Tax Credit?

A: Residents of Manitoba who participate in an eligible employee share purchase plan can claim the tax credit.

Q: What is an employee share purchase plan?

A: An employee share purchase plan is a program offered by employers that allows employees to purchase shares of the company's stock at a discounted price.

Q: How much is the tax credit?

A: The tax credit is equal to 15% of the amount paid to purchase shares through an employee share purchase plan.

Q: How do I claim the tax credit?

A: To claim the tax credit, you need to complete and file Form T1256-2 with your annual income tax return.

Q: Are there any limits on the tax credit?

A: Yes, the tax credit is subject to a maximum annual limit of $2,500 per individual.