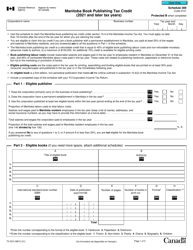

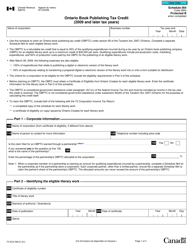

This version of the form is not currently in use and is provided for reference only. Download this version of

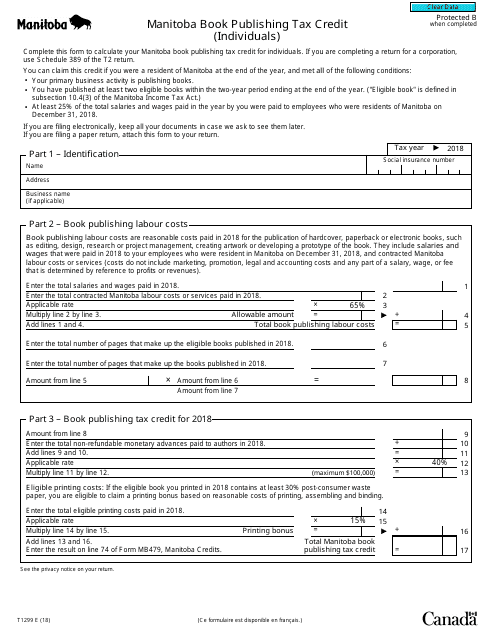

Form T1299

for the current year.

Form T1299 Manitoba Book Publishing Tax Credit (Individuals) - Canada

Form T1299 Manitoba Book Publishing Tax Credit (Individuals) is used by individuals in Canada to claim the Manitoba Book Publishing Tax Credit. This tax credit is available for individuals who have engaged in eligible book publishing activities in Manitoba. It provides a tax credit equal to a percentage of eligible expenditures incurred in the publication and promotion of eligible books.

Individuals who qualify for the Manitoba Book Publishing Tax Credit in Canada would file the Form T1299 themselves.

FAQ

Q: What is Form T1299?

A: Form T1299 is the Manitoba Book Publishing Tax Credit form for individuals in Canada.

Q: What is the Manitoba Book Publishing Tax Credit?

A: The Manitoba Book Publishing Tax Credit is a tax credit available to individuals who work in the book publishing industry in Manitoba, Canada.

Q: Who is eligible for the Manitoba Book Publishing Tax Credit?

A: Individuals who work in the book publishing industry in Manitoba, Canada may be eligible for the tax credit.

Q: How do I claim the Manitoba Book Publishing Tax Credit?

A: To claim the Manitoba Book Publishing Tax Credit, you must fill out and submit Form T1299 with your tax return.

Q: What information do I need to fill out Form T1299?

A: You will need to provide details about your employment in the book publishing industry and information about the book or books you worked on.