This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1-M

for the current year.

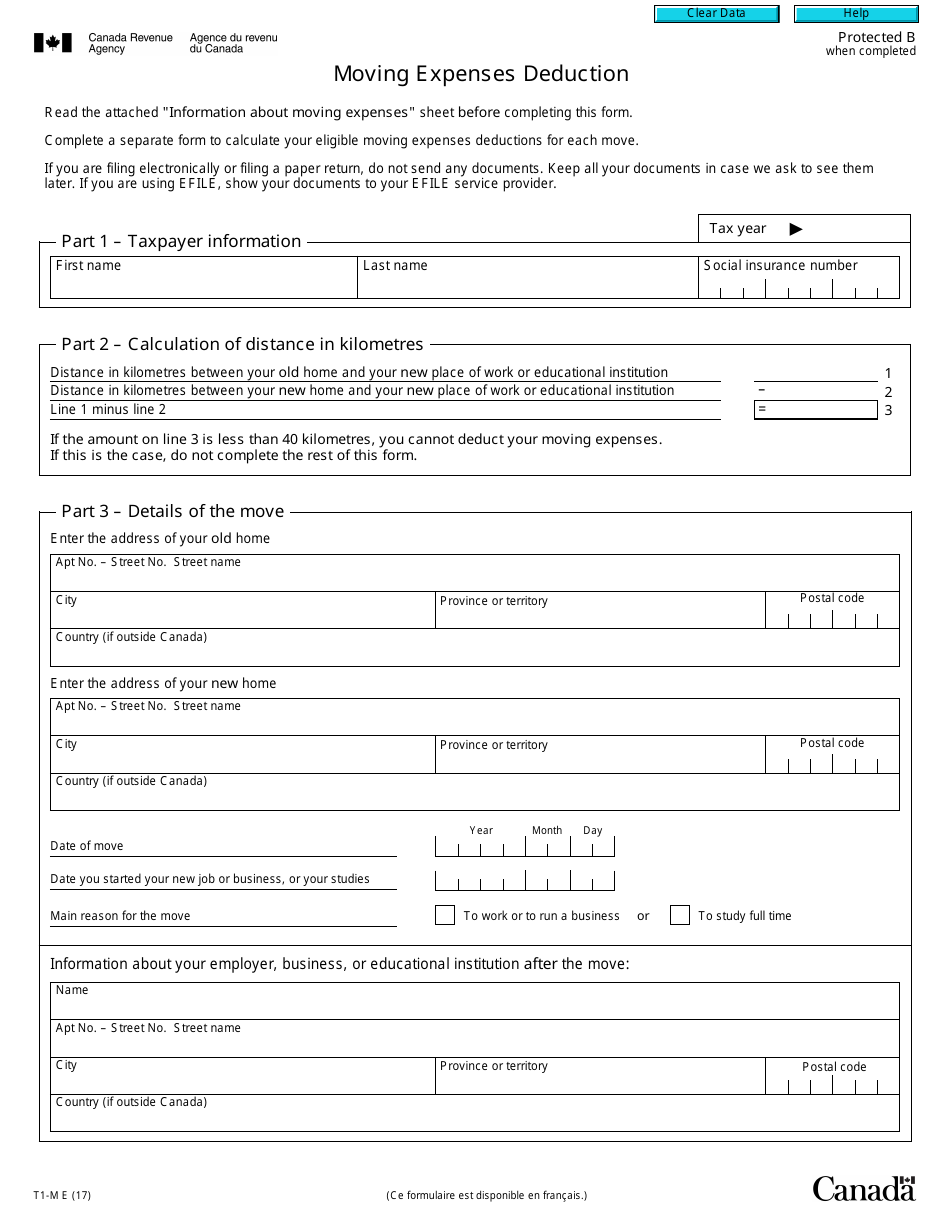

Form T1-M Moving Expenses Deduction - Canada

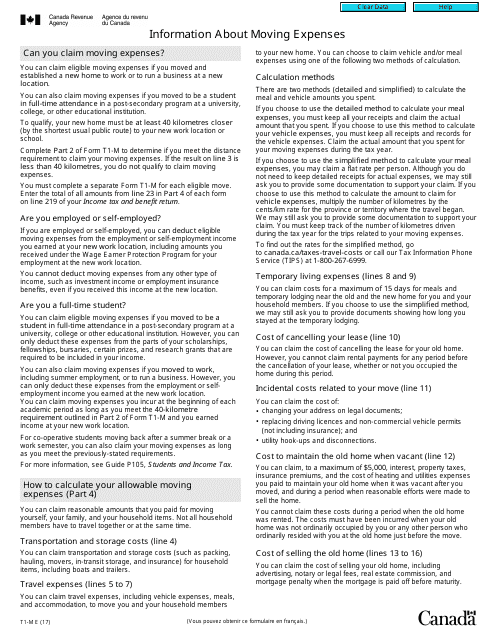

The Form T1-M Moving Expenses Deduction in Canada is used to claim a deduction for eligible moving expenses incurred when you move to start work or run a business at a new location.

Individuals who have moved to a new location in Canada for work or business purposes can file Form T1-M, Moving Expenses Deduction, to claim eligible moving expenses on their Canadian income tax return.

FAQ

Q: What is Form T1-M Moving Expenses Deduction?

A: Form T1-M is a form used in Canada to claim a deduction for moving expenses when you relocate for employment or self-employment purposes.

Q: Who can claim the moving expenses deduction?

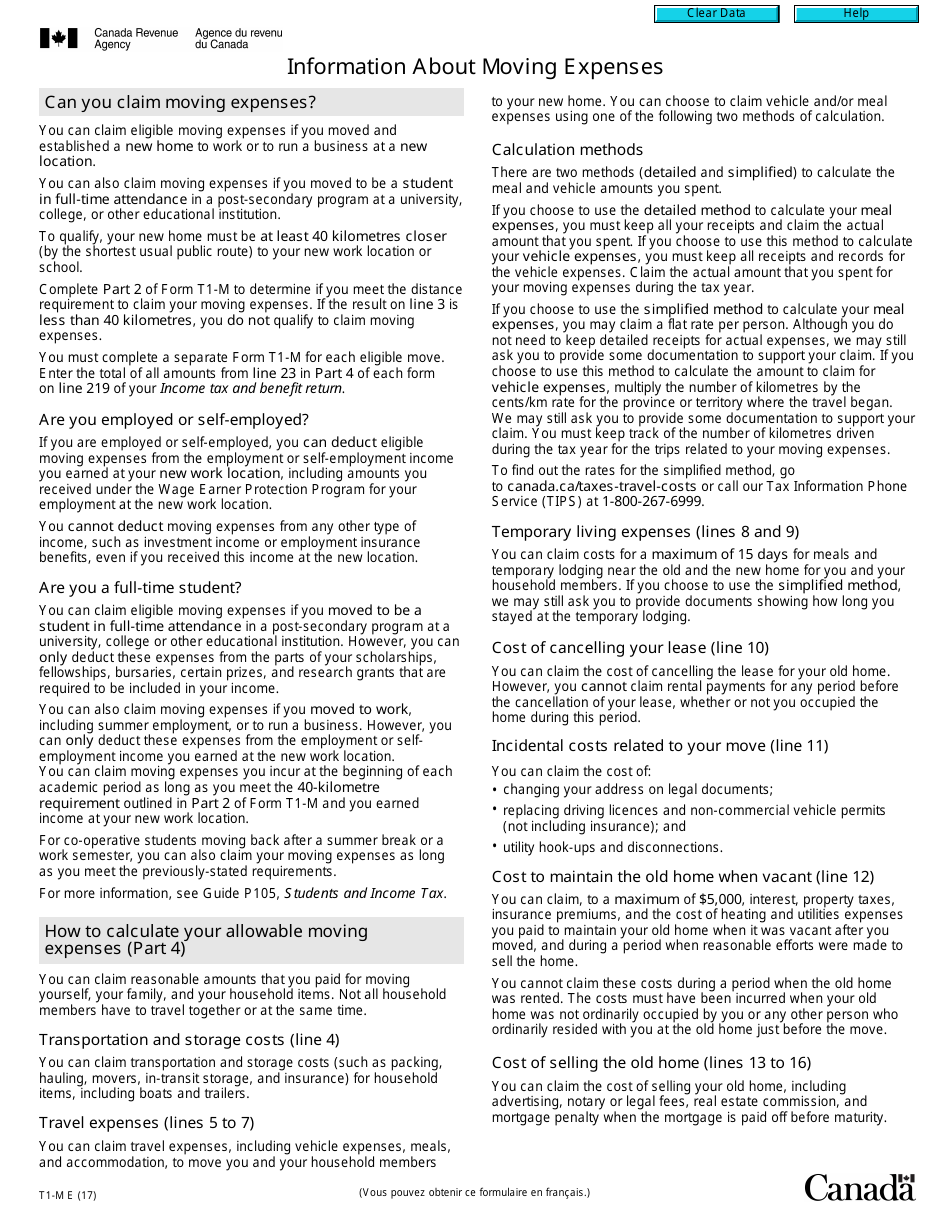

A: You can claim the moving expenses deduction if you moved and established a new home to work or run a business at a new location.

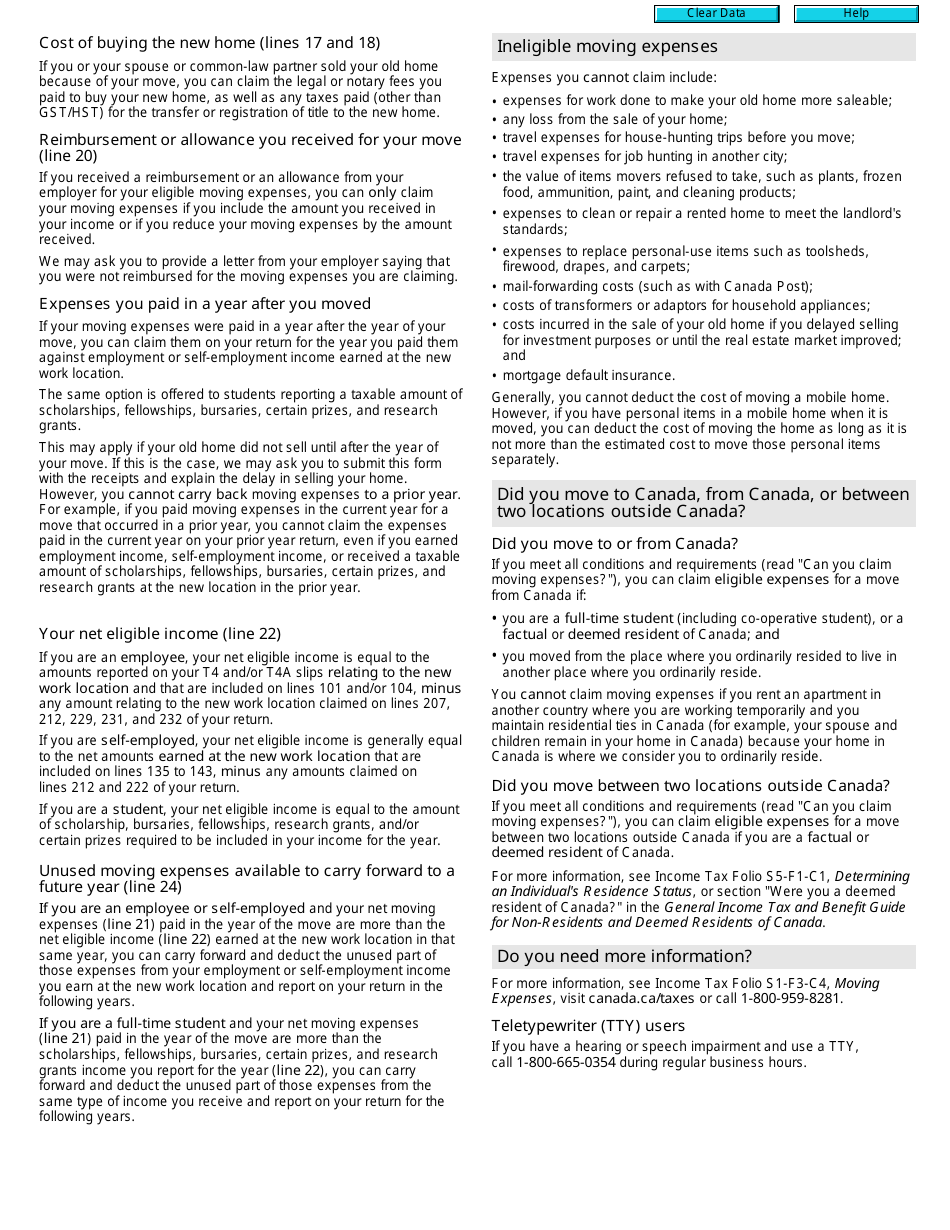

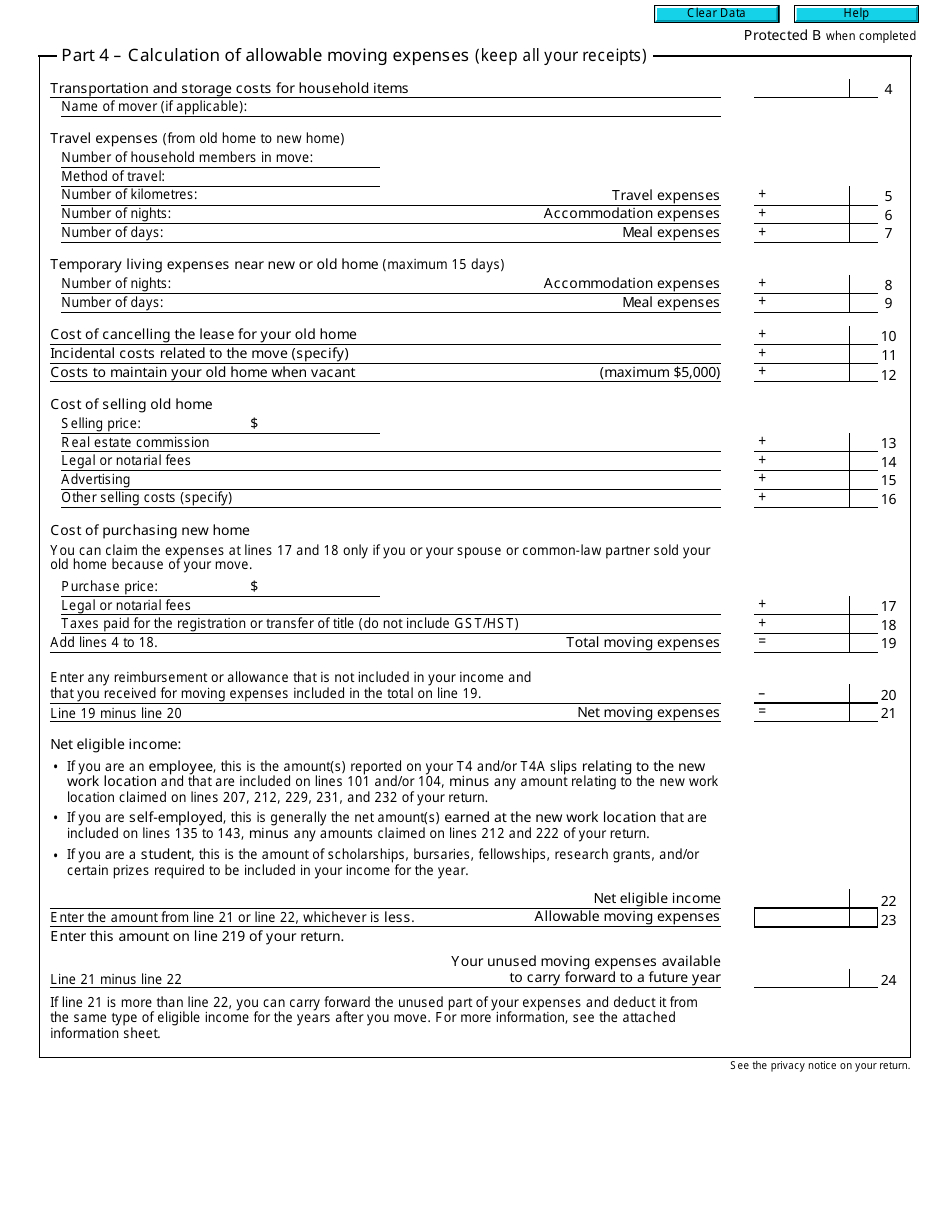

Q: What expenses can be deducted on Form T1-M?

A: Eligible moving expenses that can be deducted include transportation and storage costs, travel expenses, temporary living costs, and costs to sell your old home.

Q: How do I claim the moving expenses deduction?

A: To claim the deduction, you need to complete Form T1-M and include it with your personal income tax return. You must also provide supporting documents and receipts.

Q: Are there any limitations to the moving expenses deduction?

A: Yes, there are certain limitations on the deduction. For example, you cannot deduct expenses reimbursed by your employer and the deduction cannot exceed your income from the new location.