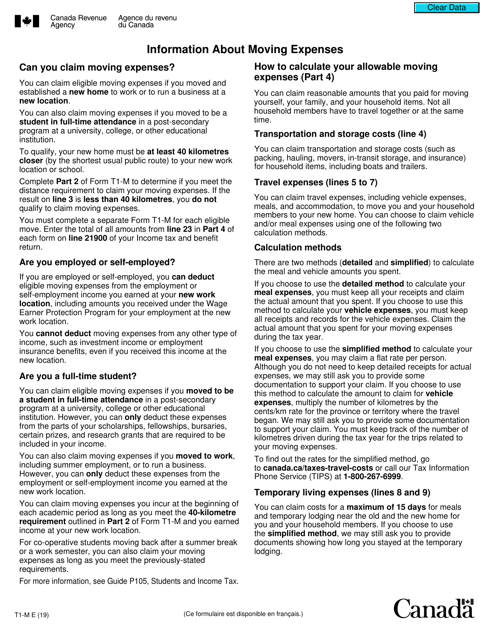

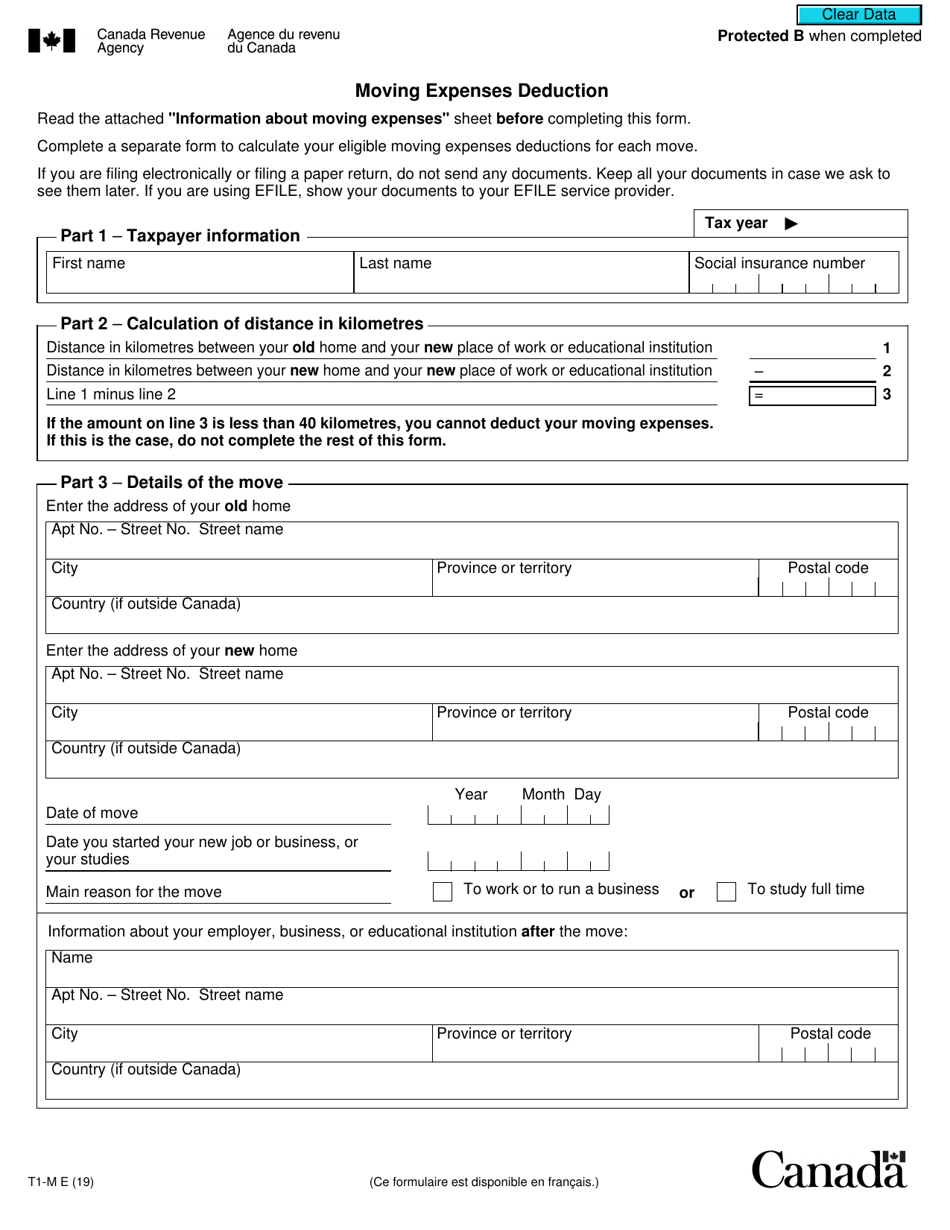

Form T1-M Moving Expenses Deduction - Canada

Form T1-M Moving Expenses Deduction is used in Canada to claim deductions for eligible moving expenses when an individual moves to a new location for work or to run a business. It allows taxpayers to reduce their taxable income by deducting certain eligible expenses related to moving.

The individual who incurred moving expenses in Canada files the Form T1-M Moving Expenses Deduction.

Form T1-M Moving Expenses Deduction - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1-M?

A: Form T1-M is a form used in Canada to claim a deduction for moving expenses on your personal income tax return.

Q: Who can claim the moving expenses deduction?

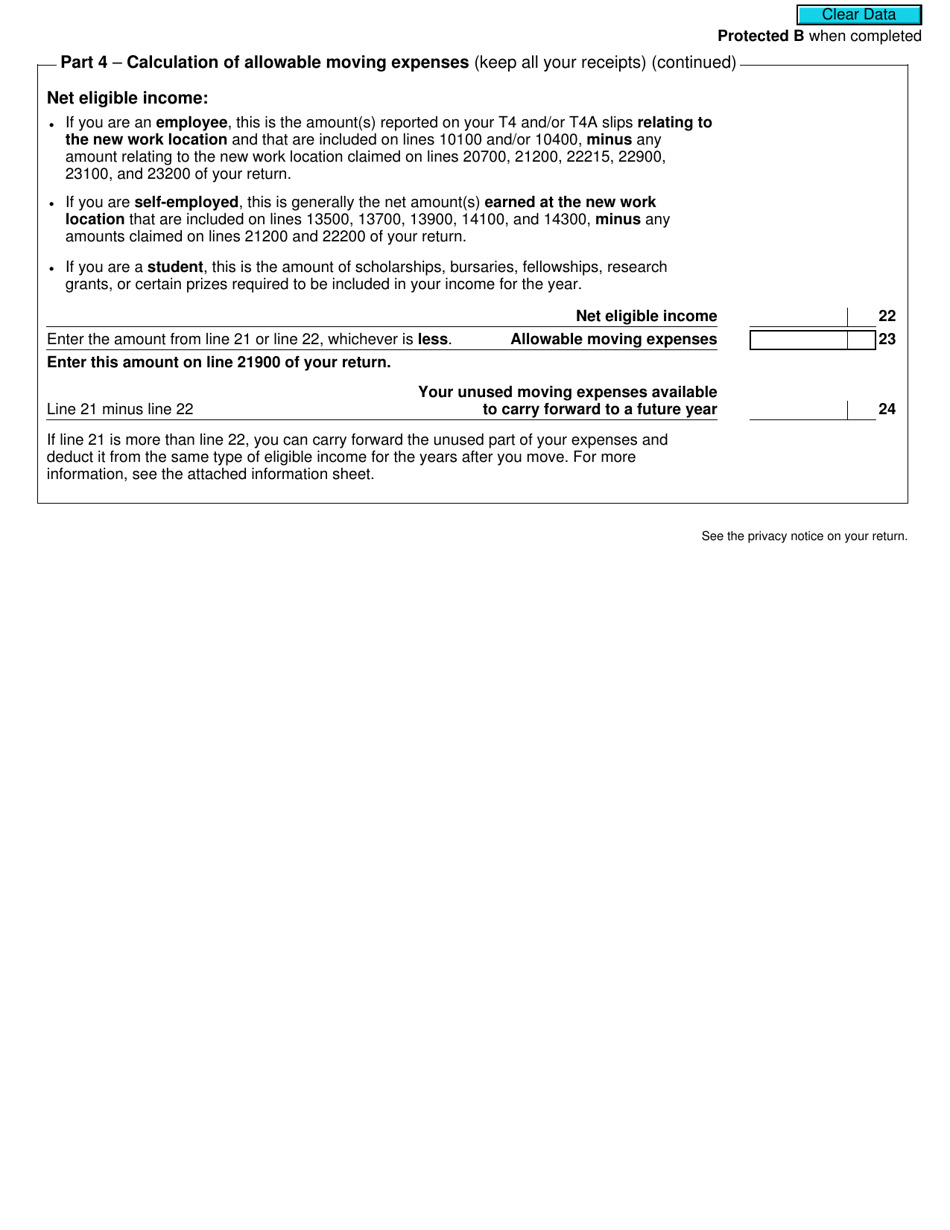

A: Individuals who have moved and established a new home to be employed or carry on a business at a new location in Canada, are eligible to claim the moving expenses deduction.

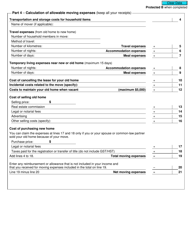

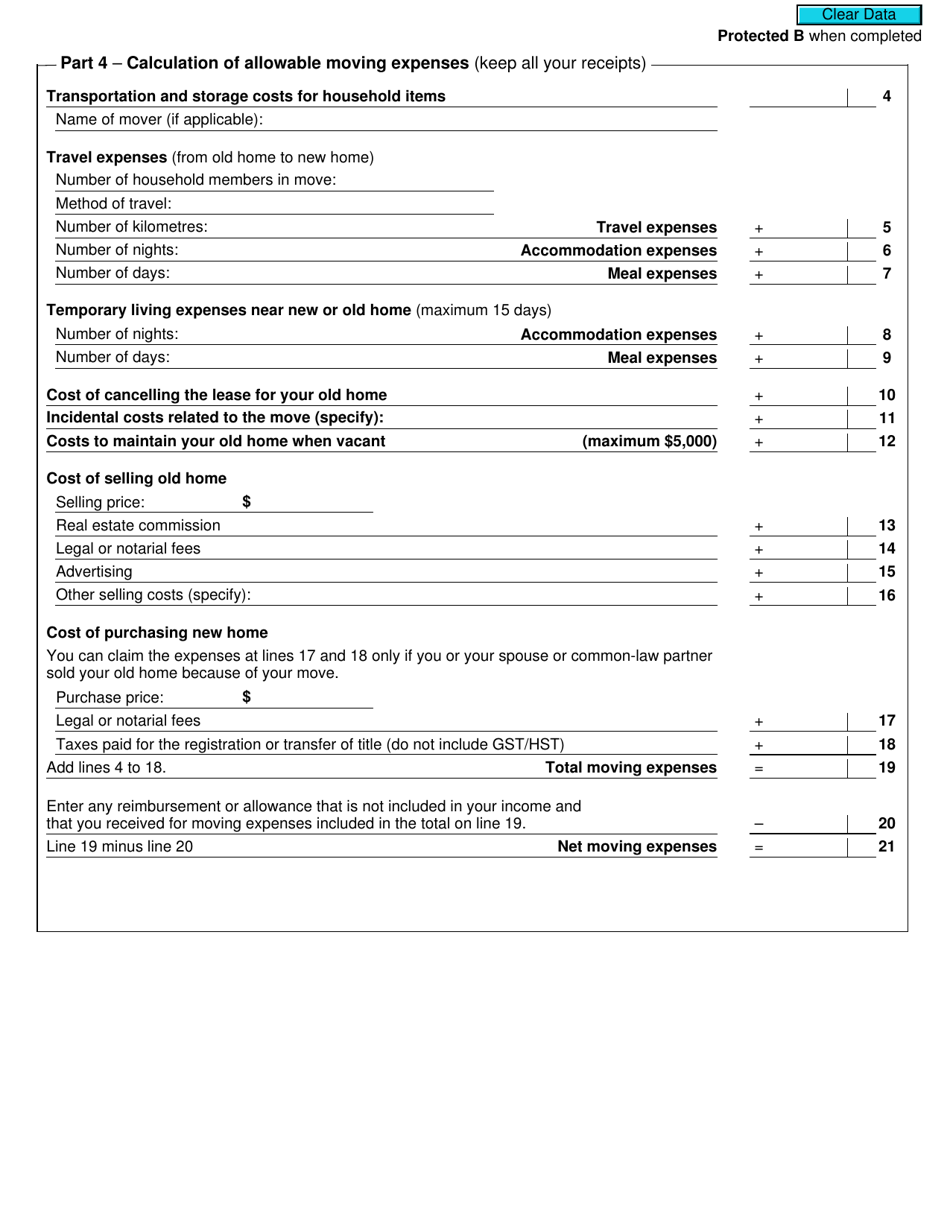

Q: What expenses can be claimed as moving expenses?

A: You can claim eligible expenses such as transportation and storage costs, travel expenses, temporary living expenses, and costs for changing your address.

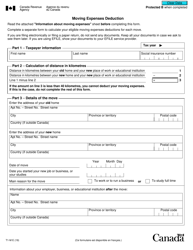

Q: How do I complete Form T1-M?

A: To complete Form T1-M, you need to provide details of your move, total eligible expenses, and any reimbursements received. The form must be filed along with your personal income tax return.

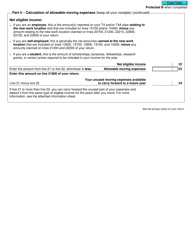

Q: Is there a limit on the amount of moving expenses I can claim?

A: Yes, there is a limit on the amount of moving expenses you can claim. The deduction cannot exceed the income you earned at the new location.

Q: Can I claim moving expenses if I moved within the same city?

A: No, you cannot claim moving expenses if you moved within the same city. The move must be from one location to another in Canada.

Q: Can I claim moving expenses if I moved from Canada to another country or vice versa?

A: No, you cannot claim moving expenses if you moved from Canada to another country or vice versa. The move must be within Canada.

Q: What should I do if I have questions about claiming moving expenses?

A: If you have questions about claiming moving expenses, you can contact the Canada Revenue Agency (CRA) or consult with a tax professional.

Q: When should I file Form T1-M?

A: You should file Form T1-M along with your personal income tax return by the due date, which is usually April 30th or June 15th for self-employed individuals.