This version of the form is not currently in use and is provided for reference only. Download this version of

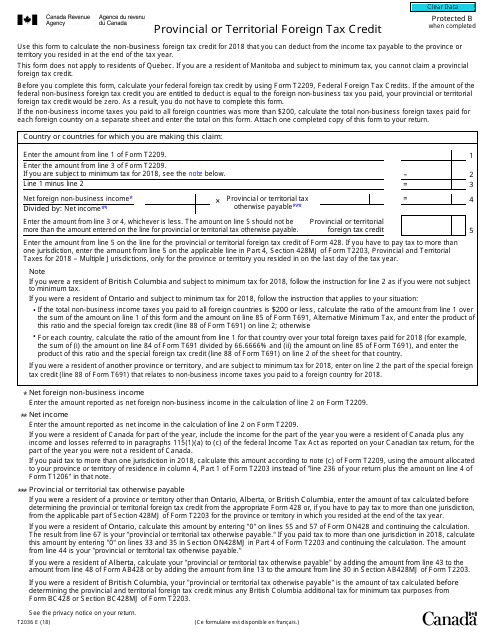

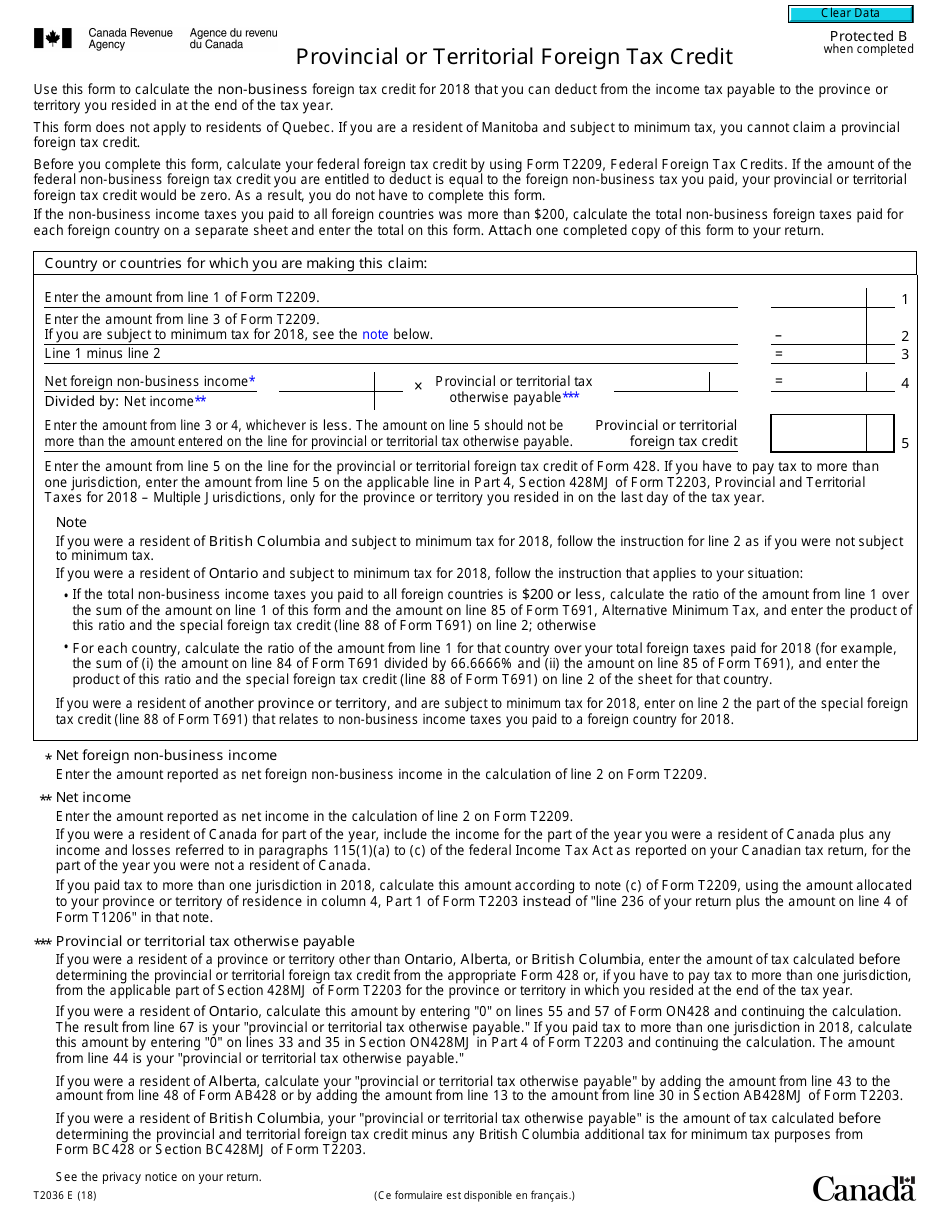

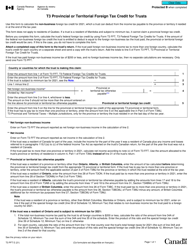

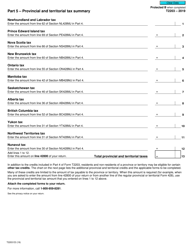

Form T2036

for the current year.

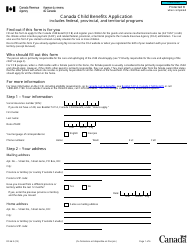

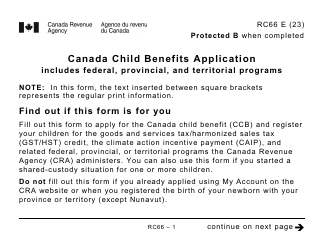

Form T2036 Provincial or Territorial Foreign Tax Credit - Canada

Form T2036 is a Canadian Revenue Agency form also known as the "Form T2036 "provincial Or Territorial Foreign Tax Credit" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download a PDF version of the Form T2036 down below or find it on Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2036?

A: Form T2036 is a tax form used in Canada to claim a Provincial or Territorial Foreign Tax Credit.

Q: What is the purpose of Form T2036?

A: The purpose of Form T2036 is to allow Canadian taxpayers to claim a credit for foreign taxes paid to a province or territory in Canada.

Q: Who can use Form T2036?

A: Canadian residents who have paid foreign taxes to a province or territory in Canada can use Form T2036 to claim a credit.

Q: What information is required to fill out Form T2036?

A: To fill out Form T2036, you will need to provide information about the foreign taxes paid, the province or territory where the taxes were paid, and your total income subject to foreign taxes.