This version of the form is not currently in use and is provided for reference only. Download this version of

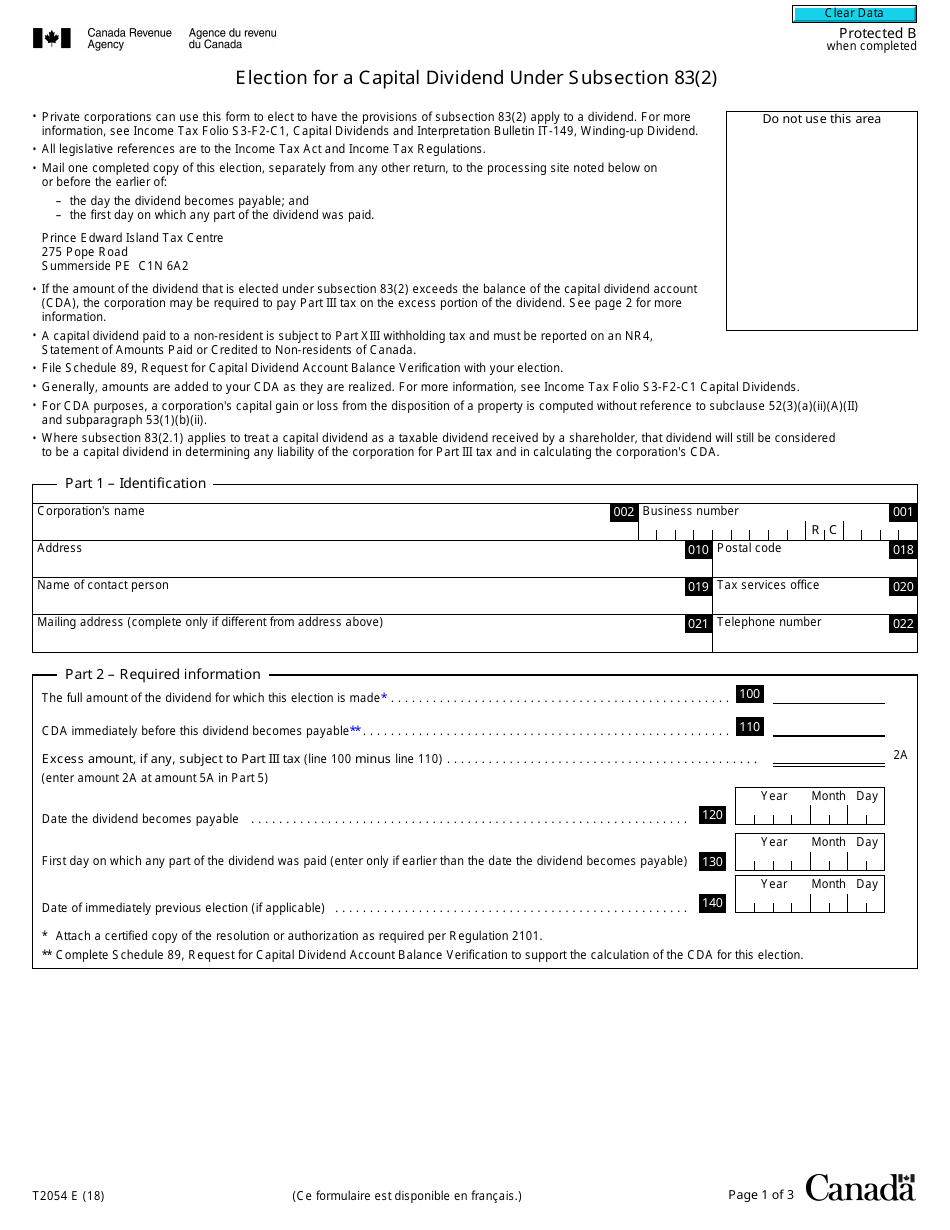

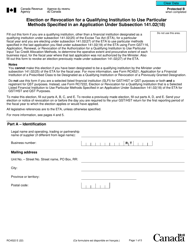

Form T2054

for the current year.

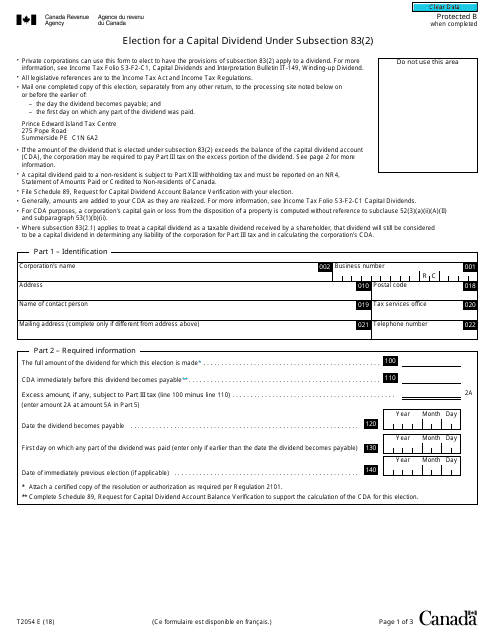

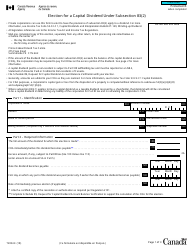

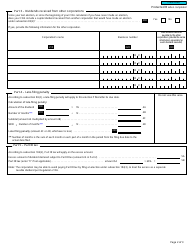

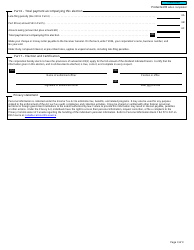

Form T2054 Election for a Capital Dividend Under Subsection 83(2) - Canada

Form T2054 is a Canadian Revenue Agency form also known as the "Form T2054 "election For A Capital Dividend Under Subsection 83(2)" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download an up-to-date Form T2054 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2054?

A: Form T2054 is a tax form used in Canada to make an election for a capital dividend under subsection 83(2).

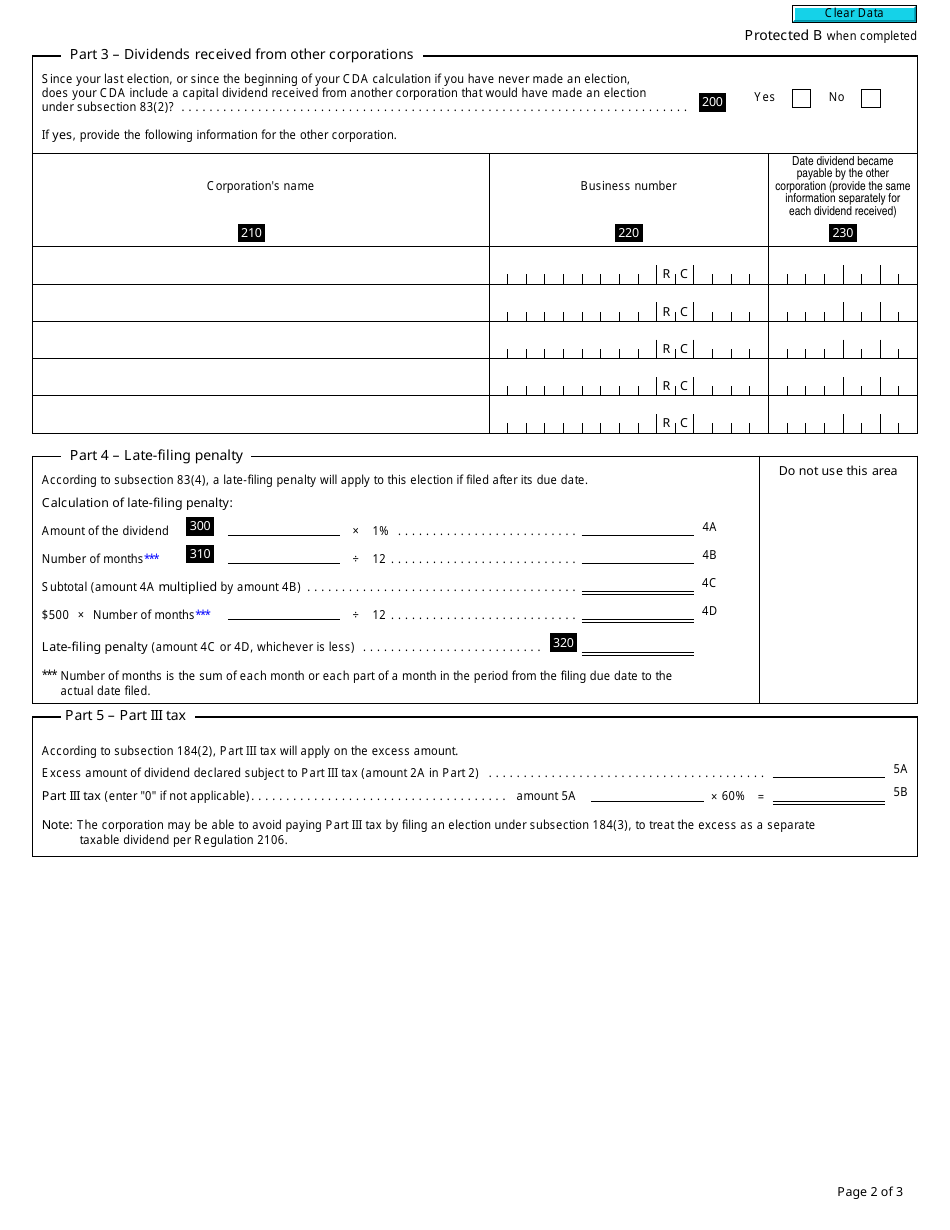

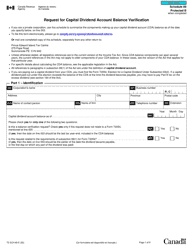

Q: What is a capital dividend?

A: A capital dividend is a type of dividend that is tax-free in the hands of the recipient.

Q: Who can use Form T2054?

A: Form T2054 can be used by taxpayers in Canada who want to make an election for a capital dividend under subsection 83(2).

Q: What is subsection 83(2)?

A: Subsection 83(2) of the Canadian Income Tax Act allows for the payment of tax-free capital dividends.

Q: Why would someone make an election for a capital dividend?

A: Making an election for a capital dividend can be beneficial for shareholders as it allows them to receive tax-free income.