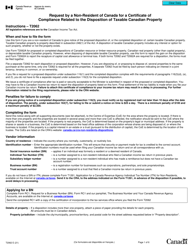

This version of the form is not currently in use and is provided for reference only. Download this version of

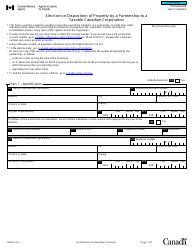

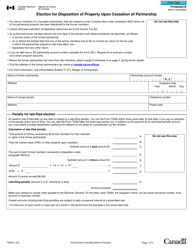

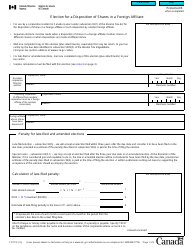

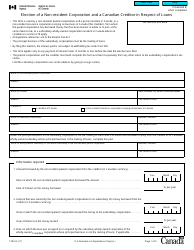

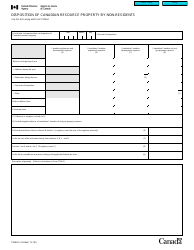

Form T2059

for the current year.

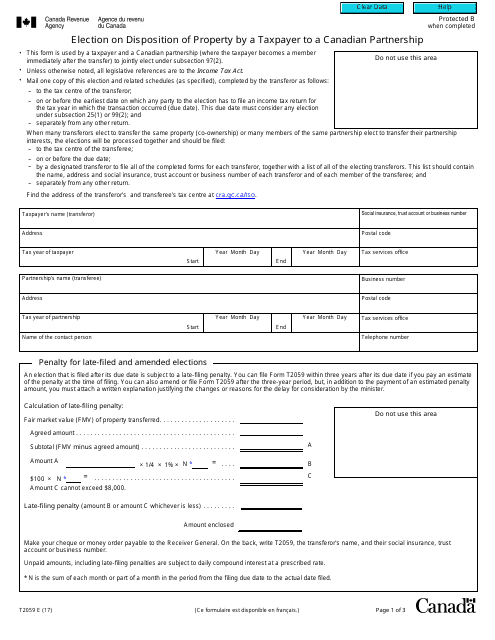

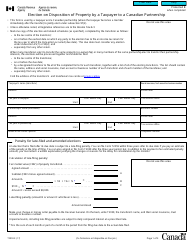

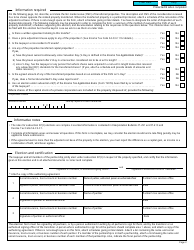

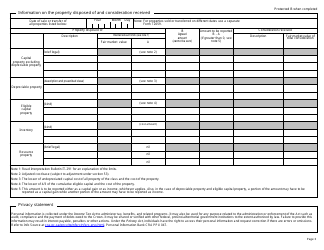

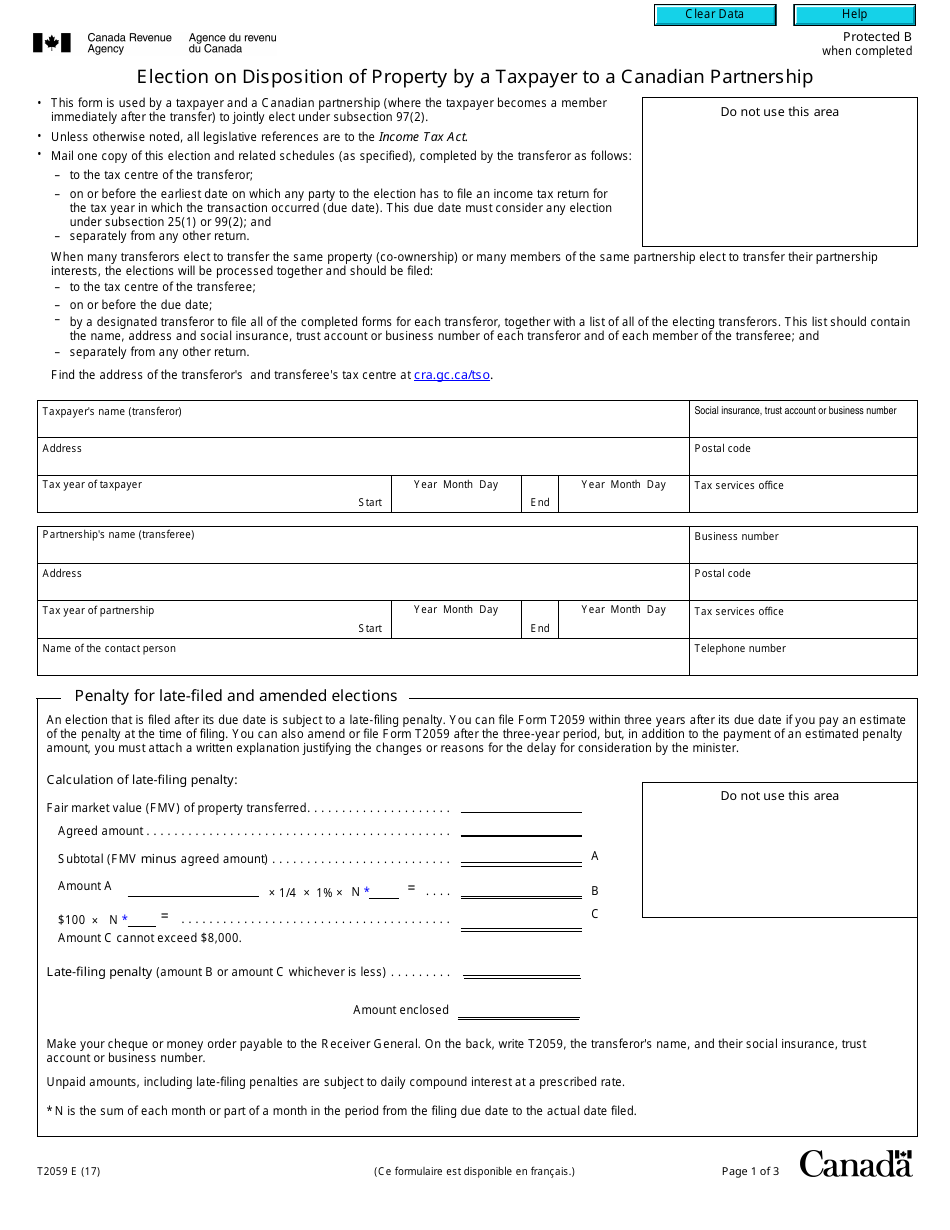

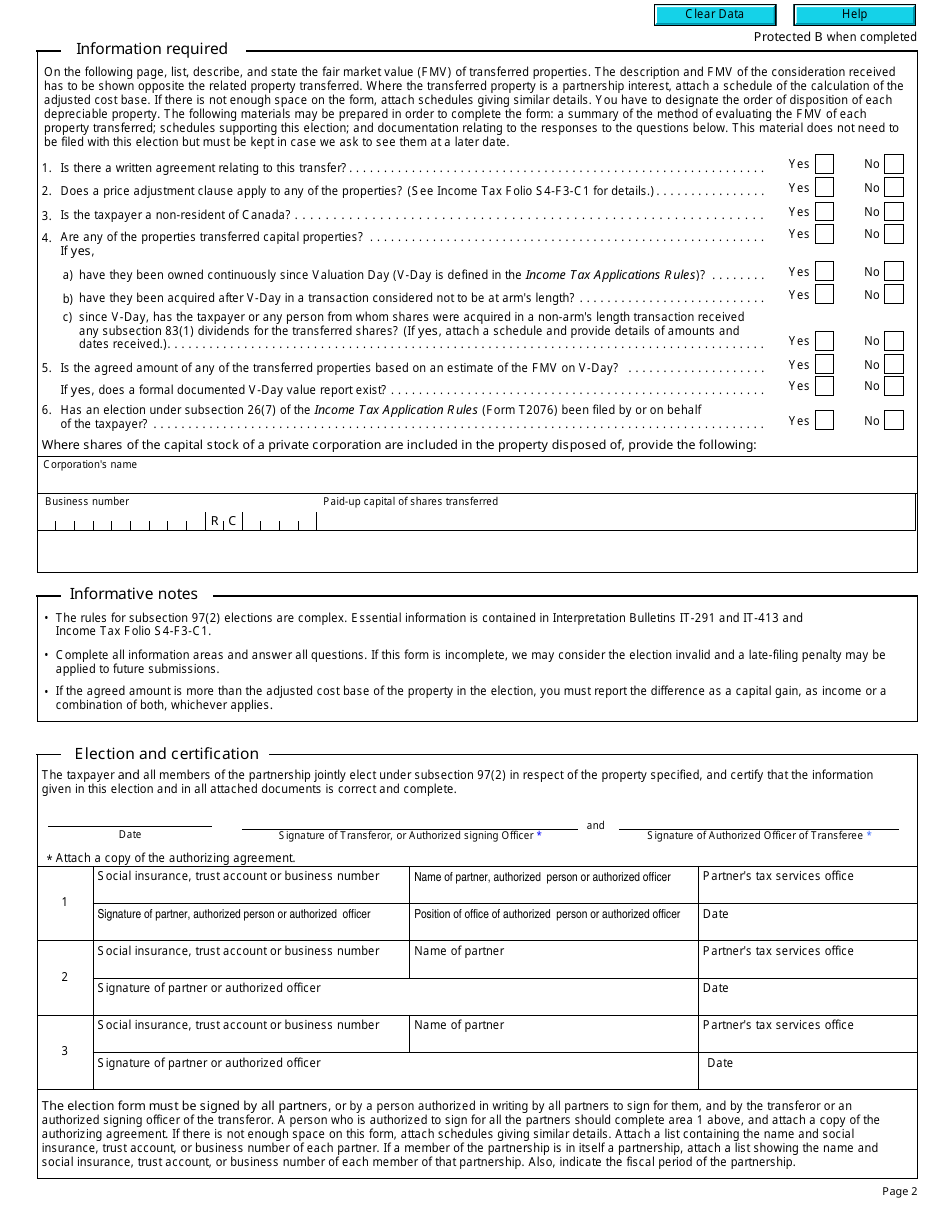

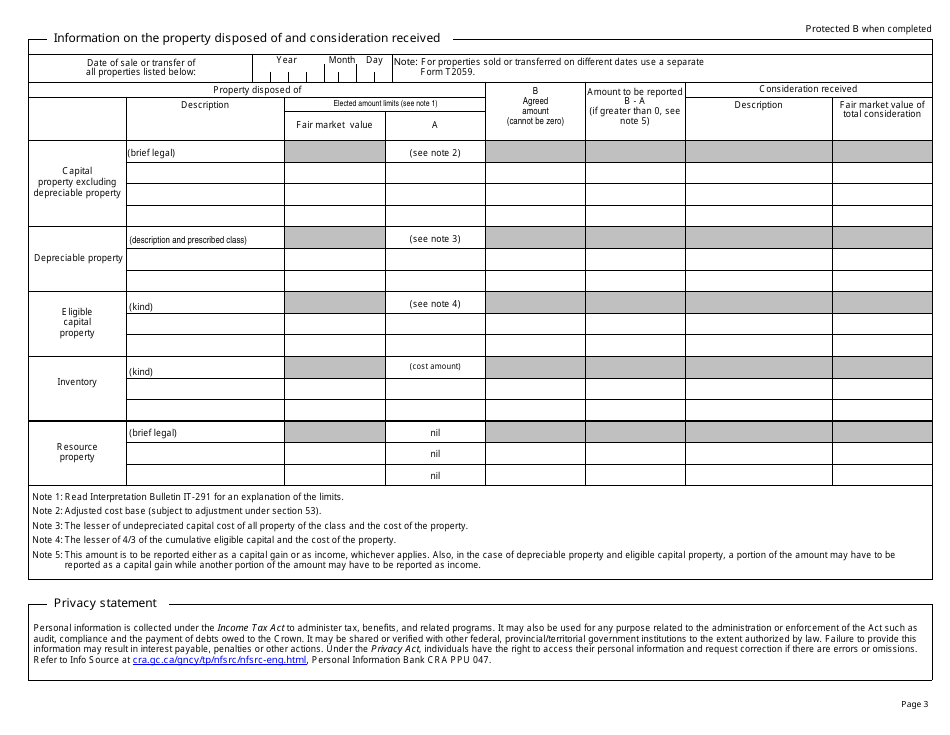

Form T2059 Election on Disposition of Property by a Taxpayer to a Canadian Partnership - Canada

Form T2059 Election on Disposition of Property by a Taxpayer to a Canadian Partnership is used in Canada to declare and provide information about the transfer of property by a taxpayer to a Canadian partnership. The form helps to determine the tax implications and treatment of the transaction.

The taxpayer who disposed of the property files the Form T2059 Election.

FAQ

Q: What is Form T2059?

A: Form T2059 is a document used by taxpayers in Canada to make an election on the disposition of property to a Canadian partnership.

Q: What is the purpose of Form T2059?

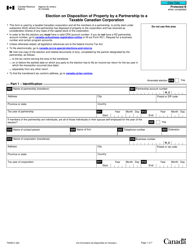

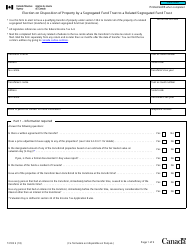

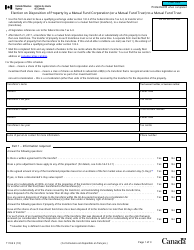

A: The purpose of Form T2059 is to report the disposition of property by a taxpayer to a Canadian partnership and make an election under section 97 of the Canadian Income Tax Act.

Q: Who needs to complete Form T2059?

A: Taxpayers who have disposed of property to a Canadian partnership and want to make an election under section 97 of the Canadian Income Tax Act need to complete Form T2059.

Q: When do I need to file Form T2059?

A: Form T2059 must be filed with the CRA within 90 days of the disposition of property to a Canadian partnership.

Q: Are there any penalties for not filing Form T2059?

A: Yes, there are penalties for not filing Form T2059 or for filing it late. It is important to file the form within the required timeframe to avoid penalties.

Q: What information is required on Form T2059?

A: Form T2059 requires information such as the taxpayer's name, address, taxpayer identification number, the details of the disposed property, and the details of the Canadian partnership.

Q: Can I make an election on the disposition of property to a non-Canadian partnership using Form T2059?

A: No, Form T2059 is specifically for making an election on the disposition of property to a Canadian partnership. For a non-Canadian partnership, different rules and forms apply.

Q: Is there a fee for filing Form T2059?

A: No, there is no fee for filing Form T2059. It is a free form provided by the CRA.

Q: Is Form T2059 available in both English and French?

A: Yes, Form T2059 is available in both English and French. Taxpayers can choose the language that is most comfortable for them.