This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2062A

for the current year.

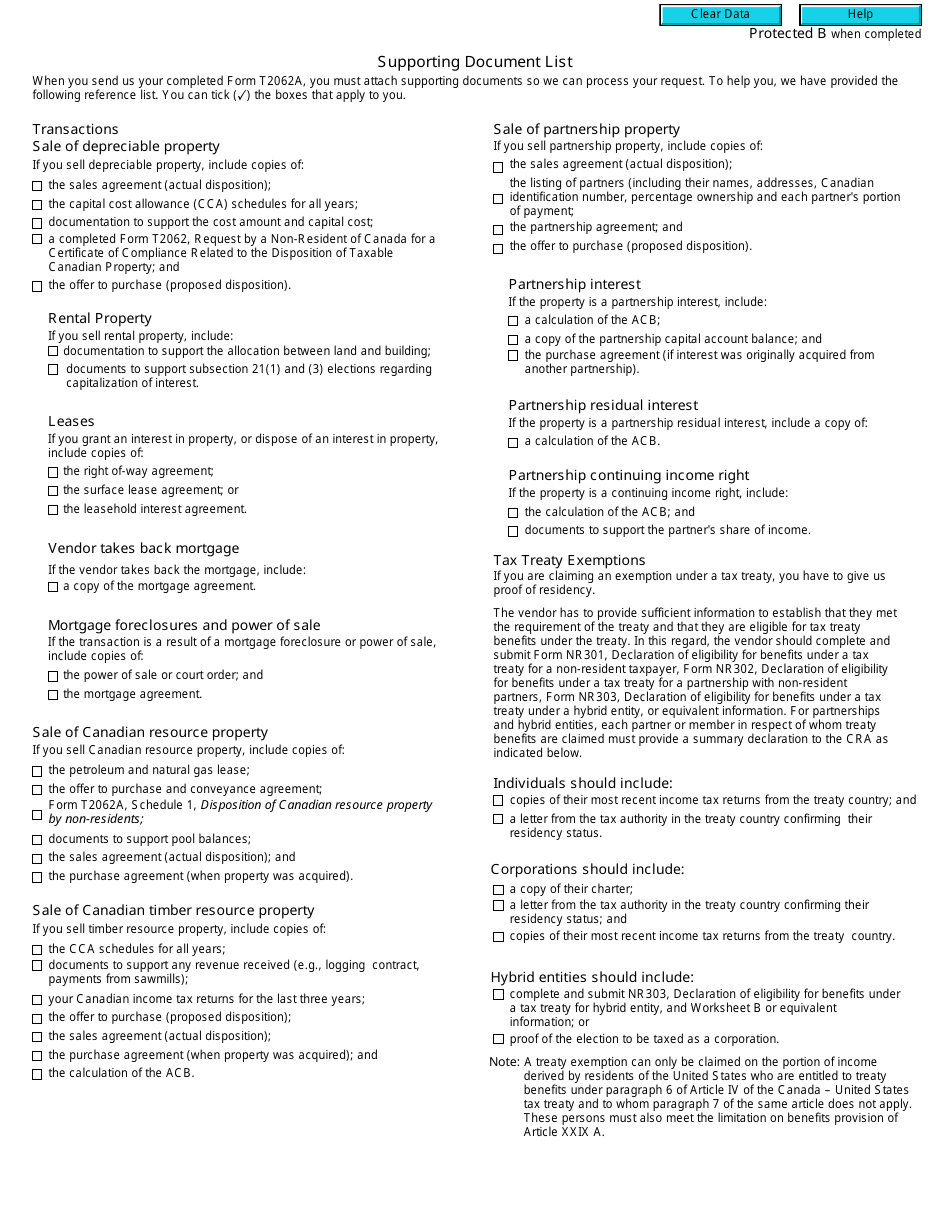

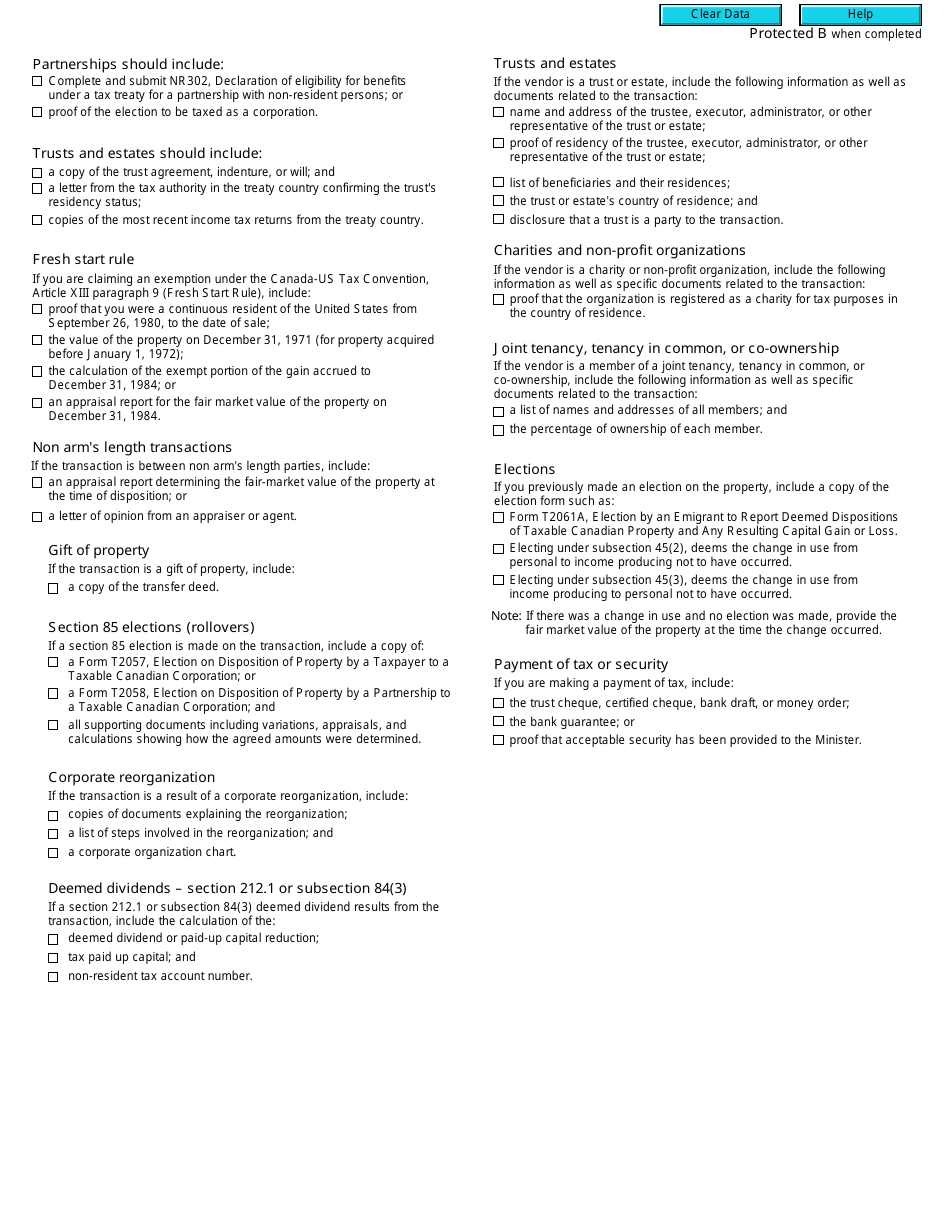

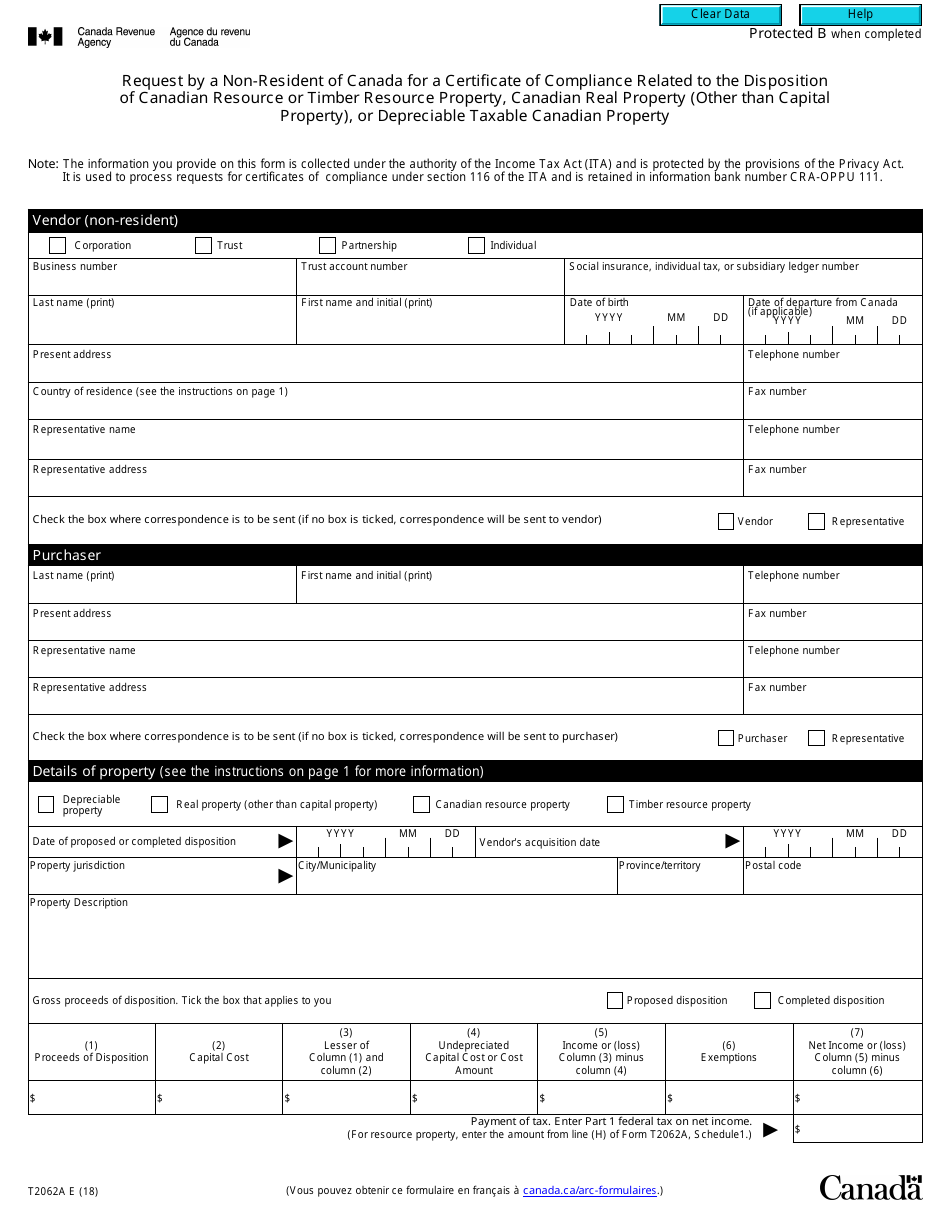

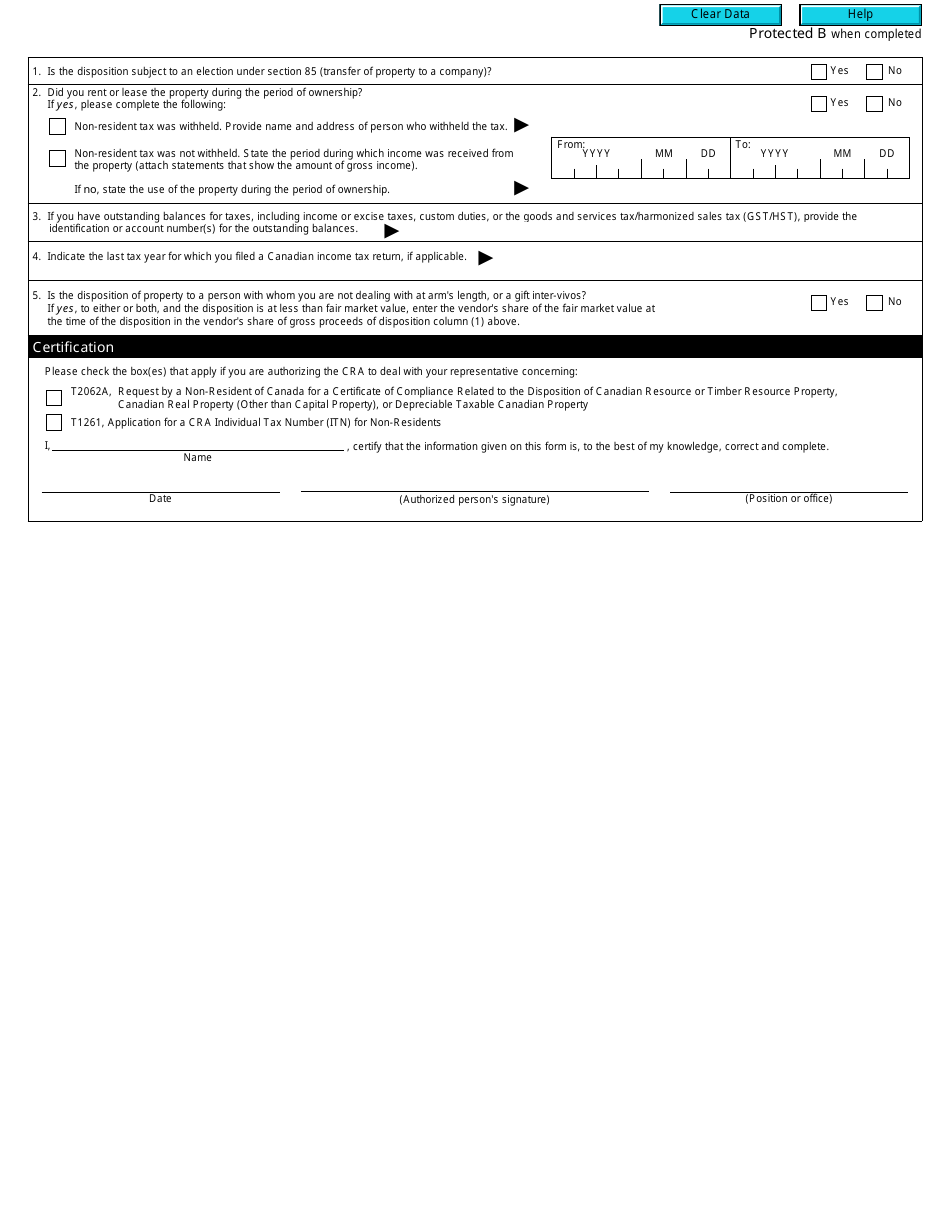

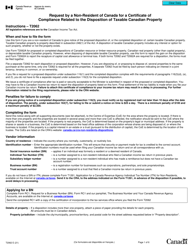

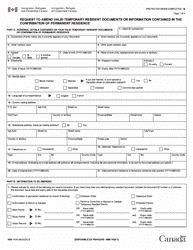

Form T2062A Request by a Non-resident of Canada for a Certificate of Compliance Related to the Disposition of Canadian Resource or Timber Resource Property, Canadian Real Property (Other Than Capital Property), or Depreciable Taxable Canadian Property - Canada

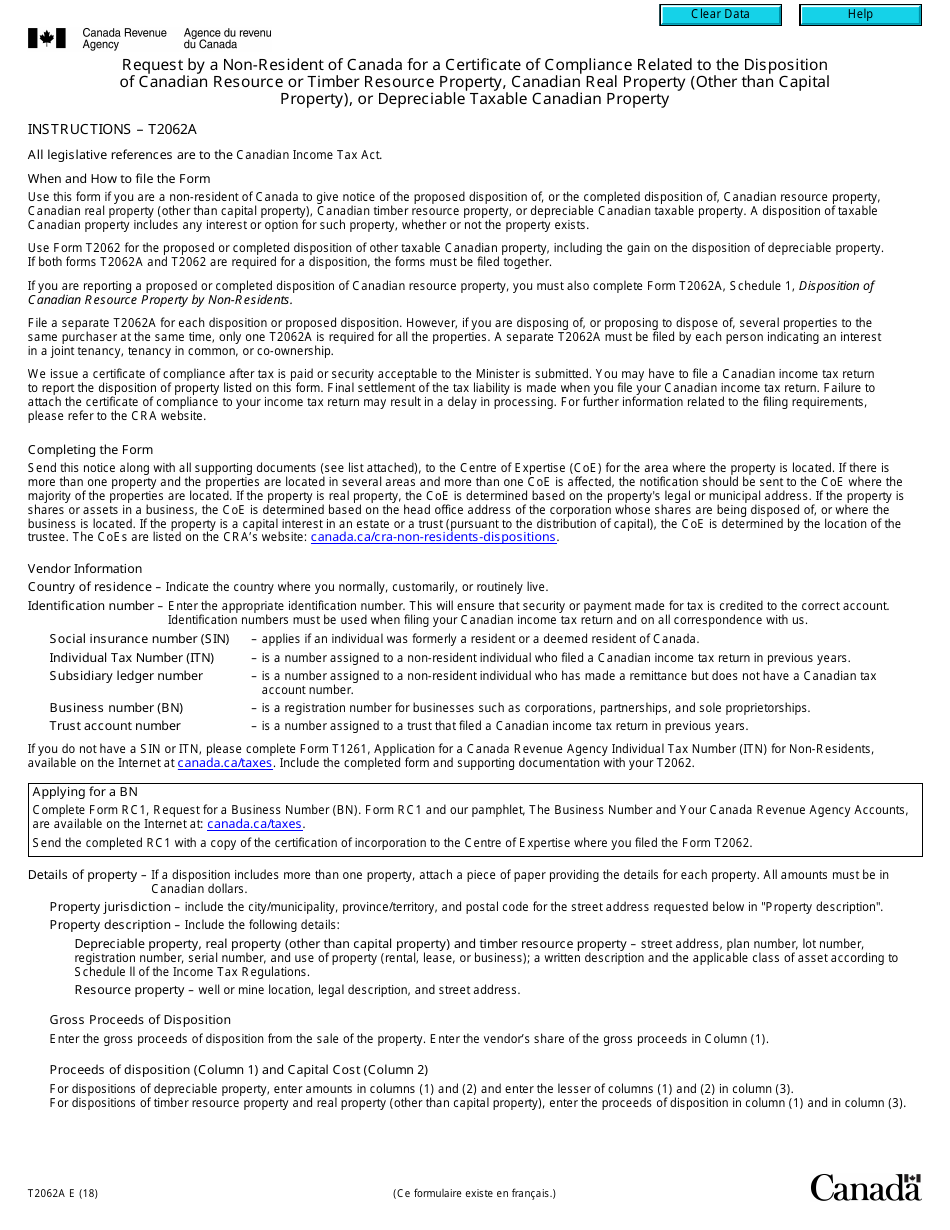

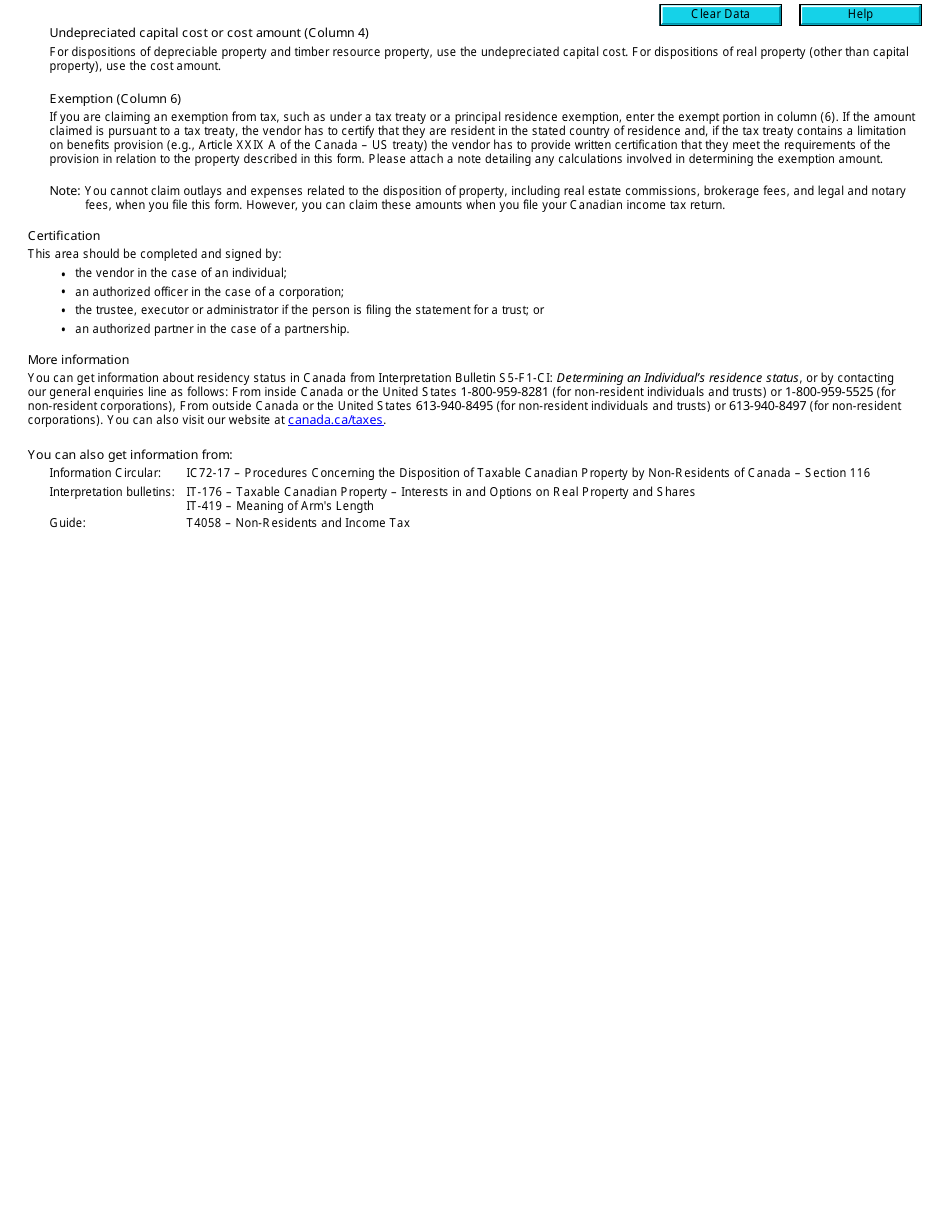

Form T2062A is used by non-residents of Canada to request a Certificate of Compliance regarding the disposal of certain Canadian properties. It applies to the disposal of Canadian resource or timber resource property, Canadian real property (excluding capital property), or depreciable taxable Canadian property. The form ensures that the appropriate tax requirements are met for non-residents when disposing these types of properties in Canada.

The Form T2062A is filed by a non-resident of Canada who wants to request a certificate of compliance related to the disposition of Canadian resource or timber resource property, Canadian real property (other than capital property), or depreciable taxable Canadian property.

FAQ

Q: What is Form T2062A?

A: Form T2062A is a request form for non-residents of Canada to obtain a Certificate of Compliance related to the disposition of certain Canadian properties.

Q: Who can use Form T2062A?

A: Non-residents of Canada who dispose of Canadian resource or timber resource property, Canadian real property (other than capital property), or depreciable taxable Canadian property.

Q: What is the purpose of Form T2062A?

A: The purpose of Form T2062A is to ensure compliance with Canadian tax laws and to obtain a certificate stating that the disposition of the mentioned Canadian properties meets the requirements.

Q: What types of Canadian properties are covered by Form T2062A?

A: Form T2062A covers Canadian resource or timber resource property, Canadian real property (other than capital property), or depreciable taxable Canadian property.

Q: What is a Certificate of Compliance?

A: A Certificate of Compliance is a document issued by the Canada Revenue Agency (CRA) stating that the disposition of the mentioned Canadian properties meets the requirements of the Income Tax Act.

Q: Do I need to submit Form T2062A before disposing of Canadian properties?

A: Yes, non-residents of Canada must submit Form T2062A to the Canada Revenue Agency (CRA) and obtain a Certificate of Compliance before disposing of the mentioned Canadian properties.

Q: What happens if I don't submit Form T2062A?

A: Failure to submit Form T2062A and obtain a Certificate of Compliance may result in penalties and potential legal consequences.

Q: How long does it take to process Form T2062A?

A: The processing time for Form T2062A may vary. It is recommended to submit the form well in advance to allow for any processing delays.