This version of the form is not currently in use and is provided for reference only. Download this version of

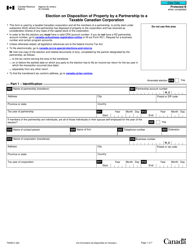

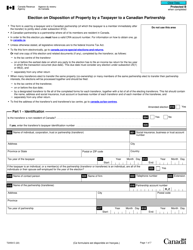

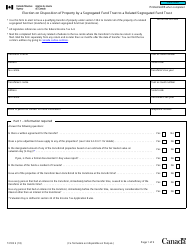

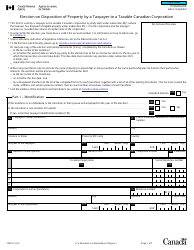

Form T2060

for the current year.

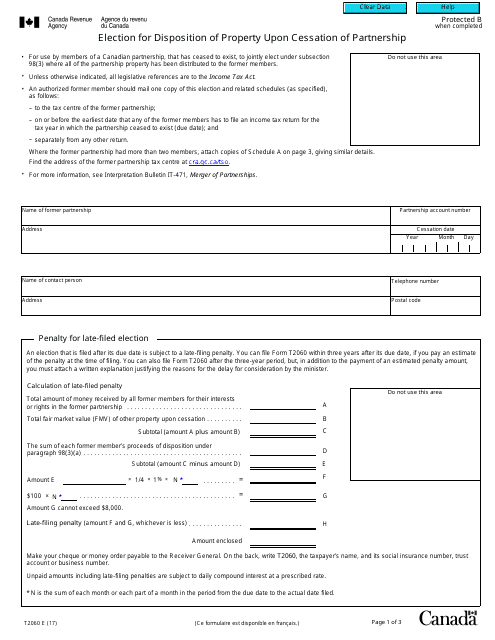

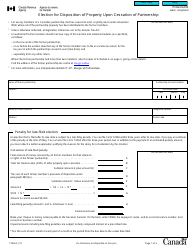

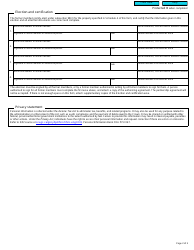

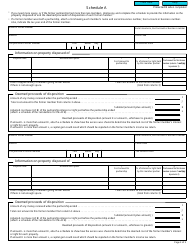

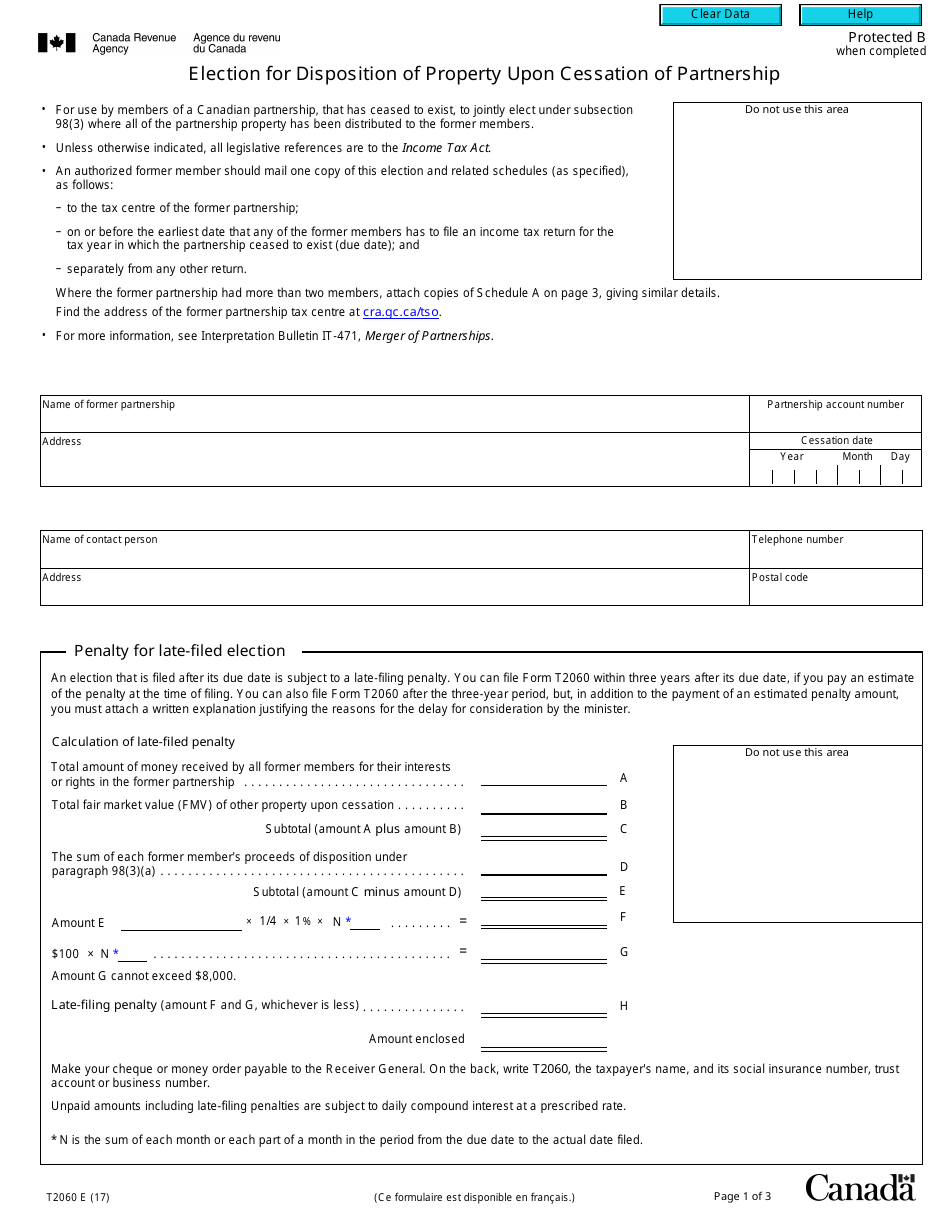

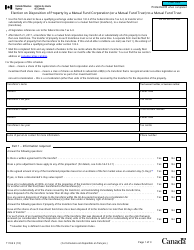

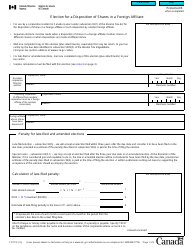

Form T2060 Election for Disposition of Property Upon Cessation of Partnership - Canada

The Form T2060 Election for Disposition of Property Upon Cessation of Partnership in Canada is used to report the disposal of partnership property when a partnership is dissolved or ceases. It allows the partners to allocate the income or losses resulting from the disposition of the partnership property.

The form T2060 Election for Disposition of Property Upon Cessation of Partnership in Canada is typically filed by the partnership itself.

FAQ

Q: What is Form T2060?

A: Form T2060 is a tax form used in Canada for the election of disposition of property upon the cessation of a partnership.

Q: Who uses Form T2060?

A: Form T2060 is used by partnerships in Canada.

Q: What is the purpose of Form T2060?

A: The purpose of Form T2060 is to report the disposition of property when a partnership ceases.

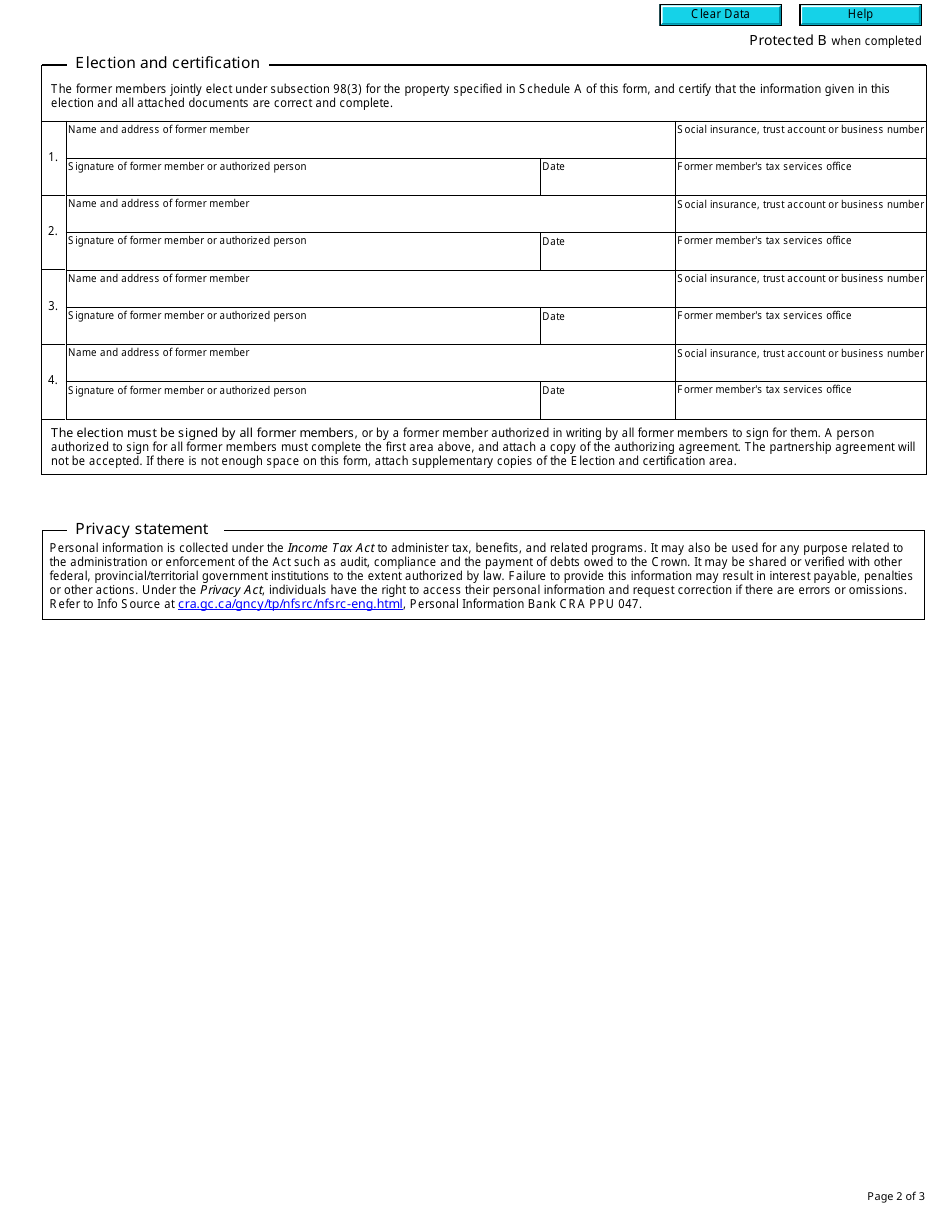

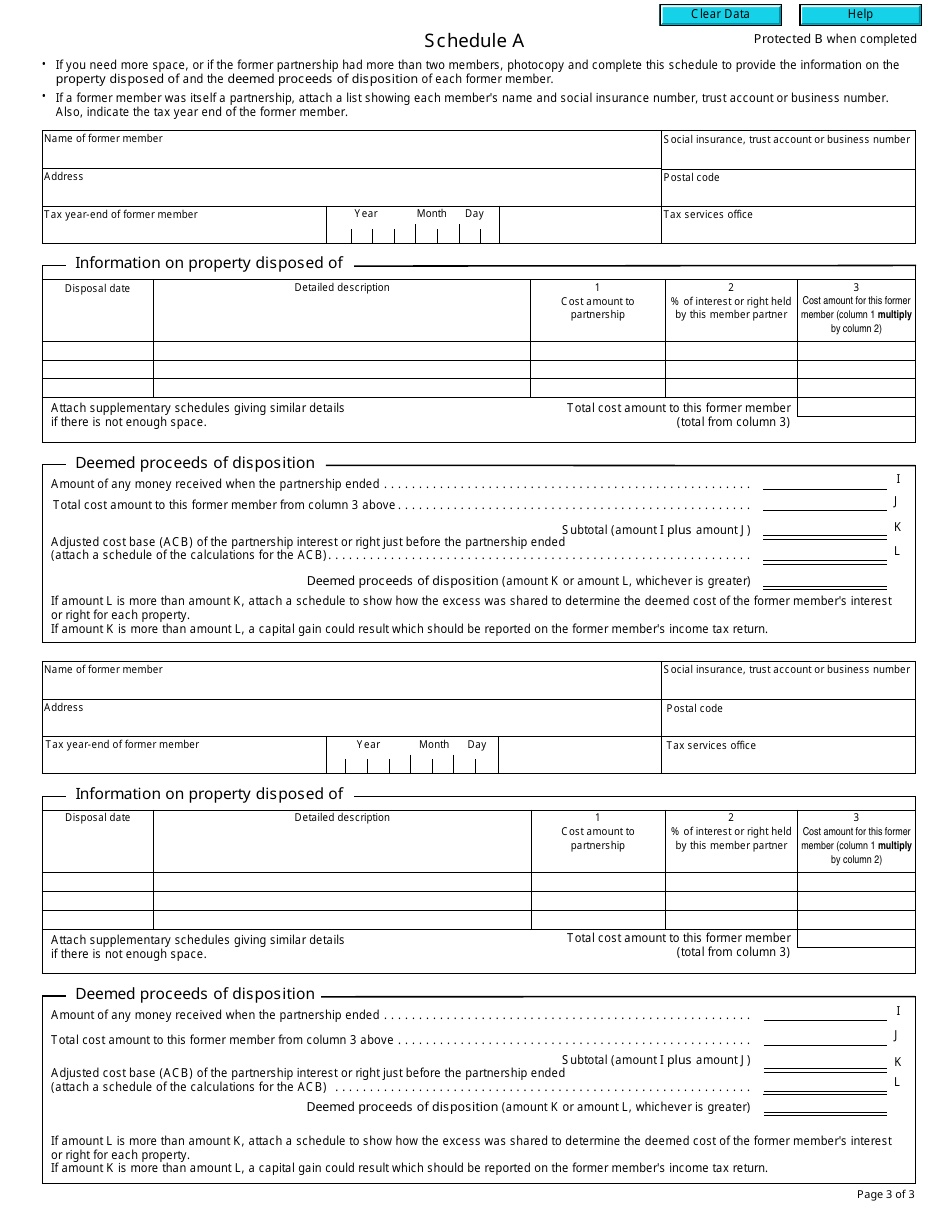

Q: How do I fill out Form T2060?

A: To fill out Form T2060, you need to provide information about the partnership, the property being disposed of, and the election being made.