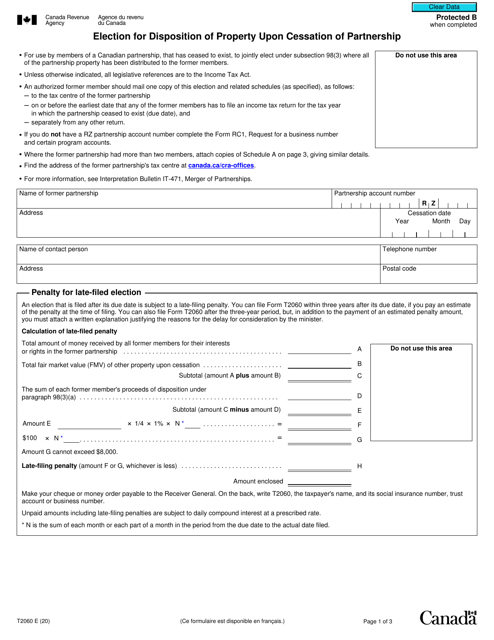

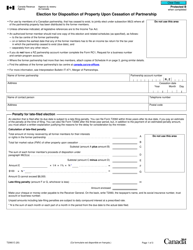

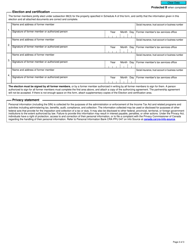

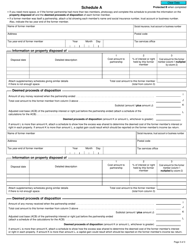

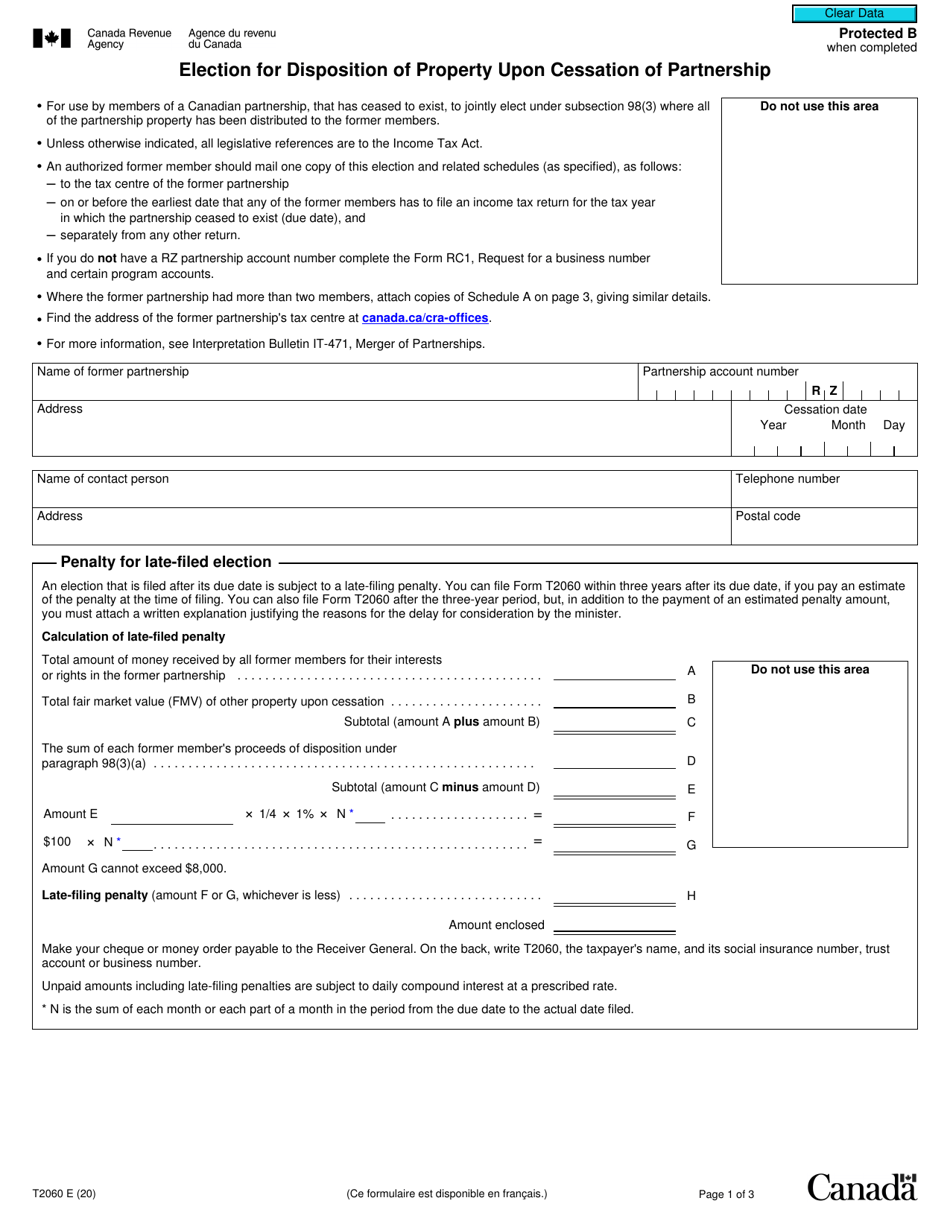

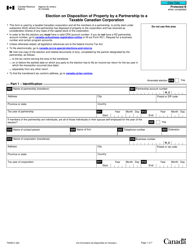

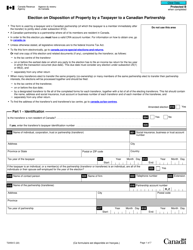

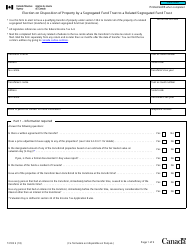

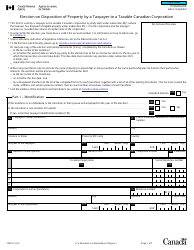

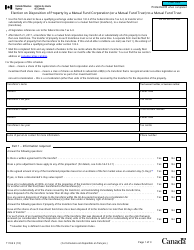

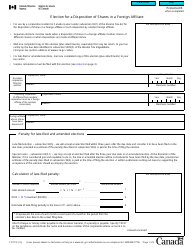

Form T2060 Election for Disposition of Property Upon Cessation of Partnership - Canada

Form T2060 Election for Disposition of Property Upon Cessation of Partnership in Canada is used to report the transfer of partnership property to a partner or another person upon the termination of a partnership.

The Form T2060 Election for Disposition of Property Upon Cessation of Partnership in Canada is filed by the partnership itself.

Form T2060 Election for Disposition of Property Upon Cessation of Partnership - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2060?

A: Form T2060 is a tax form used in Canada for making an election regarding the disposition of property upon the cessation of a partnership.

Q: When is Form T2060 used?

A: Form T2060 is used when a partnership in Canada is ceasing, and there is a disposition of partnership property.

Q: What is the purpose of Form T2060?

A: The purpose of Form T2060 is to elect how the partnership property will be distributed and to report the disposition of partnership property to the Canada Revenue Agency (CRA).

Q: Who needs to fill out Form T2060?

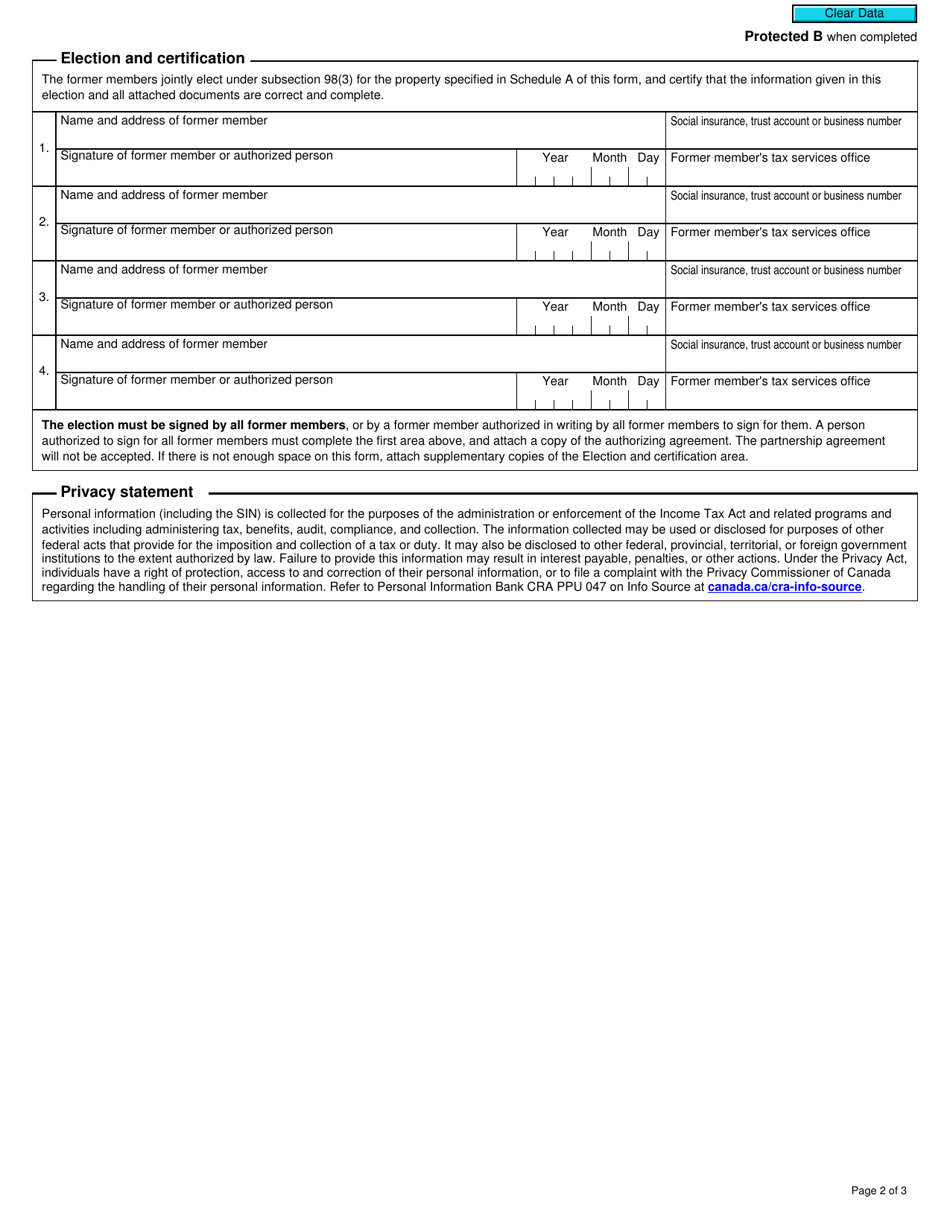

A: The partners in a partnership that is ceasing and where there is a disposition of partnership property need to fill out Form T2060.

Q: What information is required on Form T2060?

A: Form T2060 requires information about the partnership, the partners, and details of the disposition of partnership property.

Q: Is there a deadline for filing Form T2060?

A: Yes, Form T2060 must be filed with the CRA within 90 days after the end of the partnership's fiscal period in which the disposition of partnership property occurred.

Q: Are there any fees associated with filing Form T2060?

A: There are no fees for filing Form T2060 with the CRA.

Q: What happens after filing Form T2060?

A: After filing Form T2060, the CRA will review the election and may contact the partnership or partners for further information or clarification.

Q: Can I amend Form T2060 once it has been filed?

A: Yes, if there are errors or changes to the election, you can file an amended Form T2060 with the CRA.