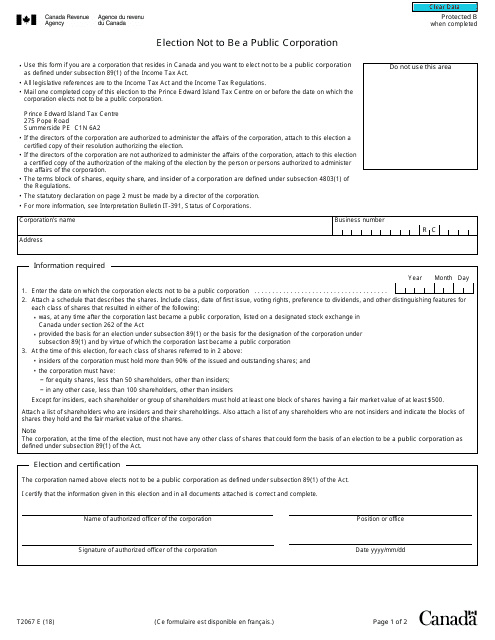

This version of the form is not currently in use and is provided for reference only. Download this version of

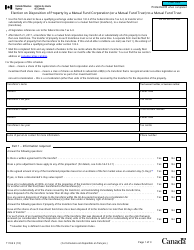

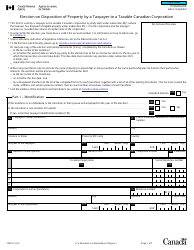

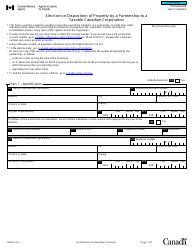

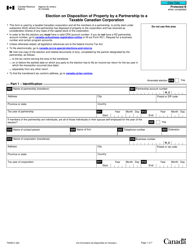

Form T2067

for the current year.

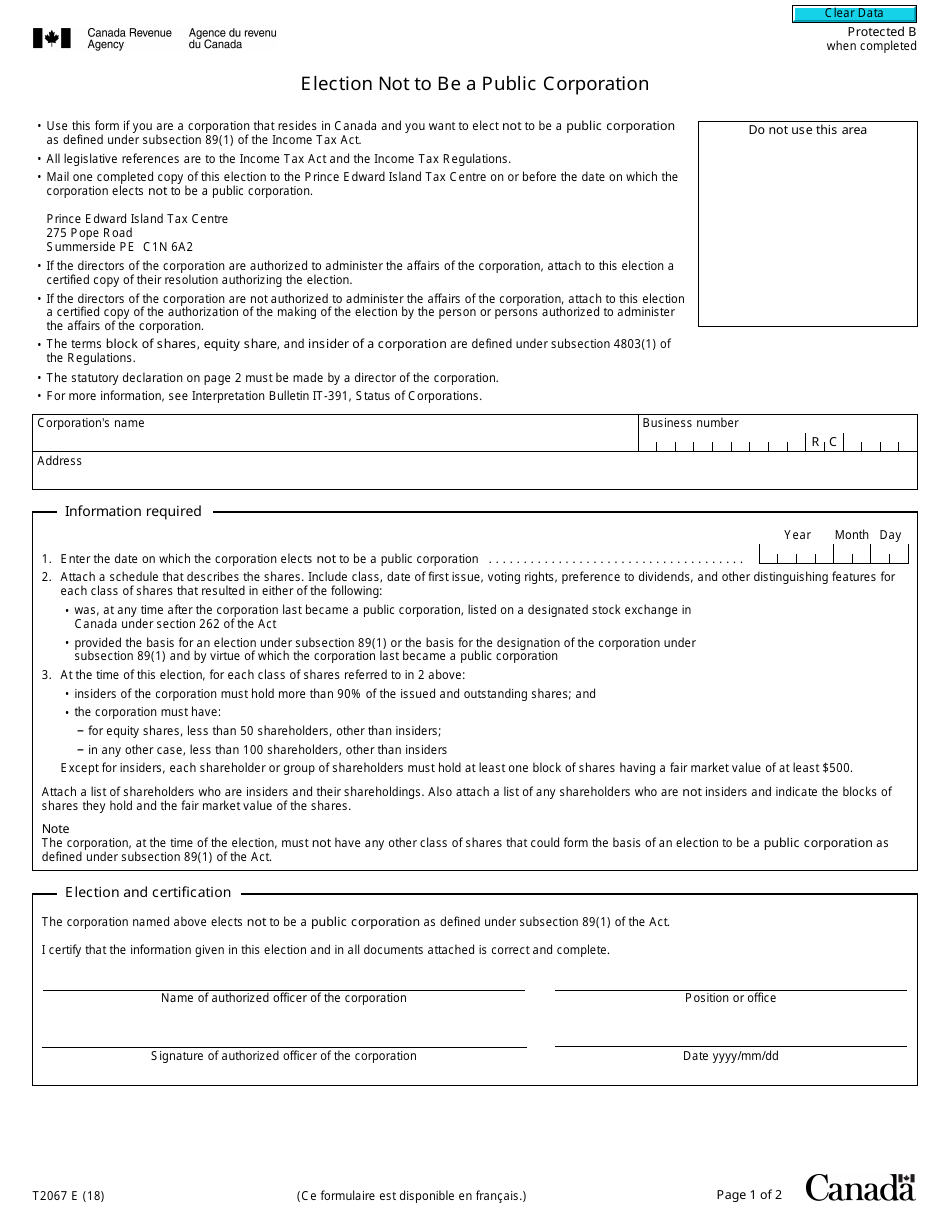

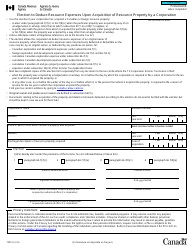

Form T2067 Election Not to Be a Public Corporation - Canada

Form T2067 or the "Form T2067 "election Not To Be A Public Corporation" - Canada" is a form issued by the Canadian Revenue Agency .

Download a PDF version of the Form T2067 down below or find it on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2067?

A: Form T2067 is a tax form in Canada.

Q: What does Form T2067 allow?

A: Form T2067 allows a corporation to elect not to be a public corporation in Canada.

Q: What is a public corporation in Canada?

A: A public corporation in Canada is a corporation whose shares are listed on a designated stock exchange.

Q: Why would a corporation elect not to be a public corporation?

A: A corporation may choose not to be a public corporation for various reasons, such as privacy or tax planning purposes.

Q: Is Form T2067 mandatory?

A: No, Form T2067 is not mandatory. It is an optional election that a corporation can choose to make.