This version of the form is not currently in use and is provided for reference only. Download this version of

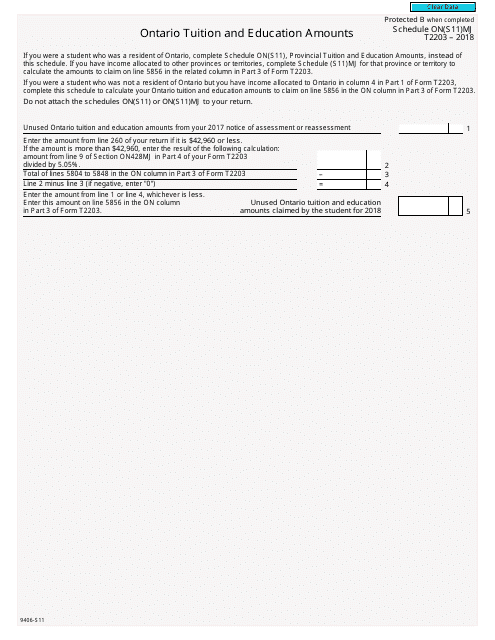

Form T2203 (9406-S11) Schedule ON(S11)MJ

for the current year.

Form T2203 (9406-S11) Schedule ON(S11)MJ Ontario Tuition and Education Amounts - Canada

This Canada-specific " Ontario Tuition And Education Amounts " is a document released by the Canadian Revenue Agency .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is Form T2203 (9406-S11) Schedule ON(S11)MJ?

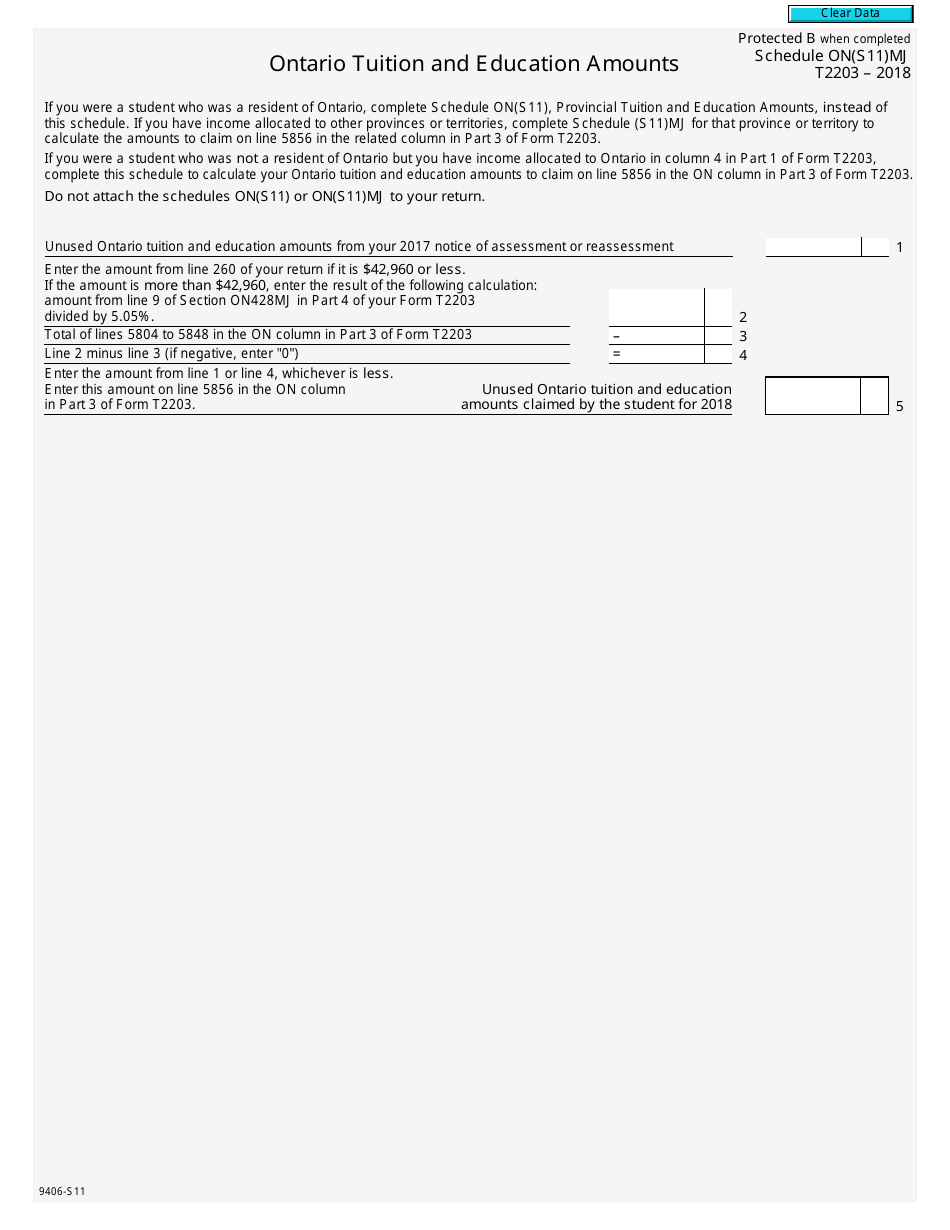

A: Form T2203 (9406-S11) Schedule ON(S11)MJ is a tax form used in Canada to claim Ontario Tuition and Education Amounts.

Q: What are the Ontario Tuition and Education Amounts?

A: The Ontario Tuition and Education Amounts are tax credits that can be claimed by residents of Ontario for eligible education expenses.

Q: Who can claim the Ontario Tuition and Education Amounts?

A: Residents of Ontario who are enrolled in post-secondary education programs can claim the Ontario Tuition and Education Amounts.

Q: What expenses are eligible for the Ontario Tuition and Education Amounts?

A: Eligible expenses include tuition fees, education-related support payments, and certain other education expenses.

Q: How do I claim the Ontario Tuition and Education Amounts?

A: To claim the Ontario Tuition and Education Amounts, you need to complete Form T2203 (9406-S11) Schedule ON(S11)MJ and attach it to your income tax return.

Q: Do I need to submit any supporting documents with Form T2203 (9406-S11) Schedule ON(S11)MJ?

A: You may need to keep supporting documents, such as tuition receipts and official transcripts, in case the CRA requests them for verification.

Q: Are there any deadlines for claiming the Ontario Tuition and Education Amounts?

A: The deadline to claim the Ontario Tuition and Education Amounts is usually the same as the deadline to file your income tax return, which is April 30th of the following year.

Q: Can I transfer or carry forward unused Ontario Tuition and Education Amounts?

A: Yes, if you cannot use all of your Ontario Tuition and Education Amounts in the current year, you may be able to transfer them to a parent or carry them forward to future years.