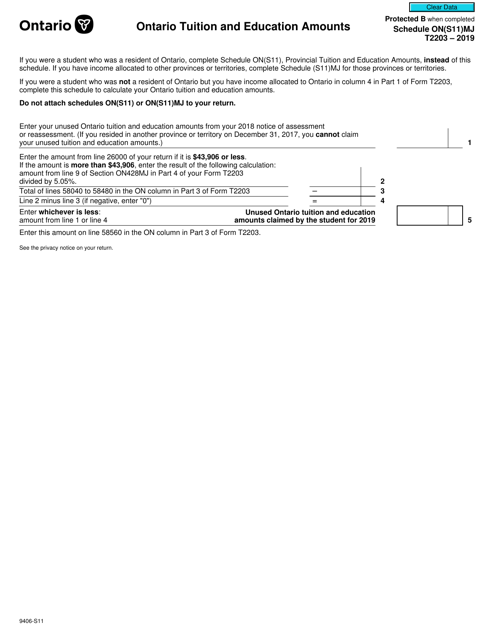

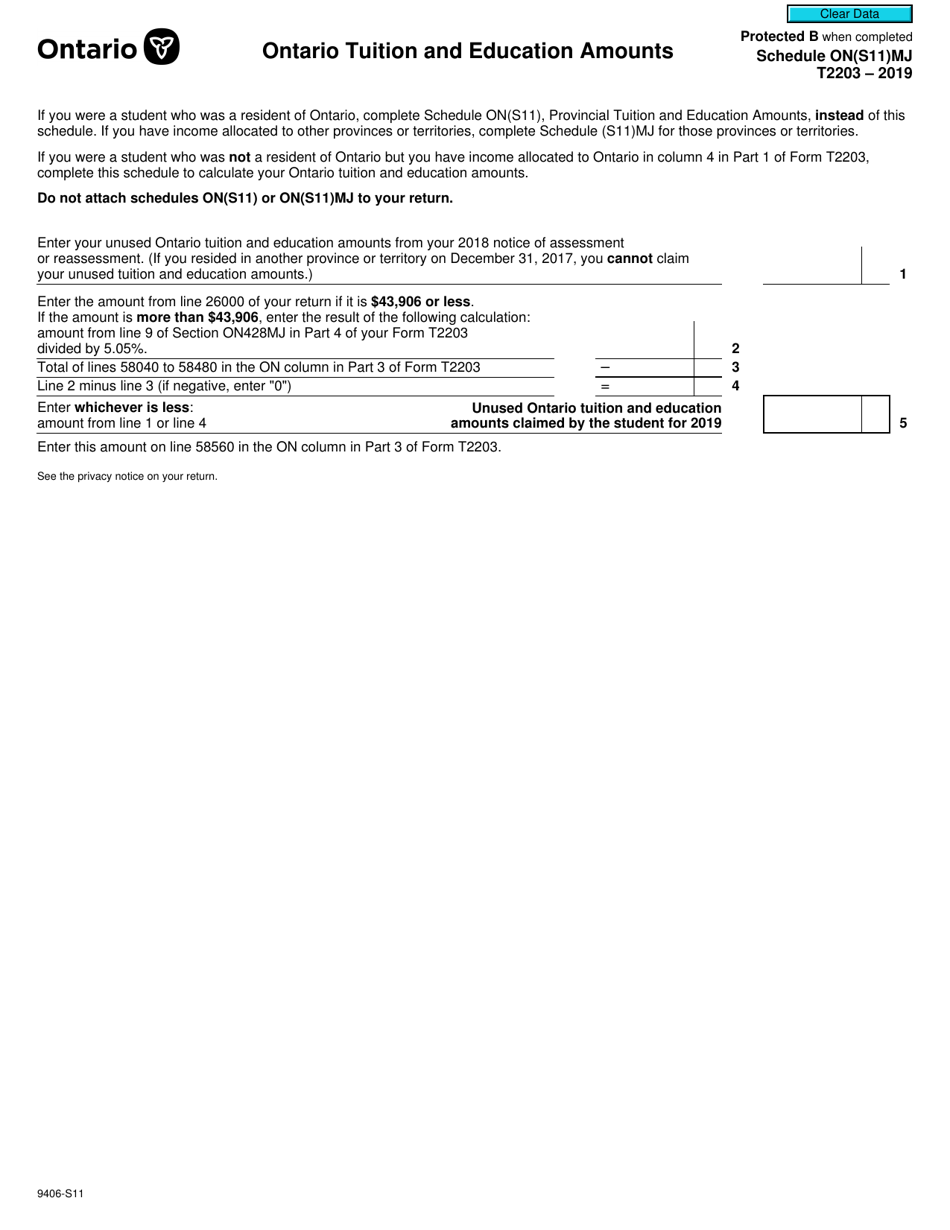

Form T2203 (9406-S11) Schedule ON(S11)MJ Ontario Tuition and Education Amounts - Canada

Form T2203 (9406-S11) Schedule ON(S11)MJ is used in Canada for claiming the Ontario Tuition and Education Amounts. This form allows taxpayers to report their eligible tuition fees and education amounts paid to a designated educational institution in Ontario.

The Form T2203 (9406-S11) Schedule ON(S11)MJ Ontario Tuition and Education Amounts in Canada is filed by individuals who are claiming tuition and education amounts for the province of Ontario.

Form T2203 (9406-S11) Schedule ON(S11)MJ Ontario Tuition and Education Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2203 (9406-S11) Schedule ON(S11)MJ?

A: Form T2203 (9406-S11) Schedule ON(S11)MJ is a Canadian tax form used to claim Ontario tuition and education amounts.

Q: What are Ontario tuition and education amounts?

A: Ontario tuition and education amounts are tax credits that can be claimed by students or their parents to reduce their tax payable.

Q: Who can claim the Ontario tuition and education amounts?

A: Students who have attended eligible post-secondary educational institutions in Ontario can claim these tax credits.

Q: What is the purpose of the Form T2203 (9406-S11) Schedule ON(S11)MJ?

A: The purpose of this form is to calculate the Ontario tuition and education amounts that can be claimed on your Canadian income tax return.

Q: How do I fill out Form T2203 (9406-S11) Schedule ON(S11)MJ?

A: The form requires you to provide information about your educational institution, your tuition fees, and any scholarships or grants you received.

Q: When is the deadline to file Form T2203 (9406-S11) Schedule ON(S11)MJ?

A: The deadline to file this form is the same as the deadline to file your Canadian income tax return, which is usually April 30th of the following year.

Q: Can I claim Ontario tuition and education amounts if I am not a resident of Ontario?

A: No, these tax credits are only available to residents of Ontario who attended eligible post-secondary educational institutions in the province.