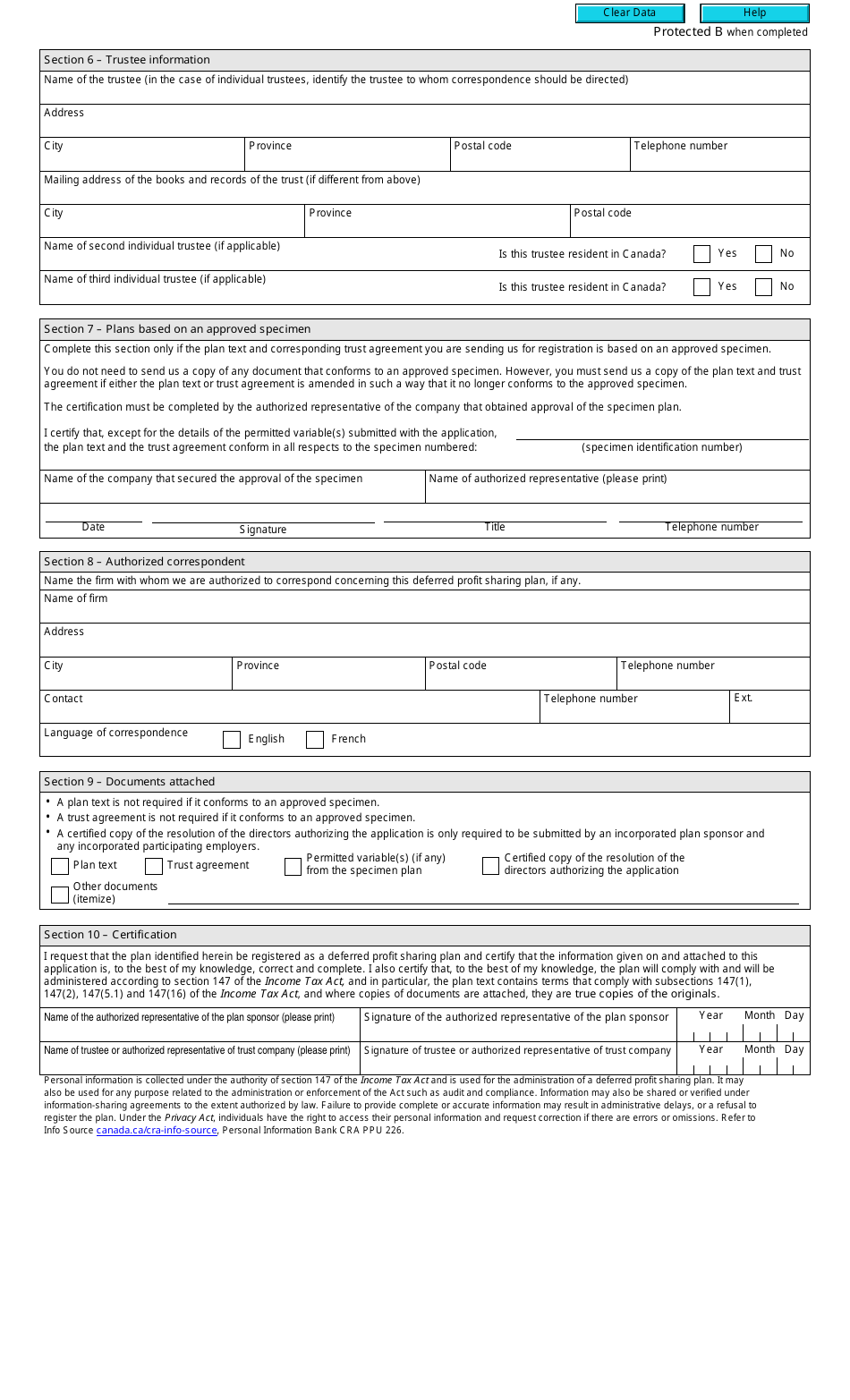

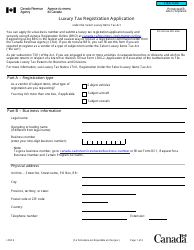

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2214

for the current year.

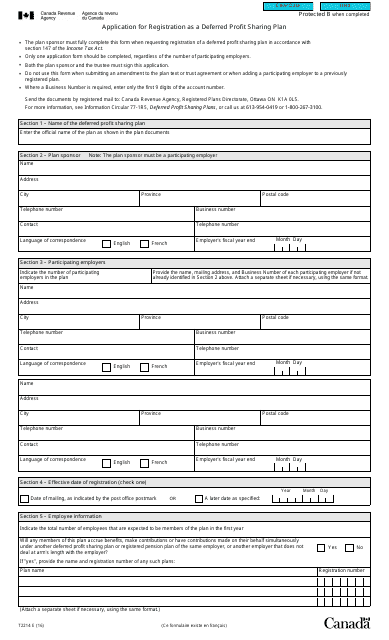

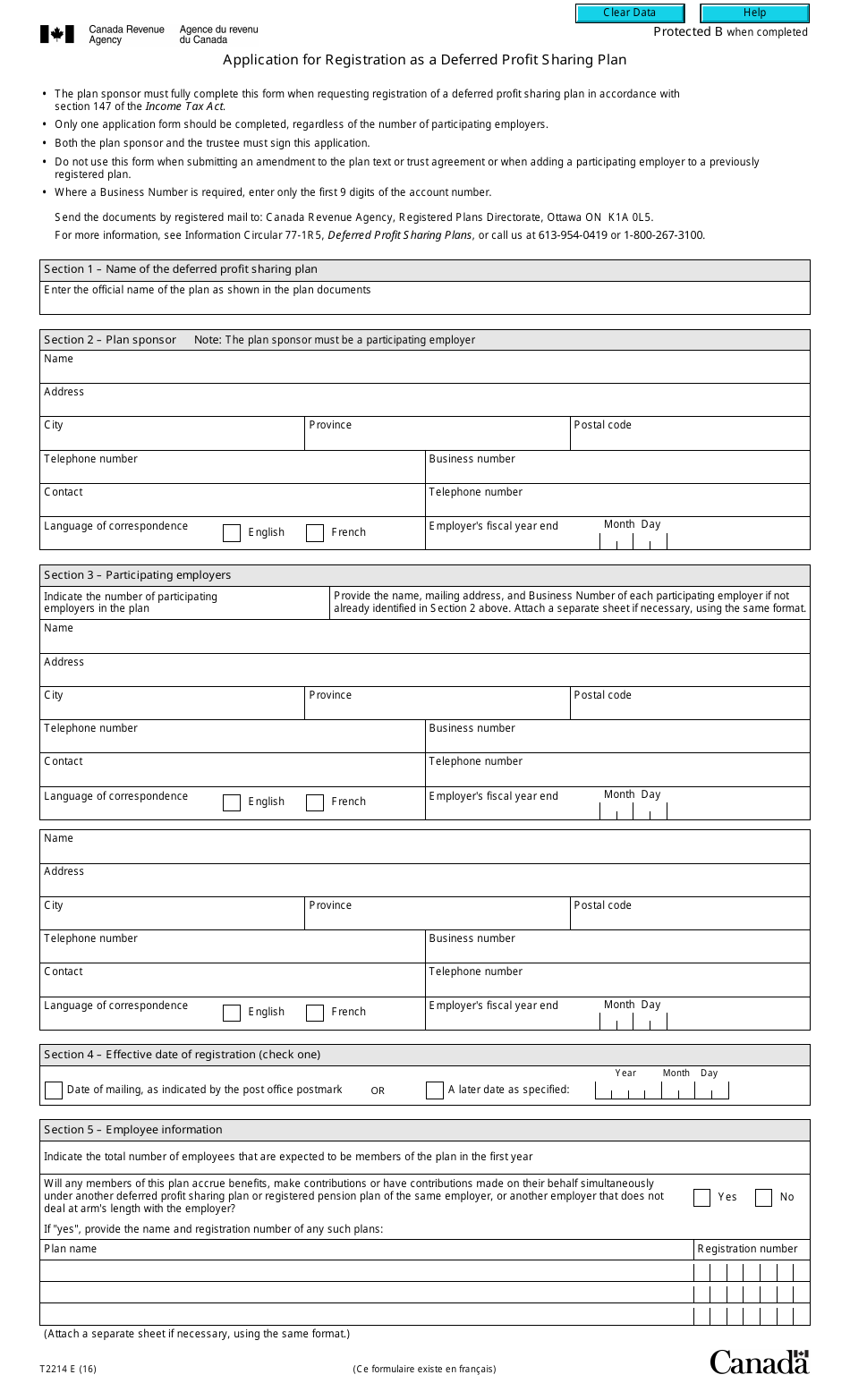

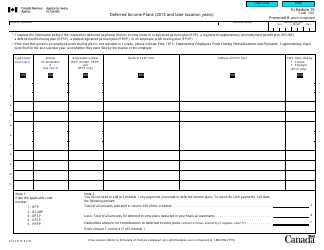

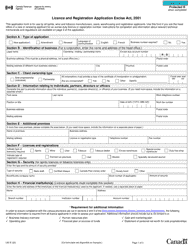

Form T2214 Application for Registration as a Deferred Profit Sharing Plan - Canada

Form T2214 Application for Registration as a Deferred Profit Sharing Plan - Canada is used to apply for registration of a deferred profit sharing plan (DPSP) with the Canada Revenue Agency (CRA). This form is specifically designed for employers who want to establish a DPSP for their employees.

The employer files the Form T2214 Application for Registration as a Deferred Profit Sharing Plan in Canada.

FAQ

Q: What is Form T2214?

A: Form T2214 is an application for registration as a Deferred Profit Sharing Plan (DPSP) in Canada.

Q: What is a Deferred Profit Sharing Plan (DPSP)?

A: A Deferred Profit Sharing Plan (DPSP) is a type of retirement savings plan offered by employers in Canada.

Q: Who can use Form T2214?

A: Employers in Canada who want to register their DPSPs must use Form T2214.

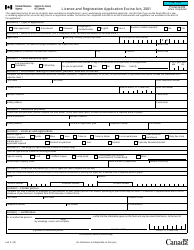

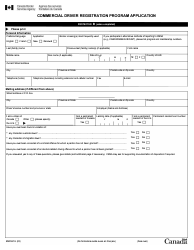

Q: What information is required in Form T2214?

A: Form T2214 requires information about the employer, plan administrator, and the DPSP itself.