This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2 Schedule 307

for the current year.

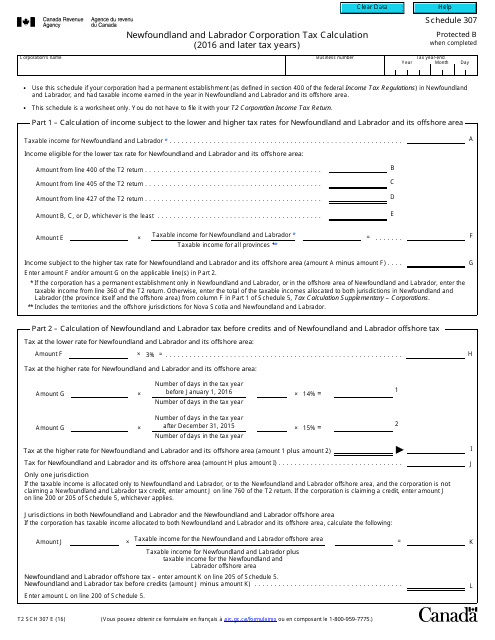

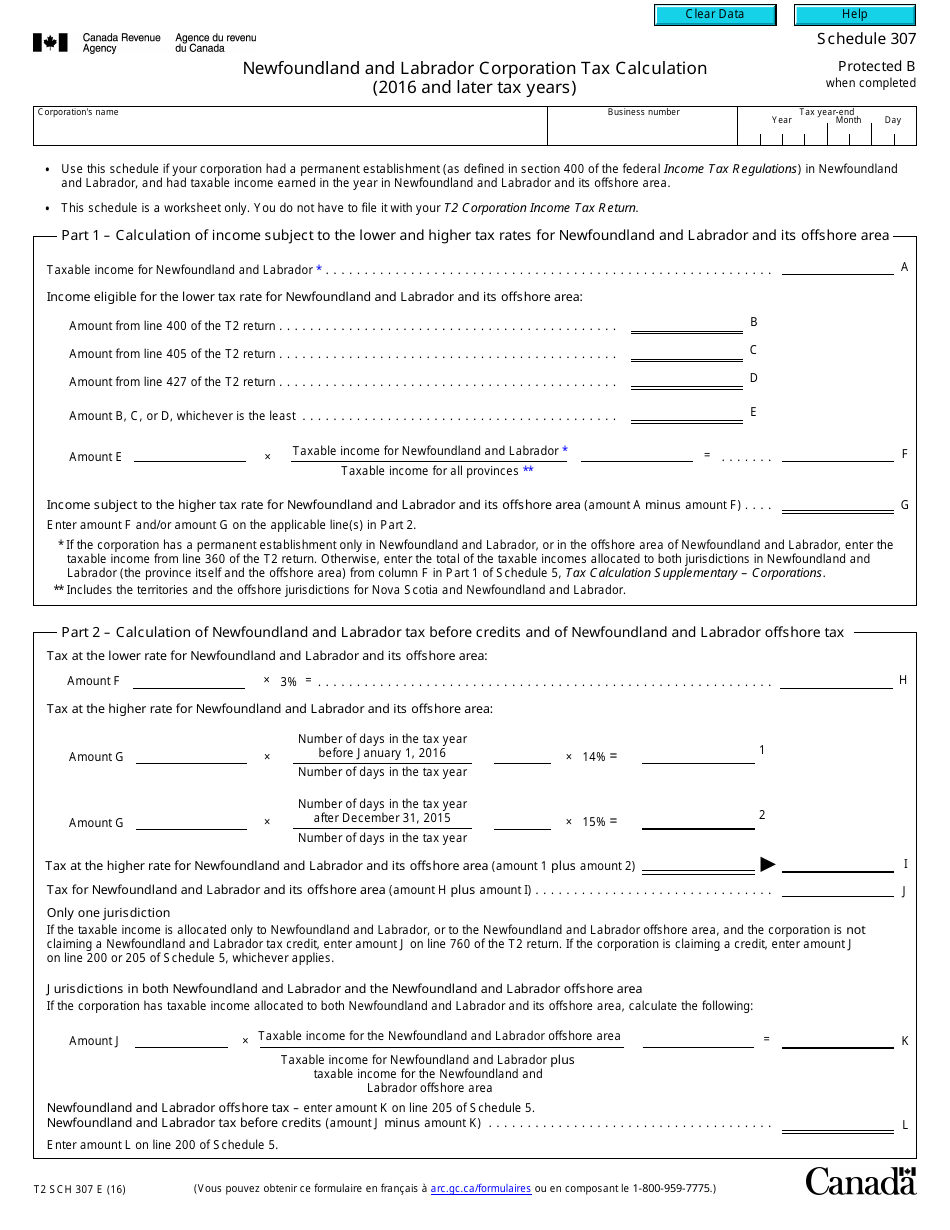

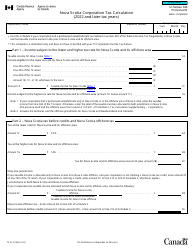

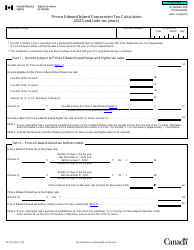

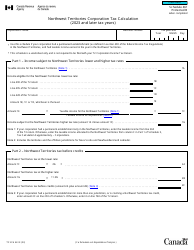

Form T2 Schedule 307 Newfoundland and Labrador Corporation Tax Calculation (2016 and Later Tax Years) - Canada

Form T2 Schedule 307 is used by corporations in Newfoundland and Labrador, Canada to calculate their corporation tax liabilities for the tax years 2016 and later. This form helps corporations determine the amount of tax they owe to the government.

The Form T2 Schedule 307 for Newfoundland and Labrador Corporation Tax Calculation is filed by corporations in Newfoundland and Labrador, Canada.

FAQ

Q: What is Form T2 Schedule 307?

A: Form T2 Schedule 307 is a tax form used by corporations in Newfoundland and Labrador, Canada to calculate their corporation tax.

Q: Who needs to file Form T2 Schedule 307?

A: Corporations operating in Newfoundland and Labrador, Canada need to file Form T2 Schedule 307 if they are liable to pay corporation tax.

Q: What does Form T2 Schedule 307 calculate?

A: Form T2 Schedule 307 calculates the corporation tax owed by a corporation in Newfoundland and Labrador, Canada.

Q: Which tax years does Form T2 Schedule 307 apply to?

A: Form T2 Schedule 307 applies to tax years 2016 and later in Newfoundland and Labrador, Canada.

Q: Is Form T2 Schedule 307 specific to Newfoundland and Labrador?

A: Yes, Form T2 Schedule 307 is specific to corporations in Newfoundland and Labrador, Canada.

Q: Is Form T2 Schedule 307 the only tax form for corporations in Newfoundland and Labrador?

A: No, corporations in Newfoundland and Labrador may also need to file other tax forms, such as Form T2 - Corporation Income Tax Return.

Q: How do I complete Form T2 Schedule 307?

A: Instructions for completing Form T2 Schedule 307 can be found on the form itself or in the CRA's guide to completing corporation tax forms.

Q: When is the deadline to file Form T2 Schedule 307?

A: The deadline to file Form T2 Schedule 307 is generally six months after the end of the corporation's tax year, but specific deadlines can vary. It's best to check with the CRA for the exact deadline.

Q: What happens if I don't file Form T2 Schedule 307?

A: If a corporation fails to file Form T2 Schedule 307 on time, they may be subject to penalties and interest charges by the CRA.