This version of the form is not currently in use and is provided for reference only. Download this version of

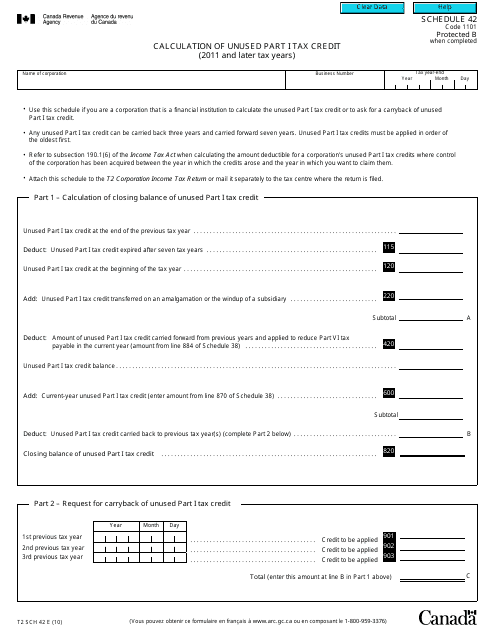

Form T2 Schedule 42

for the current year.

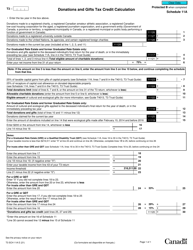

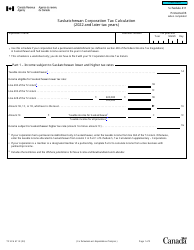

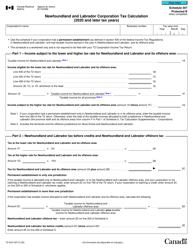

Form T2 Schedule 42 Calculation of Unused Part I Tax Credit (2011 and Later Tax Years) - Canada

Form T2 SCH 42 or the "Form T2 Sch 42 Schedule 42 "calculation Of Unused Part I Tax Credit (2011 And Later Tax Years)" - Canada" is a form issued by the Canadian Revenue Agency .

Download a PDF version of the Form T2 SCH 42 down below or find it on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2 Schedule 42?

A: Form T2 Schedule 42 is a tax form used in Canada to calculate the unused Part I tax credit for tax years 2011 and later.

Q: Who needs to use Form T2 Schedule 42?

A: Corporations in Canada need to use Form T2 Schedule 42 to calculate their unused Part I tax credit for tax years 2011 and later.

Q: What is the Part I tax credit?

A: The Part I tax credit is a credit that can be used to reduce a corporation's taxes payable in a future year.

Q: What is the purpose of calculating the unused Part I tax credit?

A: The purpose of calculating the unused Part I tax credit is to determine the amount of credit that can be carried forward and applied against future taxes owing.

Q: How do you calculate the unused Part I tax credit?

A: The unused Part I tax credit is calculated by multiplying the corporate income tax paid by the federal and provincial or territorial tax rates in the relevant tax years.