This version of the form is not currently in use and is provided for reference only. Download this version of

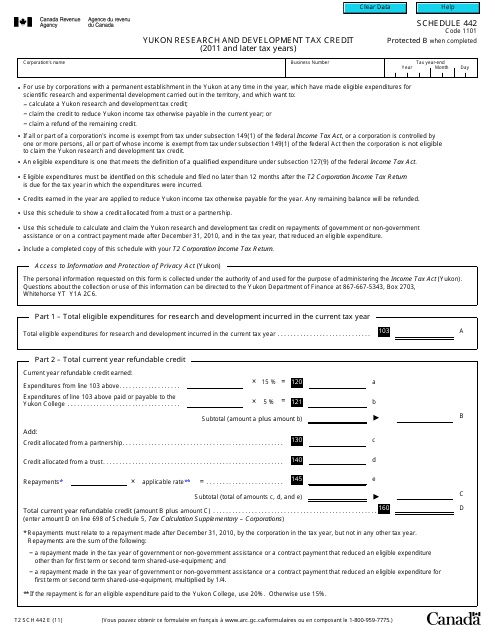

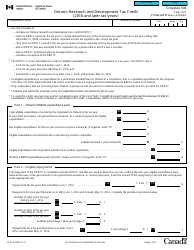

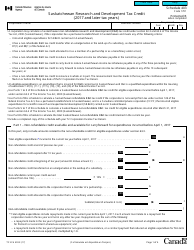

Form T2 Schedule 442

for the current year.

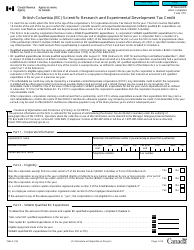

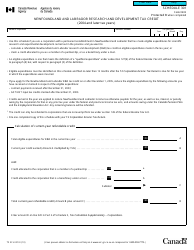

Form T2 Schedule 442 Yukon Research and Development Tax Credit (2011 and Later Taxation Years) - Canada

Form T2 SCH 442 or the "Form T2 Sch 442 Schedule 442 "yukon Tax Credit (2011 And Later Taxation Years)" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2011 and is available for digital filing. Download an up-to-date Form T2 SCH 442 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2 Schedule 442?

A: Form T2 Schedule 442 is a tax form used in Canada for claiming the Yukon Research and Development Tax Credit.

Q: Who can use Form T2 Schedule 442?

A: This form can be used by Canadian corporations that meet the eligibility requirements set by the Yukon government for claiming the research and development tax credit.

Q: What is the Yukon Research and Development Tax Credit?

A: The Yukon Research and Development Tax Credit is a tax credit offered by the Yukon government to encourage businesses to undertake research and development activities within the territory.

Q: What are the eligibility requirements for claiming the tax credit?

A: To be eligible for the tax credit, a corporation must have incurred eligible expenditures for scientific research and experimental development in the Yukon.

Q: What types of expenses are considered eligible for the tax credit?

A: Eligible expenses for the tax credit include salaries and wages, materials and supplies, overhead expenses, and subcontractor expenses directly related to the research and development activities.

Q: How is the tax credit calculated?

A: The tax credit is calculated as a percentage of the eligible expenditures incurred by the corporation in the tax year.

Q: Can the tax credit be carried forward or back?

A: Yes, any unused tax credit can be carried forward for up to 10 years or carried back for up to 3 years to reduce taxes payable in those years.