This version of the form is not currently in use and is provided for reference only. Download this version of

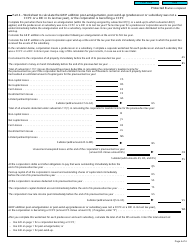

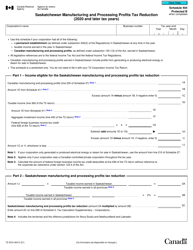

Form T2 Schedule 53

for the current year.

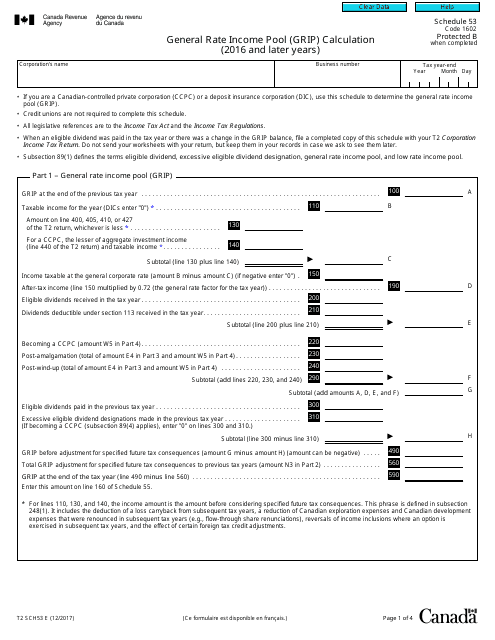

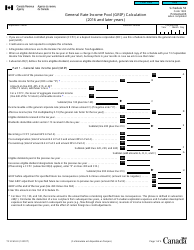

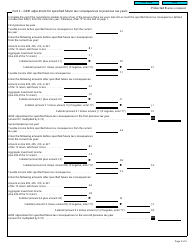

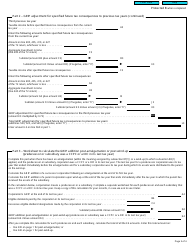

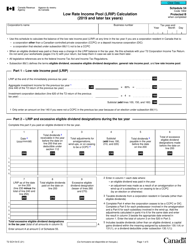

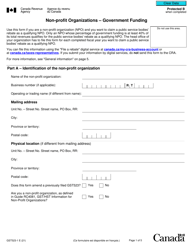

Form T2 Schedule 53 General Rate Income Pool (Grip) Calculation (2016 and Later Tax Years) - Canada

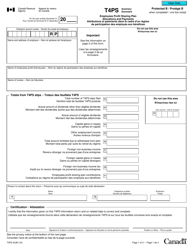

Form T2 Schedule 53 General Rate Income Pool (GRIP) Calculation in Canada is used to determine the amount of income that can be paid out as eligible dividends from a corporation's general rate income pool. It helps businesses calculate the dividends they can distribute to shareholders while taking advantage of preferential tax rates.

The corporation that wants to calculate its General Rate Income Pool (GRIP) for the tax years 2016 and later files the Form T2 Schedule 53 in Canada.

FAQ

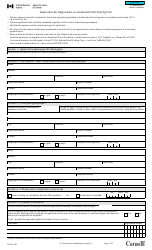

Q: What is Form T2 Schedule 53?

A: Form T2 Schedule 53 is a tax form used in Canada to calculate the General Rate Income Pool (GRIP) for tax years 2016 and later.

Q: What is the General Rate Income Pool (GRIP)?

A: The General Rate Income Pool (GRIP) is a calculation used to determine the tax consequences of certain corporate distributions in Canada.

Q: Who uses Form T2 Schedule 53?

A: Corporations in Canada use Form T2 Schedule 53 to calculate their General Rate Income Pool (GRIP) for tax years 2016 and later.

Q: What is the purpose of calculating the General Rate Income Pool (GRIP)?

A: Calculating the General Rate Income Pool (GRIP) helps determine the tax consequences of certain corporate distributions in Canada.

Q: Can individuals use Form T2 Schedule 53?

A: No, Form T2 Schedule 53 is specifically for use by corporations in Canada.

Q: Is Form T2 Schedule 53 for the tax year 2016 and later?

A: Yes, Form T2 Schedule 53 is specifically for tax years 2016 and later.