This version of the form is not currently in use and is provided for reference only. Download this version of

Form T5013 Schedule 141

for the current year.

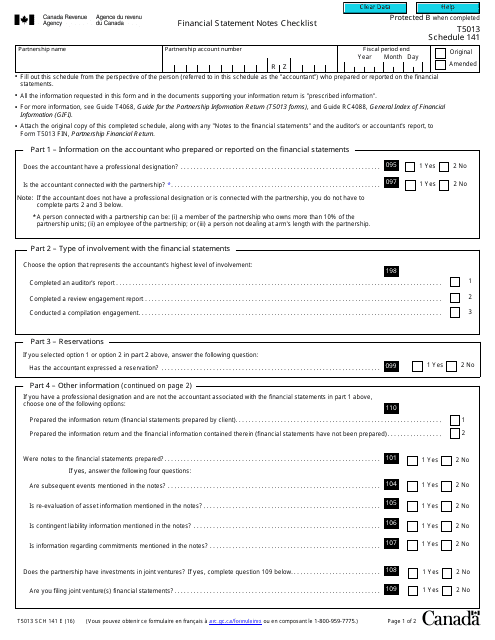

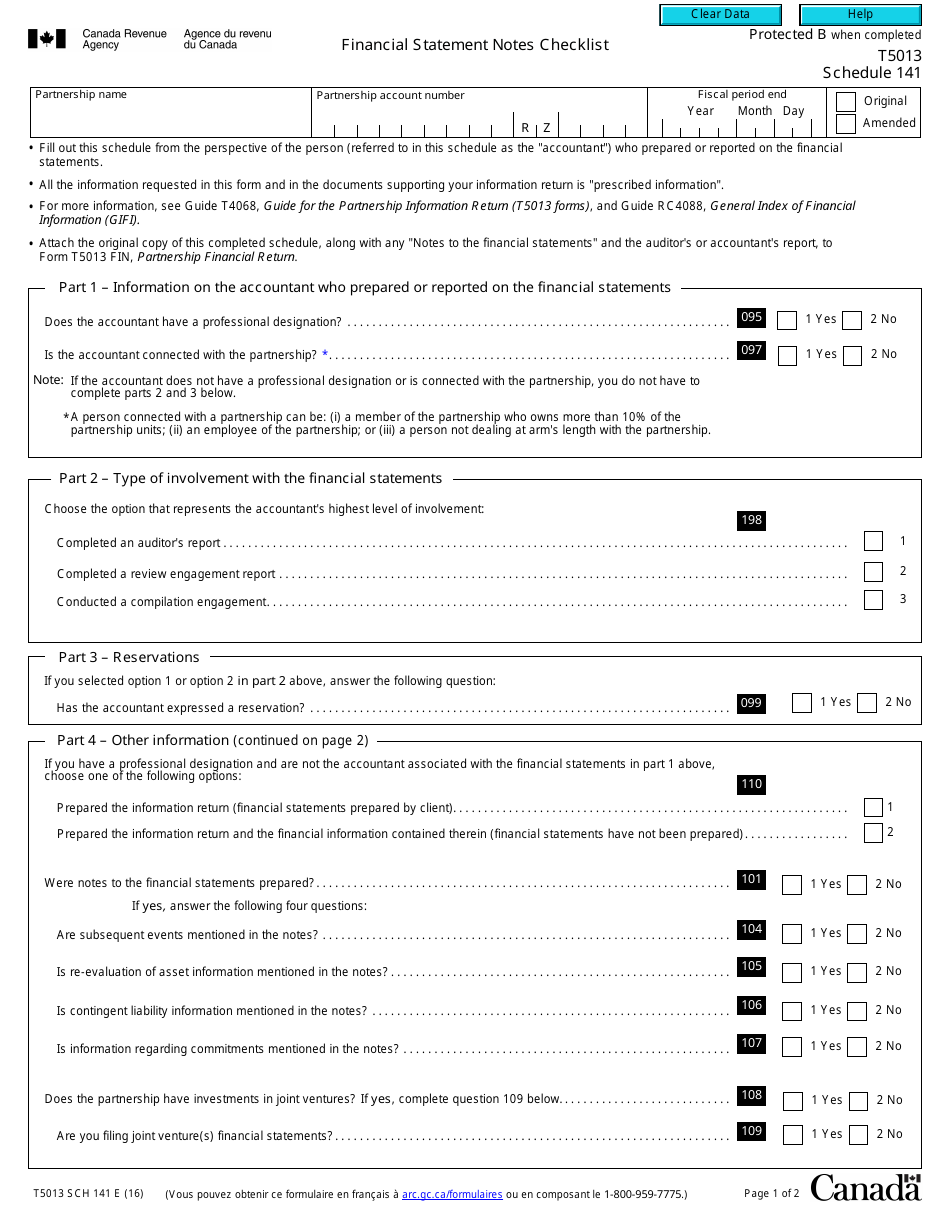

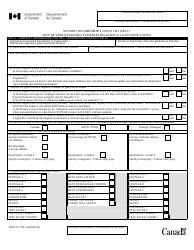

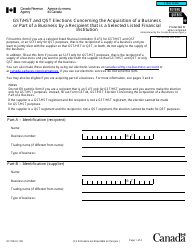

Form T5013 Schedule 141 Financial Statement Notes Checklist - Canada

Form T5013 SCH 141 or the "Form T5013 Sch 141 Schedule 141 "financial Statement Notes Checklist" - Canada" is a form issued by the Canadian Revenue Agency .

Download a PDF version of the Form T5013 SCH 141 down below or find it on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T5013 Schedule 141?

A: Form T5013 Schedule 141 is a financial statement notes checklist used in Canada for tax reporting purposes.

Q: What is the purpose of Form T5013 Schedule 141?

A: The purpose of Form T5013 Schedule 141 is to provide a checklist for including financial statement notes that accompany the T5013 Partnership Information Return.

Q: Who needs to fill out Form T5013 Schedule 141?

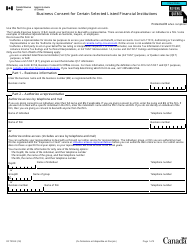

A: Partnerships in Canada that are required to file the T5013 Partnership Information Return must also complete Form T5013 Schedule 141 if they have financial statement notes to include.

Q: What are financial statement notes?

A: Financial statement notes are additional information and details that provide further clarification and context to the financial statements of a partnership. These notes help to explain key financial data and provide transparency.

Q: Are there any specific requirements for financial statement notes on Form T5013 Schedule 141?

A: Yes, there are specific requirements for financial statement notes on Form T5013 Schedule 141. These requirements include disclosing certain information about the partnership's operations, related party transactions, contingent liabilities, and other significant financial matters.

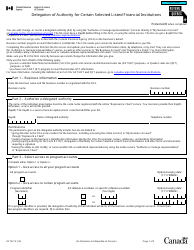

Q: How do I fill out Form T5013 Schedule 141?

A: To fill out Form T5013 Schedule 141, you need to review the financial statement notes of your partnership and provide the required information in the designated sections of the form. It is recommended to consult the instructions provided by the CRA for guidance.

Q: When is the deadline for filing Form T5013 Schedule 141?

A: The deadline for filing Form T5013 Schedule 141 is the same as the deadline for filing the T5013 Partnership Information Return, which is generally within six months of the end of the partnership's fiscal year-end.

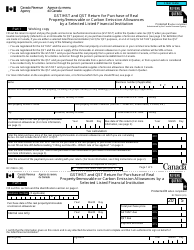

Q: What happens if I don't file Form T5013 Schedule 141?

A: If you are required to file Form T5013 Schedule 141 and fail to do so, you may face penalties and interest charges imposed by the CRA for non-compliance with tax reporting requirements. Additionally, incomplete or inaccurate financial statement notes can lead to potential audits or reassessments.