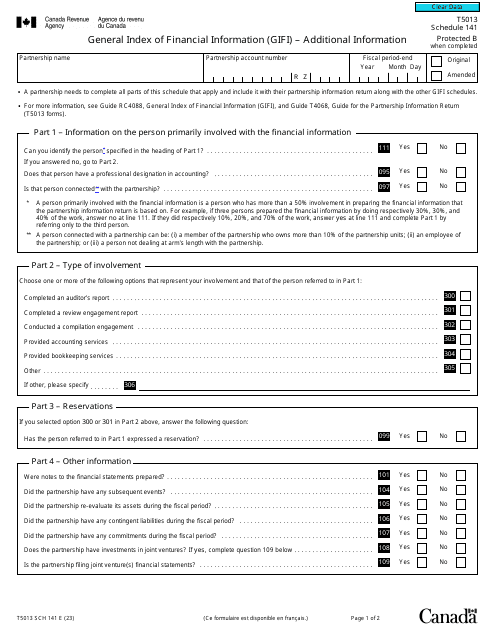

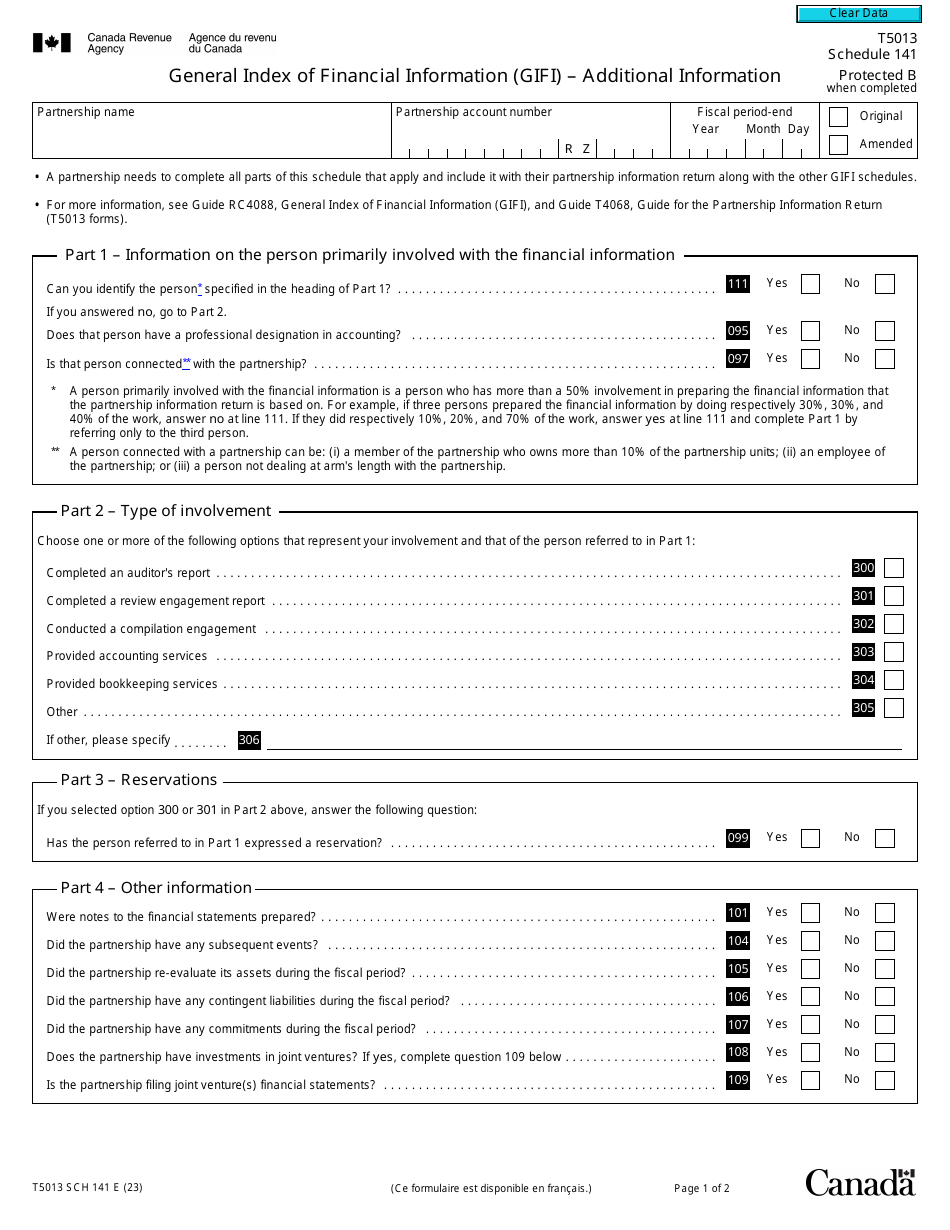

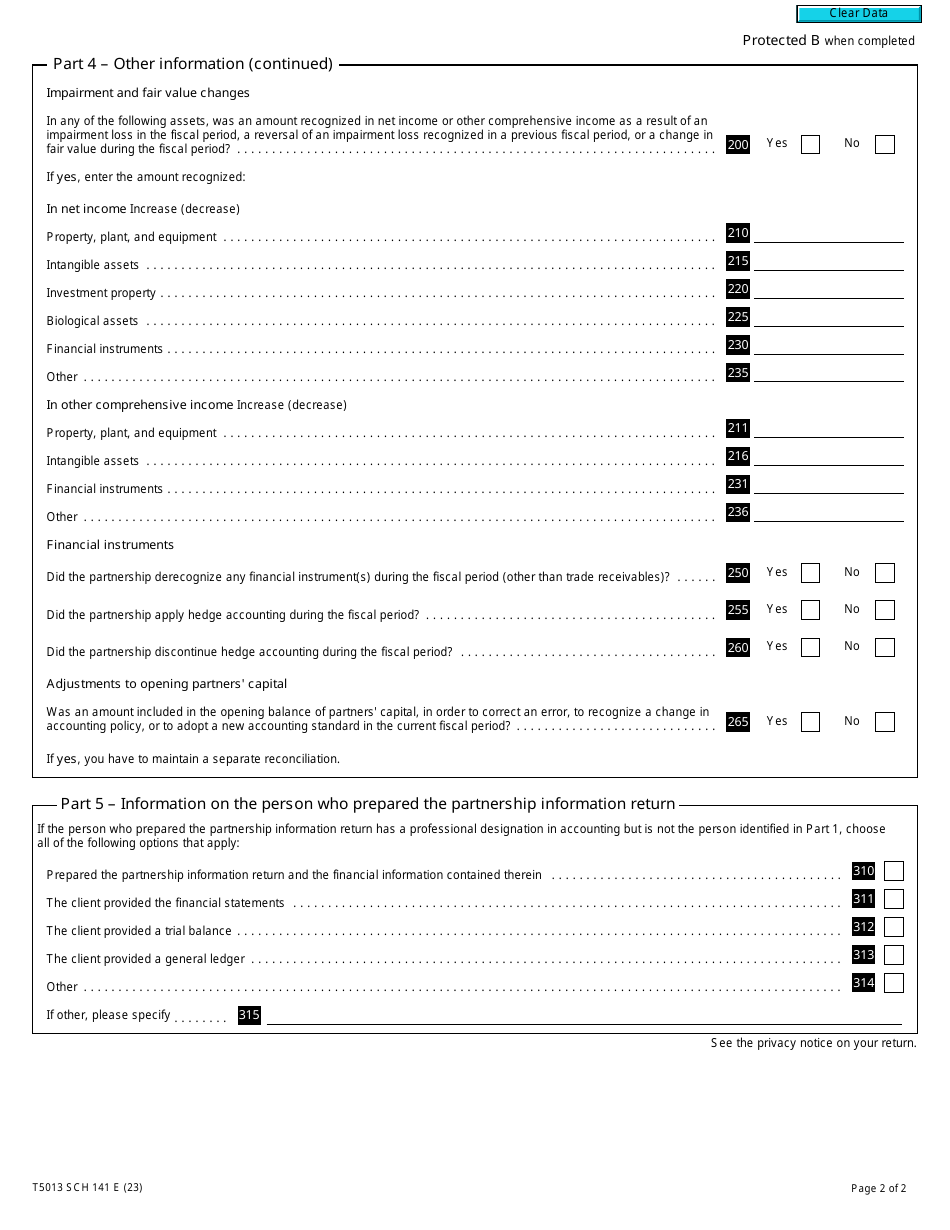

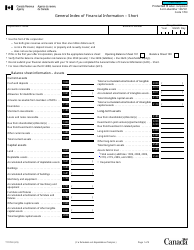

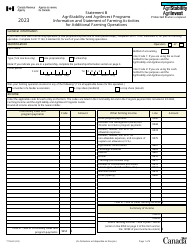

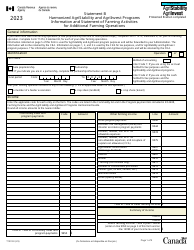

Form T5013 Schedule 141 General Index of Financial Information (Gifi) - Additional Information - Canada

Form T5013 Schedule 141 Financial Statement Notes Checklist is used in Canada to assist taxpayers in preparing financial statement notes for their T5013 Partnership Information Return.

Form T5013 Schedule 141 Financial Statement Notes Checklist - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T5013?

A: Form T5013 is a tax form used by partnerships in Canada to report their income, expenses, and other relevant information.

Q: What is Schedule 141?

A: Schedule 141 is a specific part of Form T5013 that focuses on the financial statement notes of the partnership.

Q: What is a financial statement note?

A: A financial statement note is a supplementary disclosure that provides additional information about the items included in the partnership's financial statements.

Q: Why is the financial statement notes checklist important?

A: The financial statement notes checklist helps ensure that all required information is included in the partnership's financial statements.

Q: Who needs to complete the Form T5013 Schedule 141?

A: Partnerships in Canada are required to complete Form T5013 and its associated schedules, including Schedule 141, if certain criteria are met.

Q: What are some examples of information included in the financial statement notes?

A: Financial statement notes may include details about accounting policies, significant accounting estimates, related party transactions, and other relevant information.

Q: Are there any penalties for not completing the Form T5013 and Schedule 141?

A: Yes, there are penalties for not completing the required tax forms and schedules. It is important to ensure that all necessary forms are filed accurately and on time.

Q: Can I get help with completing the Form T5013 and Schedule 141?

A: Yes, you can seek assistance from tax professionals or consult the CRA's resources, such as guides and instructions, to help you complete the Form T5013 and Schedule 141.

Q: Is the Form T5013 Schedule 141 applicable only to partnerships?

A: Yes, Schedule 141 is specifically designed for partnerships in Canada and is not applicable to other types of business entities.