This version of the form is not currently in use and is provided for reference only. Download this version of

Form T5013 Schedule 2

for the current year.

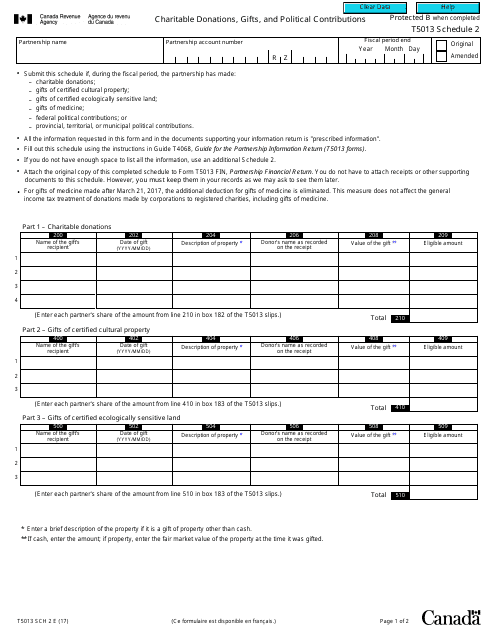

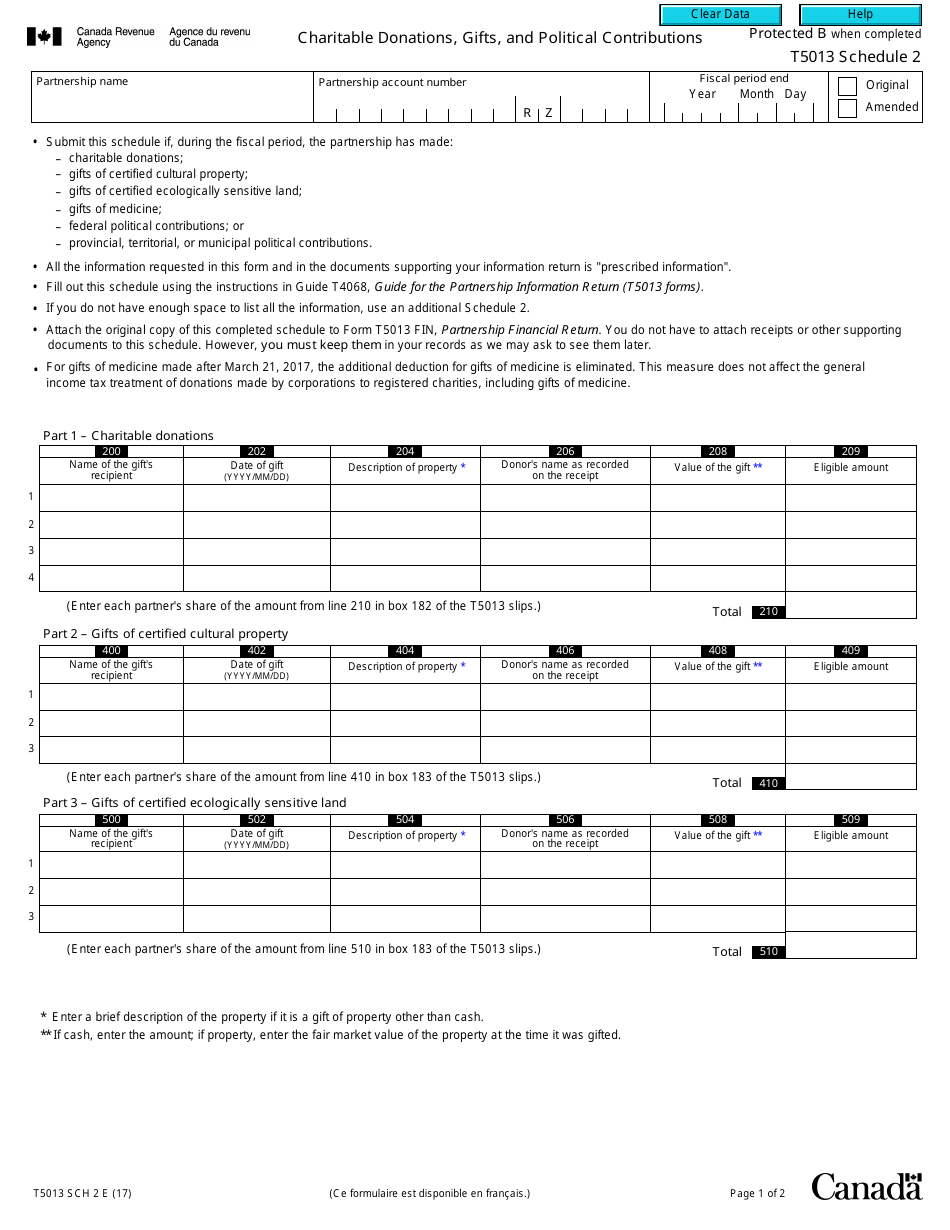

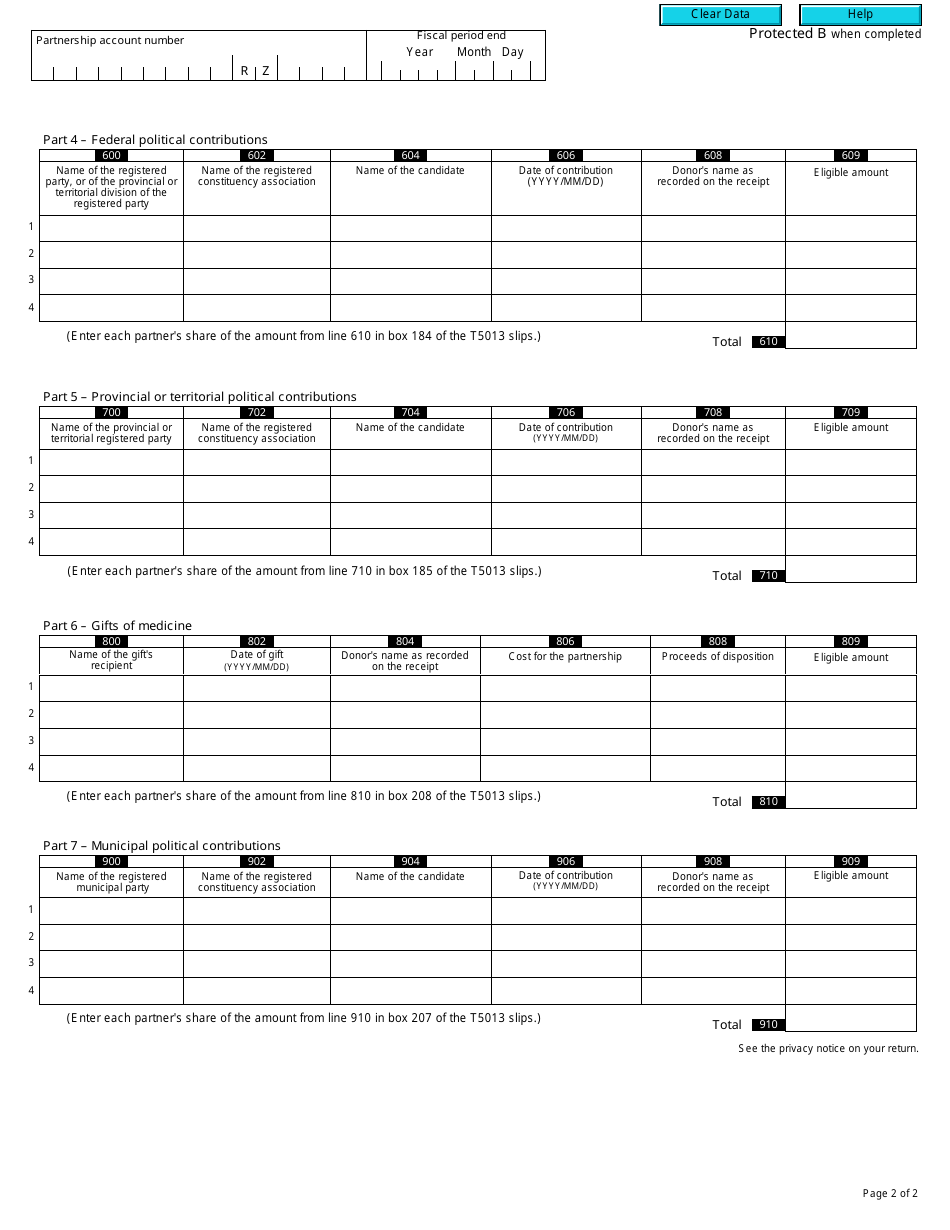

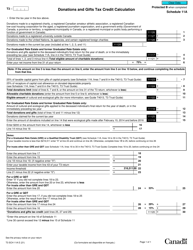

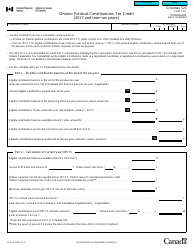

Form T5013 Schedule 2 Charitable Donations, Gifts, and Political Contributions - Canada

Form T5013 SCH 2 or the "Form T5013 Sch 2 Schedule 2 "charitable Donations, Gifts, And Political Contributions" - Canada" is a form issued by the Canadian Revenue Agency .

The form was last revised in January 1, 2017 and is available for digital filing. Download an up-to-date Form T5013 SCH 2 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T5013 Schedule 2?

A: Form T5013 Schedule 2 is a tax form used in Canada to report charitable donations, gifts, and political contributions.

Q: Who needs to file Form T5013 Schedule 2?

A: Partnerships that are required to file Form T5013, Statement of Partnership Income, must also file Form T5013 Schedule 2 if they made charitable donations, gifts, or political contributions during the tax year.

Q: What information is required in Form T5013 Schedule 2?

A: You will need to provide details of the partnership's charitable donations, gifts, and political contributions, including the names and addresses of the organizations or individuals received the contributions.

Q: When is the deadline to file Form T5013 Schedule 2?

A: Form T5013 Schedule 2 must be filed along with Form T5013 by the deadline for filing the partnership's tax return, which is generally within six months after the end of the partnership's fiscal period.

Q: What are the consequences of not filing Form T5013 Schedule 2?

A: Failure to file Form T5013 Schedule 2 may result in penalties and interest charges imposed by the CRA.

Q: Can I claim a tax deduction for charitable donations made through a partnership?

A: No, individual partners cannot claim tax deductions for charitable donations made through a partnership. Only the partnership can claim the deduction.

Q: Can I claim a tax credit for political contributions made through a partnership?

A: No, political contributions made through a partnership are not eligible for the federal political contribution tax credit.

Q: Are there any limits on the amount of charitable donations that can be claimed?

A: Yes, there are limits on the amount of charitable donations that can be claimed. The maximum donation limit for a tax year is generally 75% of the partnership's net income for that year.

Q: Can I carry forward unused charitable donation amounts?

A: Yes, if the partnership cannot fully use the charitable donation amount in the current tax year, it can carry forward the unused amount for up to five years.