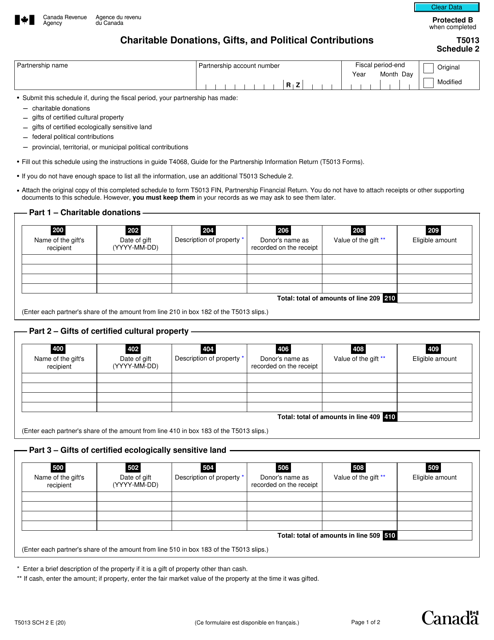

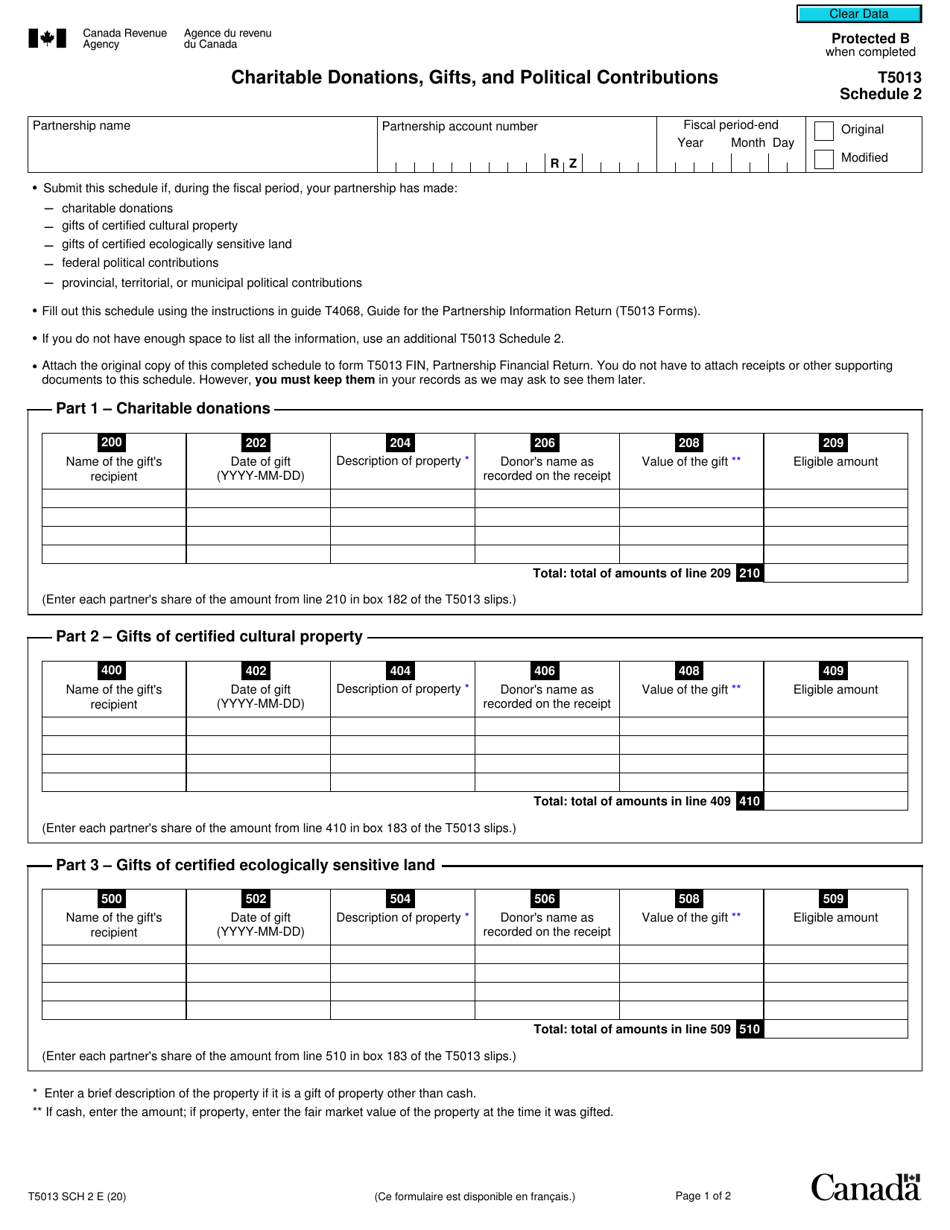

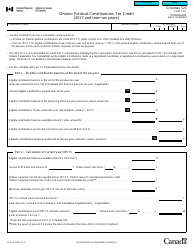

Form T5013 Schedule 2 Charitable Donations, Gifts, and Political Contributions - Canada

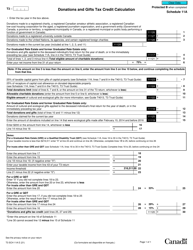

Form T5013 Schedule 2 Charitable Donations, Gifts, and Political Contributions in Canada is used by partnerships to report any charitable donations, gifts, or political contributions made by the partnership.

Individuals or corporations that have made charitable donations, gifts, or political contributions in Canada may be required to file Form T5013 Schedule 2. This form is filed by the recipients of these contributions, typically charitable organizations or eligible political parties.

Form T5013 Schedule 2 Charitable Donations, Gifts, and Political Contributions - Canada - Frequently Asked Questions (FAQ)

Q: What is T5013 Schedule 2?

A: T5013 Schedule 2 is a tax form used in Canada to report charitable donations, gifts, and political contributions made by partnerships.

Q: Who needs to fill out T5013 Schedule 2?

A: Partnerships in Canada who have made charitable donations, gifts, or political contributions need to fill out T5013 Schedule 2.

Q: What information is required on T5013 Schedule 2?

A: On T5013 Schedule 2, partnerships need to report details of their charitable donations, gifts, and political contributions, including the recipient organization and the amount donated.

Q: When is T5013 Schedule 2 due?

A: T5013 Schedule 2 is generally due on or before the partnership's filing deadline, which is usually within six months after the end of the fiscal period.