This version of the form is not currently in use and is provided for reference only. Download this version of

Form T5013 Schedule 6

for the current year.

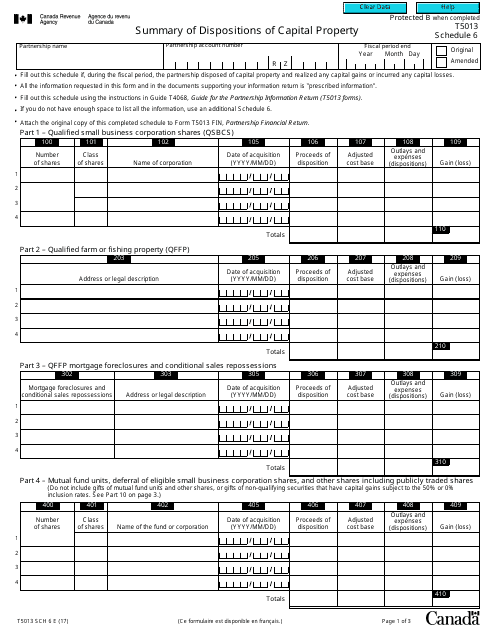

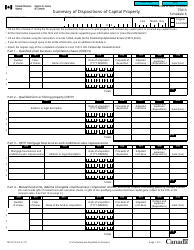

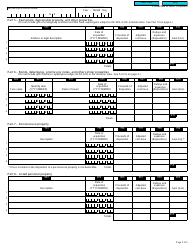

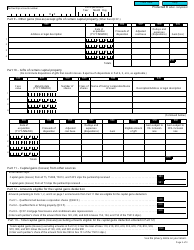

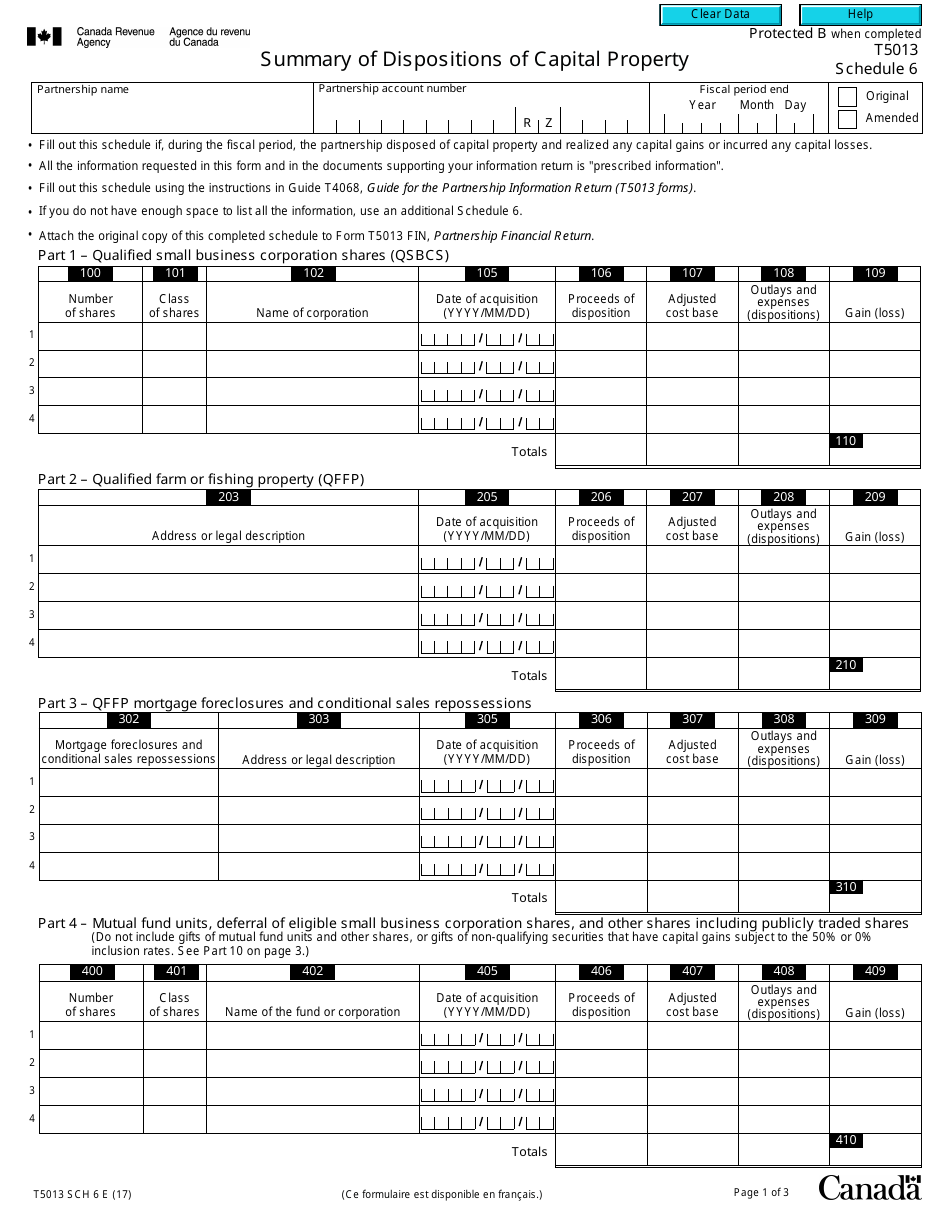

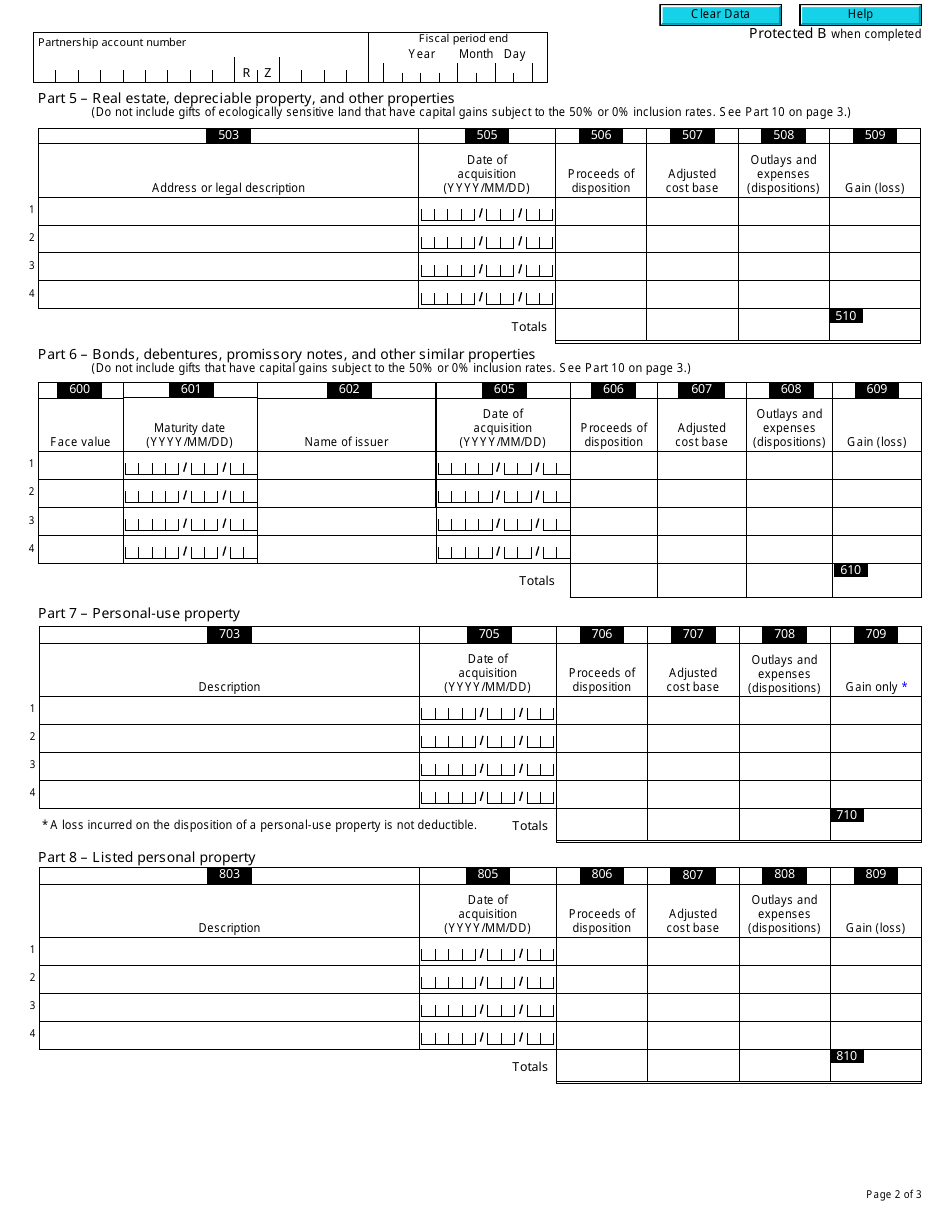

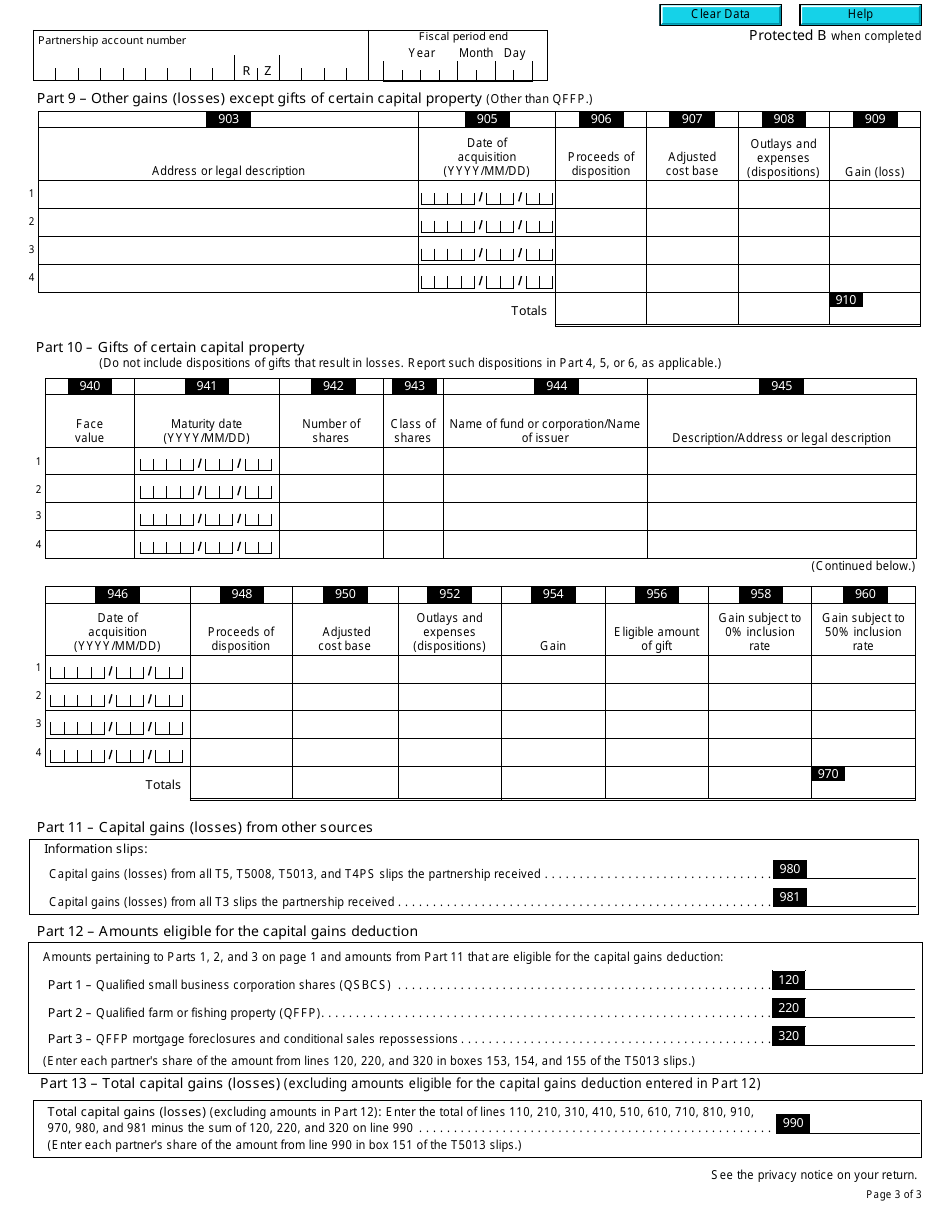

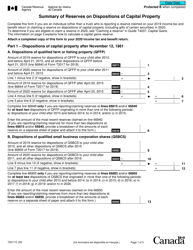

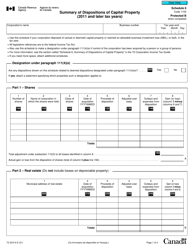

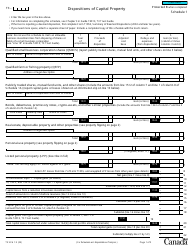

Form T5013 Schedule 6 Summary of Dispositions of Capital Property - Canada

Form T5013 Schedule 6, Summary of Dispositions of Capital Property, is used in Canada to report the details of the sales or other dispositions of capital property made by a partnership. It provides a summary of these transactions for tax purposes.

The partners of a partnership in Canada are responsible for filing Form T5013 Schedule 6. It summarizes the dispositions of capital property made by the partnership.

FAQ

Q: What is Form T5013 Schedule 6?

A: Form T5013 Schedule 6 is a summary of dispositions of capital property in Canada.

Q: Who needs to fill out Form T5013 Schedule 6?

A: Partnerships in Canada that had dispositions of capital property during the tax year need to fill out Form T5013 Schedule 6.

Q: What is the purpose of Form T5013 Schedule 6?

A: The form is used to report the details of capital property dispositions, including the type of property, the sale proceeds, and any capital gains or losses.

Q: Do I need to file Form T5013 Schedule 6 with my personal tax return?

A: No, Form T5013 Schedule 6 should be filed separately by partnerships and not attached to individual tax returns.

Q: When is the deadline for filing Form T5013 Schedule 6?

A: The deadline for filing Form T5013 Schedule 6 is the same as the partnership's tax return filing deadline, which is usually March 31st of the following year.

Q: What happens if I fail to file Form T5013 Schedule 6?

A: Failing to file Form T5013 Schedule 6 or filing it late can result in penalties and interest charges from the Canada Revenue Agency (CRA).