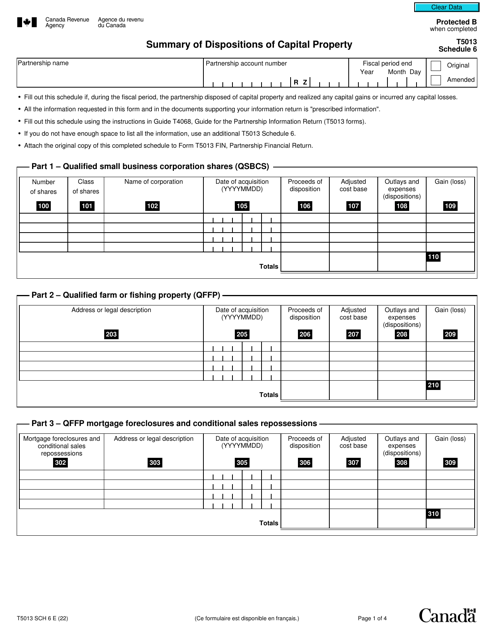

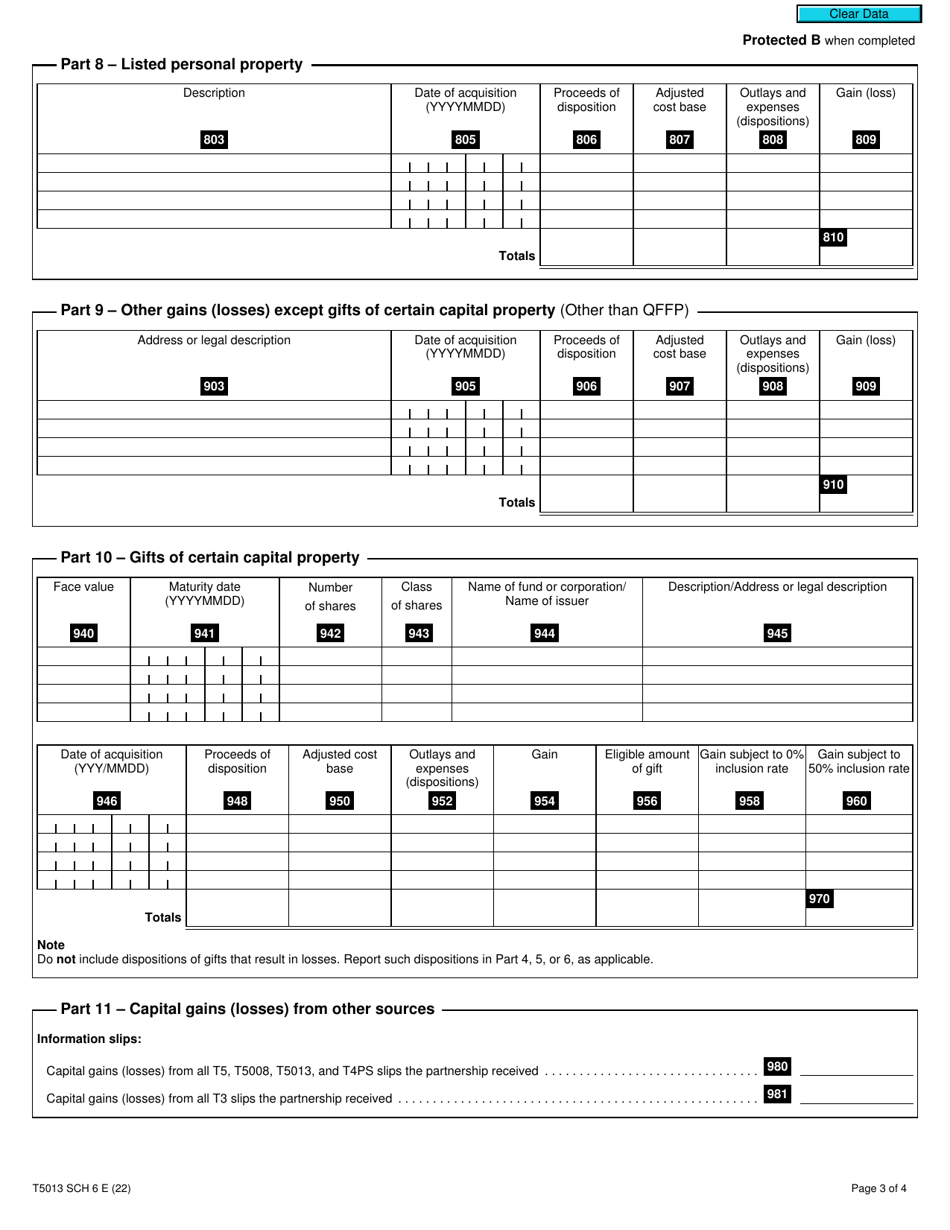

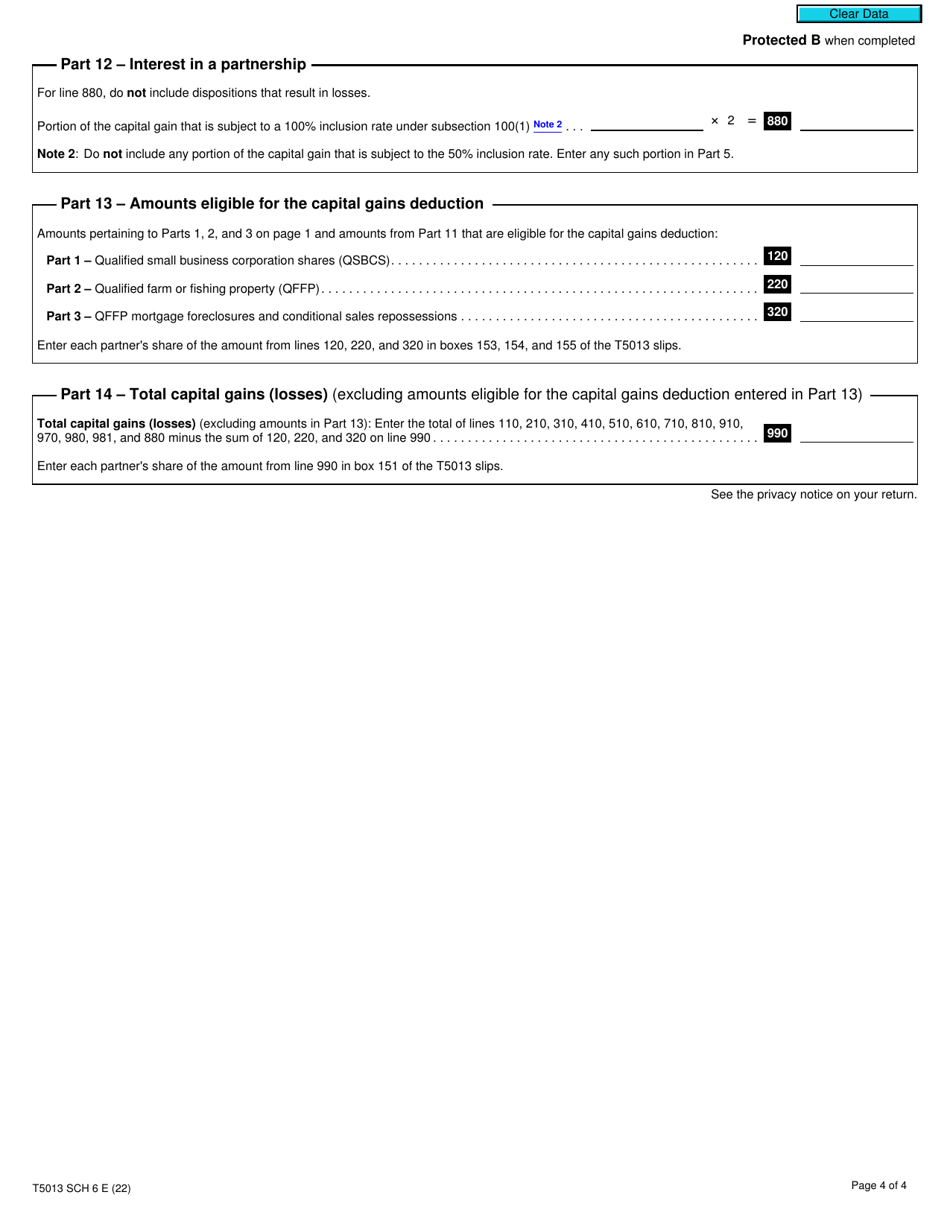

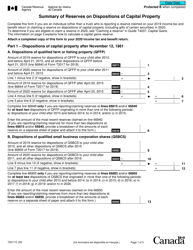

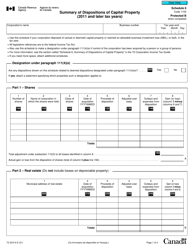

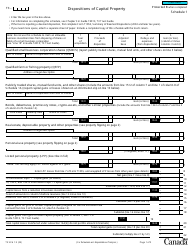

Form T5013 Schedule 6 Summary of Dispositions of Capital Property - Canada

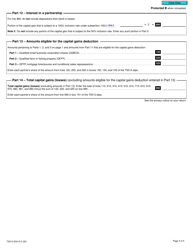

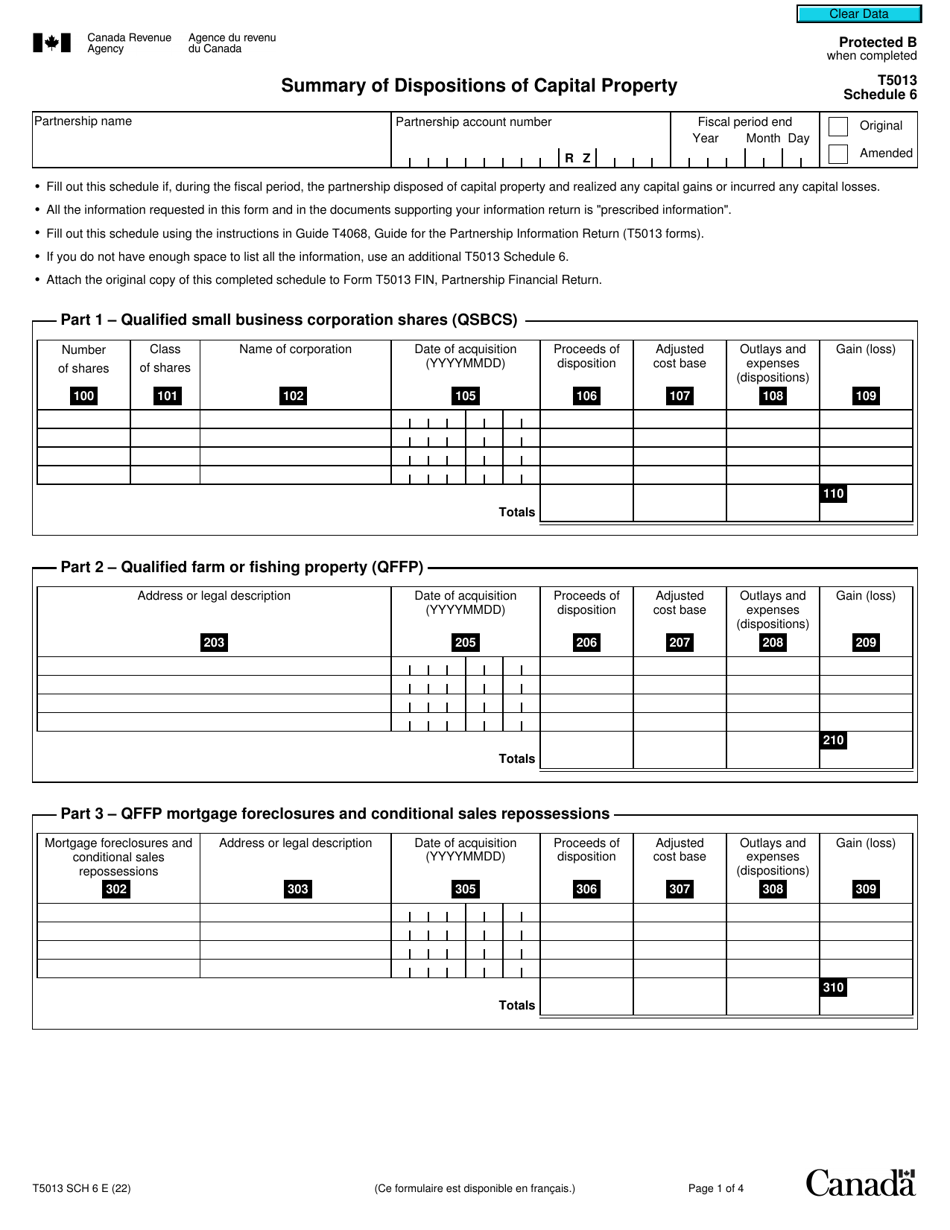

Form T5013 Schedule 6 - Summary of Dispositions of Capital Property in Canada is used to report the details of capital property, such as real estate or investments, that have been disposed of by a partnership. It provides information on the type of property, the proceeds from the disposition, and any resulting gains or losses.

The partnership that disposed of the capital property is required to file the Form T5013 Schedule 6 Summary of Dispositions of Capital Property in Canada.

Form T5013 Schedule 6 Summary of Dispositions of Capital Property - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T5013 Schedule 6? A: Form T5013 Schedule 6 is used in Canada to report the summary of dispositions of capital property.

Q: What is the purpose of Form T5013 Schedule 6? A: The purpose of Form T5013 Schedule 6 is to provide a summary of the dispositions of capital property for tax reporting.

Q: Who needs to file Form T5013 Schedule 6? A: Partnerships in Canada that have dispositions of capital property during the tax year need to file Form T5013 Schedule 6.

Q: When is the deadline to file Form T5013 Schedule 6? A: The deadline to file Form T5013 Schedule 6 is usually within six months after the end of the partnership's taxation year.