This version of the form is not currently in use and is provided for reference only. Download this version of

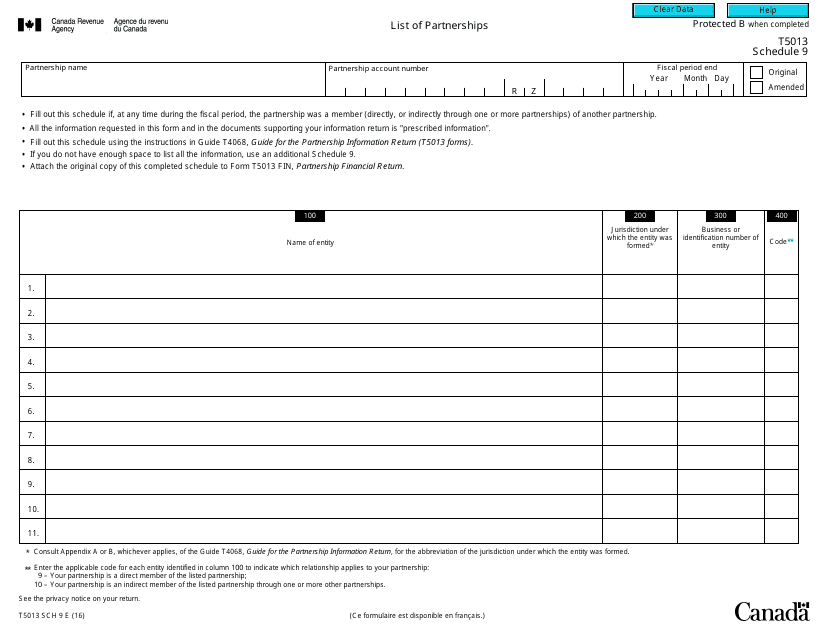

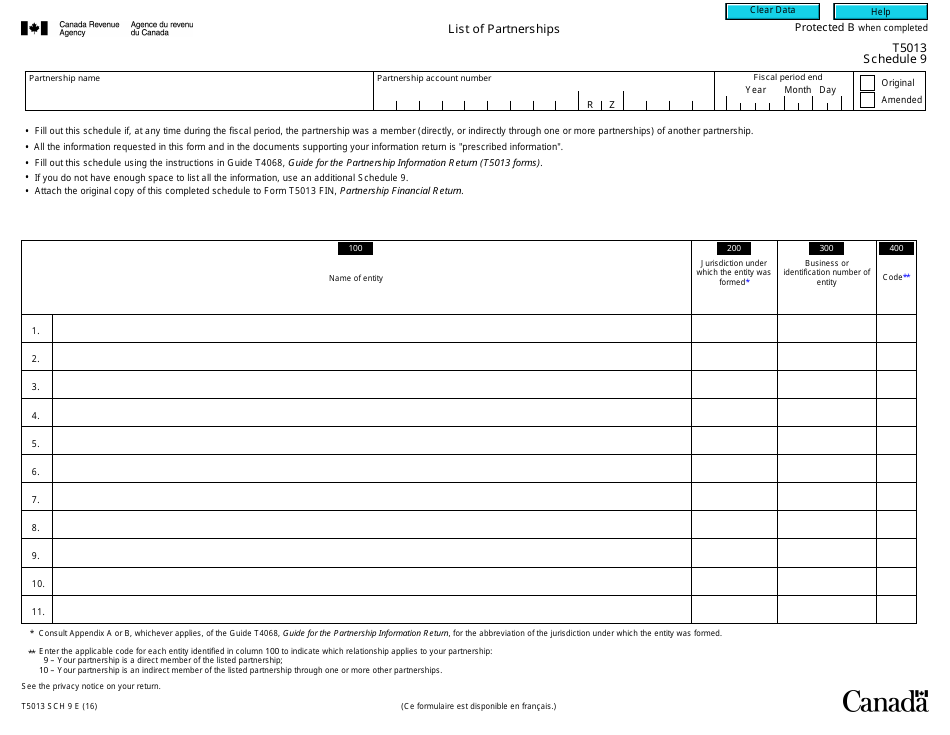

Form T5013 Schedule 9

for the current year.

Form T5013 Schedule 9 List of Partnerships - Canada

Form T5013 Schedule 9 is used in Canada to provide a list of partnerships that a taxpayer is a member of. It is a supporting document that accompanies the T5013 Partnership Information Return. The schedule provides details such as the name and address of each partnership and the taxpayer's percentage of ownership in each partnership.

The Form T5013 Schedule 9 List of Partnerships in Canada is typically filed by individuals or businesses that are partners in a partnership.

FAQ

Q: What is Form T5013?

A: Form T5013 is a tax form used in Canada to report information about partnerships.

Q: What is Schedule 9?

A: Schedule 9 is a supplementary schedule to Form T5013 that provides a list of partnerships.

Q: What information is required on Schedule 9?

A: Schedule 9 requires information such as the partnership name, address, and business number.

Q: Who needs to complete Schedule 9?

A: Partnerships in Canada are required to complete Schedule 9.

Q: Is Schedule 9 submitted separately or with Form T5013?

A: Schedule 9 is filed along with Form T5013.

Q: When is the deadline to file Form T5013 and Schedule 9?

A: The deadline to file Form T5013 and Schedule 9 is generally within six months of the end of the partnership's fiscal year.