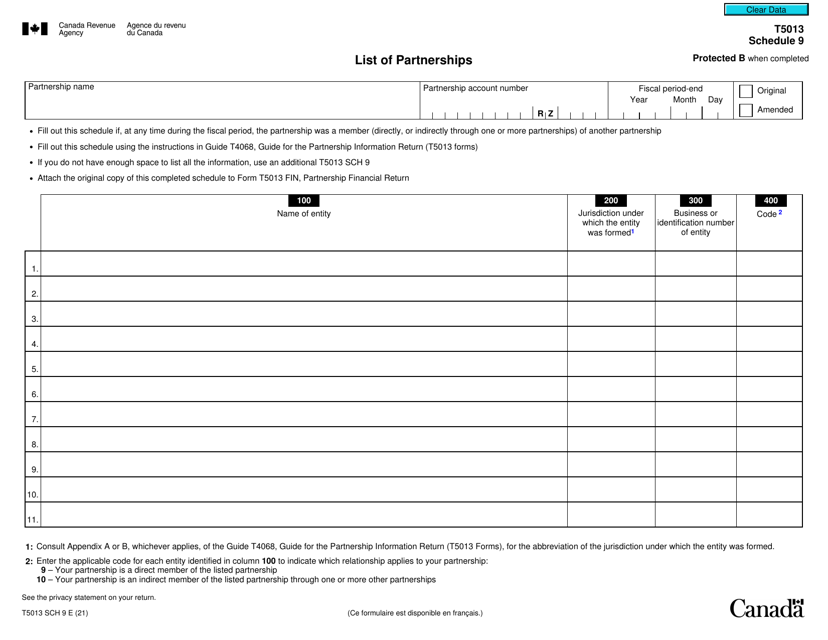

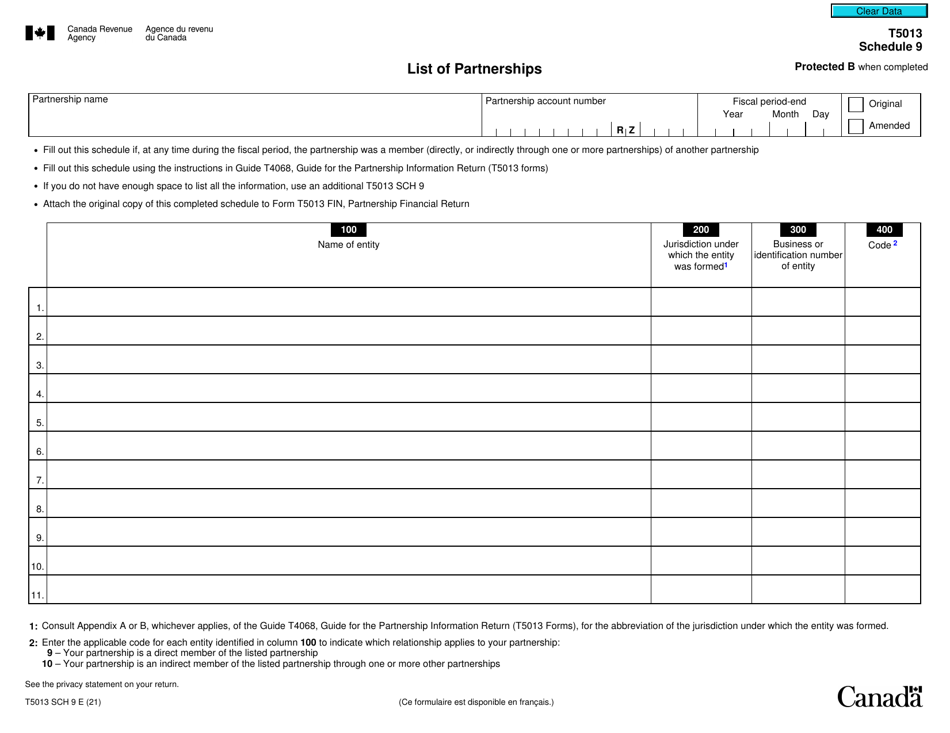

Form T5013 Schedule 9 List of Partnerships - Canada

The Form T5013 Schedule 9 List of Partnerships in Canada is used to report information about partnerships, including the names and identification numbers of all partners, their share of income or loss, and other important details.

The partnerships themselves are responsible for filing the Form T5013 Schedule 9 List of Partnerships in Canada.

Form T5013 Schedule 9 List of Partnerships - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T5013 Schedule 9?

A: Form T5013 Schedule 9 is a document used in Canada to list partnerships.

Q: What is its purpose?

A: The purpose of Form T5013 Schedule 9 is to provide information about the partnerships in which the taxpayer is involved.

Q: Who needs to file Form T5013 Schedule 9?

A: Anyone who is part of a partnership in Canada needs to file Form T5013 Schedule 9.

Q: When is the deadline for filing Form T5013 Schedule 9?

A: The deadline for filing Form T5013 Schedule 9 is usually the same as the deadline for filing your personal income tax return in Canada.

Q: Are there any penalties for not filing Form T5013 Schedule 9?

A: Yes, there can be penalties for not filing Form T5013 Schedule 9, including potential fines and penalties for each day the form is late.

Q: Can I e-file Form T5013 Schedule 9?

A: Yes, you can e-file Form T5013 Schedule 9 using certain tax preparation software or through the CRA's Netfile service.

Q: Do I need to attach supporting documents to Form T5013 Schedule 9?

A: No, you do not need to attach supporting documents to Form T5013 Schedule 9. However, you should keep them for your records in case of an audit.

Q: What information do I need to complete Form T5013 Schedule 9?

A: To complete Form T5013 Schedule 9, you will need information about the partnerships you are involved in, including their names, addresses, and tax identification numbers.

Q: Is Form T5013 Schedule 9 only for Canadian residents?

A: No, Form T5013 Schedule 9 is also required for non-residents of Canada who are part of a partnership in the country.