This version of the form is not currently in use and is provided for reference only. Download this version of

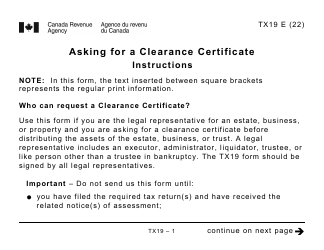

Form TX19

for the current year.

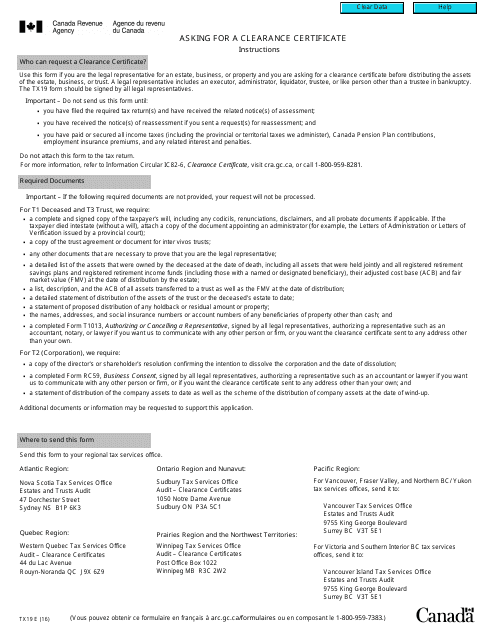

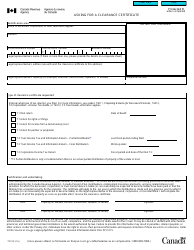

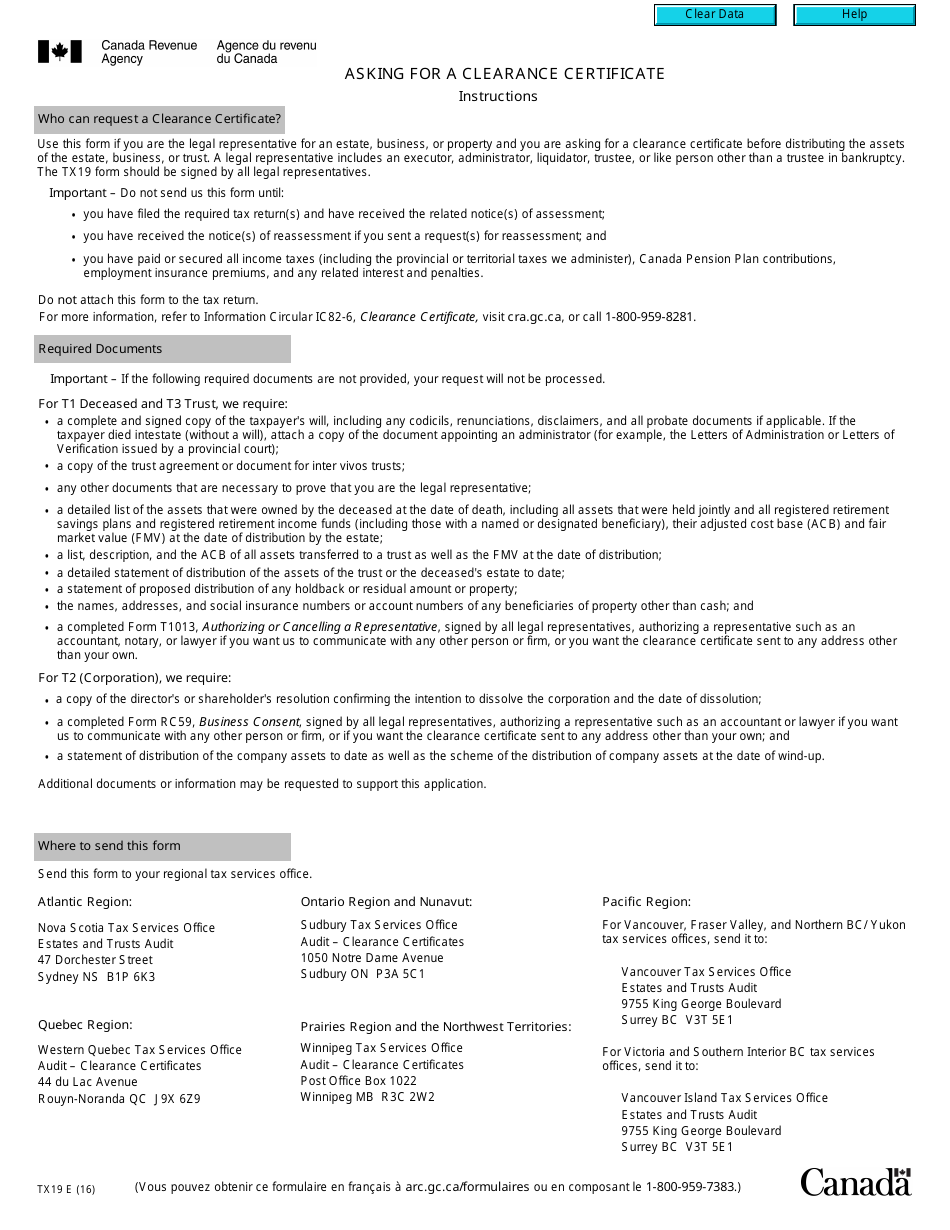

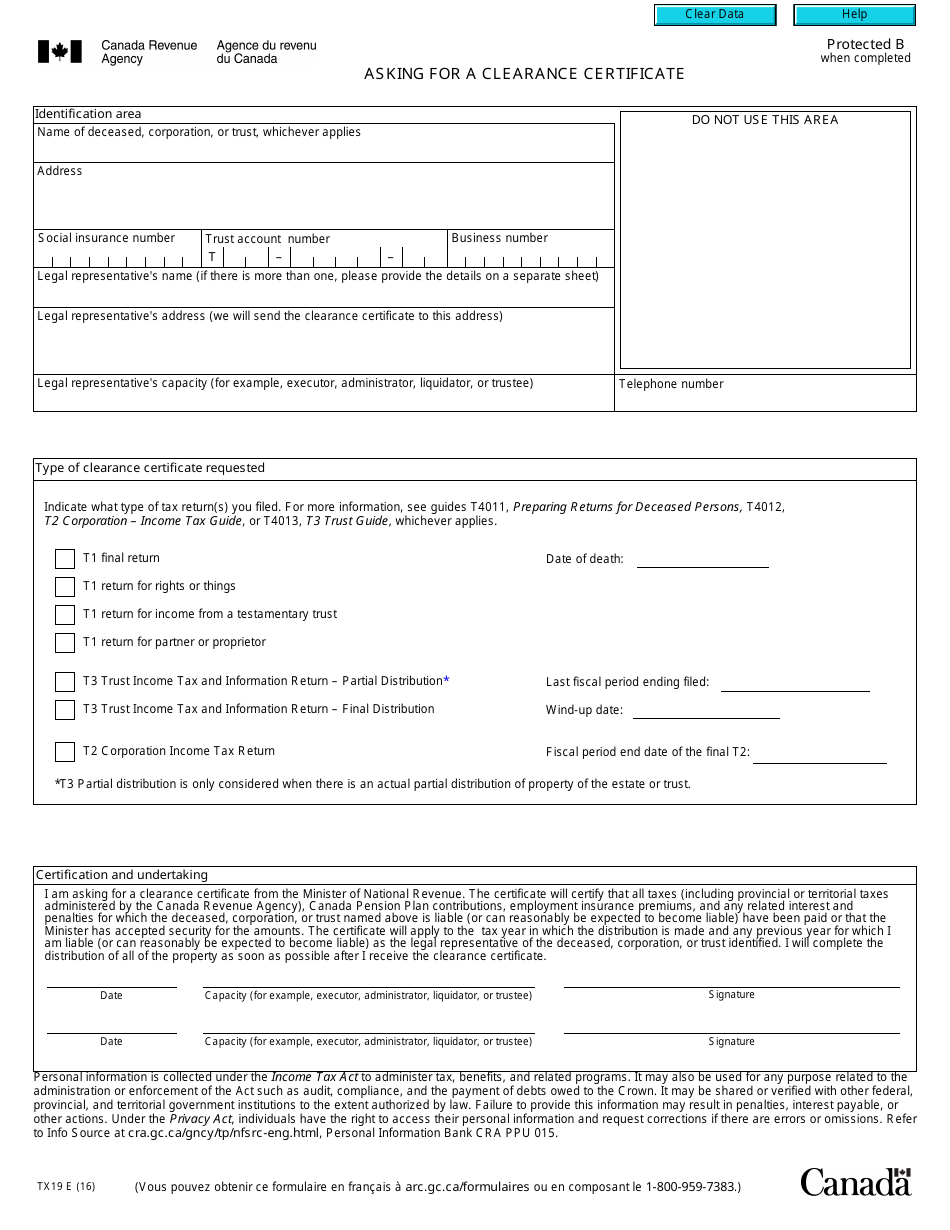

Form TX19 Asking for a Clearance Certificate - Canada

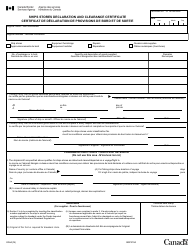

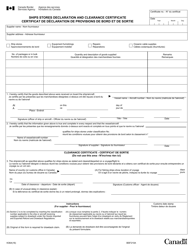

Form TX19, also known as the Clearance Certificate - Canada, is used to request a certificate that verifies if any taxes are owed to the Canadian government. It is typically required for individuals or businesses that are either leaving Canada or distributing property from an estate. The certificate confirms that all outstanding tax obligations have been satisfied.

In Canada, the Form TX19 asking for a clearance certificate is filed by the executor or administrator of a deceased person's estate.

FAQ

Q: What is a Clearance Certificate?

A: A Clearance Certificate is a document issued by the Canada Revenue Agency (CRA) that confirms that all tax liabilities of a deceased person or an individual or business entity are paid or settled.

Q: Who needs to request a Clearance Certificate?

A: The representative of a deceased person's estate or an individual or business entity that has potential tax liabilities.

Q: Why do I need a Clearance Certificate?

A: A Clearance Certificate provides proof that all tax liabilities are settled and reduces the risk of any future tax issues.

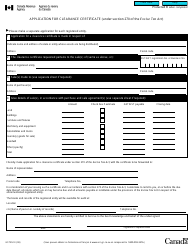

Q: How do I request a Clearance Certificate?

A: You can request a Clearance Certificate by completing and filing Form TX19 - Asking for a Clearance Certificate.

Q: How long does it take to receive a Clearance Certificate?

A: The processing time for a Clearance Certificate can vary. It is recommended to allow several weeks for the CRA to process the request.

Q: What happens if I don't request a Clearance Certificate?

A: If you don't request a Clearance Certificate, there may be uncertainty regarding the settlement of tax liabilities, which can lead to potential tax issues in the future.

Q: Can I request a Clearance Certificate for past tax years?

A: No, the Clearance Certificate is only issued for the current tax year.

Q: What should I do if I have any additional questions?

A: If you have any additional questions or need further assistance, you can contact the Canada Revenue Agency directly.