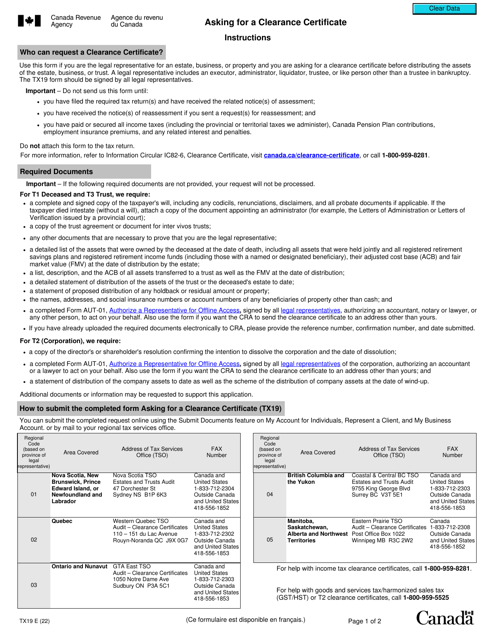

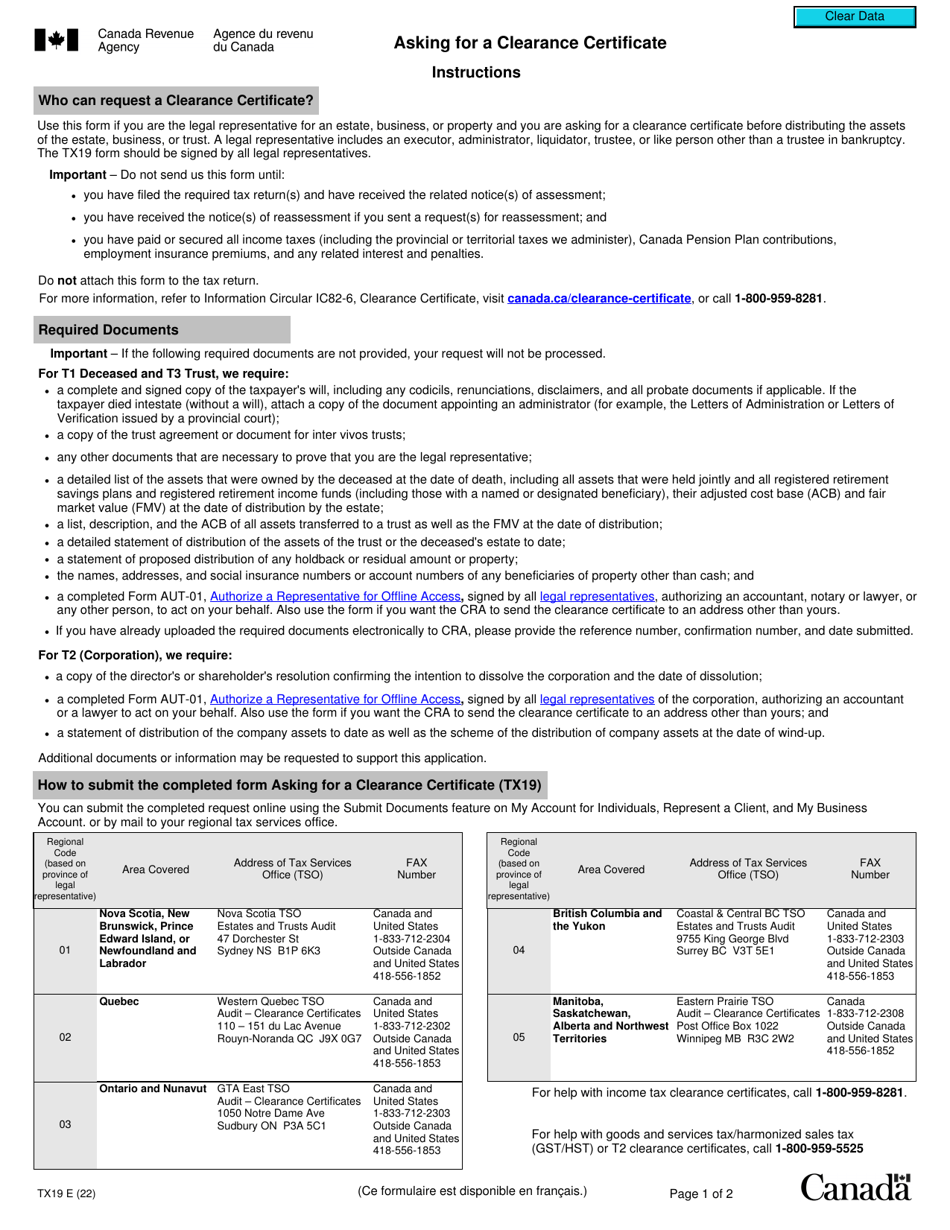

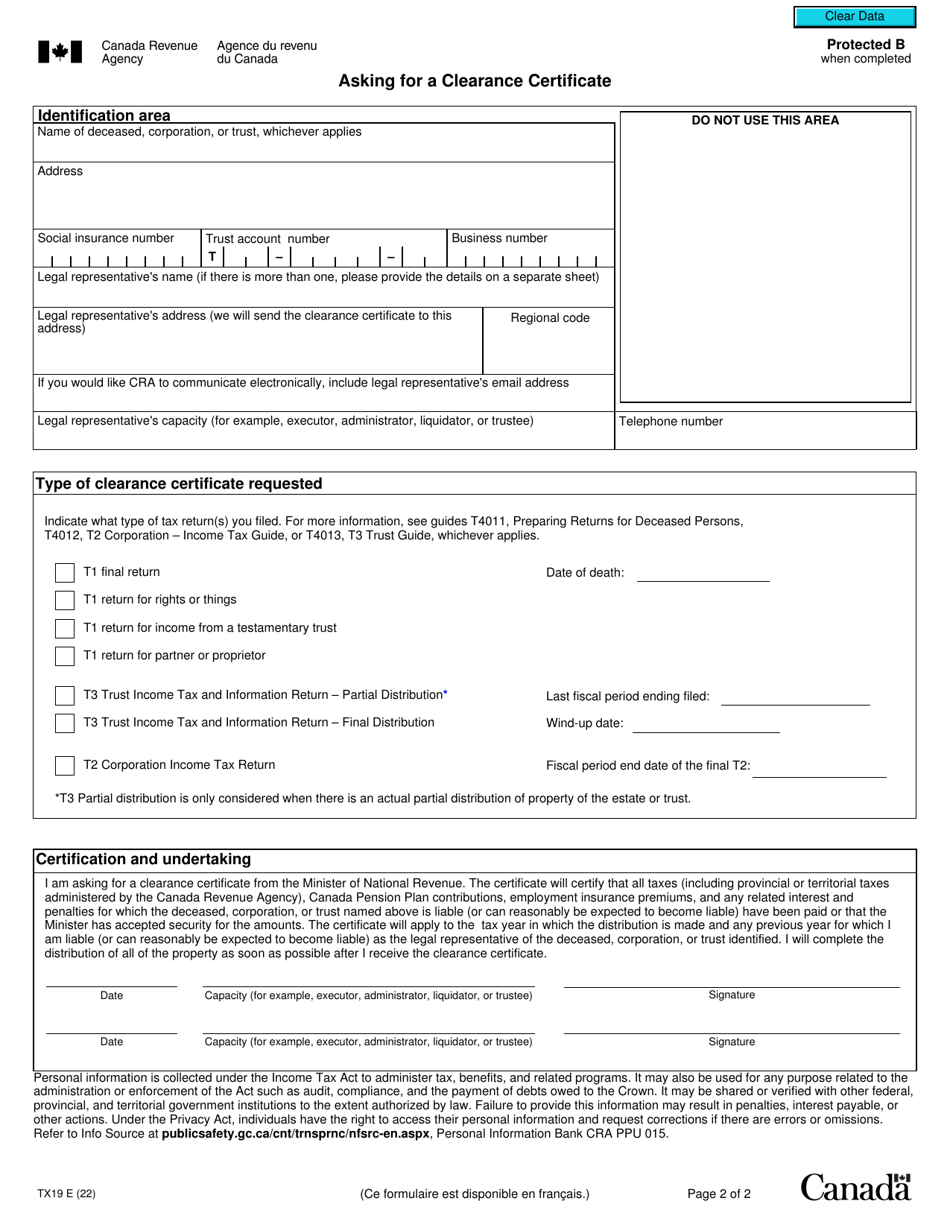

Form TX19 Asking for a Clearance Certificate - Canada

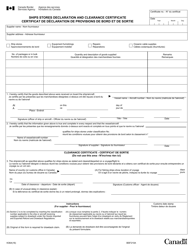

Form TX19, also known as the Clearance Certificate - Canada, is typically used to request a certificate from the Canada Revenue Agency (CRA) to confirm that all tax obligations for a deceased individual or a corporation have been satisfied. This certificate is often required when distributing assets or closing an estate. It ensures that there are no outstanding tax liabilities. So, Form TX19 is asking for a clearance certificate from the CRA to verify tax compliance.

In Canada, individuals or businesses who have sold or transferred taxable property may file the Form TX19 to request a clearance certificate.

Form TX19 Asking for a Clearance Certificate - Canada - Frequently Asked Questions (FAQ)

Q: What is Form TX19?

A: Form TX19 is a document used in Canada to request a Clearance Certificate.

Q: What is a Clearance Certificate?

A: A Clearance Certificate is a document issued by the Canada Revenue Agency (CRA) that confirms that a person or business has paid all taxes owed and has no outstanding tax liabilities.

Q: When is Form TX19 used?

A: Form TX19 is used when an individual or business needs to request a Clearance Certificate from the CRA.

Q: Why would someone need a Clearance Certificate?

A: A Clearance Certificate may be required in various situations, such as selling or transferring certain assets, closing a business, or receiving a refund of overpaid taxes.

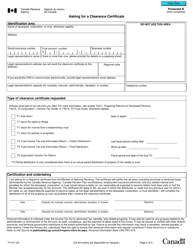

Q: How do I fill out Form TX19?

A: Form TX19 requires information about the taxpayer, the type of taxes being certified, and any outstanding tax liabilities. It is important to provide accurate and complete information.

Q: What happens after I submit Form TX19?

A: Once the CRA receives Form TX19, they will review it and either issue a Clearance Certificate or request additional information if needed.

Q: How long does it take to receive a Clearance Certificate?

A: The processing time for a Clearance Certificate can vary, but it typically takes several weeks. It is recommended to submit the form well in advance of any deadlines.