This version of the form is not currently in use and is provided for reference only. Download this version of

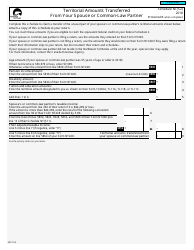

Form 5000-S2 Schedule 2

for the current year.

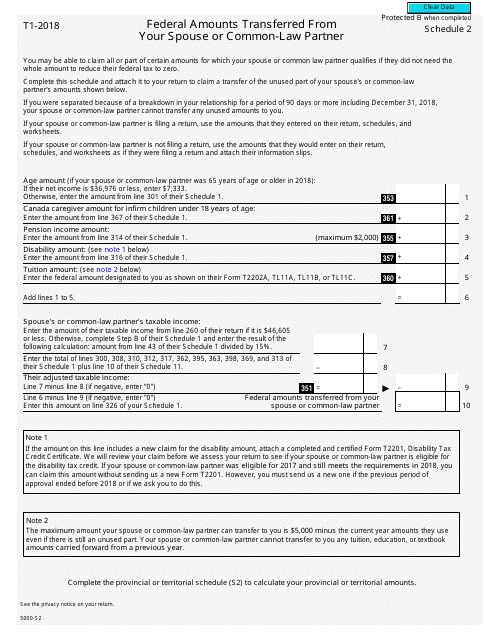

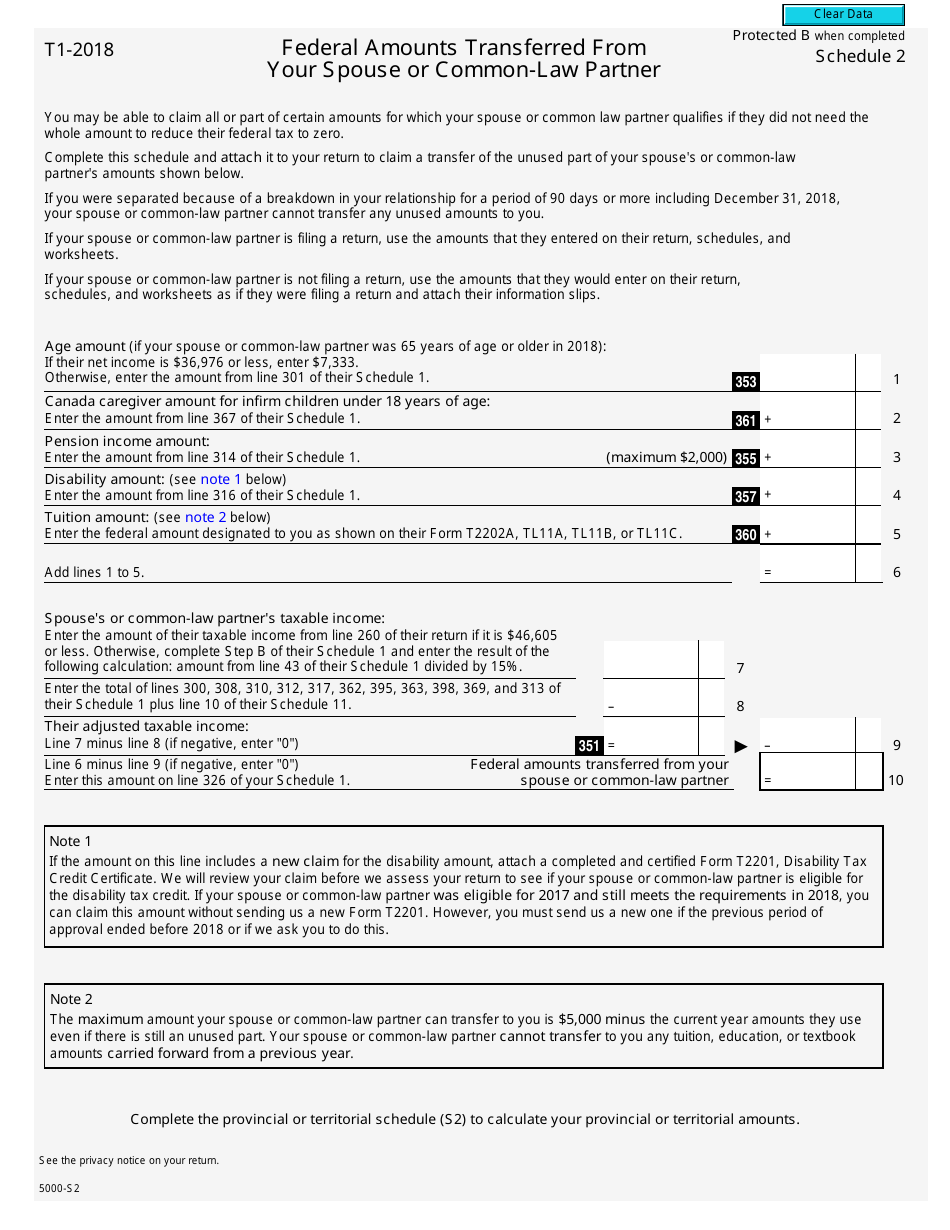

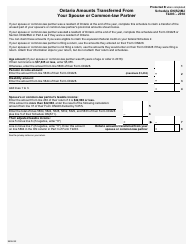

Form 5000-S2 Schedule 2 Federal Amounts Transferred From Your Spouse or Common-Law Partner - Canada

This fillable " Federal Amounts Transferred From Your Spouse Or Common-law Partner " is a document issued by the Canadian Revenue Agency specifically for Canada residents.

Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application.

FAQ

Q: What is Form 5000-S2?

A: Form 5000-S2 is a schedule used in Canada for reporting federal amounts transferred from your spouse or common-law partner.

Q: What is Schedule 2?

A: Schedule 2 is a part of Form 5000-S2 that specifically deals with reporting federal amounts transferred from your spouse or common-law partner.

Q: What are federal amounts in this context?

A: Federal amounts refer to certain income, deductions, credits, or expenses that can be transferred from your spouse or common-law partner to reduce your tax liability.

Q: Who can transfer federal amounts?

A: Married couples or common-law partners in Canada can transfer certain federal amounts to each other to optimize their tax situation.

Q: Why would someone transfer federal amounts?

A: Transferring federal amounts can help to reduce the overall tax burden for a couple by redistributing certain income, deductions, credits, or expenses between them.

Q: What should I do with Schedule 2?

A: You should complete Schedule 2 if you and your spouse or common-law partner have agreed to transfer federal amounts on your tax returns. It allows you to report the specific amounts being transferred.