This version of the form is not currently in use and is provided for reference only. Download this version of

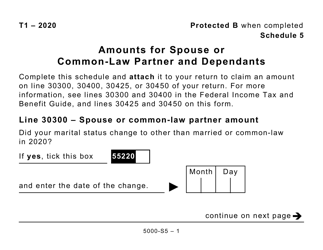

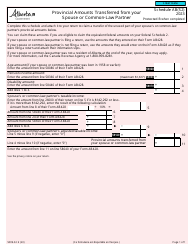

Form 5000-S5 Schedule 5

for the current year.

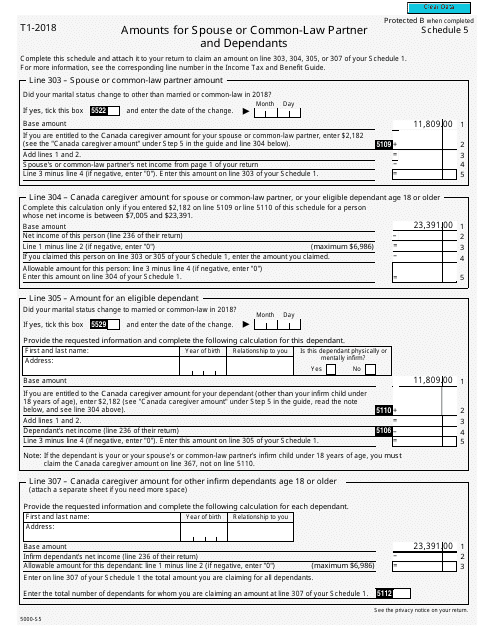

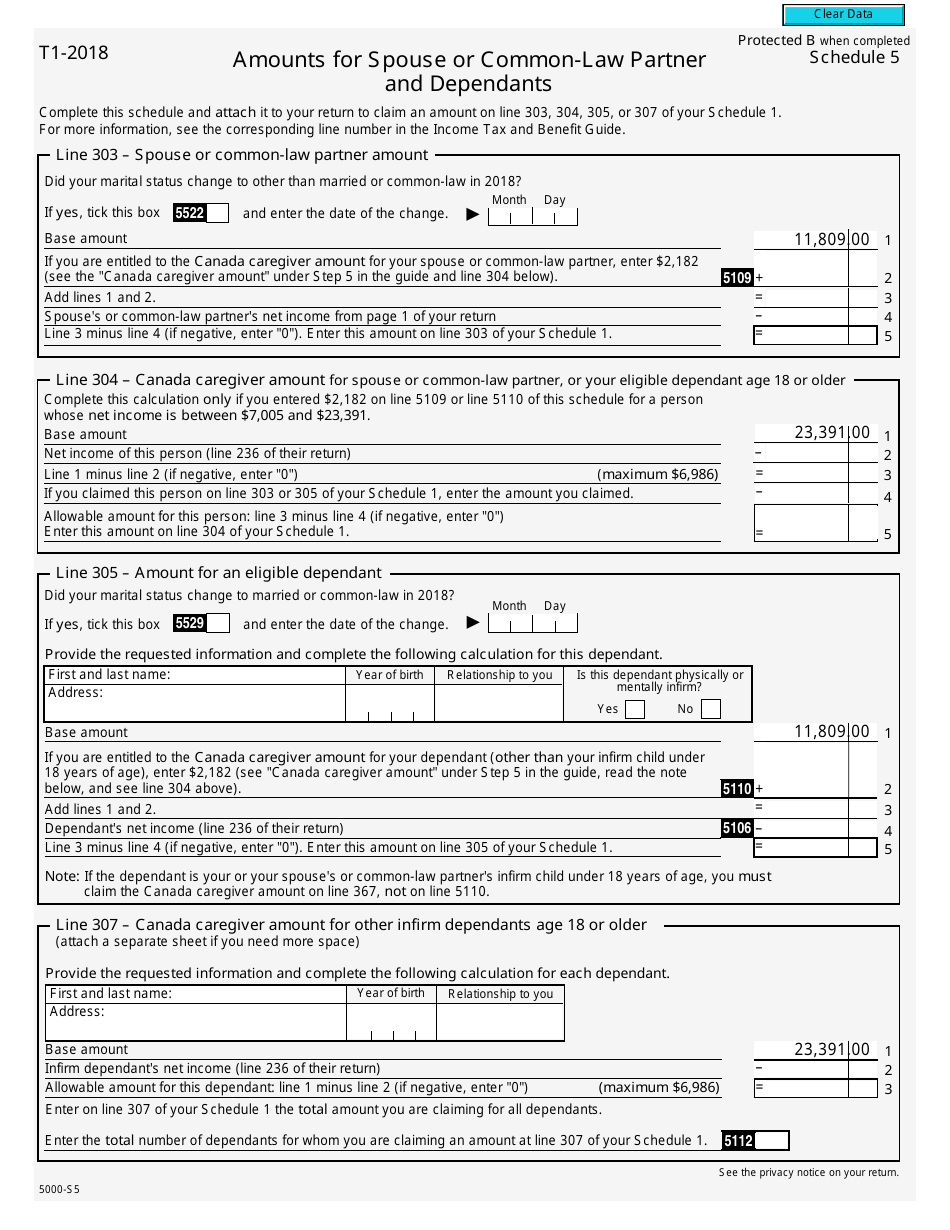

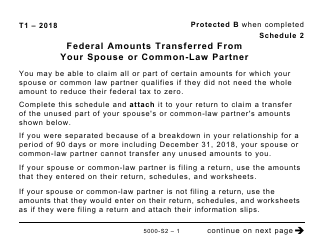

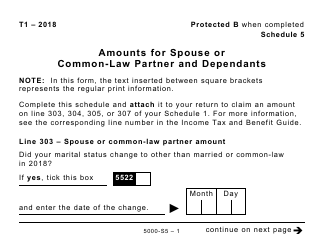

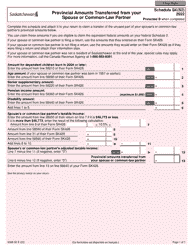

Form 5000-S5 Schedule 5 Amounts for Spouse or Common-Law Partner and Dependants - Common to All - Canada

This Canada-specific " Amounts For Spouse Or Common-law Partner And Dependants - Common To All " is a document released by the Canadian Revenue Agency .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is Form 5000-S5 Schedule 5?

A: Form 5000-S5 Schedule 5 is a document used in Canada to report amounts for spouse or common-law partner and dependants.

Q: Who needs to fill out Form 5000-S5 Schedule 5?

A: Anyone who wants to report amounts for their spouse or common-law partner and dependants in Canada needs to fill out this form.

Q: What information is required on Form 5000-S5 Schedule 5?

A: Form 5000-S5 Schedule 5 requires information about your spouse or common-law partner and dependants, including their names, social insurance numbers, and dates of birth.

Q: When is Form 5000-S5 Schedule 5 due?

A: Form 5000-S5 Schedule 5 is usually due when filing your annual tax return in Canada.

Q: Do I need to submit Form 5000-S5 Schedule 5 if I don't have a spouse or dependants?

A: If you don't have a spouse or dependants, you do not need to submit Form 5000-S5 Schedule 5.

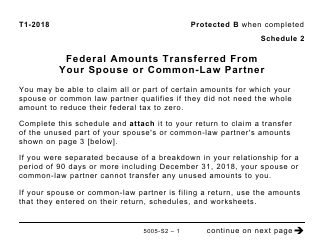

Q: Can I claim any benefits or credits for my spouse or dependants using Form 5000-S5 Schedule 5?

A: Yes, this form allows you to claim benefits and credits for your spouse or dependants, such as the Canada Child Benefit.

Q: Are there any penalties for not filing Form 5000-S5 Schedule 5?

A: Failure to file Form 5000-S5 Schedule 5 may result in penalties or the loss of certain benefits and credits.

Q: Can I make changes to Form 5000-S5 Schedule 5 after submitting it?

A: If you need to make changes to Form 5000-S5 Schedule 5 after submitting it, you can file an amendment with the Canada Revenue Agency.

Q: Is Form 5000-S5 Schedule 5 used in the United States?

A: No, Form 5000-S5 Schedule 5 is specific to Canada and is not used in the United States.