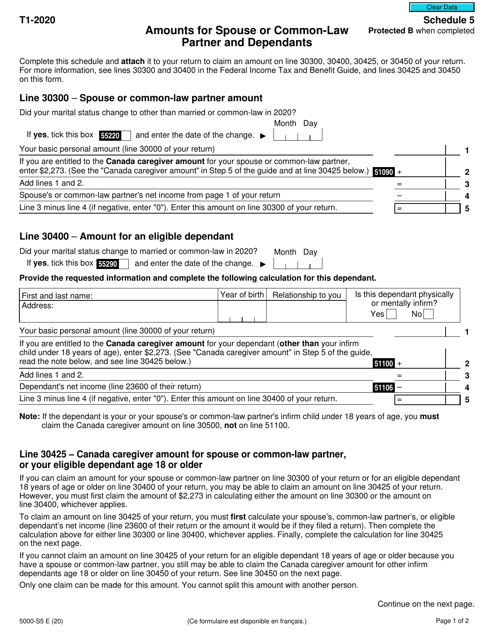

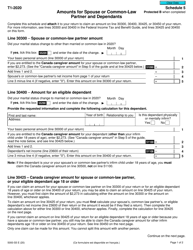

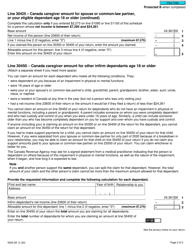

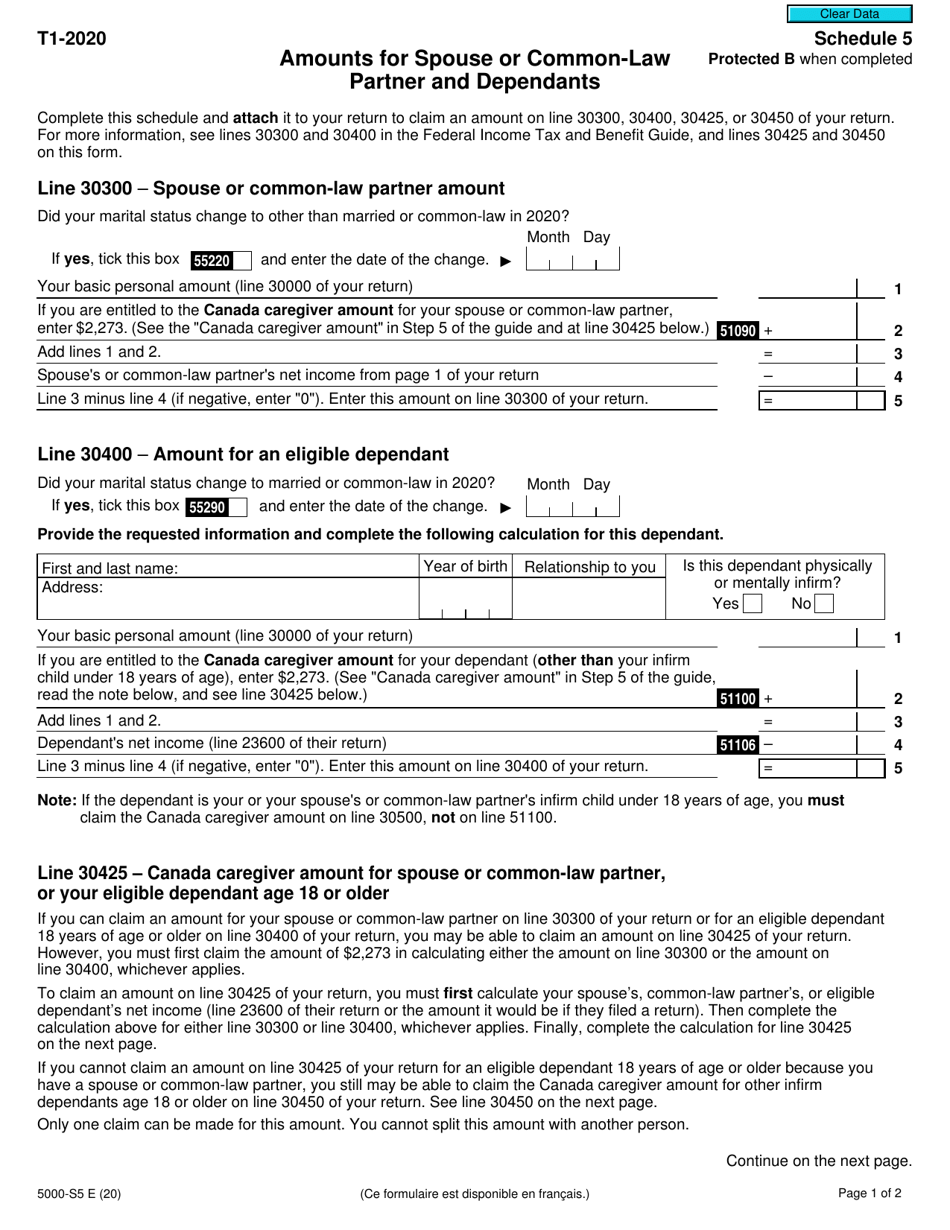

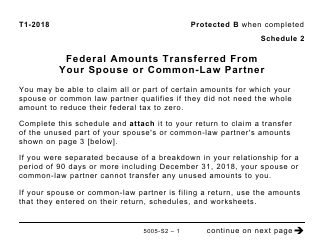

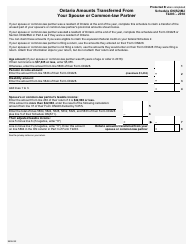

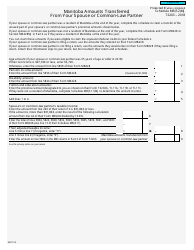

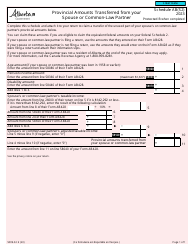

Form 5000-S5 Schedule 5 Amounts for Spouse or Common-Law Partner and Dependants - Canada

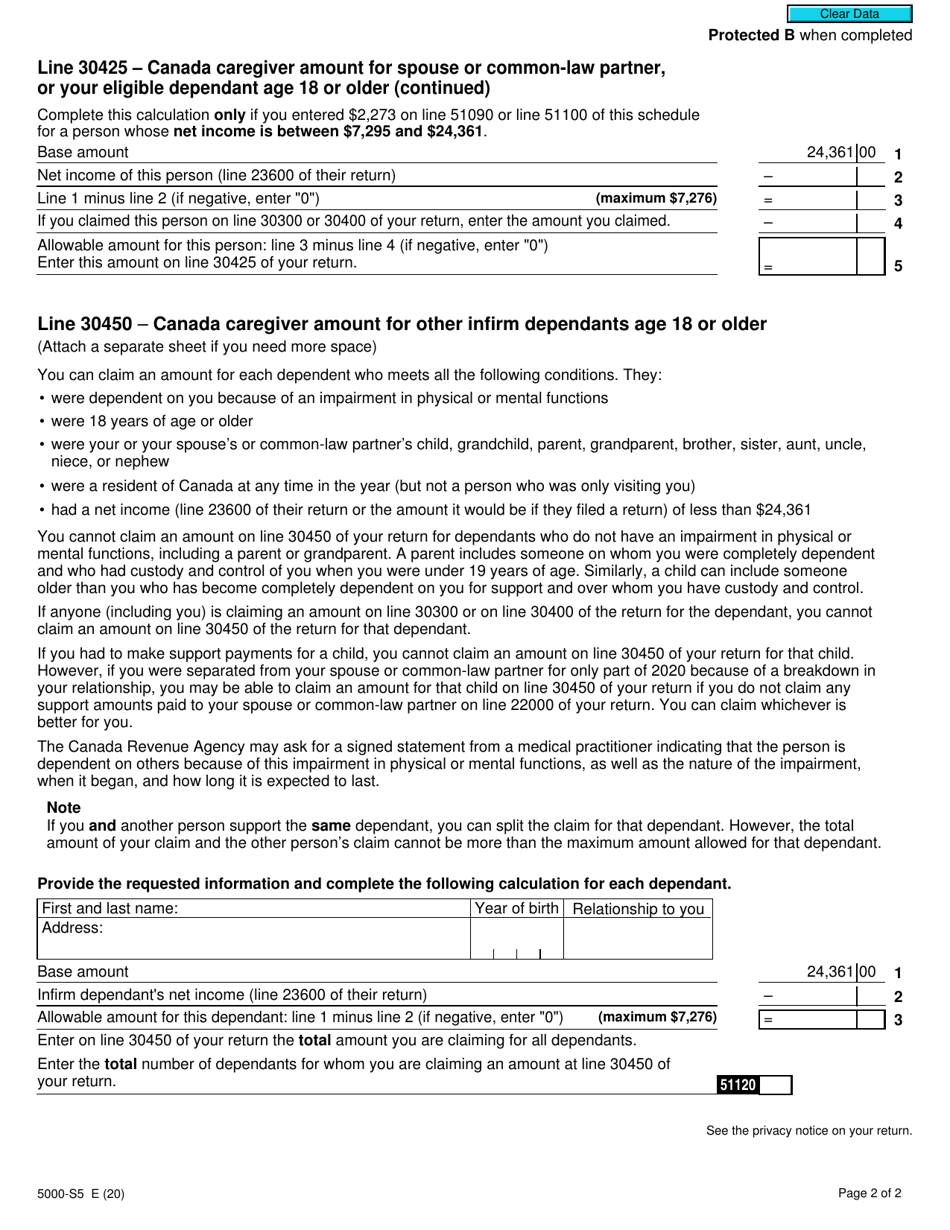

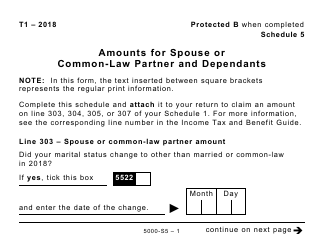

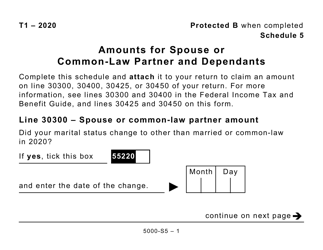

Form 5000-S5 Schedule 5 in Canada is used to report the amounts for your spouse or common-law partner and dependants for various tax benefits and credits.

The Form 5000-S5 Schedule 5 Amounts for Spouse or Common-Law Partner and Dependants is filed by the taxpayer in Canada.

Form 5000-S5 Schedule 5 Amounts for Spouse or Common-Law Partner and Dependants - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5000-S5?

A: Form 5000-S5 is a tax form in Canada.

Q: What is the purpose of Schedule 5?

A: The purpose of Schedule 5 is to report amounts for spouse or common-law partner and dependants on your tax return.

Q: Who needs to fill out Schedule 5?

A: Schedule 5 needs to be filled out by individuals who have a spouse or common-law partner and/or dependants.

Q: What kind of information do I need to fill out Schedule 5?

A: You will need to provide the required information about your spouse or common-law partner and/or dependants, including their name, social insurance number, and other relevant details.

Q: Is Schedule 5 mandatory for everyone?

A: No, Schedule 5 is only mandatory for individuals who have a spouse or common-law partner and/or dependants.

Q: When is the deadline for filing Schedule 5?

A: The deadline for filing Schedule 5 is the same as the deadline for filing your income tax return, which is typically April 30th.

Q: Can I claim deductions for my spouse or dependants on Schedule 5?

A: Yes, Schedule 5 allows you to claim certain deductions and credits for your spouse or dependants.

Q: What if I make a mistake on Schedule 5?

A: If you make a mistake on Schedule 5, you can correct it by filing an adjustment request with the CRA.

Q: Is Schedule 5 used for both federal and provincial taxes?

A: Yes, Schedule 5 is used for both federal and provincial taxes in Canada.