This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5015-R

for the current year.

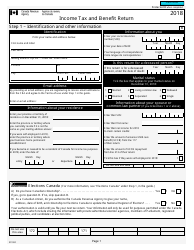

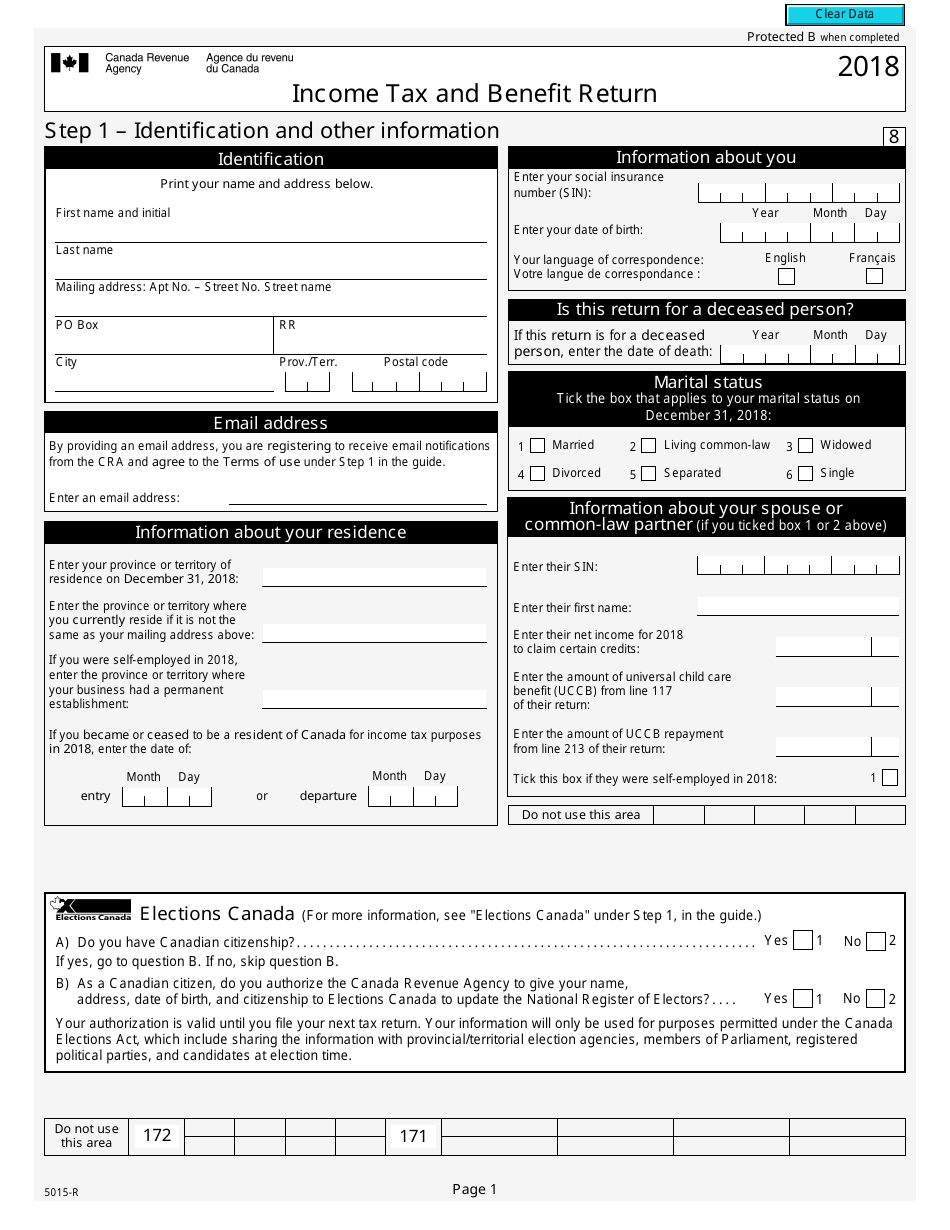

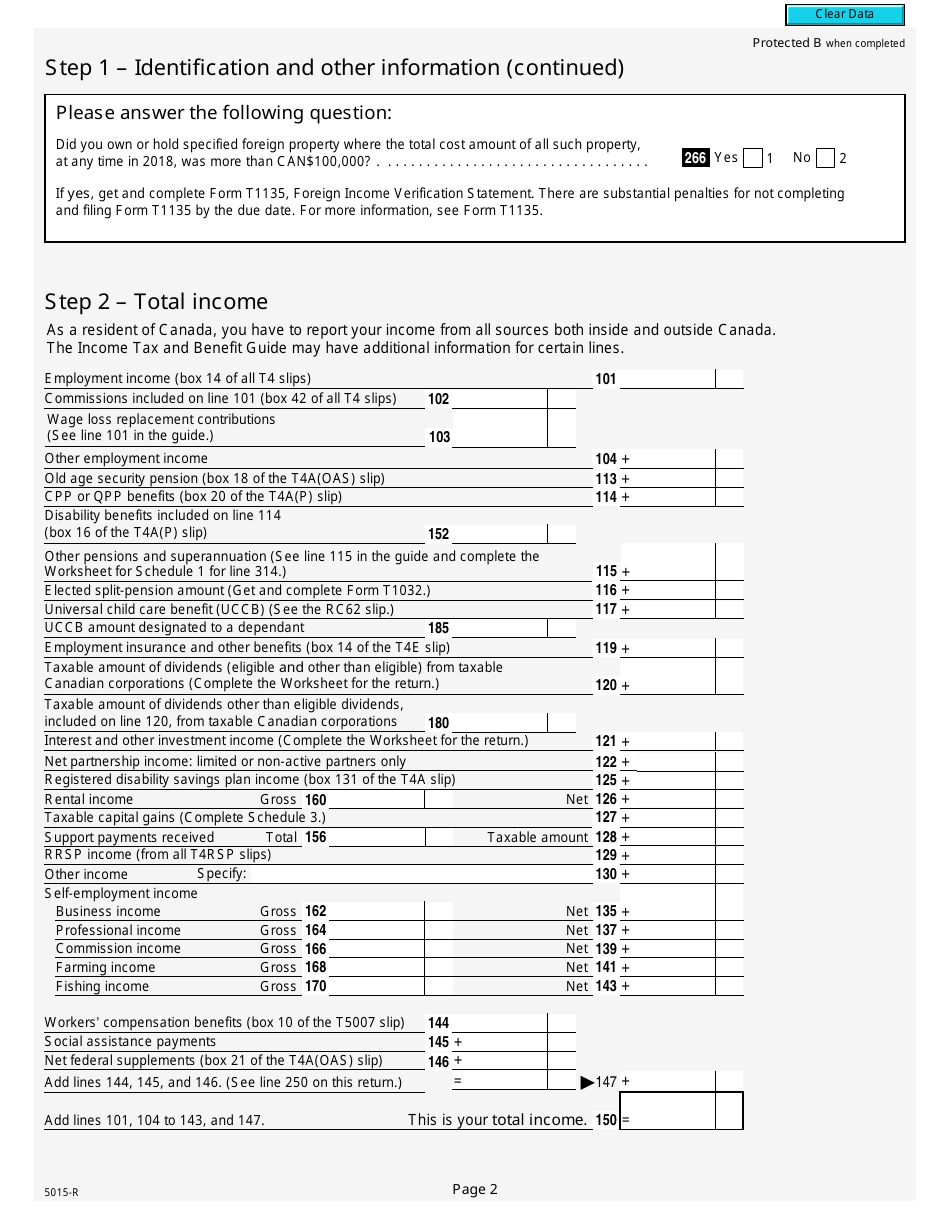

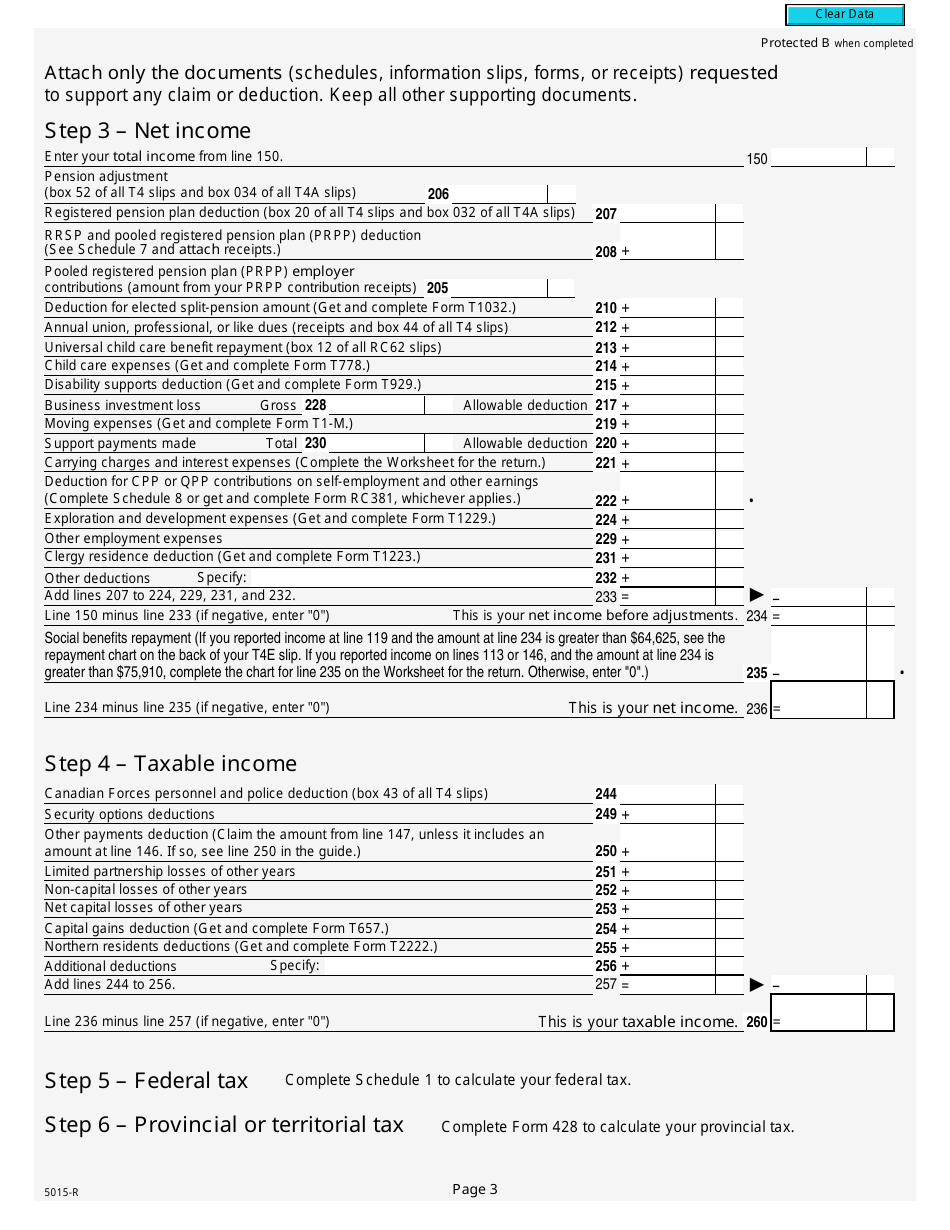

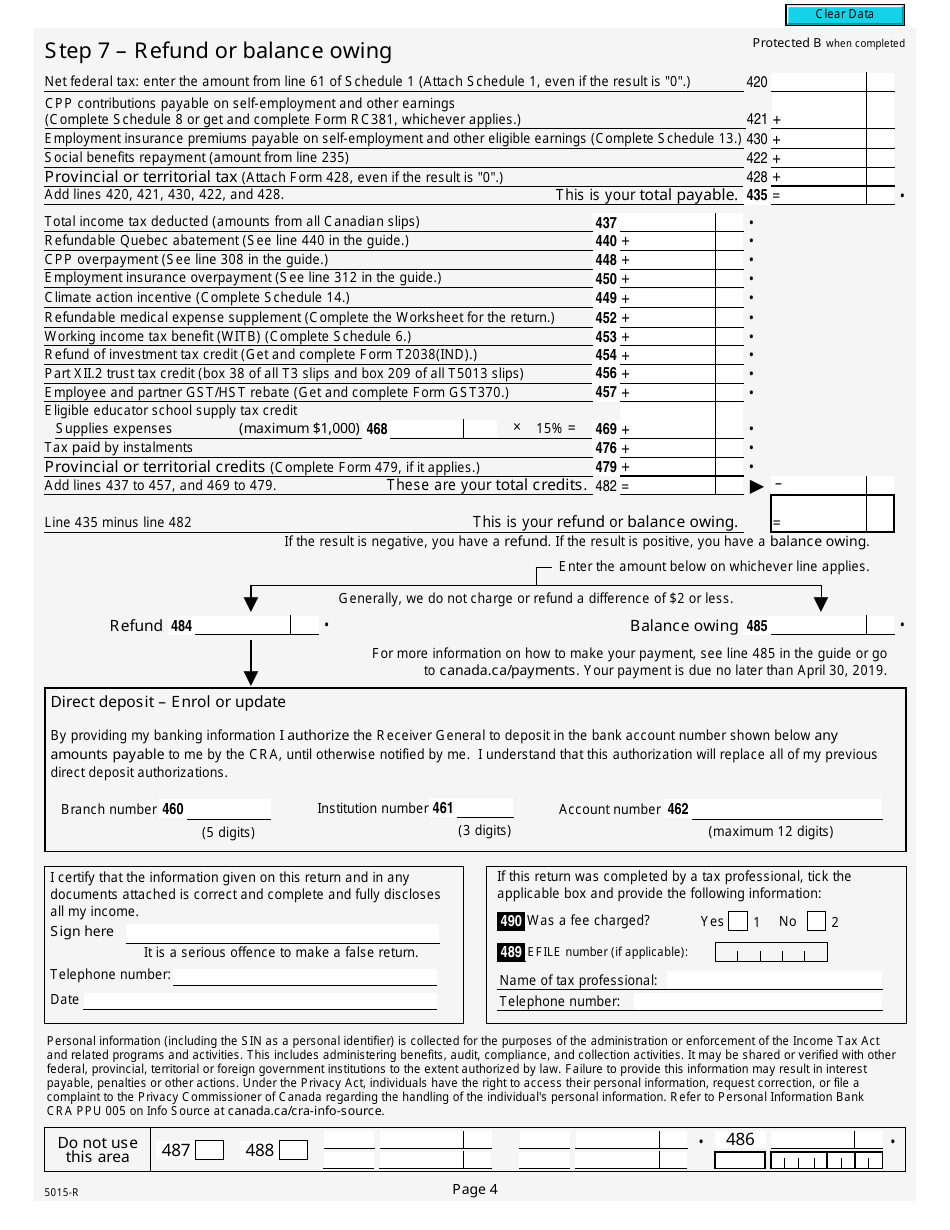

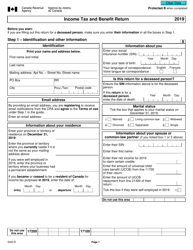

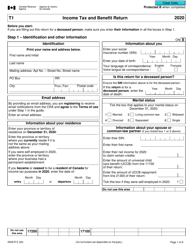

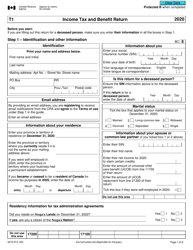

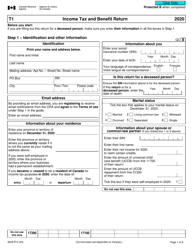

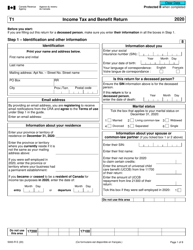

Form 5015-R Income Tax and Benefit Return - Canada

This fillable " Income Tax And Benefit Return " is a document issued by the Canadian Revenue Agency specifically for Canada residents.

Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application.

FAQ

Q: What is Form 5015-R?

A: Form 5015-R is the Income Tax and Benefit Return form used in Canada.

Q: Who needs to file Form 5015-R?

A: Any individual who resides in Canada and earns income needs to file Form 5015-R.

Q: What information is required to complete Form 5015-R?

A: You will need to provide your personal information, income details, deductions, and credits.

Q: When is the deadline for filing Form 5015-R?

A: The deadline for filing Form 5015-R is April 30th of each year.

Q: What happens if I don't file Form 5015-R?

A: If you don't file Form 5015-R, you may be subject to penalties and interest charges.

Q: Can I get help with filling out Form 5015-R?

A: Yes, you can seek assistance from a tax professional or use the resources provided by the CRA.

Q: How long do I need to keep a copy of Form 5015-R?

A: It is recommended to keep a copy of Form 5015-R and related documents for at least six years.