This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5010-S11 Schedule BC(S11)

for the current year.

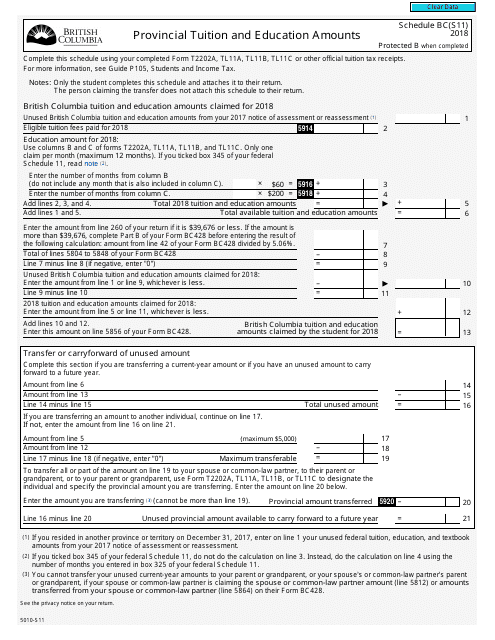

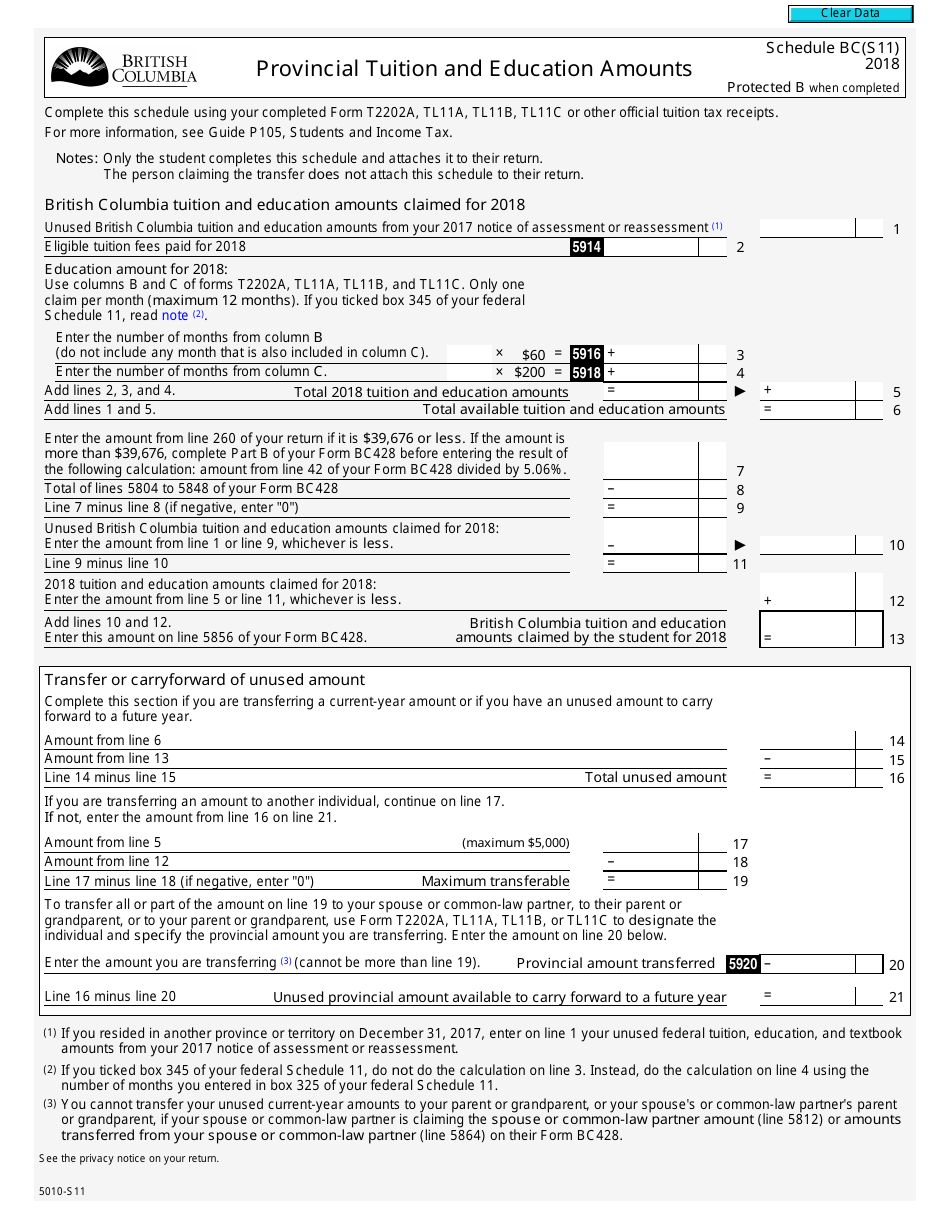

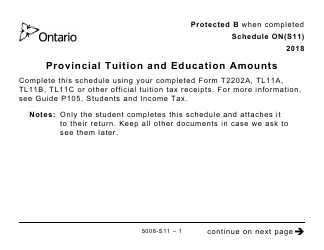

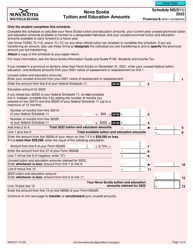

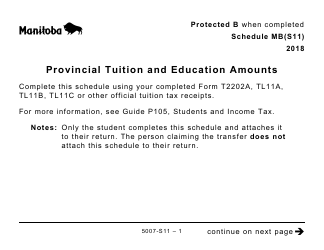

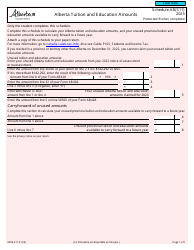

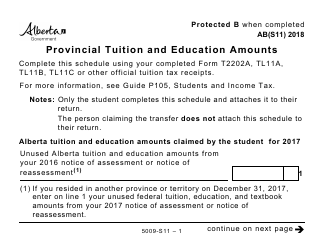

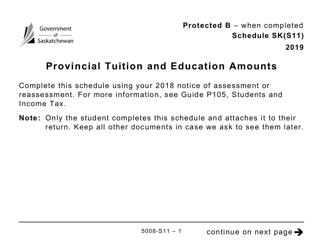

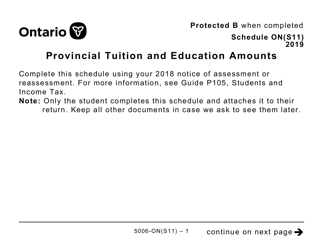

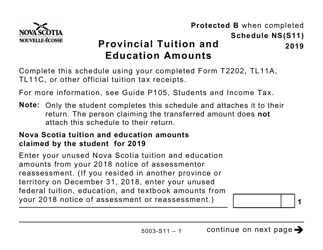

Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts - Canada

Form 5010-S11 Schedule BC(S11) Provincial Tuition and Education Amounts - Canada is used to claim tuition and education amounts on your provincial tax return in the province of British Columbia. It is used to calculate the credits and deductions related to your education expenses.

The Form 5010-S11 Schedule BC(S11) is filed by residents of the Province of British Columbia in Canada.

FAQ

Q: What is Form 5010-S11 Schedule BC(S11)?

A: Form 5010-S11 Schedule BC(S11) is a tax form used in Canada to claim provincial tuition and education amounts.

Q: What is the purpose of Form 5010-S11 Schedule BC(S11)?

A: The purpose of Form 5010-S11 Schedule BC(S11) is to claim provincial tuition and education amounts in Canada.

Q: Who needs to use Form 5010-S11 Schedule BC(S11)?

A: Canadian residents who paid tuition fees or educational expenses in British Columbia may need to use Form 5010-S11 Schedule BC(S11) to claim provincial tax credits.

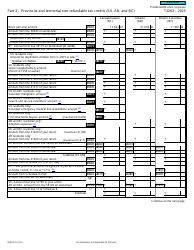

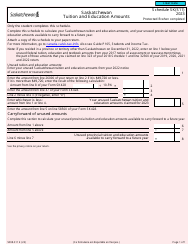

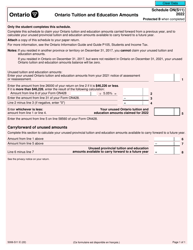

Q: What information is required on Form 5010-S11 Schedule BC(S11)?

A: On Form 5010-S11 Schedule BC(S11), you will need to provide details about the tuition fees and educational expenses paid in British Columbia.

Q: When is the deadline to file Form 5010-S11 Schedule BC(S11)?

A: The deadline to file Form 5010-S11 Schedule BC(S11) is usually the same as the deadline for filing your annual income tax return in Canada.