This version of the form is not currently in use and is provided for reference only. Download this version of

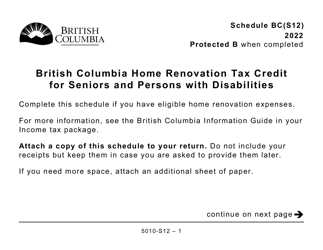

Form 5010-S12 Schedule BC(S12)

for the current year.

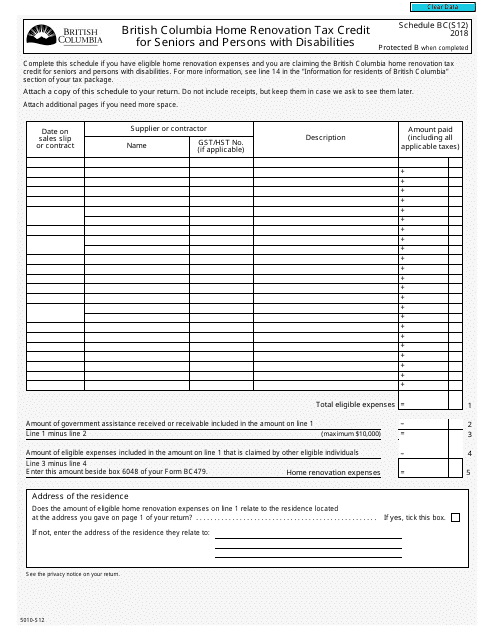

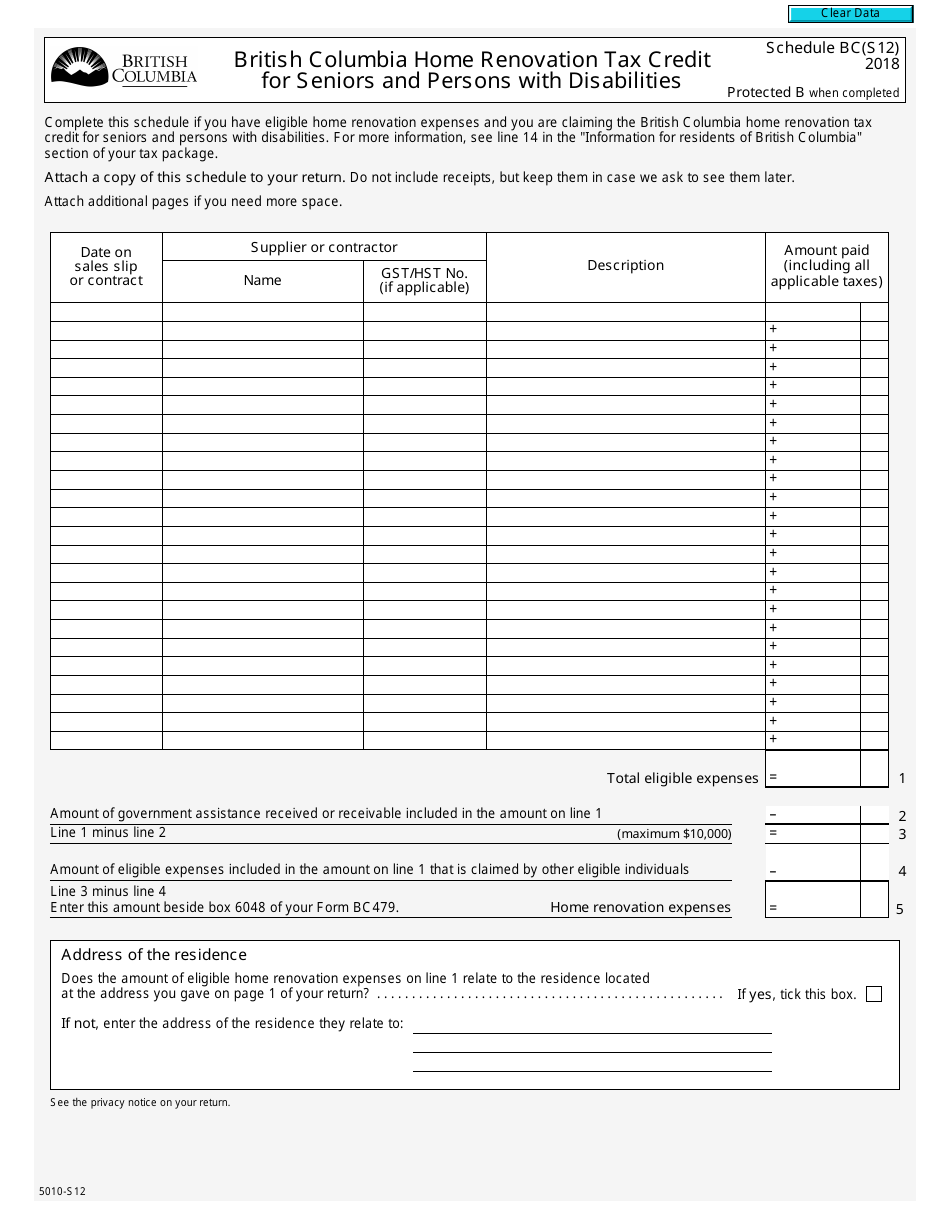

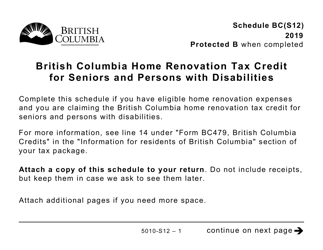

Form 5010-S12 Schedule BC(S12) British Columbia Seniors Home Renovation Tax Credit and Persons With Disabilities - Canada

Form 5010-S12 Schedule BC(S12) is used in Canada for claiming the British Columbia Seniors Home Renovation Tax Credit and Persons With DisabilitiesTax Credit. This form helps individuals in British Columbia to request tax credits for eligible expenses related to home renovations for seniors and persons with disabilities.

The individual or their authorized representative is responsible for filing the Form 5010-S12 Schedule BC(S12) in Canada.

FAQ

Q: What is the Form 5010-S12?

A: Form 5010-S12 is the Schedule BC(S12) used in Canada for the Seniors Home Renovation Tax Credit and Persons With Disabilities.

Q: What is the British Columbia Seniors Home Renovation Tax Credit?

A: The British Columbia Seniors Home Renovation Tax Credit is a tax credit offered in British Columbia, Canada for eligible seniors who make renovations to their homes to improve accessibility and safety.

Q: Who is eligible for the British Columbia Seniors Home Renovation Tax Credit?

A: Eligible seniors in British Columbia who are 65 years of age or older may be eligible for the tax credit.

Q: What is the purpose of the British Columbia Seniors Home Renovation Tax Credit?

A: The purpose of the tax credit is to assist seniors in making their homes safer and more accessible, allowing them to age in place.

Q: What is the Persons With Disabilities tax credit?

A: The Persons With Disabilities tax credit is a tax credit offered in British Columbia, Canada for individuals with disabilities who make renovations to their homes to improve accessibility and safety.

Q: Who is eligible for the Persons With Disabilities tax credit?

A: Individuals with disabilities in British Columbia who meet certain criteria may be eligible for the tax credit.

Q: What is the goal of the Persons With Disabilities tax credit?

A: The goal of the tax credit is to support individuals with disabilities in making their homes more accessible and accommodating to their needs.