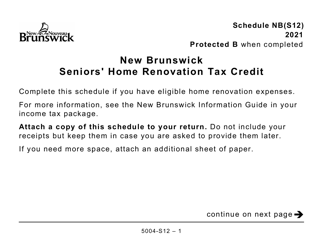

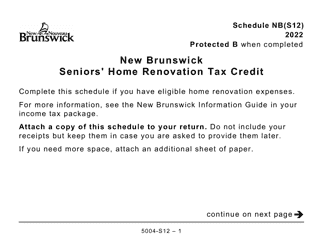

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5004-S12 Schedule NB(S12)

for the current year.

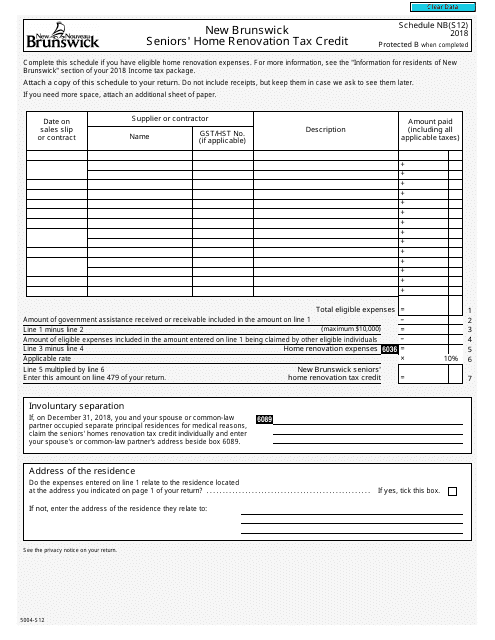

Form 5004-S12 Schedule NB(S12) New Brunswick Seniors' Home Renovation Tax Credit - Canada

Form 5004-S12 Schedule NB(S12) is used in Canada for claiming the New Brunswick Seniors' Home Renovation Tax Credit. This tax credit provides financial assistance to seniors in New Brunswick who have made eligible home renovations to make their living spaces safer and more accessible.

The individual taxpayers in New Brunswick, Canada file the Form 5004-S12 Schedule NB(S12) for the New Brunswick Seniors' Home Renovation Tax Credit.

FAQ

Q: What is Form 5004-S12?

A: Form 5004-S12 is a schedule for claiming the New Brunswick Seniors' Home Renovation Tax Credit in Canada.

Q: What is the New Brunswick Seniors' Home Renovation Tax Credit?

A: The New Brunswick Seniors' Home Renovation Tax Credit is a tax credit available to seniors in New Brunswick, Canada, for expenses related to home renovations.

Q: Who is eligible for the New Brunswick Seniors' Home Renovation Tax Credit?

A: Seniors who are 65 years of age or older and who meet certain residency requirements in New Brunswick are eligible for the tax credit.

Q: What expenses can be claimed under the New Brunswick Seniors' Home Renovation Tax Credit?

A: Expenses related to home renovations, repairs, and improvements that help seniors maintain their independence, accessibility, and safety in their home can be claimed.

Q: How much is the New Brunswick Seniors' Home Renovation Tax Credit?

A: The tax credit is equal to 10% of eligible expenses, up to a maximum credit of $4,000 per year.

Q: How do I claim the New Brunswick Seniors' Home Renovation Tax Credit?

A: You need to complete and submit Form 5004-S12 Schedule NB(S12) along with your income tax return for the relevant tax year.

Q: Are there any restrictions on the New Brunswick Seniors' Home Renovation Tax Credit?

A: Yes, there are restrictions on the type of expenses that can be claimed and the maximum credit that can be received.

Q: Are there any deadlines for claiming the New Brunswick Seniors' Home Renovation Tax Credit?

A: Yes, the tax credit must be claimed on your annual income tax return for the relevant tax year, which has specific filing deadlines set by the CRA.

Q: Is the New Brunswick Seniors' Home Renovation Tax Credit refundable?

A: No, the tax credit is non-refundable, but any unused portion can be carried forward and claimed in future years.