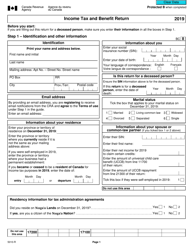

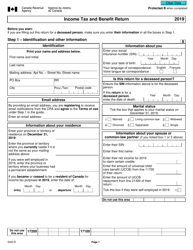

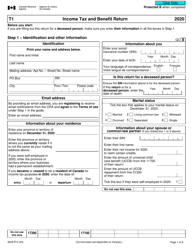

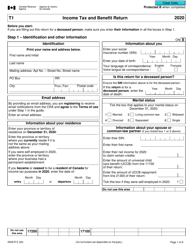

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5013-R

for the current year.

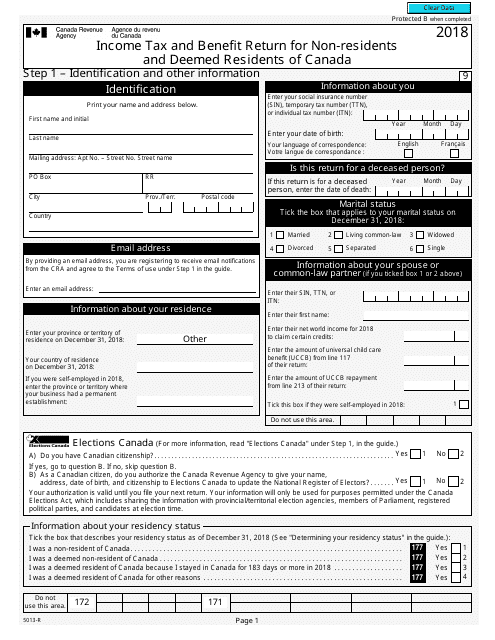

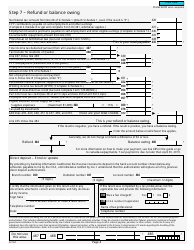

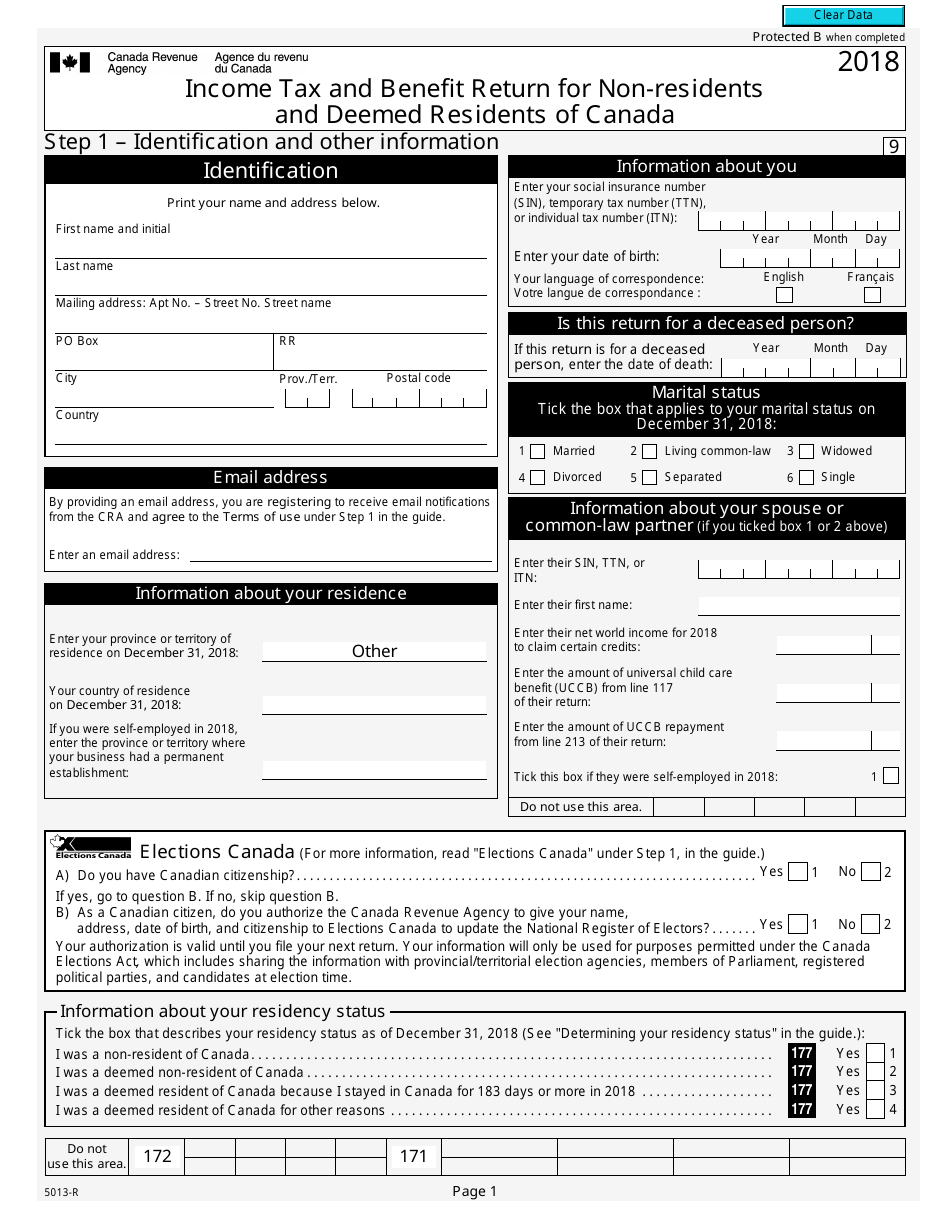

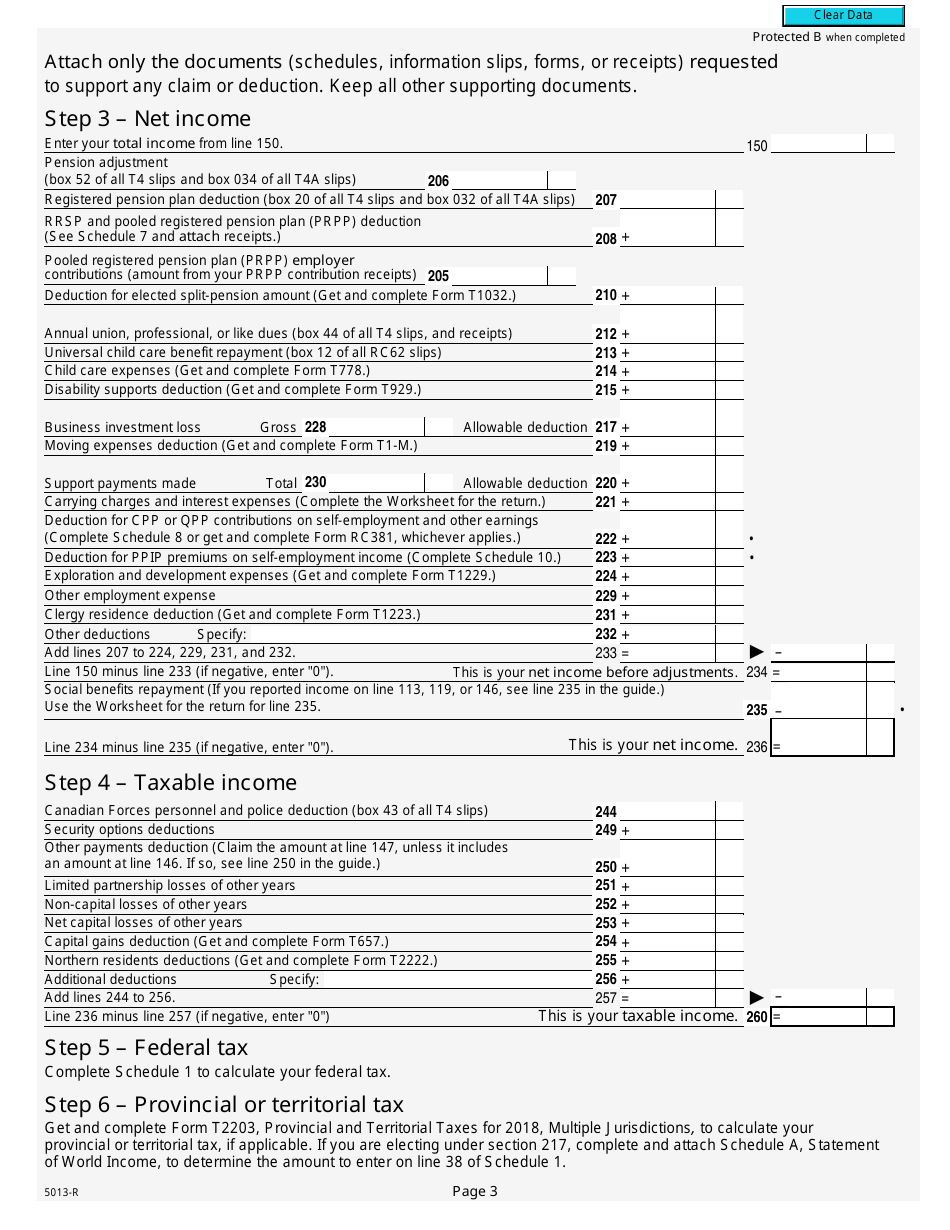

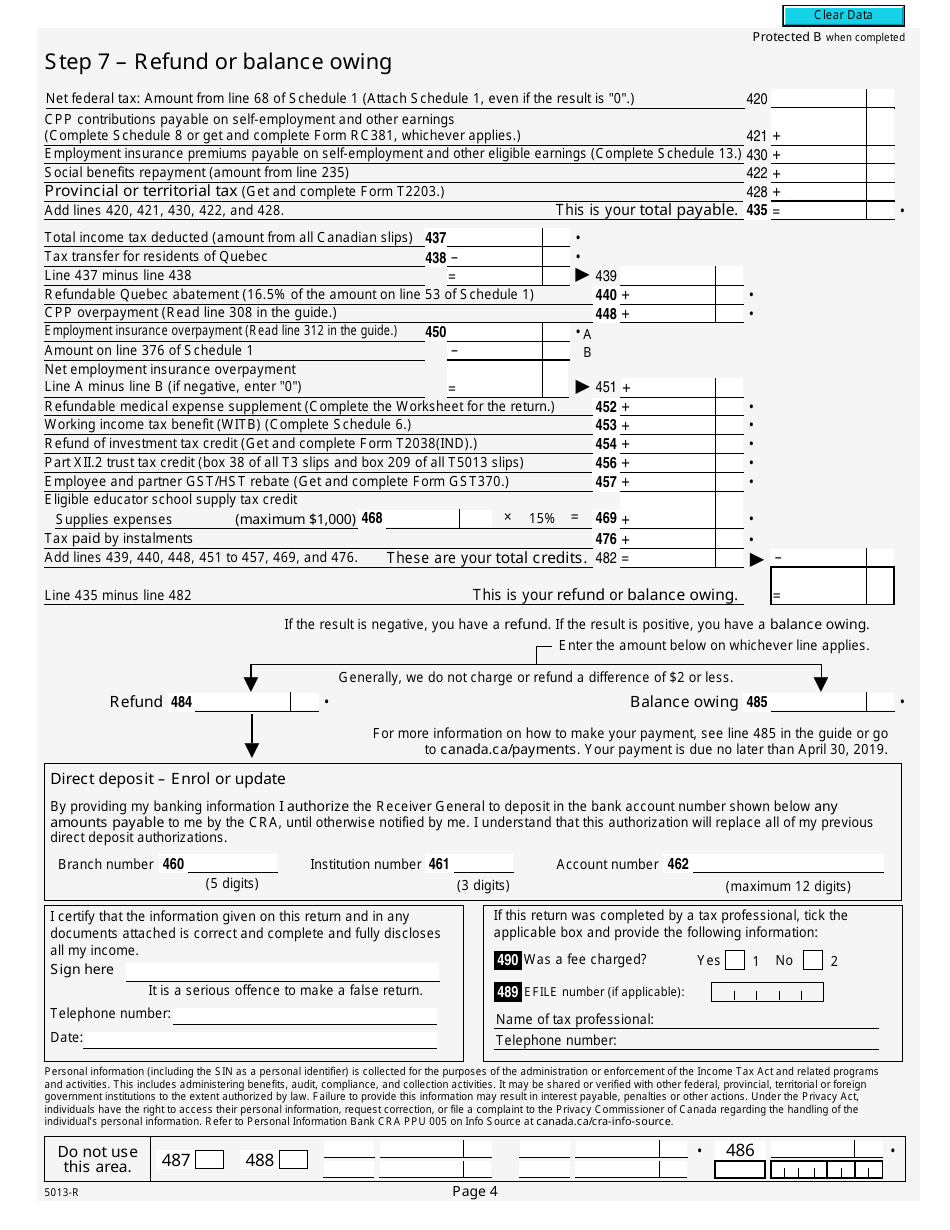

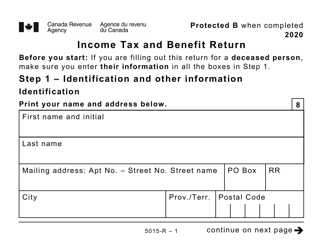

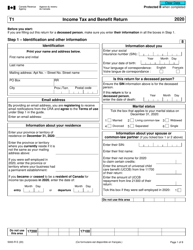

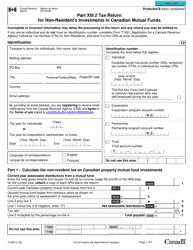

Form 5013-R Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada - Canada

Form 5013-R is the Income Tax and Benefit Return specifically for non-residents and deemed residents of Canada. It is used to report income earned in Canada by individuals who are not Canadian residents.

The Form 5013-R Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada is filed by individuals who are non-residents or deemed residents of Canada.

FAQ

Q: What is Form 5013-R?

A: Form 5013-R is an Income Tax and Benefit Return for Non-residents and Deemed Residents of Canada.

Q: Who needs to file Form 5013-R?

A: Non-residents and deemed residents of Canada need to file Form 5013-R.

Q: What is the purpose of Form 5013-R?

A: The purpose of Form 5013-R is to report income and claim benefits for non-residents and deemed residents of Canada.

Q: What information is required to complete Form 5013-R?

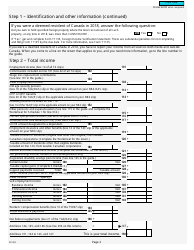

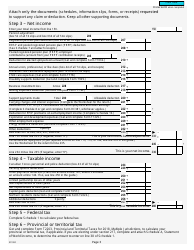

A: You will need to provide information on your income, deductions, and credits.

Q: When is the deadline to file Form 5013-R?

A: The deadline to file Form 5013-R is generally June 30th of the year following the tax year.

Q: Are there any penalties for late filing of Form 5013-R?

A: Yes, there may be penalties and interest charges for late filing of Form 5013-R.

Q: Can I get an extension to file Form 5013-R?

A: No, there are no extensions available for filing Form 5013-R.