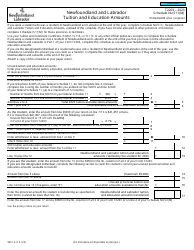

This version of the form is not currently in use and is provided for reference only. Download this version of

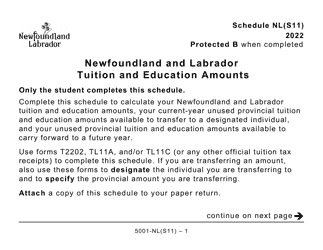

Form 5001-S11 Schedule NL(S11)

for the current year.

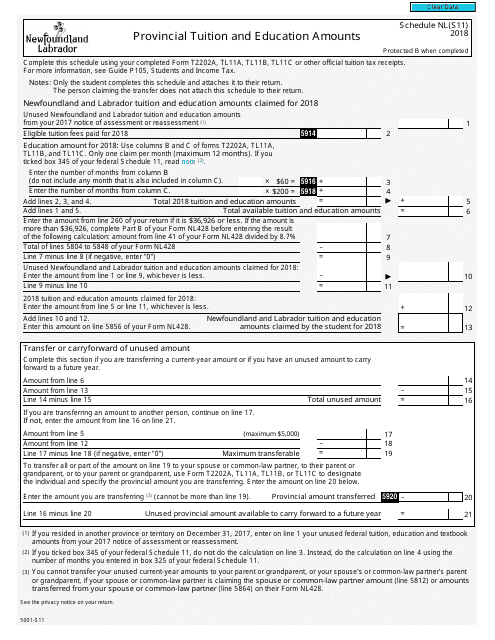

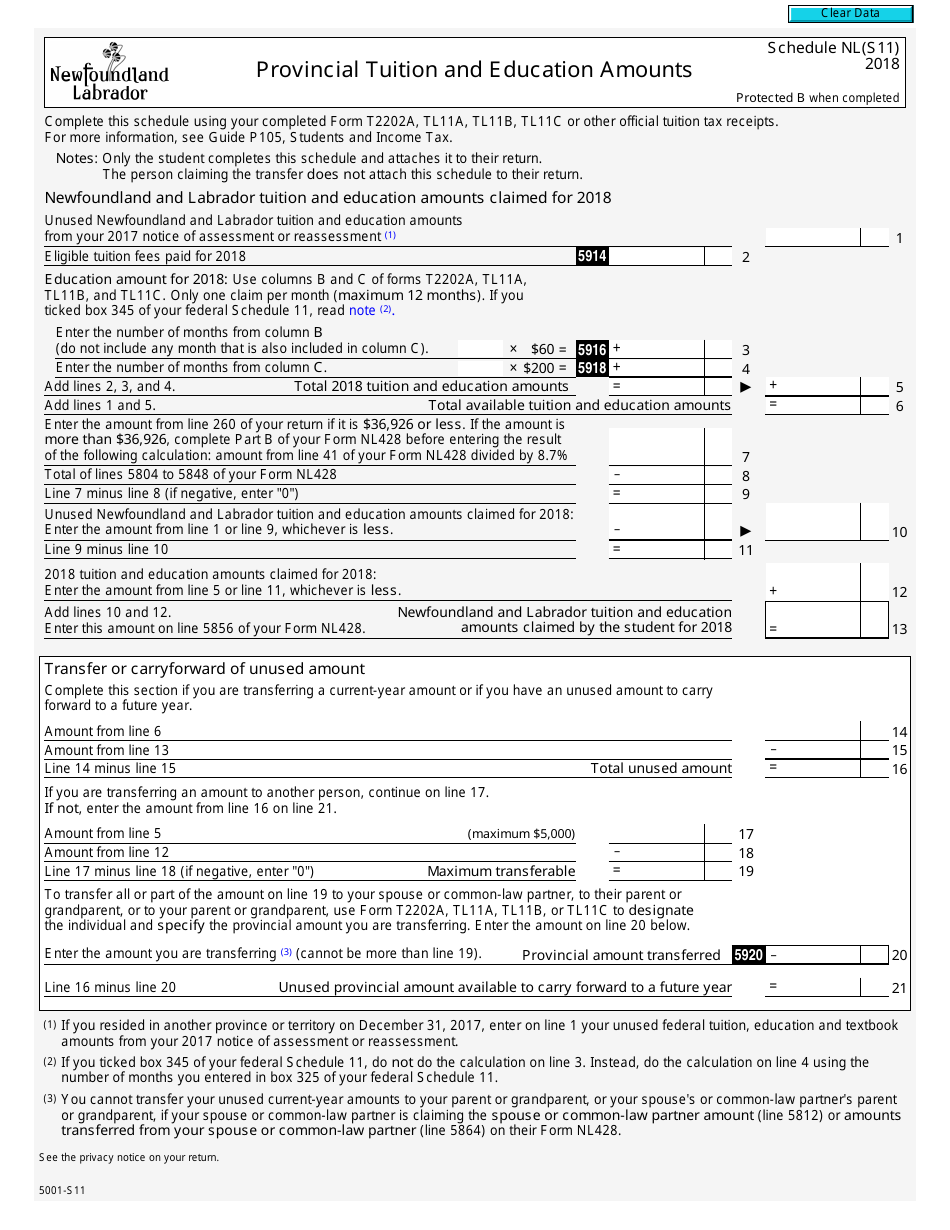

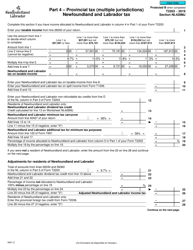

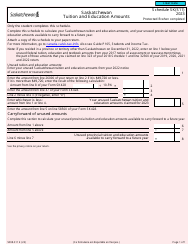

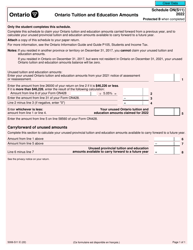

Form 5001-S11 Schedule NL(S11) Provincial Tuition and Education Amounts - Canada

Form 5001-S11 Schedule NL(S11) Provincial Tuition and Education Amounts is used in Canada to claim tuition and education amounts for the province of Newfoundland and Labrador. It allows residents of Newfoundland and Labrador to claim tax credits for eligible educational expenses.

The Form 5001-S11 Schedule NL(S11) Provincial Tuition and Education Amounts is filed by residents of the province of Newfoundland and Labrador in Canada.

FAQ

Q: What is Form 5001-S11?

A: Form 5001-S11 is a tax form related to provincial tuition and education amounts in Canada.

Q: What is Schedule NL(S11)?

A: Schedule NL(S11) is a specific schedule within Form 5001-S11 that is used to calculate the provincial tuition and education amounts.

Q: What are provincial tuition and education amounts?

A: Provincial tuition and education amounts refer to deductions or credits that individuals can claim on their tax returns for eligible education expenses.

Q: Why is Form 5001-S11 important?

A: Form 5001-S11 is important because it helps individuals calculate and claim the provincial tuition and education amounts they are eligible for.

Q: Who needs to fill out Form 5001-S11?

A: Individuals who have paid eligible education expenses in Canada and want to claim the provincial tuition and education amounts on their tax returns need to fill out Form 5001-S11.

Q: Is Form 5001-S11 specific to Canada?

A: Yes, Form 5001-S11 is specific to Canada and related to the provincial tuition and education amounts in the country.

Q: When is the deadline to file Form 5001-S11?

A: The deadline to file Form 5001-S11 is usually the same as the deadline for filing your annual tax return, which is generally April 30th of the following year.

Q: What happens if I don't fill out Form 5001-S11?

A: If you don't fill out Form 5001-S11, you may miss out on claiming the provincial tuition and education amounts on your tax return, which could result in a higher tax liability.

Q: Can I claim both federal and provincial tuition and education amounts?

A: Yes, you can claim both federal and provincial tuition and education amounts on your tax return, as long as you meet the eligibility criteria for each.