This version of the form is not currently in use and is provided for reference only. Download this version of

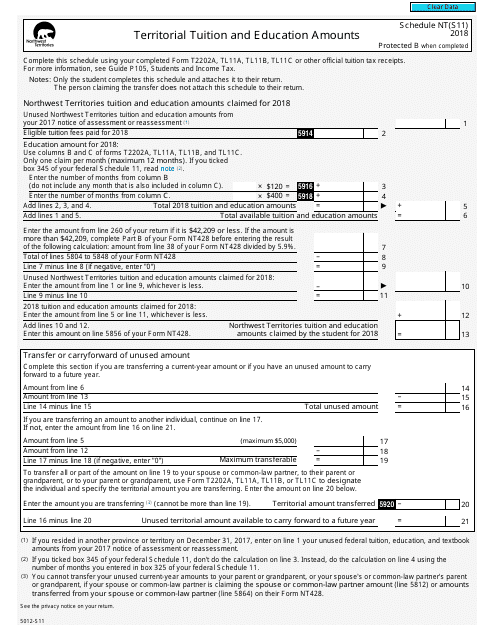

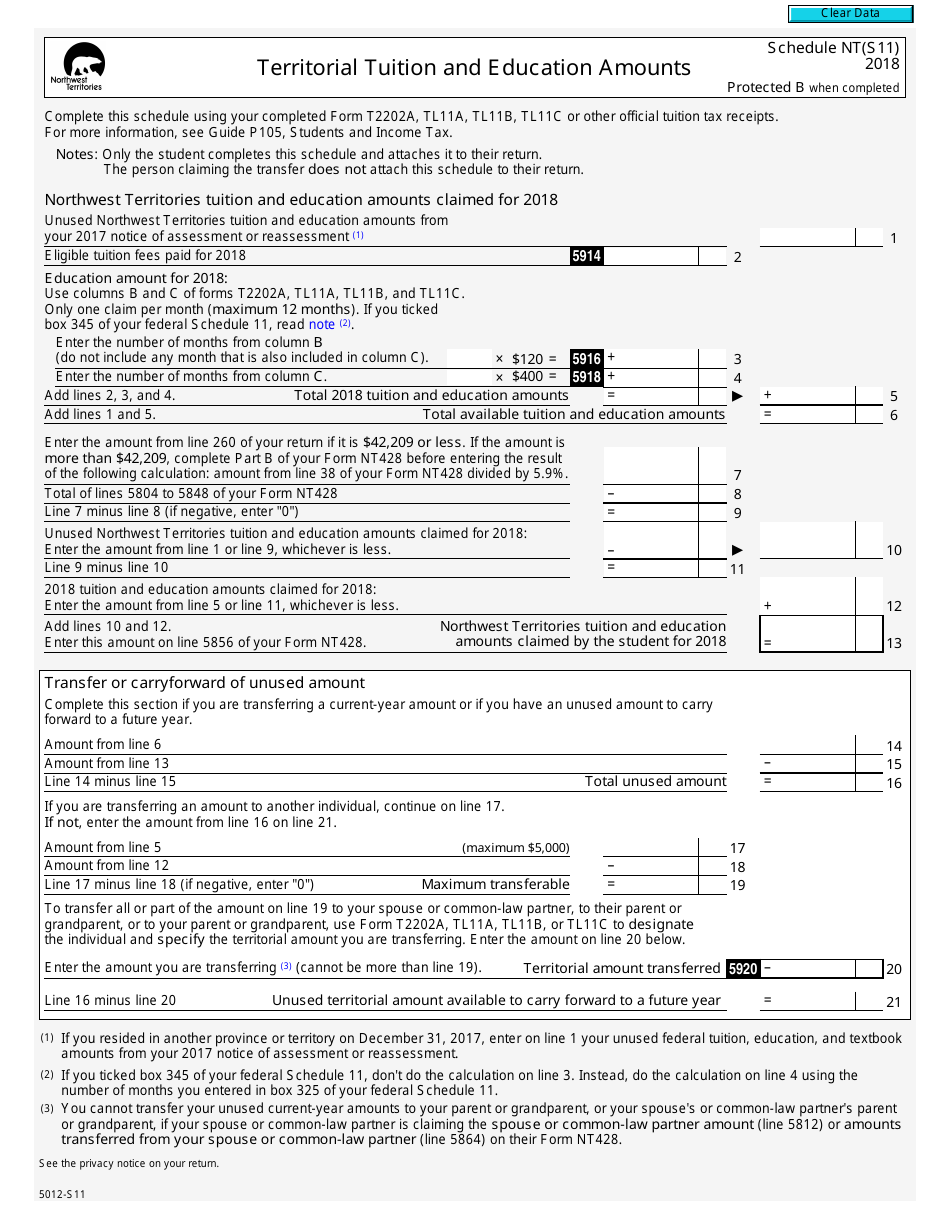

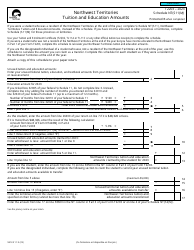

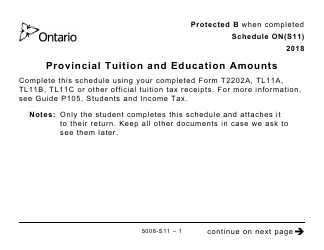

Form 5012-S11 Schedule NT(S11)

for the current year.

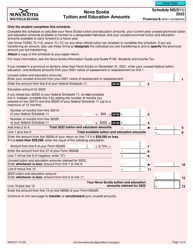

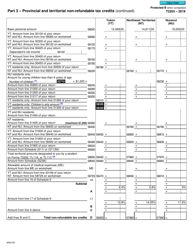

Form 5012-S11 Schedule NT(S11) Territorial Tuition and Education Amounts - Canada

The Form 5012-S11 Schedule NT(S11) Territorial Tuition and Education Amounts in Canada is filed by individuals who reside in Nunavut and want to claim territorial tuition and education amounts.

FAQ

Q: What is Form 5012-S11?

A: Form 5012-S11 is the schedule used for reporting territorial tuition and education amounts in Canada.

Q: What is Schedule NT(S11)?

A: Schedule NT(S11) is a specific part of Form 5012-S11 that is used to report territorial tuition and education amounts.

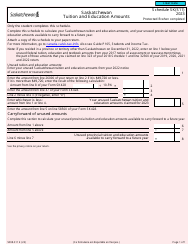

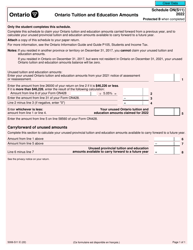

Q: What are territorial tuition and education amounts?

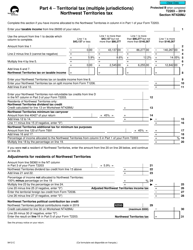

A: Territorial tuition and education amounts are tax credits available to residents of certain Canadian territories for education-related expenses.

Q: Who is eligible to claim territorial tuition and education amounts?

A: Residents of certain Canadian territories, such as Yukon, Northwest Territories, and Nunavut, may be eligible to claim these amounts.

Q: What expenses can be claimed under territorial tuition and education amounts?

A: Eligible expenses may include tuition fees, textbooks, and other education-related costs.

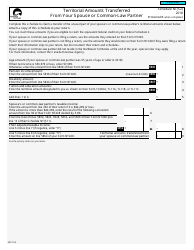

Q: How do I report territorial tuition and education amounts?

A: You can report these amounts by completing Schedule NT(S11) of Form 5012-S11 and submitting it with your Canadian tax return.