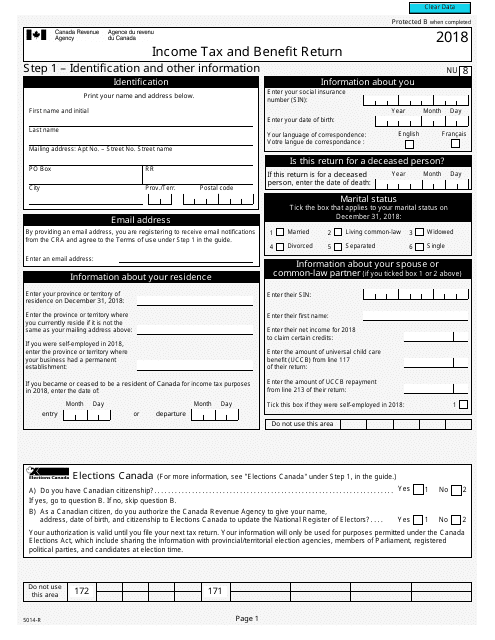

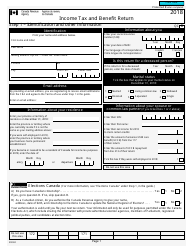

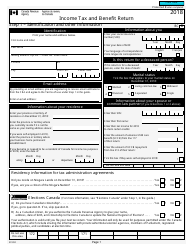

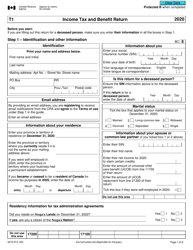

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5014-R

for the current year.

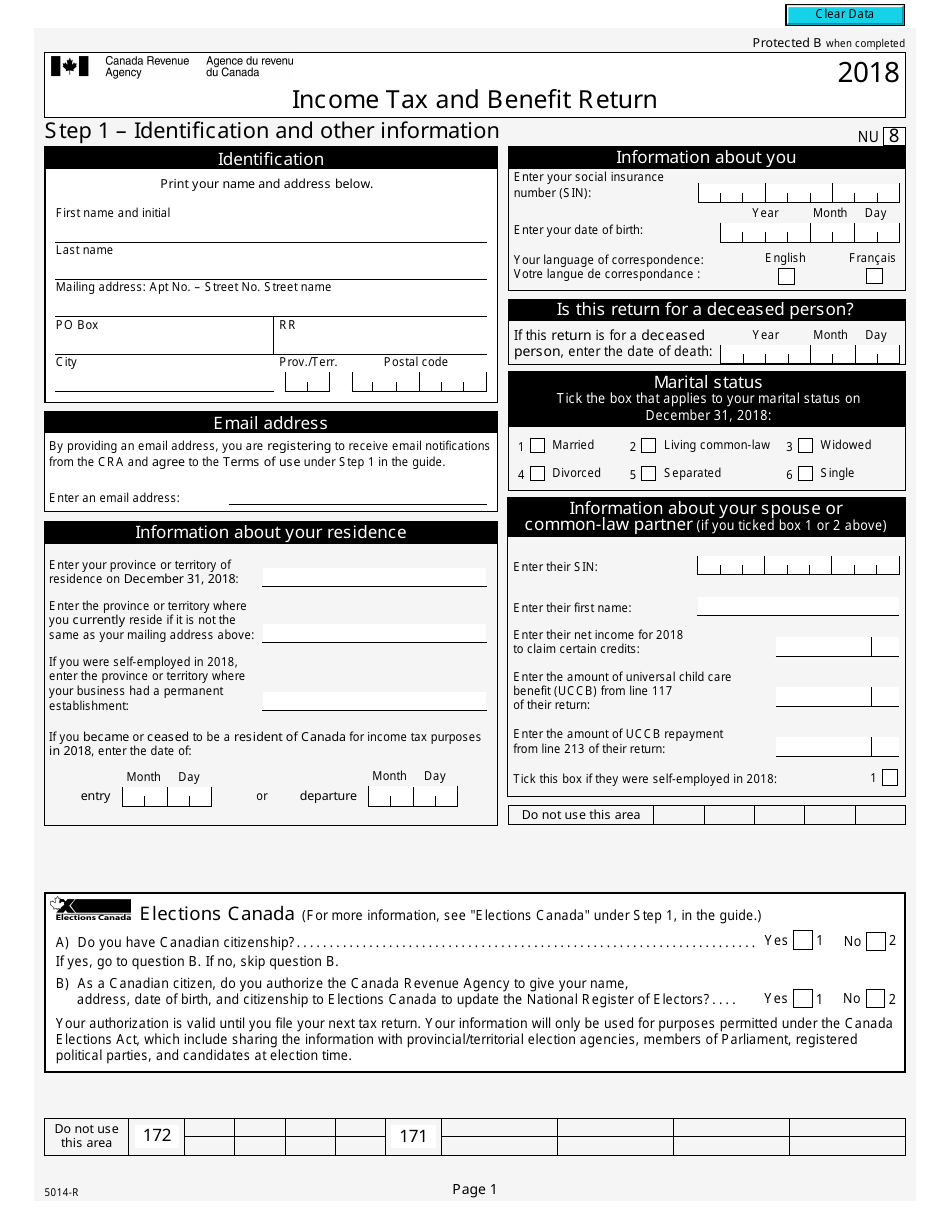

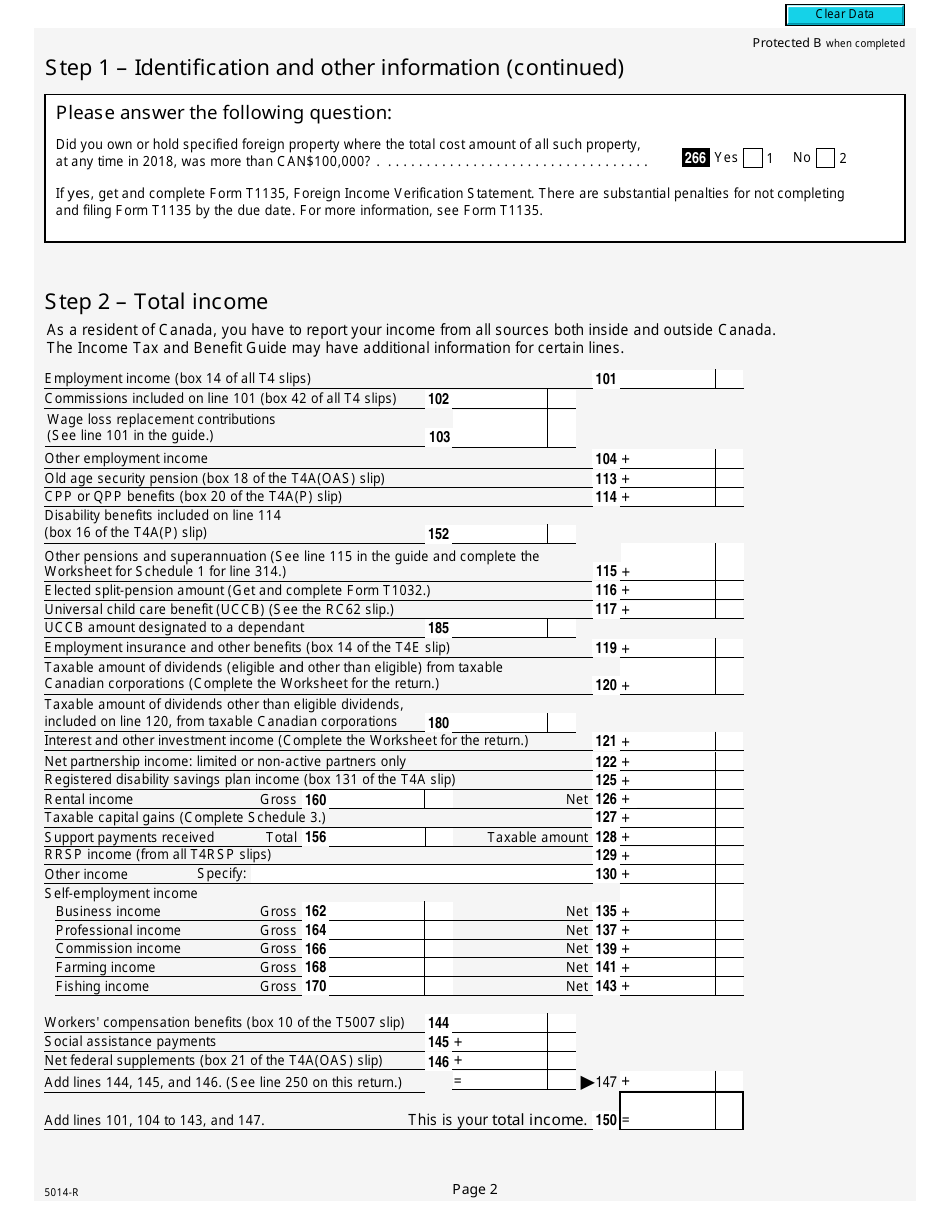

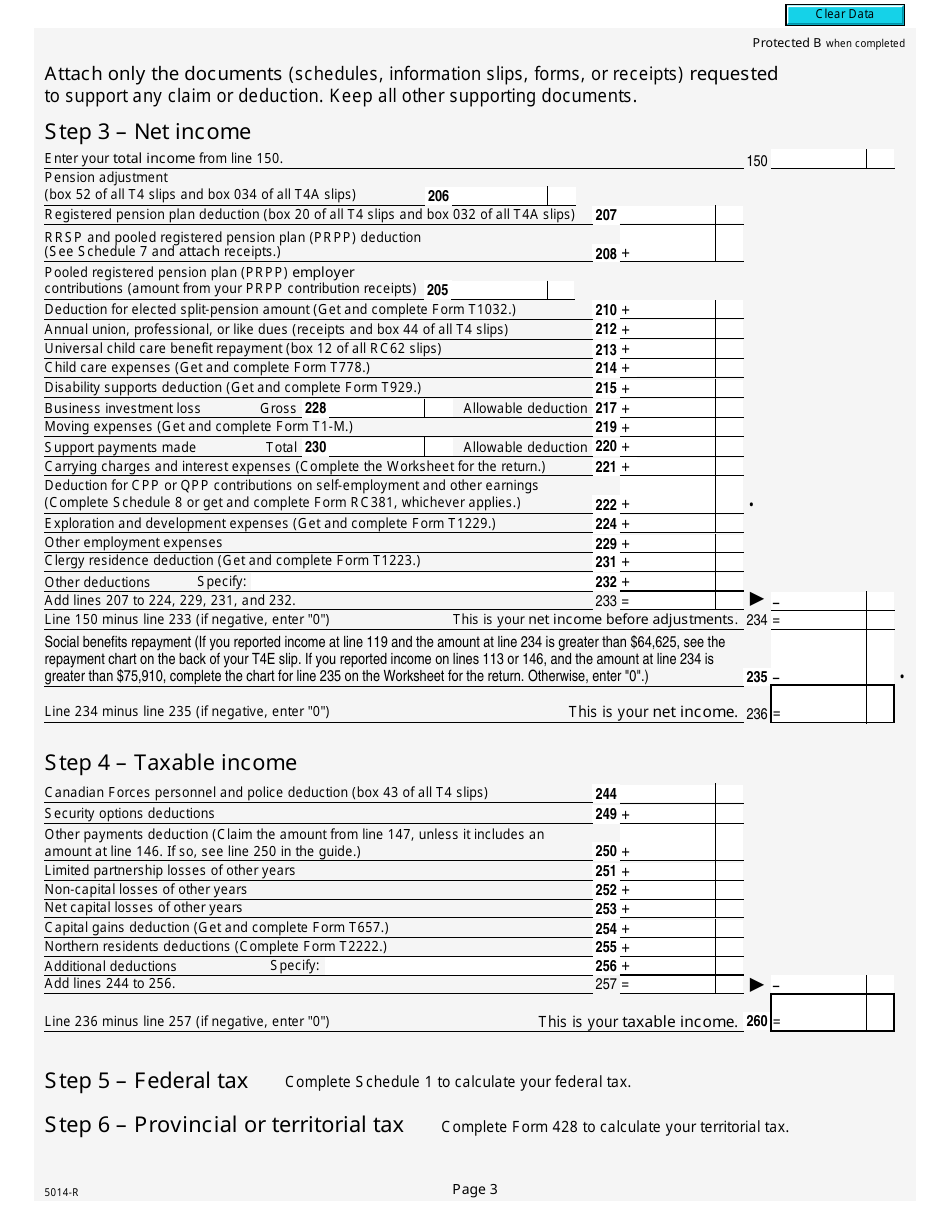

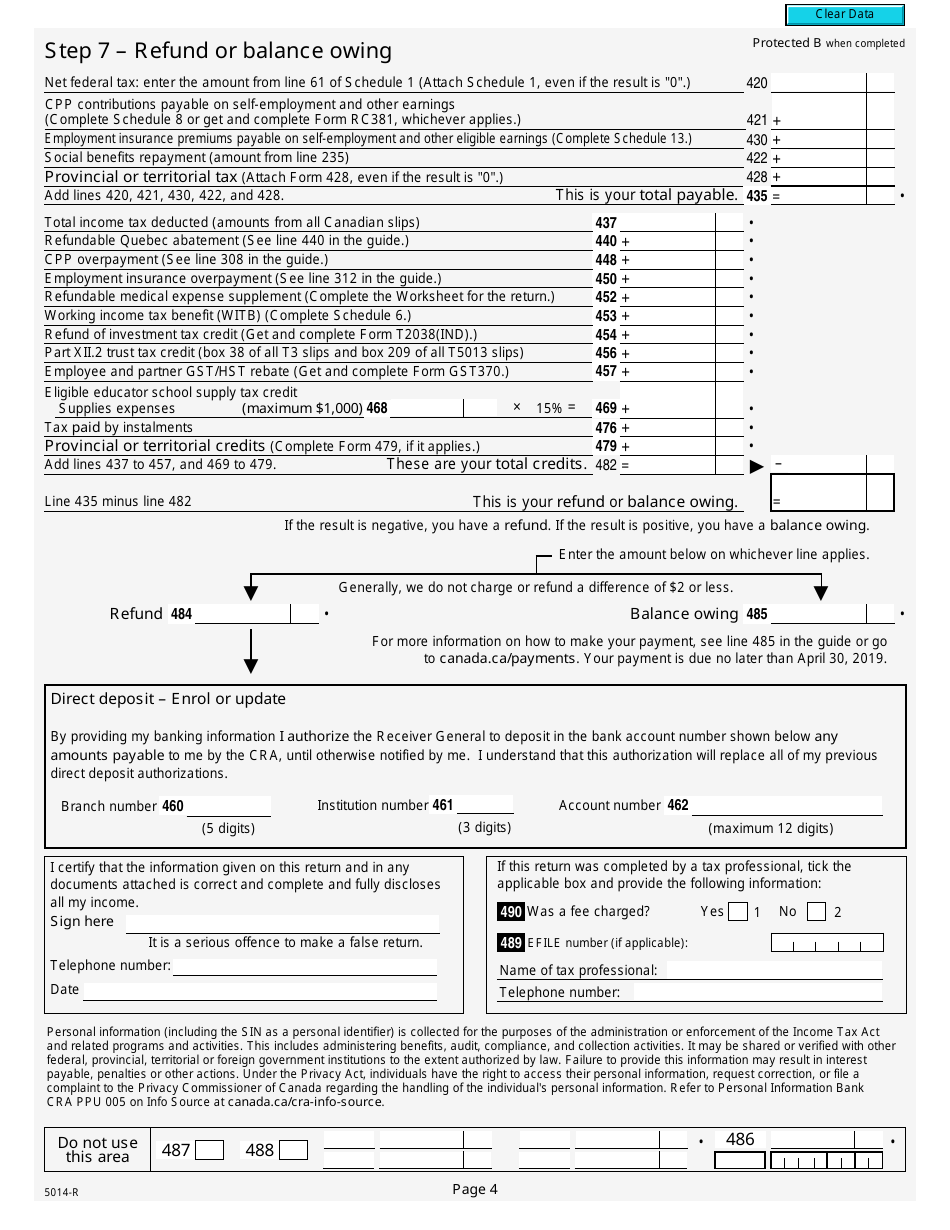

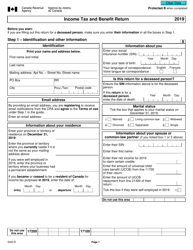

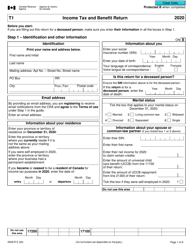

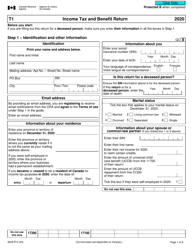

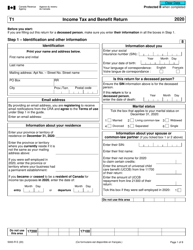

Form 5014-R Income Tax and Benefit Return - Canada

The Form 5014-R Income Tax and Benefit Return in Canada is filed by individuals who are residents of Canada and need to report their income and claim various tax benefits.

FAQ

Q: What is Form 5014-R?

A: Form 5014-R is the Income Tax and Benefit Return for Canadian residents.

Q: Who needs to file Form 5014-R?

A: Canadian residents who need to report their income and claim certain tax credits and benefits need to file Form 5014-R.

Q: What information is required on Form 5014-R?

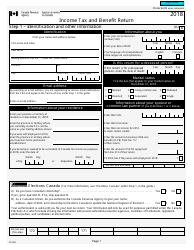

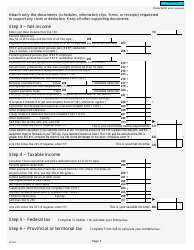

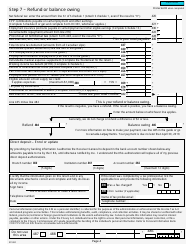

A: Form 5014-R requires personal information, income details, deductions, and credits.

Q: When is the deadline to file Form 5014-R?

A: The deadline to file Form 5014-R is usually April 30th of each year.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties and interest charges for late filing.

Q: Can I file Form 5014-R electronically?

A: Yes, you can file Form 5014-R electronically using the CRA's Netfile system.

Q: What if I don't have all the required documents for Form 5014-R?

A: You should try to gather all the necessary documents. If you are missing some, you should still file your return and provide the missing information later if possible.

Q: Can I claim tax credits and benefits on Form 5014-R?

A: Yes, Form 5014-R allows you to claim various tax credits and benefits, such as the Canada Child Benefit and the GST/HST credit.