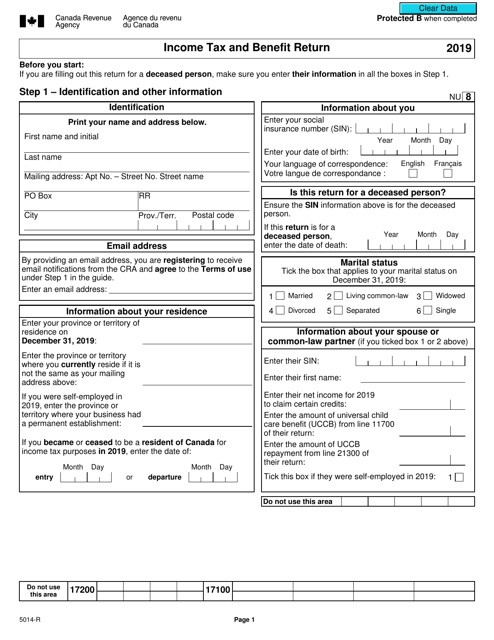

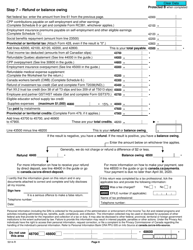

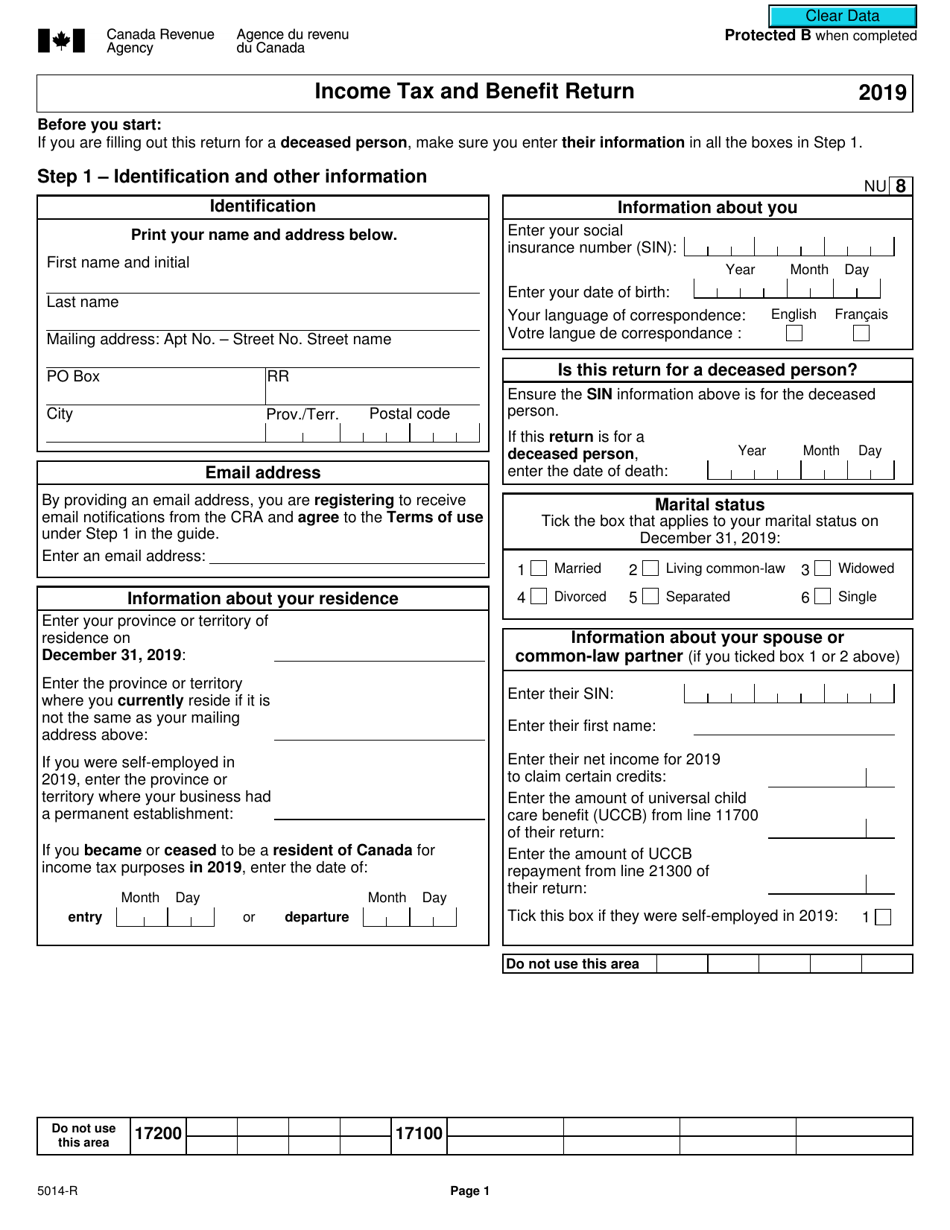

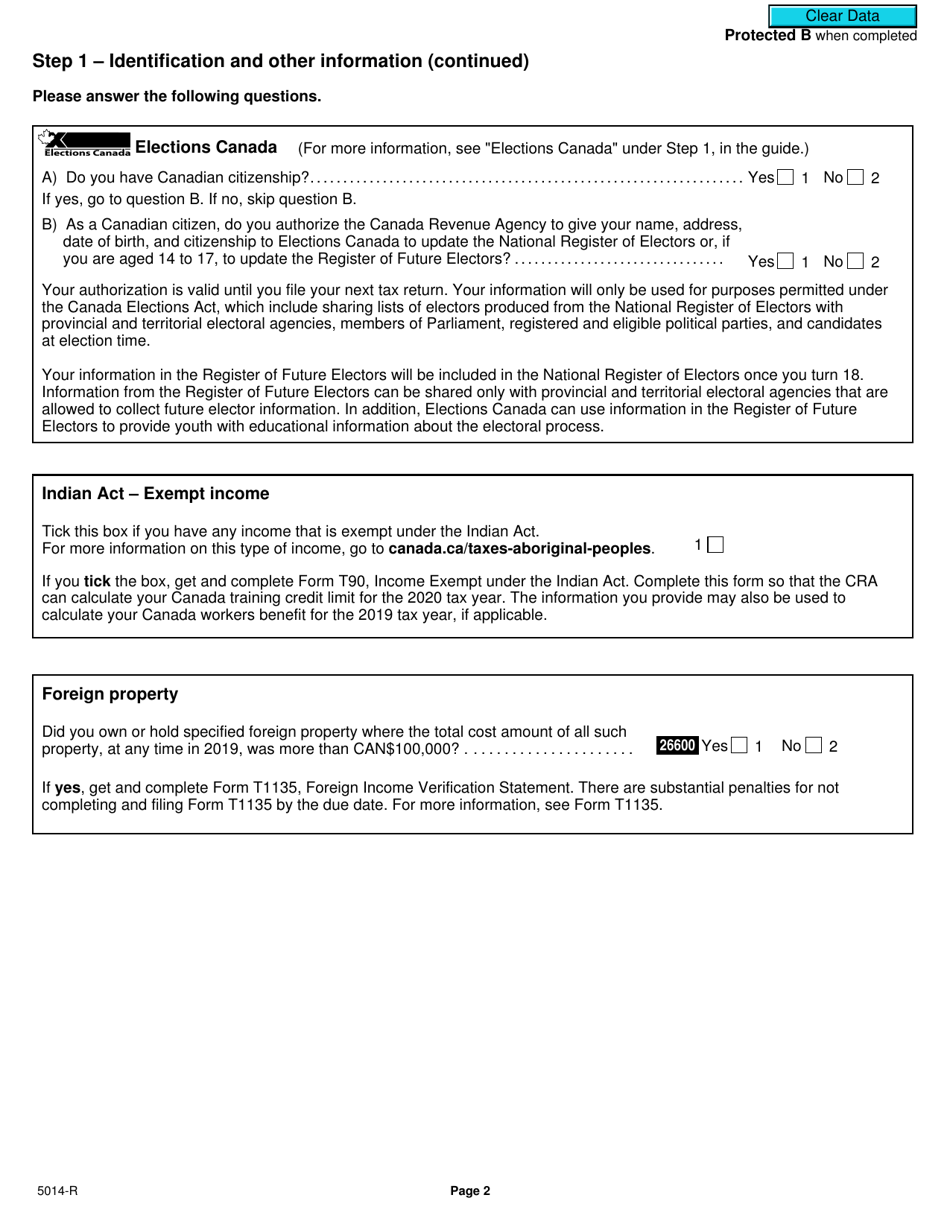

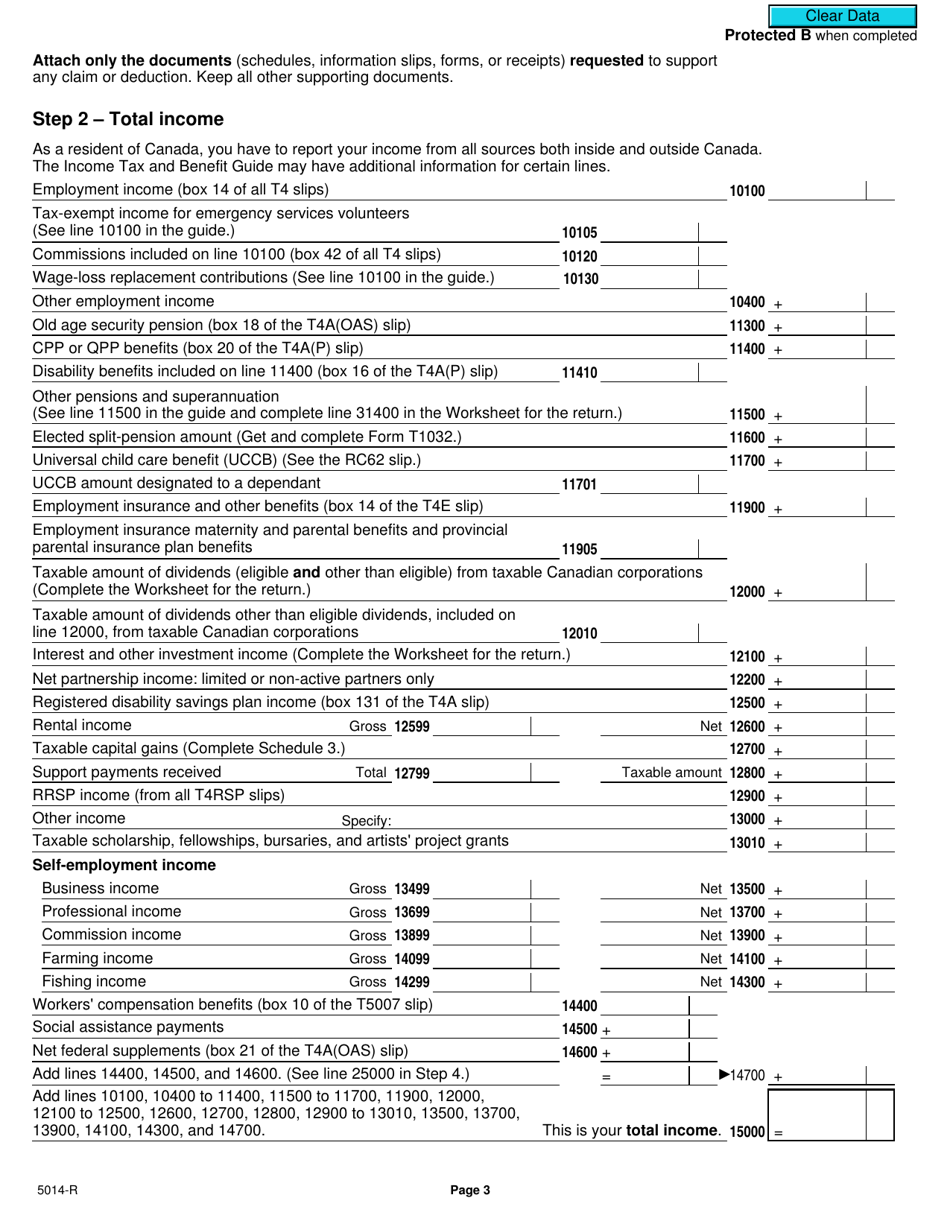

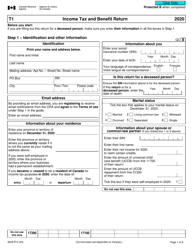

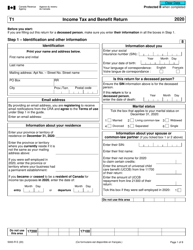

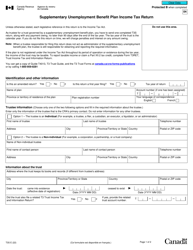

Form 5014-R Income Tax and Benefit Return - Nunavut - Canada

Form 5014-R is used for filing Income Tax and Benefit Return specifically for residents of Nunavut in Canada. It is used to report and calculate the amount of income taxes owed or to claim any tax benefits or refunds.

The Form 5014-R Income Tax and Benefit Return in Nunavut, Canada, is filed by individuals who are residents of Nunavut and need to report their income and claim tax benefits.

Form 5014-R Income Tax and Benefit Return - Nunavut - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5014-R?

A: Form 5014-R is the Income Tax and Benefit Return specific to Nunavut, Canada.

Q: Who is required to file Form 5014-R?

A: Residents of Nunavut who need to file their income tax and benefit return.

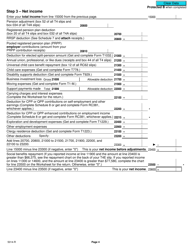

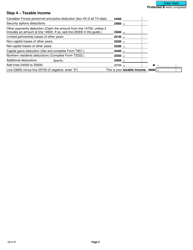

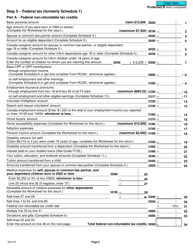

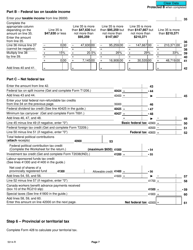

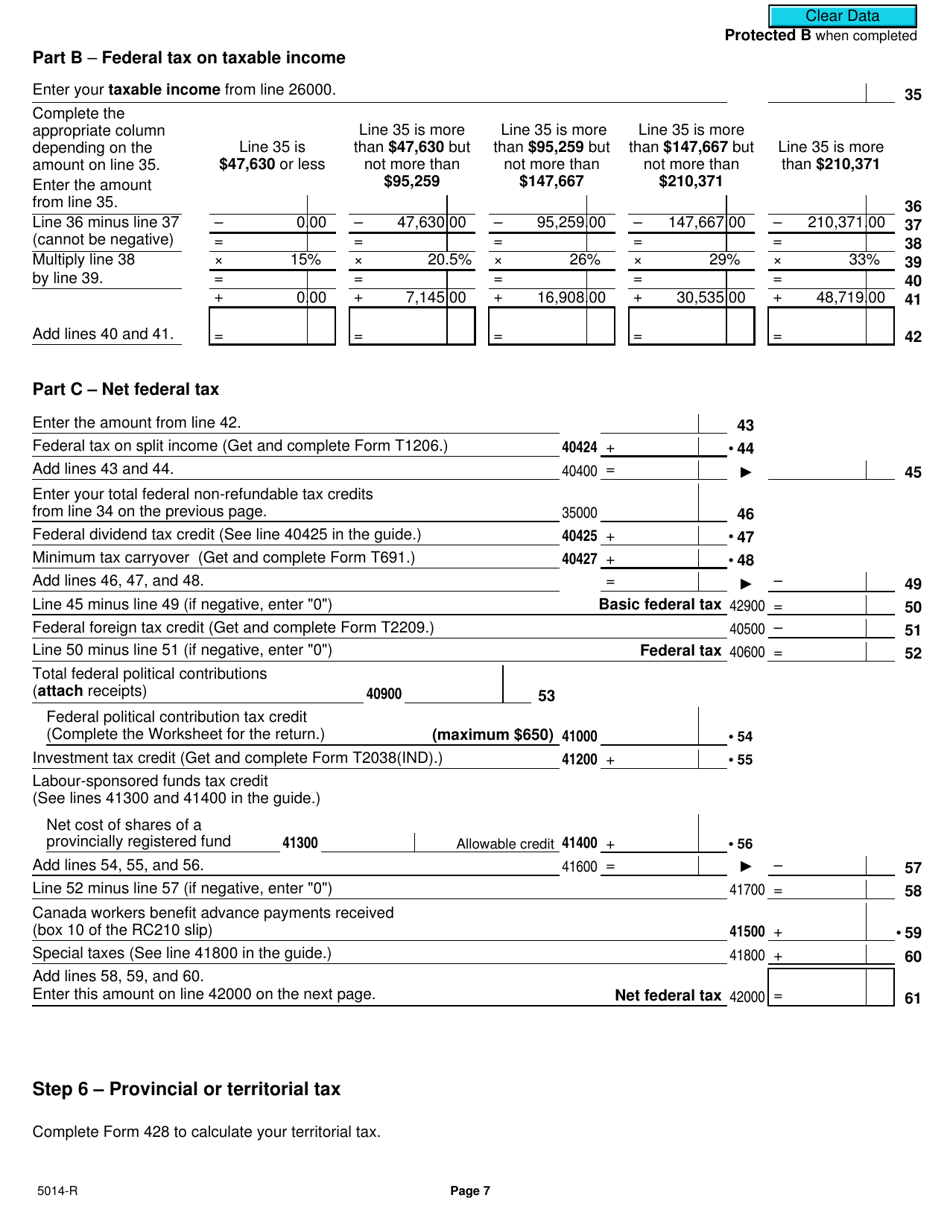

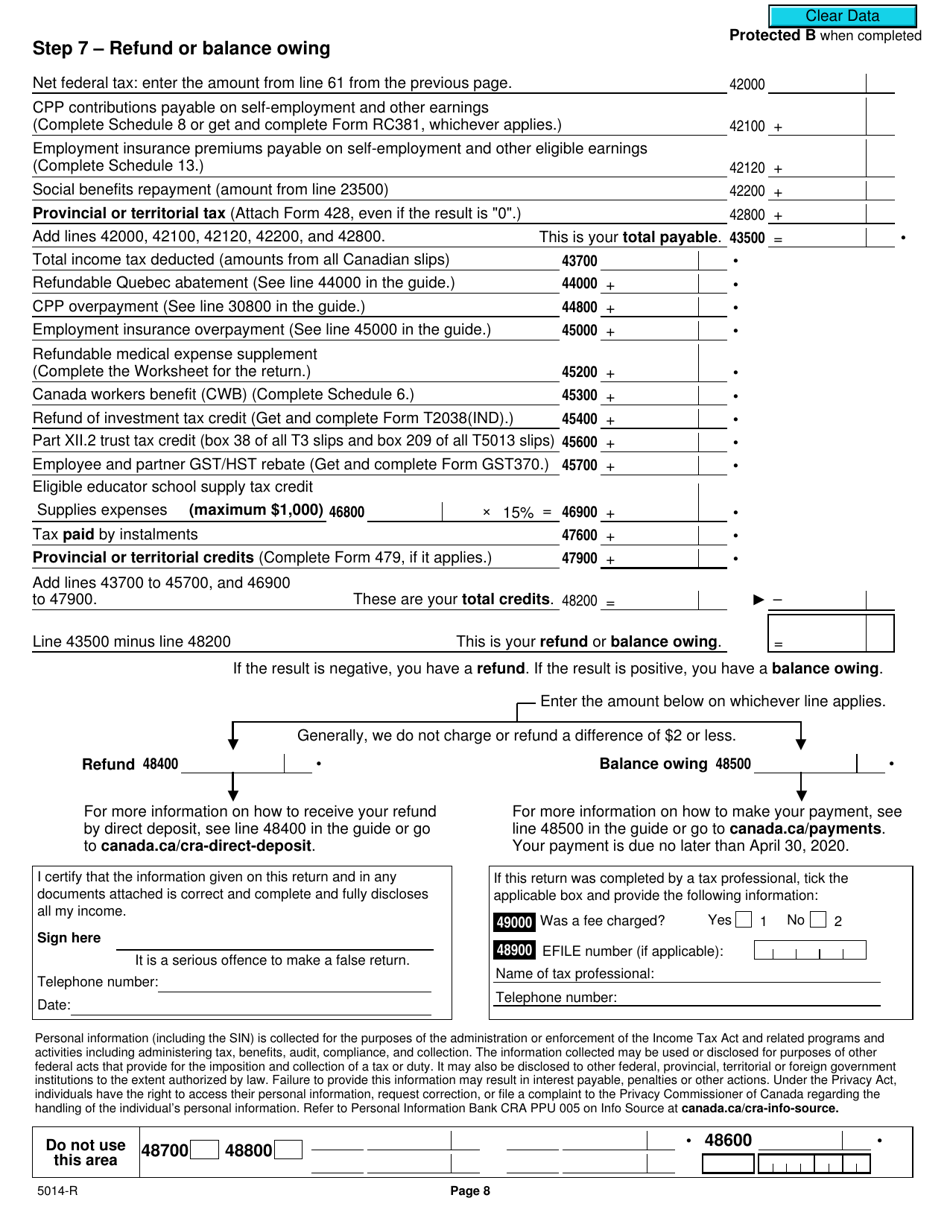

Q: What does Form 5014-R include?

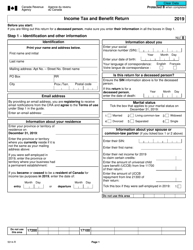

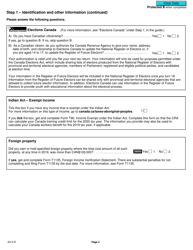

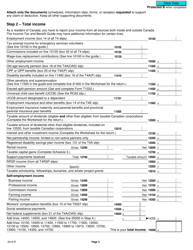

A: Form 5014-R includes sections for reporting various types of income and claiming tax credits and deductions.

Q: When is the deadline for filing Form 5014-R?

A: The deadline for filing Form 5014-R is typically April 30th of each year.

Q: Are there any penalties for late filing of Form 5014-R?

A: Yes, there may be penalties for late filing, so it's important to submit your return by the deadline.

Q: Do I have to include all my income on Form 5014-R?

A: Yes, you must report all sources of income, including employment income, self-employment income, and investment income.

Q: Can I claim tax credits and deductions on Form 5014-R?

A: Yes, you can claim various tax credits and deductions on Form 5014-R to reduce your taxable income.

Q: What if I need help filling out Form 5014-R?

A: If you need assistance, you can seek help from a tax professional or use the resources provided by the Canada Revenue Agency (CRA).