This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5014-S11 Schedule NU(S11)

for the current year.

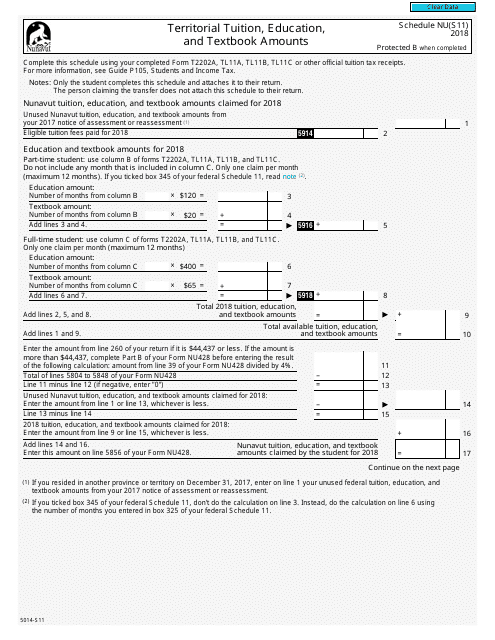

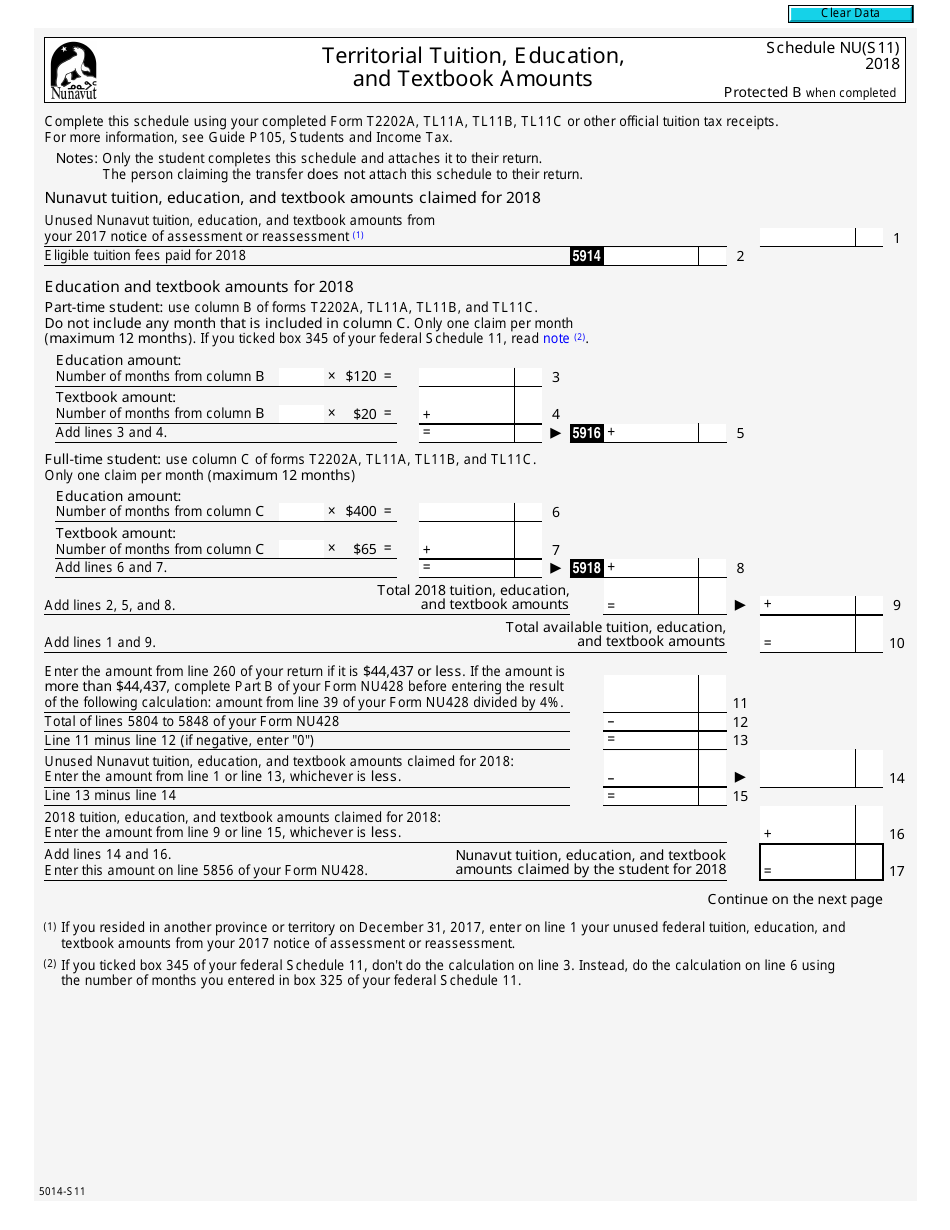

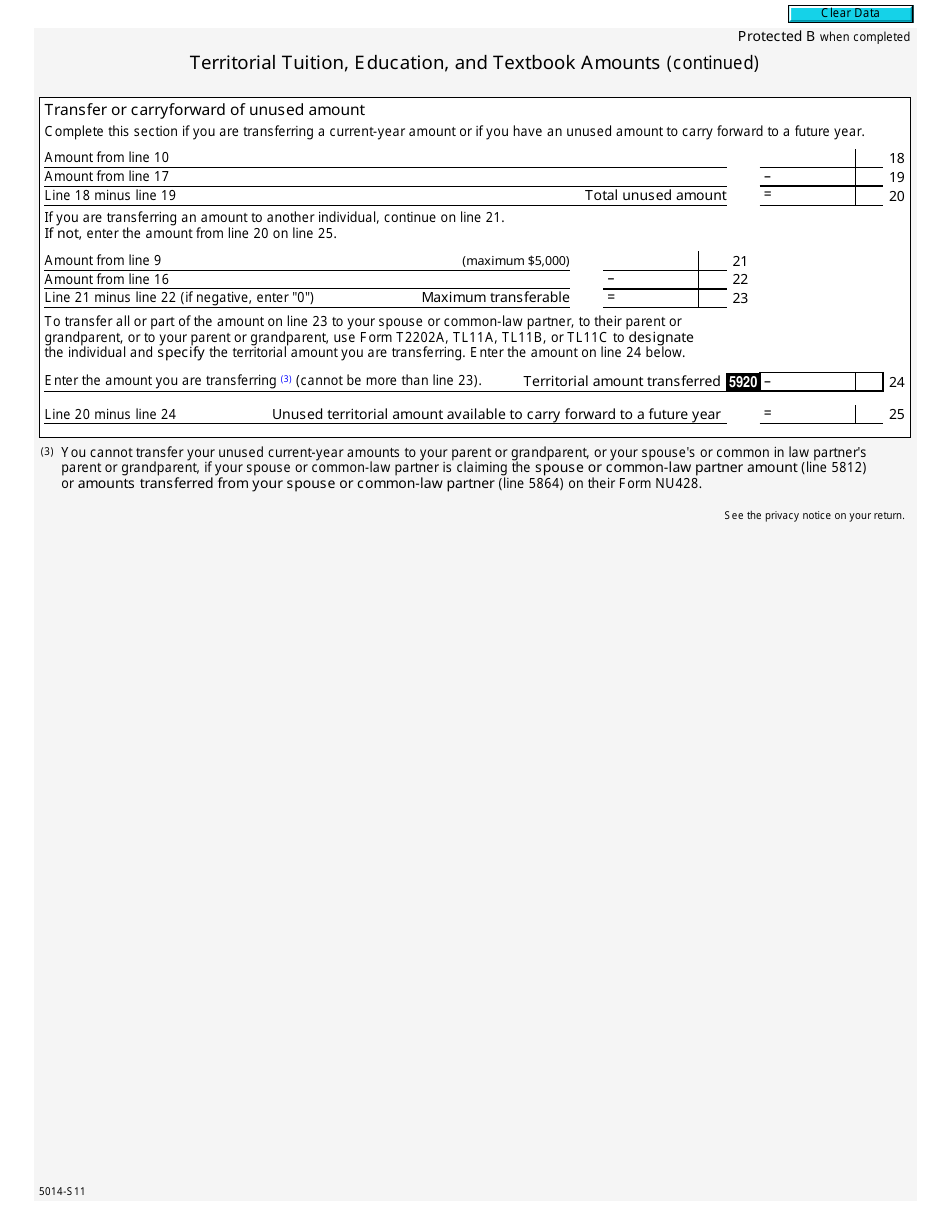

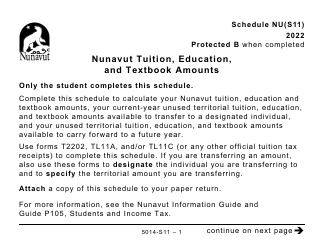

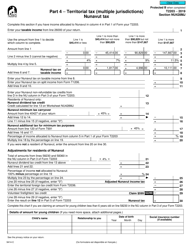

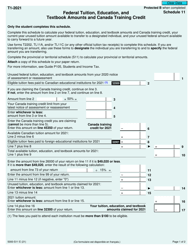

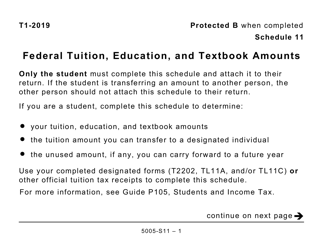

Form 5014-S11 Schedule NU(S11) Territorial Tuition, Education, and Textbook Amounts - Canada

Form 5014-S11 Schedule NU(S11) Territorial Tuition, Education, and Textbook Amounts - Canada is used to claim the territorial tuition, education, and textbook amounts for residents of Canada. This form helps individuals offset their education-related expenses when filing their tax returns.

The form 5014-S11 Schedule NU(S11) for territorial tuition, education, and textbook amounts in Canada is filed by individual taxpayers.

FAQ

Q: What is Form 5014-S11 Schedule NU(S11)?

A: Form 5014-S11 Schedule NU(S11) is a tax form used in Canada to claim territorial tuition, education, and textbook amounts.

Q: What are territorial tuition, education, and textbook amounts?

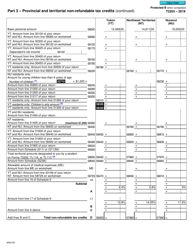

A: Territorial tuition, education, and textbook amounts are credits that can be claimed by residents of certain Canadian territories to reduce their tax liability.

Q: Who is eligible to claim territorial tuition, education, and textbook amounts?

A: Residents of certain Canadian territories, such as Yukon, Northwest Territories, and Nunavut, may be eligible to claim territorial tuition, education, and textbook amounts.

Q: What is the purpose of claiming territorial tuition, education, and textbook amounts?

A: Claiming territorial tuition, education, and textbook amounts can help reduce the amount of tax owed by residents of certain Canadian territories.

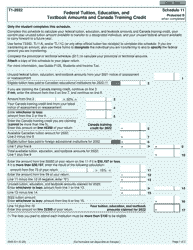

Q: How do I claim territorial tuition, education, and textbook amounts?

A: To claim territorial tuition, education, and textbook amounts, you need to complete Form 5014-S11 Schedule NU(S11) and include it with your Canadian tax return.

Q: Are territorial tuition, education, and textbook amounts the same in all Canadian territories?

A: No, the amounts may vary depending on the specific Canadian territory and the applicable tax laws.

Q: Can I claim territorial tuition, education, and textbook amounts if I live in a province instead of a territory?

A: No, territorial tuition, education, and textbook amounts are only available for residents of certain Canadian territories.

Q: What documents do I need to support my claim for territorial tuition, education, and textbook amounts?

A: You may be required to provide supporting documents, such as tuition receipts and educational institution certificates, to the Canada Revenue Agency (CRA) to support your claim for territorial tuition, education, and textbook amounts.

Q: When should I file Form 5014-S11 Schedule NU(S11)?

A: You should file Form 5014-S11 Schedule NU(S11) along with your Canadian tax return when you are ready to submit your taxes for the applicable tax year.