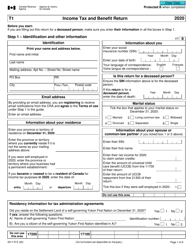

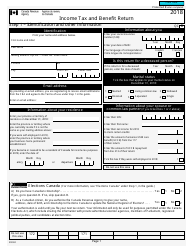

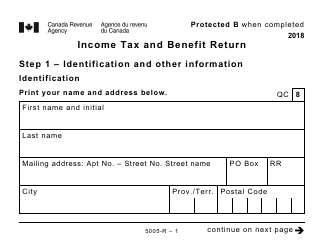

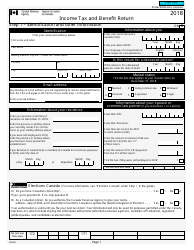

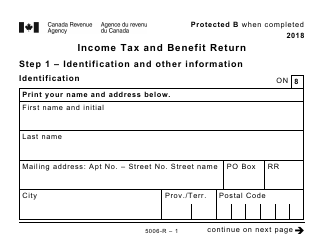

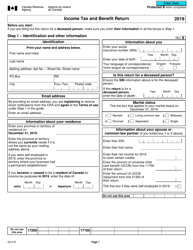

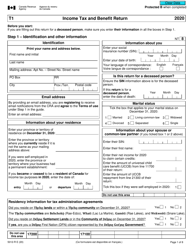

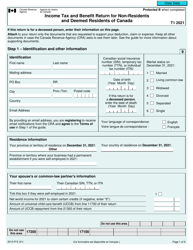

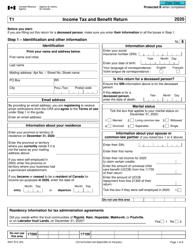

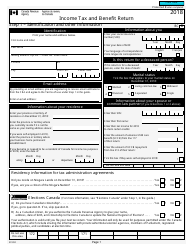

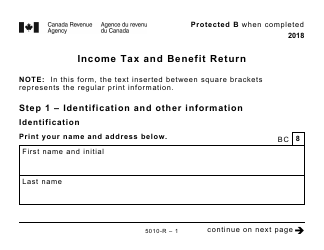

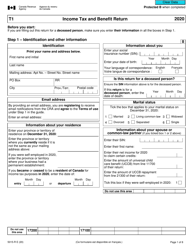

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5014-S6 Schedule 6

for the current year.

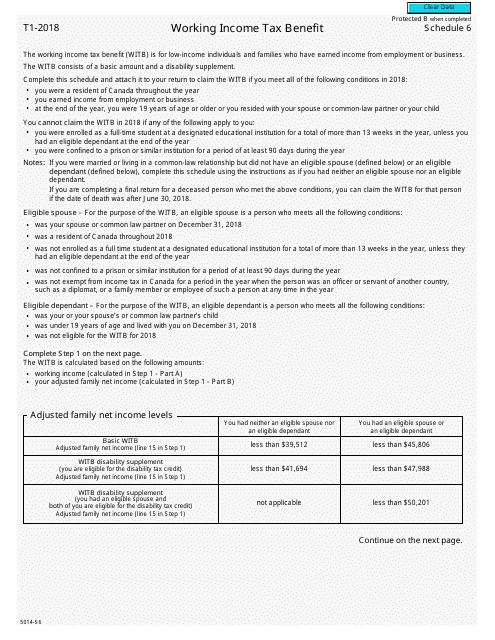

Form 5014-S6 Schedule 6 Working Income Tax Benefit - Canada

Form 5014-S6 Schedule 6 Working Income Tax Benefit in Canada is used to determine eligibility for and calculate the Working Income Tax Benefit (WITB) for individuals and families. The WITB is a refundable tax credit designed to provide tax relief to low-income working individuals and families. It is intended to supplement the earnings of low-income workers and help reduce poverty. The form helps individuals and families calculate the amount of WITB they may be eligible for, based on their employment income and other factors.

The Form 5014-S6 Schedule 6 Working Income Tax Benefit in Canada is typically filed by individuals who are eligible for the Working Income Tax Benefit (WITB). The WITB is a refundable tax credit designed to provide additional support to low-income individuals and families who have employment income. By completing this form, eligible individuals can claim the WITB on their income tax return.

FAQ

Q: What is Form 5014-S6?

A: Form 5014-S6 is Schedule 6 for the Working Income Tax Benefit (WITB) in Canada.

Q: What is the Working Income Tax Benefit (WITB)?

A: The Working Income Tax Benefit (WITB) is a refundable tax credit designed to provide tax relief for eligible individuals or families with low-income who are working.

Q: Who is eligible for the Working Income Tax Benefit (WITB)?

A: To be eligible for the Working Income Tax Benefit (WITB), you must be a resident of Canada, at least 19 years old, have an eligible working income, and meet certain other criteria.

Q: What is Schedule 6 on Form 5014-S6?

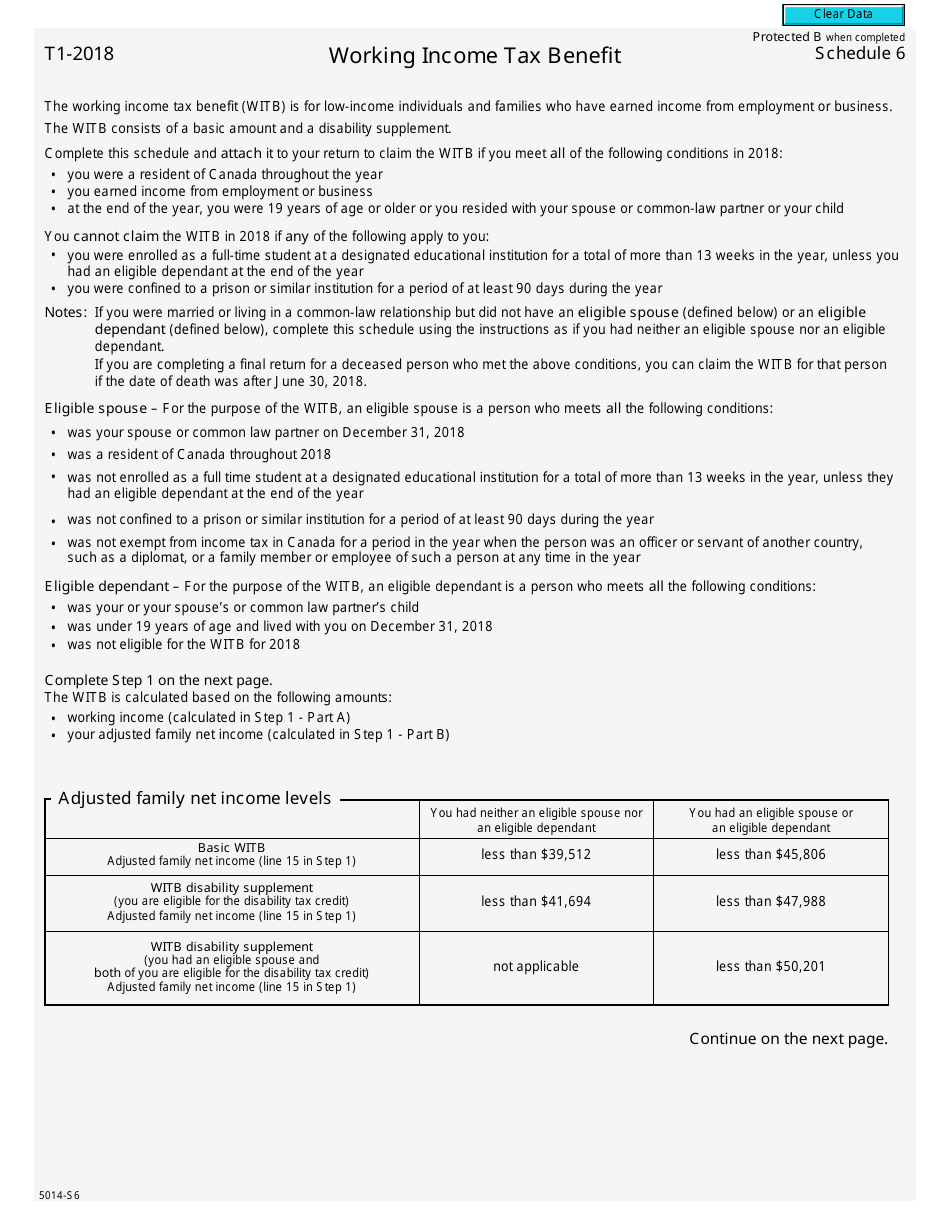

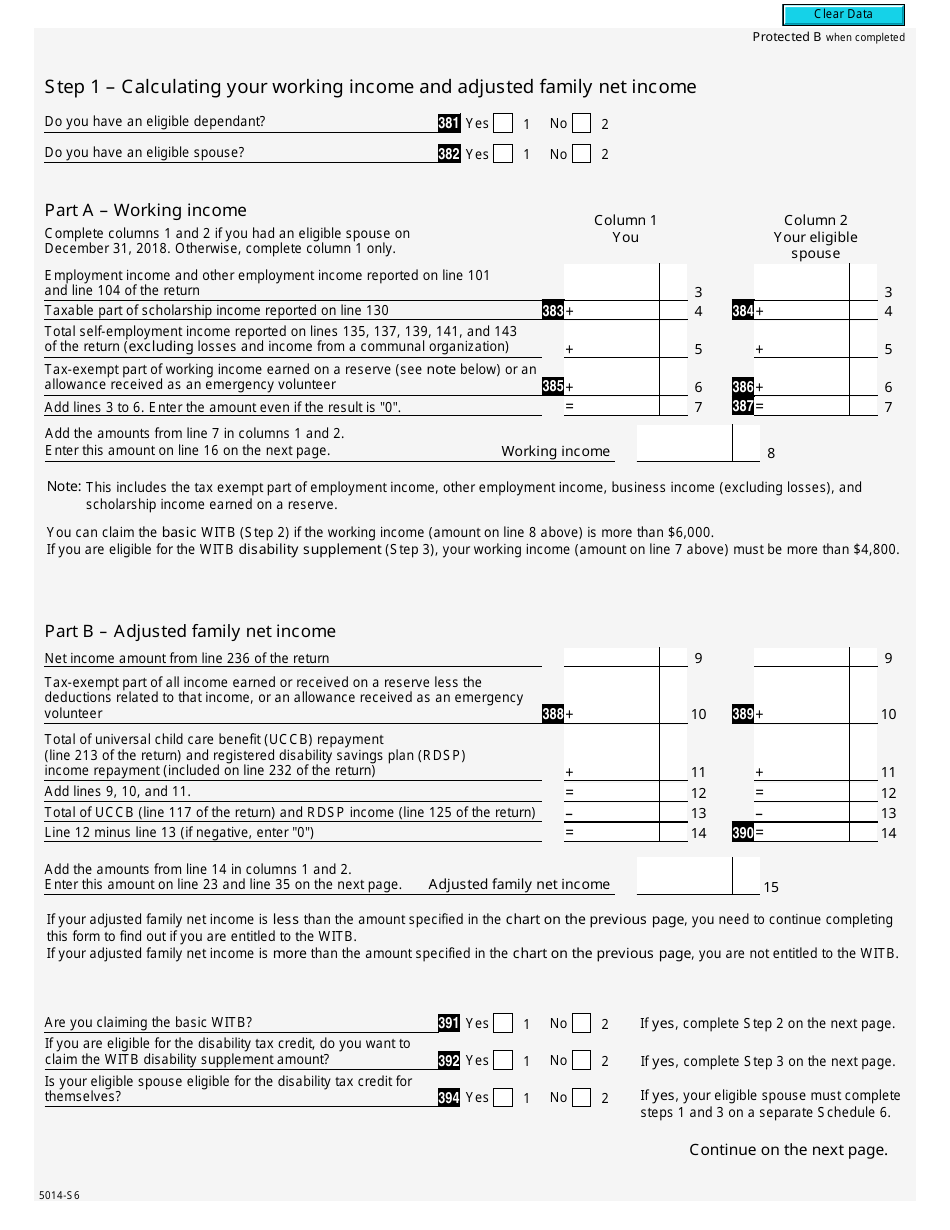

A: Schedule 6 on Form 5014-S6 is used to calculate the Working Income Tax Benefit (WITB) for eligible individuals or families.

Q: How do I complete Schedule 6 on Form 5014-S6?

A: To complete Schedule 6 on Form 5014-S6, you will need to provide information about your working income, employment status, and other relevant details as required.

Q: Is the Working Income Tax Benefit (WITB) taxable?

A: No, the Working Income Tax Benefit (WITB) is not taxable and does not need to be reported as income on your tax return.

Q: When is the deadline to file Form 5014-S6 Schedule 6?

A: The deadline to file Form 5014-S6 Schedule 6 is usually April 30th of the year following the tax year for which you are claiming the Working Income Tax Benefit (WITB).

Q: Can I claim the Working Income Tax Benefit (WITB) if I am receiving other benefits?

A: Yes, you may still be eligible to claim the Working Income Tax Benefit (WITB) even if you are receiving other benefits, such as social assistance or disability benefits. However, your total income and eligibility criteria will determine the amount of benefit you receive.

Q: How will I receive the Working Income Tax Benefit (WITB) if I am eligible?

A: If you are eligible for the Working Income Tax Benefit (WITB), it will be calculated and paid as part of your tax refund or applied to reduce any taxes owing.