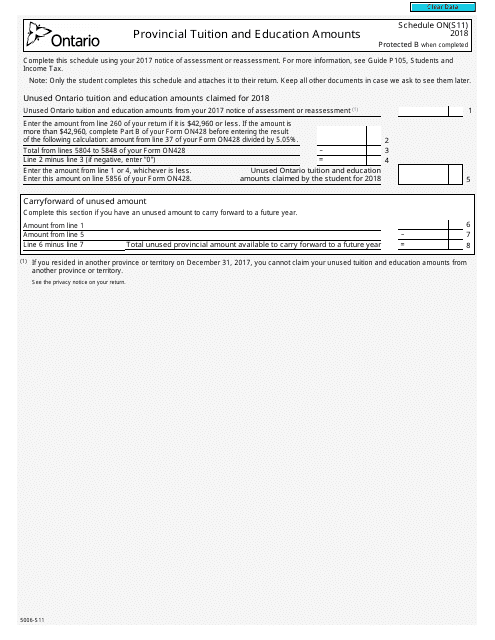

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5006-S11 Schedule ON(S11)

for the current year.

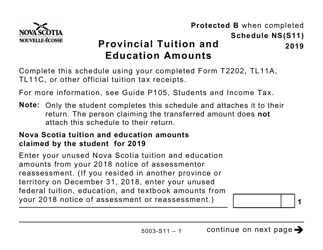

Form 5006-S11 Schedule ON(S11) Provincial Tuition and Education Amounts - Canada

Form 5006-S11 Schedule ON(S11) is used to claim the provincial tuition and education amounts in Ontario, Canada. It allows eligible individuals to reduce their provincial tax payable and carry forward any unused amount to future years.

The Form 5006-S11 Schedule ON(S11) Provincial Tuition and Education Amounts in Canada is filed by residents of the province of Ontario.

FAQ

Q: What is Form 5006-S11?

A: Form 5006-S11 is the form used in Canada to claim provincial tuition and education amounts.

Q: What is Schedule ON(S11)?

A: Schedule ON(S11) is a specific schedule of Form 5006-S11 used to claim provincial tuition and education amounts in the province of Ontario.

Q: What are provincial tuition and education amounts?

A: Provincial tuition and education amounts are tax credits that can reduce the amount of tax you owe.

Q: How do I claim provincial tuition and education amounts?

A: To claim provincial tuition and education amounts, you need to fill out Form 5006-S11 and include it with your tax return.

Q: Can I claim provincial tuition and education amounts in provinces other than Ontario?

A: Yes, different provinces have their own schedules and forms for claiming provincial tuition and education amounts.

Q: When is the deadline to file Form 5006-S11?

A: The deadline to file Form 5006-S11 is usually the same as the deadline to file your income tax return, which is April 30th for most individuals.

Q: What if I miss the deadline to file Form 5006-S11?

A: If you miss the deadline to file Form 5006-S11, you may still be able to claim the provincial tuition and education amounts by filing an adjustment request.

Q: Can I carry forward unused provincial tuition and education amounts?

A: Yes, you can carry forward unused provincial tuition and education amounts to future years.

Q: Is there an income limit to claim provincial tuition and education amounts?

A: No, there is no specific income limit to claim provincial tuition and education amounts, but the credit may be reduced for higher income individuals.